VeriSign, Inc. (NASDAQ: VRSN), a global leader in domain names

and Internet security, today reported financial results for the

first quarter of 2016.

First Quarter GAAP Financial Results

VeriSign, Inc. and subsidiaries (“Verisign”) reported revenue of

$282 million for the first quarter of 2016, up 9.1 percent from the

same quarter in 2015. Verisign reported net income of $107 million

and diluted earnings per share (diluted “EPS”) of $0.82 for the

first quarter of 2016, compared to net income of $88 million and

diluted EPS of $0.66 for the same quarter in 2015. The operating

margin was 59.2 percent for the first quarter of 2016 compared to

55.8 percent for the same quarter in 2015.

First Quarter Non-GAAP Financial Results

Verisign reported, on a non-GAAP basis, net income of $112

million and diluted EPS of $0.85 for the first quarter of 2016,

compared to net income of $99 million and diluted EPS of $0.74 for

the same quarter in 2015. The non-GAAP operating margin was 63.3

percent for the first quarter of 2016 compared to 59.7 percent for

the same quarter in 2015. A table reconciling the GAAP to the

non-GAAP results (which excludes items described below) is appended

to this release.

“The Company’s strong and consistent financial performance

reflects the focus and discipline of our teams in executing our

strategy,” commented Jim Bidzos, Executive Chairman, President and

Chief Executive Officer.

Financial Highlights

- Verisign ended the first quarter with

cash, cash equivalents and marketable securities of $1.9 billion, a

decrease of $20 million from year-end 2015.

- Cash flow from operations was $144

million for the first quarter of 2016, compared with $133 million

for the same quarter in 2015.

- Deferred revenues on March 31, 2016,

totaled $992 million, an increase of $31 million from year-end

2015.

- During the first quarter, Verisign

repurchased 1.8 million shares of its common stock for $150

million. At March 31, 2016, $916 million remained available and

authorized under the current share repurchase program which has no

expiration.

- For purposes of calculating diluted

EPS, the first quarter diluted share count included 21.1 million

shares related to subordinated convertible debentures, compared

with 15.8 million shares for the same quarter in 2015. These

represent diluted shares and not shares that have been issued.

Business Highlights

- Verisign Registry Services added 2.65

million net new names during the first quarter, ending with 142.5

million .com and .net domain names in the domain name base, which

represents a 7.1 percent increase over the base at the end of the

first quarter in 2015.

- In the first quarter, Verisign

processed 10.0 million new domain name registrations for .com and

.net, as compared to 8.7 million for the same quarter in 2015.

- The final .com and .net renewal rate

for the fourth quarter of 2015 was 73.3 percent compared with 72.5

percent for the same quarter in 2014. Renewal rates are not fully

measurable until 45 days after the end of the quarter.

Non-GAAP Financial Measures and

Adjusted EBITDA

Verisign provides quarterly and annual financial statements that

are prepared in accordance with generally accepted accounting

principles (GAAP). Along with this information, management

typically discloses and discusses certain non-GAAP financial

information in quarterly earnings releases, on investor conference

calls and during investor conferences and related events. This

non-GAAP financial information does not include the following types

of financial measures that are included in GAAP: stock-based

compensation, unrealized gain/loss on the contingent interest

derivative on the subordinated convertible debentures, and non-cash

interest expense. Non-GAAP net income is decreased by amounts

accrued, if any, during the period for contingent interest payable

resulting from upside or downside triggers related to the

subordinated convertible debentures and is adjusted for an income

tax rate of 26 percent which differs from the GAAP income tax

rate.

On a quarterly basis, Verisign also provides Adjusted EBITDA.

Adjusted EBITDA is a non-GAAP financial measure and is calculated

in accordance with the terms of the indentures governing Verisign’s

4.625% senior notes due 2023 and 5.25% senior notes due 2025.

Adjusted EBITDA refers to net income before interest, taxes,

depreciation and amortization, stock-based compensation, unrealized

loss (gain) on the contingent interest derivative on the

subordinated convertible debentures and unrealized (gain) loss on

hedging agreements.

Management believes that this non-GAAP financial data

supplements the GAAP financial data by providing investors with

additional information that allows them to have a clearer picture

of Verisign’s operations. The presentation of this additional

information is not meant to be considered in isolation nor as a

substitute for results prepared in accordance with GAAP. Management

believes that the non-GAAP information enhances investors’ overall

understanding of Verisign’s financial performance and the

comparability of Verisign’s operating results from period to

period.

The tables appended to this release include a reconciliation of

the non-GAAP financial information to the comparable financial

information reported in accordance with GAAP for the given

periods.

Today’s Conference Call

Verisign will host a live conference call today at 4:30 p.m.

(EDT) to review the first quarter 2016 results. The call will be

accessible by direct dial at (888) 676-VRSN (U.S.) or (913)

312-1449 (international), conference ID: Verisign. A listen-only

live web cast of the conference call and accompanying slide

presentation will also be available at https://investor.verisign.com. An audio archive of

the call will be available at https://investor.verisign.com/events.cfm. This

news release and the financial information discussed on today’s

conference call are available at https://investor.verisign.com.

About Verisign

Verisign, a global leader in domain names and Internet security,

enables Internet navigation for many of the world’s most recognized

domain names and provides protection for websites and enterprises

around the world. Verisign ensures the security, stability and

resiliency of key Internet infrastructure and services, including

the .com and .net domains and two of the Internet’s root servers,

as well as performs the root-zone maintainer function for the core

of the Internet’s Domain Name System (DNS). Verisign’s Security

Services include intelligence-driven Distributed Denial of Service

Protection, iDefense Security Intelligence and Managed DNS. To

learn more about what it means to be Powered by Verisign, please

visit Verisign.com.

VRSNF

Statements in this announcement other than historical data and

information constitute forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 as amended and

Section 21E of the Securities Exchange Act of 1934 as amended.

These statements involve risks and uncertainties that could cause

our actual results to differ materially from those stated or

implied by such forward-looking statements. The potential risks and

uncertainties include, among others, whether the U.S. Department of

Commerce will approve any exercise by us of our right to increase

the price per .com domain name, under certain circumstances, the

uncertainty of whether we will be able to demonstrate to the U.S.

Department of Commerce that market conditions warrant removal of

the pricing restrictions on .com domain names and the uncertainty

of whether we will experience other negative changes to our pricing

terms; the failure to renew key agreements on similar terms, or at

all; new or existing governmental laws and regulations in the U.S.

or other applicable foreign jurisdictions; system interruptions;

security breaches; attacks on the Internet by hackers, viruses, or

intentional acts of vandalism; the uncertainty of the impact of the

U.S. government’s transition of key Internet domain name functions

(the Internet Assigned Numbers Authority (“IANA”) function) and the

related root zone management function; changes in Internet

practices and behavior and the adoption of substitute technologies;

the success or failure of the evolution of our target markets; the

operational and other risks from the introduction of new gTLDs by

ICANN and our provision of back-end registry services; the highly

competitive business environment in which we operate; whether we

can maintain strong relationships with registrars and their

resellers to maintain their marketing focus on our products and

services; challenging global economic conditions; economic and

political risk associated with our international operations; our

ability to protect and enforce our rights to our intellectual

property and ensure that we do not infringe on others’ intellectual

property; the outcome of legal or other challenges resulting from

our activities or the activities of registrars or registrants, or

litigation generally; the impact of our new strategic initiatives,

including our IDN gTLDs; whether we can retain and motivate our

senior management and key employees; the impact of unfavorable tax

rules and regulations; and our ability to continue to reinvest

offshore our foreign earnings. More information about potential

factors that could affect our business and financial results is

included in our filings with the SEC, including in our Annual

Report on Form 10-K for the year ended Dec. 31, 2015, Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K. Verisign

undertakes no obligation to update any of the forward-looking

statements after the date of this announcement.

©2016 VeriSign, Inc. All rights reserved. VERISIGN, the

VERISIGN logo, and other trademarks, service marks, and designs are

registered or unregistered trademarks of VeriSign, Inc. and its

subsidiaries in the United States and in foreign countries. All

other trademarks are property of their respective owners.

VERISIGN, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except par

value)

(Unaudited)

March 31,

2016

December 31,

2015

ASSETS

Current assets: Cash and cash equivalents $ 234,025 $ 228,659

Marketable securities 1,661,804 1,686,771 Accounts receivable, net

16,188 12,638 Other current assets 34,040

39,856 Total current assets 1,946,057

1,967,924 Property and equipment, net 286,202 295,570

Goodwill 52,527 52,527 Deferred tax assets 15,324 17,361 Other

long-term assets 23,563 24,355 Total

long-term assets 377,616 389,813 Total

assets $ 2,323,673 $ 2,357,737

LIABILITIES AND

STOCKHOLDERS’ DEFICIT

Current liabilities: Accounts payable and accrued liabilities $

148,677 $ 188,171 Deferred revenues 703,599 680,483 Subordinated

convertible debentures, including contingent interest derivative

629,437 634,326 Total current

liabilities 1,481,713 1,502,980

Long-term deferred revenues 288,741 280,859 Senior notes 1,235,813

1,235,354 Deferred tax liabilities 310,856 294,194 Other long-term

tax liabilities 114,573 114,797 Total

long-term liabilities 1,949,983 1,925,204

Total liabilities 3,431,696 3,428,184

Commitments and contingencies Stockholders’ deficit:

Preferred stock—par value $.001 per share; Authorized shares:

5,000; Issued and outstanding shares: none — — Common stock—par

value $.001 per share; Authorized shares: 1,000,000; Issued

shares:323,884 at March 31, 2016 and 322,990 at December 31, 2015;

Outstanding shares:108,879 at March 31, 2016 and 110,072 at

December 31, 2015 324 323 Additional paid-in capital 17,412,920

17,558,822 Accumulated deficit (18,518,143 ) (18,625,599 )

Accumulated other comprehensive loss (3,124 ) (3,993

) Total stockholders’ deficit (1,108,023 ) (1,070,447

) Total liabilities and stockholders’ deficit $ 2,323,673 $

2,357,737

VERISIGN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME

(In thousands, except per share

data)

(Unaudited)

Three Months Ended March 31, 2016 2015

Revenues $ 281,876 $ 258,422 Costs and expenses: Cost

of revenues 50,582 48,353 Sales and marketing 20,027 22,382

Research and development 16,743 17,152 General and administrative

27,757 26,298 Total costs and expenses

115,109 114,185 Operating income

166,767 144,237 Interest expense (28,804 ) (22,017 ) Non-operating

income (loss), net 3,121 (5,555 ) Income

before income taxes 141,084 116,665 Income tax expense

(33,628 ) (28,427 ) Net income 107,456

88,238 Unrealized gain on investments 935 87 Realized (gain)

on investments, included in net income (66 ) (4 )

Other comprehensive income 869 83

Comprehensive income $ 108,325 $ 88,321

Earnings per share: Basic $ 0.98 $ 0.75 Diluted $

0.82 $ 0.66 Shares used to compute earnings per share

Basic 109,592 117,139 Diluted

131,581 133,850

VERISIGN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

Three Months Ended March 31,

2016 2015 Cash flows from operating

activities: Net income $ 107,456 $ 88,238 Adjustments to reconcile

net income to net cash provided by operating activities:

Depreciation of property and equipment 14,867 15,747 Stock-based

compensation 11,759 10,128 Excess tax benefit associated with

stock-based compensation (6,018 ) (5,993 ) Unrealized (gain) loss

on contingent interest derivative on Subordinated Convertible

Debentures (1,065 ) 7,019 Payment of Contingent interest (6,544 )

(5,225 ) Amortization of debt discount and issuance costs 3,267

2,845 Other, net (779 ) (144 ) Changes in operating assets and

liabilities Accounts receivable (3,779 ) (1,282 ) Prepaid expenses

and other assets 6,524 (3,084 ) Accounts payable and accrued

liabilities (31,537 ) (28,816 ) Deferred revenues 30,998 34,582 Net

deferred income taxes and other long-term tax liabilities

18,477 18,654 Net cash provided by operating

activities 143,626 132,669 Cash flows

from investing activities: Proceeds from maturities and sales of

marketable securities 900,810 325,399 Purchases of marketable

securities (874,031 ) (257,415 ) Purchases of property and

equipment (7,082 ) (13,042 ) Other investing activities —

(3,787 ) Net cash provided by investing activities

19,697 51,155 Cash flows from financing

activities: Proceeds from issuance of common stock from option

exercises and employee stock purchase plans 8,084 8,776 Repurchases

of common stock (172,360 ) (178,330 ) Proceeds from borrowings, net

of issuance costs — 493,824 Excess tax benefit associated with

stock-based compensation 6,018 5,993

Net cash (used in) provided by financing activities (158,258

) 330,263 Effect of exchange rate changes on cash and

cash equivalents 301 184 Net increase

in cash and cash equivalents 5,366 514,271 Cash and cash

equivalents at beginning of period 228,659

191,608 Cash and cash equivalents at end of period $ 234,025

$ 705,879 Supplemental cash flow disclosures: Cash

paid for interest $ 27,028 $ 25,494 Cash paid for

income taxes, net of refunds received $ 13,711 $ 12,970

VERISIGN, INC.

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

(In thousands, except per share

data)

(Unaudited)

Three Months Ended March 31,

2016 2015 Operating Income

Net Income Operating Income

Net Income GAAP as reported $ 166,767 $

107,456 144,237 $ 88,238 Adjustments: Stock-based compensation

11,759 11,759 10,128 10,128 Unrealized (gain) loss on contingent

interest derivative on the subordinated convertible debentures

(1,065 ) 7,019 Non-cash interest expense 3,267 2,706 Contingent

interest payable on subordinated convertible debentures (3,346 )

(2,690 ) Tax adjustment (5,813 )

(6,369 )

Non-GAAP $ 178,526 $

112,258 $ 154,365 $ 99,032

Revenues $ 281,876 $ 258,422

Non-GAAP operating

margin 63.3 % 59.7 %

Diluted shares

131,581 133,850

Diluted EPS, non-GAAP $ 0.85 $ 0.74

VERISIGN, INC.

RECONCILIATION OF NON-GAAP ADJUSTED

EBITDA

(In thousands)

(Unaudited)

The following table reconciles GAAP net

income to non-GAAP Adjusted EBITDA for the periods shown below (in

thousands):

Three Months Ended

March 31,

2016 2015 Net Income

$

107,456

$ 88,238 Interest expense 28,804 22,017 Income tax expense 33,628

28,427 Depreciation and amortization 14,867 15,747 Stock-based

compensation 11,759 10,128 Unrealized (gain) loss on contingent

interest derivative on the subordinated convertible debentures

(1,065 ) 7,019 Unrealized loss (gain) on hedging agreements

562 (456 )

Non-GAAP Adjusted EBITDA

$

196,011

$ 171,120

Four Quarters Ended

March 31, 2016

Net income 394,454 Interest expense 114,418 Income tax

expense 117,615 Depreciation and amortization 60,611 Stock-based

compensation 47,706 Unrealized loss on contingent interest

derivative on the subordinated convertible debentures 6,046

Unrealized loss on hedging agreements 1,113

Non-GAAP Adjusted EBITDA

$

741,963

VERISIGN, INC.

STOCK-BASED COMPENSATION

CLASSIFICATION

(In thousands)

(Unaudited)

The following table presents the

classification of stock-based compensation:

Three Months Ended March 31,

2016 2015 Cost of revenues $ 1,841 $

1,739 Sales and marketing 1,633 1,299 Research and development

1,703 1,721 General and administrative 6,582 5,369

Total stock-based compensation expense $ 11,759 $ 10,128

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160428006620/en/

VeriSign, Inc.Investor Relations:David Atchley,

703-948-4643datchley@verisign.comorMedia Relations:Deana Alvy,

703-948-4179dalvy@verisign.com

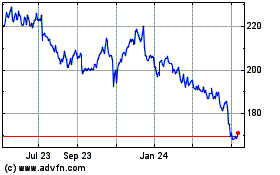

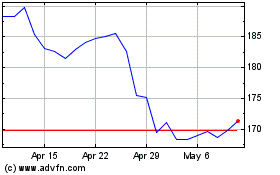

VeriSign (NASDAQ:VRSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

VeriSign (NASDAQ:VRSN)

Historical Stock Chart

From Apr 2023 to Apr 2024