UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 4, 2015

VISION-SCIENCES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

000-20970 |

|

13-3430173 |

|

(State or other jurisdiction |

|

(Registration number) |

|

(IRS employer |

|

of incorporation) |

|

identification no.) |

|

identification no.) |

|

40 Ramland Road South

Orangeburg, NY |

|

10962 |

|

(Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area code: (845) 365-0600

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☑ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On February 4, 2015, Vision-Sciences, Inc. (the “Company”) issued a press release regarding the Company’s financial results for its third quarter and first nine months of fiscal 2015, ended December 31, 2014. A copy of the Company’s press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 8.01. Other Events.

The information set forth above under Item 2.02 of this Current Report is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press release dated February 4, 2015 announcing the financial results for the three and nine months ended December 31, 2014.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act whether made before or after the date of this Current Report, except as shall be expressly set forth by specific reference in such a filing.

Important Additional Information and Where to Find It

In connection with the proposed merger, the Company has filed with the SEC a registration statement on Form S-4 that includes a preliminary joint proxy statement of the Company and Uroplasty, Inc. (“Uroplasty”) that also constitutes a preliminary prospectus of the Company. The registration statement is not complete and will be further amended. The Company and Uroplasty will make the definitive joint proxy statement/prospectus available to their respective shareholders. Investors are urged to read the definitive joint proxy statement/prospectus when it becomes available, because it will contain important information. The registration statement, joint proxy statement/prospectus and other documents filed by the Company and Uroplasty with the SEC are available free of charge at the SEC's website (www.sec.gov) and from the Company and Uroplasty. Requests for copies of the joint proxy statement/prospectus and other documents filed by the Company may be made by contacting Gary Siegel, Vice President, Finance by phone at (845) 848-1085 or by email at gary.siegel@visionsciences.com, and requests for copies of the joint proxy statement/prospectus and other documents filed by Uroplasty with the SEC may be made by contacting Brett Reynolds, Senior Vice President, Chief Financial Officer by phone at (952) 426-6152 or by email at brett.reynolds@uroplasty.com.

Participants in the Solicitation

The Company, Uroplasty, and their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from the Company’s and Uroplasty's respective shareholders in connection with the proposed transaction. Information regarding the Company’s directors and executive officers and the ownership of the Company’s stock is contained in the Company’s annual report on Form 10-K for the fiscal year ended March 31, 2014 and its proxy statement for its 2014 annual meeting of shareholders, which was filed with the SEC on June 17, 2014. Information about the directors and executive officers of Uroplasty and their ownership of Uroplasty stock is set forth in Uroplasty's annual report on Form 10-K for the fiscal year ended March 31, 2014, and its proxy statement for its 2014 annual meeting of shareholders, which was filed with the SEC on July 22, 2014. These documents can be obtained free of charge from the sources indicated above. Certain directors, executive officers and employees of the Company and Uroplasty may have direct or indirect interest in the transaction due to securities holdings, vesting of equity awards and rights to severance payments. Additional information regarding the participants in the solicitation of the Company’s and Uroplasty’s respective shareholders will be included in the joint proxy statement/prospectus filed with the SEC.

Cautionary Statements Related to Forward-Looking Statements

This Current Report (including the press release attached hereto as Exhibit 99.1) includes forward-looking statements. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and other words of similar meaning. Forward-looking statements in this Current Report include, but are not limited to, statements about the benefits of the transaction; expected revenue growth rates; the expected timing of the completion of the transaction; and the combined company's plans, objectives, expectations and intentions with respect to future operations, products and services. Each forward-looking statement contained in this Current Report is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others, uncertainties as to the timing of the transaction; uncertainties as to whether the Company’s and Uroplasty’s shareholders will approve the transaction; the risk that competing offers will be made; the possibility that various closing conditions for the transaction may not be satisfied or waived; the risk that shareholder litigation in connection with the transaction may result in significant costs of defense, indemnification and liability; other business effects, including the effects of industry, economic or political conditions outside of either company's control; the failure to realize synergies and cost-savings from the transaction or delay in realization thereof; the businesses of the Company and Uroplasty may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; operating costs and business disruption following completion of the transaction, including adverse effects on employee retention and on each company's respective business relationships with third parties; transaction costs; actual or contingent liabilities; the adequacy of the combined company's capital resources; and the risks identified under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2014, filed with the SEC on May 30, 2014, and Uroplasty's Annual Report on Form 10-K, for the fiscal year ended March 31, 2014, filed with the SEC on June 9, 2014, as well as both companies' subsequent Quarterly Reports on Form 10-Q and other information filed by each company with the SEC. The Company and Uroplasty caution investors not to place considerable reliance on the forward-looking statements contained in this Current Report. You are encouraged to read the Company’s and Uroplasty's filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this Current Report speak only as of the date of this release, and the Company and Uroplasty undertake no obligation to update or revise any of these statements. The Company’s and Uroplasty's businesses are subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Vision-Sciences, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VISION-SCIENCES, INC. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Gary Siegel |

|

|

|

Name: |

Gary Siegel |

|

|

|

Title: |

Vice President, Finance |

|

|

|

|

|

Date: February 4, 2015

Exhibit 99.1

Vision-Sciences Reports Financial Results for Third Quarter and First Nine Months of Fiscal 2015

Orangeburg, NY – February 4, 2014 – Vision-Sciences, Inc. (Nasdaq: VSCI), a leading provider of unique flexible endoscopic products, today announced financial results for the three- and nine-month periods ended December 31, 2014.

Third Quarter Fiscal 2015 Highlights

| |

● |

Net sales increased 9% to $4.9 million in the third quarter of fiscal 2015 as compared with $4.5 million in the third quarter of fiscal 2014. On a sequential basis, net sales increased 20% from second quarter of 2015 levels; |

| |

● |

Medical sales of $3.9 million for the third quarter of fiscal year 2015 increased 8% from $3.6 million in the third quarter of fiscal 2014. Excluding sales to Stryker Corporation, medical sales increased 33% to $3.2 million; in May 2014 the Company decided not to renew an agreement with Stryker for the sale of Vision-Sciences' cystoscopy products; |

| |

● |

Industrial sales increased 16% to $1.1 million as compared with the third quarter of fiscal 2014; |

| |

● |

Operating loss improved 2% as compared with the third quarter of fiscal 2014 to $(1.4) million, however, this included expenses of $464 thousand related to our previously announced proposed merger with Uroplasty, Inc.; |

| |

● |

Net loss of $1.6 million and $(0.03) per basic and diluted share were unchanged from the third quarter of fiscal 2014 even though this quarter’s results included merger-related expenses; and, |

| |

● |

Entered into merger agreement with Uroplasty, Inc., a global medical device company that develops, manufactures, and markets innovative proprietary products for the urology market. |

First Nine Months of Fiscal Year 2015 Highlights

| |

● |

Net sales increased by 5% to $12.8 million from $12.1 million in the first nine months of fiscal 2014; |

| |

● |

Operating loss improved by 8% to $(4.7) million compared to $(5.2) million in the first nine months of fiscal 2014; |

| |

● |

Net loss improved by 5% to $(5.1) million, or ($0.11) per basic and diluted share, compared to a net loss of $(5.3) million, or ($0.12) per basic and diluted share, for the first nine months of 2014; and, |

| |

● |

Net cash used in operating activities was $3.7 million for the first nine months of 2015, an improvement from $4.5 million in the prior-year period. |

“We are pleased with our financial results for the third quarter and first nine months of fiscal 2015, which reflect our ongoing focus on sales force execution, gross margin improvements and new product introductions. These initiatives are further reflected in the improvements across the board and in our operating results,” commented Howard Zauberman, President and Chief Executive Officer of Vision-Sciences, Inc. “We look forward to continued growth, which we believe will be accelerated by the combination of Uroplasty and Vision-Sciences, yielding long-term benefits to both companies and our shareholders.”

Results of Operations

Net sales in the third quarter of fiscal 2015 increased by 9% to $4.9 million as compared with $4.5 million in the same period one year ago, driven by higher sales in our medical and industrial businesses. Medical sales of $3.9 million for the third quarter of fiscal year 2015 increased 8% from $3.6 million in the third quarter of fiscal 2014. Excluding sales to Stryker Corporation, sales in our medical business were $3.2 million, an increase of 33% compared with the same period one year ago.

Net sales in the first nine months of fiscal 2015 increased by 5% to $12.8 million compared with $12.1 million in the prior-year period, reflecting higher sales in our medical and industrial businesses. Medical sales of $10.2 million for the first nine months of fiscal year 2015 increased 2% from $10.0 million in the first nine months of fiscal 2014. Excluding sales to Stryker Corporation, sales in our medical business were $8.7 million in the first nine months of fiscal 2015, an increase of 35% compared with the same period one year ago.

Industrial sales in the third quarter of fiscal 2015 increased by 16% to $1.1 million as compared with $0.9 million in the third quarter of fiscal 2014. Industrial sales in the first nine months of fiscal 2015 increased by 23% to $2.6 million as compared with $2.1 million in the first nine months of fiscal 2014. The growth in each period was primarily due to economic improvement in the U.S. airline industry. The launch of two new industrial products late in the third quarter of fiscal 2015, our latest small video borescope and a new digital processor, contributed to that increase.

Net sales detail (in thousands, except for percentages) for the third quarter and first nine months of fiscal years 2015 and 2014 were as follows:

| |

|

Three Months Ended

December 31, |

|

|

|

|

|

Nine Months Ended

December 31, |

|

|

|

|

|

Market/Category |

|

2015 |

|

|

2014 |

|

|

% |

|

|

2015 |

|

|

2014 |

|

|

% |

|

| |

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

Urology |

|

$ |

1,995 |

|

|

$ |

2,097 |

|

|

|

-5 |

% |

|

$ |

5,696 |

|

|

$ |

5,614 |

|

|

|

1 |

% |

|

ENT |

|

|

510 |

|

|

|

386 |

|

|

|

32 |

% |

|

|

1,271 |

|

|

|

1,128 |

|

|

|

13 |

% |

|

TNE |

|

|

68 |

|

|

|

361 |

|

|

|

-81 |

% |

|

|

325 |

|

|

|

944 |

|

|

|

-66 |

% |

|

Pulmonology |

|

|

241 |

|

|

|

276 |

|

|

|

-13 |

% |

|

|

833 |

|

|

|

757 |

|

|

|

10 |

% |

|

Repairs, peripherals and accessories |

|

|

1,041 |

|

|

|

466 |

|

|

|

123 |

% |

|

|

2,057 |

|

|

|

1,570 |

|

|

|

31 |

% |

|

Total net medical sales |

|

$ |

3,855 |

|

|

$ |

3,586 |

|

|

|

8 |

% |

|

$ |

10,182 |

|

|

$ |

10,013 |

|

|

|

2 |

% |

|

Total net industrial sales |

|

|

1,065 |

|

|

|

921 |

|

|

|

16 |

% |

|

|

2,600 |

|

|

|

2,114 |

|

|

|

23 |

% |

|

Net Sales |

|

$ |

4,920 |

|

|

$ |

4,507 |

|

|

|

9 |

% |

|

$ |

12,782 |

|

|

$ |

12,127 |

|

|

|

5 |

% |

Gross profit increased 38% to $1.9 million for the third quarter of fiscal 2015. Gross profit as a percent of net sales increased to 38.7% for the third quarter of fiscal 2015, as compared to 30.6% in the prior-year period. For the first nine months of fiscal 2015, gross profit increased 18% to $4.3 million. Gross profit as a percent of net sales increased to 33.7% for the first nine months of fiscal 2015, as compared to 30.1% in the prior-year period. The increases in gross profit and gross profit as a percent of net sales are attributable to a favorable product mix as well as our cost-savings measures.

Selling, general and administrative (“SG&A”) expenses were $2.8 million in the third quarter of fiscal 2015, an increase of $0.5 million, or 20%, compared with the prior-year period. For the first nine months of fiscal 2015, SG&A expenses were $7.6 million, an increase of $0.2 million, or 3%, compared with the prior-year period. In both the third quarter and nine month periods of fiscal 2015, expenses related to the merger with Uroplasty more than offset our cost-saving measures. Excluding merger-related expenses, SG&A expenses were $2.3 million in the third quarter of fiscal 2015, virtually unchanged from last year’s third quarter, and $7.1 million in the first nine months of fiscal 2015, a decrease of $0.3 million, or 4%, as compared with the first nine months of fiscal 2014.

Research and development (“R&D”) expenses were $0.6 million in the third quarter of fiscal 2015, an increase of $36 thousand, or 7%, over the same period last year, primarily attributable to higher product development costs. For the first nine months of fiscal 2015, R&D expenses increased by $66 thousand, or 4%, over the same period last year.

Our operating loss improved by $33 thousand, or 2%, to $(1.4) million in the third quarter of fiscal 2015 as compared with the prior-year period, primarily due to the higher gross margin, which was largely offset by expenses related to the merger. During the first nine months of fiscal 2015, operating loss improved by $0.4 million, or 8%, to $(4.7) million as compared with the prior-year period, primarily due to higher gross margin.

Our net loss was $(1.6) million, or $(0.03) per basic and diluted share, for the quarters ended December 31, 2015 and 2014. For the first nine months of fiscal 2015, the net loss improved to $(5.1) million, or $(0.11) per basic and diluted share, as compared with a net loss of $(5.3) million, or ($0.12) per basic and diluted share, in the first nine months of 2014.

At December 31, 2014, we had cash and cash equivalents of $1.5 million and working capital of $6.6 million, compared with cash and cash equivalents of $1.2 million and working capital of $6.9 million at March 31, 2014. Net cash used in operating activities was $3.7 million for the first nine months of fiscal 2015, an improvement from $4.5 million in the same period one year ago.

On June 16, 2014, we issued a convertible promissory note to Lewis C. Pell, our Chairman, which allowed us to borrow up to $5.0 million. As of December 31, 2014, we had $4.0 million in principal outstanding under the note.

As part of the activities related to our proposed merger, on January 27, 2015, we filed with the U.S. Securities and Exchange Commission a registration statement on Form S-4, which includes a preliminary joint proxy statement for us and Uroplasty, Inc that also constitutes our prospectus. The registration statement is not yet complete and will be further amended. If the merger is completed, we will be renamed “Cogentix Medical, Inc.”

Conference Call

Howard Zauberman, President and Chief Executive Officer, and Gary Siegel, Vice President, Finance, will host a conference call to discuss the second quarter fiscal 2015 financial results at 8:30 a.m. EDT, on Thursday, February 5, 2014.

|

Conference dial-in: |

(877) 303-1595 |

|

International dial-in: |

(970) 315-0449 |

|

Conference ID: |

70941792 |

|

Webcast: |

http://ir.visionsciences.com/ |

An audio replay of the conference call will be available from 11:30 a.m. EST on Thursday, February 5, 2015, through 11:59 p.m. EST on Thursday, February 19, 2015, by dialing (855) 859-2056 from the U.S. or (404) 537-3406 from abroad. The audio webcast will also be available in the investor section of the Company's website, www.visionsciences.com.

About Vision-Sciences, Inc.

Vision-Sciences, Inc. designs, develops, manufactures and markets products for flexible endoscopy. The Company’s unique product lines feature a streamlined visualization system and proprietary sterile disposable microbial barrier, known as EndoSheath technology, providing users with efficient and cost effective endoscope turnover while enhancing patient safety. Information about Vision-Sciences’ products is available at www.visionsciences.com.

Vision-Sciences owns the registered trademarks Vision Sciences®, EndoSheath®, EndoWipe®, Slide-On®, and The Vision System®.

Important Additional Information and Where to Find It

In connection with the proposed merger, Vision-Sciences has filed with the SEC a registration statement on Form S-4 that includes a preliminary joint proxy statement of Uroplasty and Vision-Sciences that also constitutes a preliminary prospectus of Vision-Sciences. The registration statement is not complete and will be further amended. Uroplasty and Vision-Sciences will make the definitive joint proxy statement/prospectus available to their respective shareholders. Investors are urged to read the definitive joint proxy statement/prospectus when it becomes available, because it will contain important information. The registration statement, joint proxy statement/prospectus and other documents filed by Uroplasty and Vision-Sciences with the SEC are available free of charge at the SEC's website (www.sec.gov) and from Uroplasty and Vision-Sciences. Requests for copies of the joint proxy statement/prospectus and other documents filed by Uroplasty with the SEC may be made by contacting Brett Reynolds, Senior Vice President, Chief Financial Officer by phone at (952) 426-6152 or by email at brett.reynolds@uroplasty.com, and request for copies of the joint proxy statement/prospectus and other documents filed by Vision-Sciences may be made by contacting Gary Siegel, Vice President, Finance by phone at (845) 848-1085 or by email at gary.siegel@visionsciences.com.

Participants in the Solicitation

Uroplasty, Vision-Sciences, their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from Uroplasty's and Vision-Sciences' respective shareholders in connection with the proposed transaction. Information about the directors and executive officers of Uroplasty and their ownership of Uroplasty stock is set forth in Uroplasty's annual report on Form 10-K for the fiscal year ended March 31, 2014, and its proxy statement for its 2014 annual meeting of shareholders, which was filed with the SEC on July 22, 2014. Information regarding Vision-Sciences' directors and executive officers is contained in Vision-Sciences' annual report on Form 10-K for the fiscal year ended March 31, 2014 and its proxy statement for its 2014 annual meeting of shareholders, which was filed with the SEC on June 17, 2014. These documents can be obtained free of charge from the sources indicated above. Certain directors, executive officers and employees of Uroplasty and Vision-Sciences may have direct or indirect interest in the transaction due to securities holdings, vesting of equity awards and rights to severance payments. Additional information regarding the participants in the solicitation of Uroplasty and Vision-Sciences shareholders will be included in the joint proxy statement/prospectus filed with the SEC.

Cautionary Statements Related to Forward-Looking Statements

This press release includes forward-looking statements. These forward-looking statements generally can be identified by the use of words such as "anticipate," "expect," "plan," "could," "may," "will," "believe," "estimate," "forecast," "goal," "project," and other words of similar meaning. Forward-looking statements in this press release include, but are not limited to, statements about the benefits of the transaction; expected revenue growth rates; the expected timing of the completion of the transaction; and the combined company's plans, objectives, expectations and intentions with respect to future operations, products and services. Each forward-looking statement contained in this press release is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others, uncertainties as to the timing of the transaction; uncertainties as to whether Uroplasty shareholders and Vision-Sciences shareholders will approve the transaction; the risk that competing offers will be made; the possibility that various closing conditions for the transaction may not be satisfied or waived; the risk that shareholder litigation in connection with the transaction may result in significant costs of defense, indemnification and liability; other business effects, including the effects of industry, economic or political conditions outside of either company's control; the failure to realize synergies and cost-savings from the transaction or delay in realization thereof; the businesses of Uroplasty and Vision-Sciences may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; operating costs and business disruption following completion of the transaction, including adverse effects on employee retention and on each company's respective business relationships with third parties; transaction costs; actual or contingent liabilities; the adequacy of the combined company's capital resources; and the risks identified under the heading "Risk Factors" in Uroplasty's Annual Report on Form 10-K, for the fiscal year ended March 31, 2014, filed with the Securities and Exchange Commission ("SEC") on June 9, 2014, and Vision-Sciences' Annual Report on Form 10-K for the fiscal year ended March 31, 2014, filed with the SEC on May 30, 2014, as well as both companies' subsequent Quarterly Reports on Form 10-Q and other information filed by each company with the SEC. Uroplasty and Vision-Sciences caution investors not to place considerable reliance on the forward-looking statements contained in this press release. You are encouraged to read Uroplasty's and Vision-Sciences' filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this press release speak only as of the date of this release, and Uroplasty and Vision-Sciences undertake no obligation to update or revise any of these statements. Uroplasty's and Vision-Sciences' businesses are subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

|

Contacts: |

|

|

Gary Siegel |

Lisa Wilson |

|

Vice President, Finance |

President |

|

Vision-Sciences, Inc. |

In-Site Communications, Inc. |

|

(845) 365-0600 |

(212) 452-2793 |

|

invest@visionsciences.com |

lwilson@insitecony.com |

(Financial tables follow)

Vision-Sciences, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(in thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

4,920 |

|

|

$ |

4,507 |

|

|

$ |

12,782 |

|

|

$ |

12,127 |

|

|

Cost of sales |

|

|

3,017 |

|

|

|

3,129 |

|

|

|

8,472 |

|

|

|

8,474 |

|

|

Gross profit |

|

|

1,903 |

|

|

|

1,378 |

|

|

|

4,310 |

|

|

|

3,653 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general, and administrative expenses |

|

|

2,760 |

|

|

|

2,304 |

|

|

|

7,609 |

|

|

|

7,404 |

|

|

Research and development expenses |

|

|

588 |

|

|

|

552 |

|

|

|

1,465 |

|

|

|

1,399 |

|

|

Operating loss |

|

|

(1,445 |

) |

|

|

(1,478 |

) |

|

|

(4,764 |

) |

|

|

(5,150 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, (net) |

|

|

(114 |

) |

|

|

(58 |

) |

|

|

(303 |

) |

|

|

(142 |

) |

|

Other, net |

|

|

(3 |

) |

|

|

(18 |

) |

|

|

(15 |

) |

|

|

(16 |

) |

|

Loss before provision for income taxes |

|

|

(1,562 |

) |

|

|

(1,554 |

) |

|

|

(5,082 |

) |

|

|

(5,308 |

) |

|

Income tax provision |

|

|

- |

|

|

|

8 |

|

|

|

- |

|

|

|

11 |

|

|

Net loss |

|

$ |

(1,562 |

) |

|

$ |

(1,562 |

) |

|

$ |

(5,082 |

) |

|

$ |

(5,319 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share - basic and diluted |

|

$ |

(0.03 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.12 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in computing net loss per common share - basic and diluted |

|

|

46,364 |

|

|

|

46,163 |

|

|

|

46,317 |

|

|

|

46,139 |

|

Vision-Sciences, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(in thousands)

| |

|

December 31, |

|

|

March 31, |

|

| |

|

2014 |

|

|

2014 |

|

|

|

|

(unaudited) |

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,548 |

|

|

$ |

1,237 |

|

|

Accounts receivable, net |

|

|

4,056 |

|

|

|

3,818 |

|

|

Inventories, net |

|

|

4,314 |

|

|

|

4,194 |

|

|

Prepaid expenses and other current assets |

|

|

513 |

|

|

|

455 |

|

|

Total current assets |

|

|

10,431 |

|

|

|

9,704 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

922 |

|

|

|

1,062 |

|

|

Other assets, net |

|

|

67 |

|

|

|

67 |

|

|

Total assets |

|

$ |

11,420 |

|

|

$ |

10,833 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,064 |

|

|

$ |

1,217 |

|

|

Accrued expenses |

|

|

1,134 |

|

|

|

918 |

|

|

Accrued compensation |

|

|

349 |

|

|

|

474 |

|

|

Deferred revenue |

|

|

318 |

|

|

|

210 |

|

|

Capital lease obligations |

|

|

- |

|

|

|

22 |

|

|

Total current liabilities |

|

|

3,865 |

|

|

|

2,841 |

|

| |

|

|

|

|

|

|

|

|

|

Convertible debt—related party |

|

|

26,522 |

|

|

|

22,414 |

|

|

Deferred revenue, net of current portion |

|

|

13 |

|

|

|

93 |

|

|

Total liabilities |

|

|

30,400 |

|

|

|

25,348 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and Contingencies |

|

|

|

|

|

|

|

|

|

Stockholders’ deficit: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value |

|

|

|

|

|

|

|

|

|

Authorized—5,000 shares; issued and outstanding - none |

|

|

- |

|

|

|

- |

|

|

Common stock, $0.01 par value |

|

|

|

|

|

|

|

|

|

Authorized—100,000 shares; issued and outstanding—48,380 shares and 47,614 shares, respectively |

|

|

484 |

|

|

|

476 |

|

|

Additional paid-in capital |

|

|

103,245 |

|

|

|

102,629 |

|

|

Treasury stock at cost, 65 shares and 59 shares of common stock, respectively |

|

|

(85 |

) |

|

|

(78 |

) |

|

Accumulated deficit |

|

|

(122,624 |

) |

|

|

(117,542 |

) |

|

Total stockholders’ deficit |

|

|

(18,980 |

) |

|

|

(14,515 |

) |

|

Total liabilities and stockholders’ deficit |

|

$ |

11,420 |

|

|

$ |

10,833 |

|

Vision-Sciences, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(in thousands)

(Unaudited)

| |

|

Nine Months |

|

| |

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(5,082 |

) |

|

$ |

(5,319 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

466 |

|

|

|

532 |

|

|

Stock-based compensation expense |

|

|

562 |

|

|

|

499 |

|

|

Provision for bad debt expenses |

|

|

20 |

|

|

|

16 |

|

|

Amortization of debt discount |

|

|

108 |

|

|

|

5 |

|

|

Loss on disposal of fixed assets |

|

|

9 |

|

|

|

6 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(258 |

) |

|

|

198 |

|

|

Inventories |

|

|

(408 |

) |

|

|

(465 |

) |

|

Prepaid expenses and other current assets |

|

|

(58 |

) |

|

|

(37 |

) |

|

Other assets |

|

|

- |

|

|

|

10 |

|

|

Accounts payable |

|

|

847 |

|

|

|

(215 |

) |

|

Accrued expenses |

|

|

216 |

|

|

|

169 |

|

|

Accrued compensation |

|

|

(125 |

) |

|

|

(8 |

) |

|

Deferred revenue |

|

|

28 |

|

|

|

67 |

|

|

Net cash used in operating activities |

|

|

(3,675 |

) |

|

|

(4,542 |

) |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(47 |

) |

|

|

(53 |

) |

|

Proceeds from disposal of fixed assets |

|

|

- |

|

|

|

3 |

|

|

Net cash used in investing activities |

|

|

(47 |

) |

|

|

(50 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of convertible debt—related party |

|

|

4,000 |

|

|

|

5,000 |

|

|

Proceeds from exercise of stock options |

|

|

62 |

|

|

|

- |

|

|

Common stock repurchased |

|

|

(7 |

) |

|

|

(28 |

) |

|

Payments of capital leases |

|

|

(22 |

) |

|

|

(46 |

) |

|

Net cash provided by financing activities |

|

|

4,033 |

|

|

|

4,926 |

|

|

Net increase in cash and cash equivalents |

|

|

311 |

|

|

|

334 |

|

|

Cash and cash equivalents at beginning of period |

|

$ |

1,237 |

|

|

$ |

788 |

|

|

Cash and cash equivalents at end of period |

|

$ |

1,548 |

|

|

$ |

1,122 |

|

Page 8

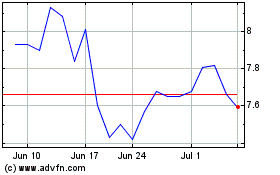

Cognyte Software (NASDAQ:CGNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cognyte Software (NASDAQ:CGNT)

Historical Stock Chart

From Apr 2023 to Apr 2024