UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 23, 2015

VERISIGN, INC.

(Exact Name of Registrant as Specified in its Charter)

Delaware

(State or Other Jurisdiction of

Incorporation)

|

| | |

| | |

000-23593 | | 94-3221585 |

(Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

| | |

12061 Bluemont Way, Reston, VA | | 20190 |

(Address of Principal Executive Offices) | | (Zip Code) |

(703) 948-3200

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

c | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

c | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

c | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

c | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02. | Results of Operations and Financial Condition. |

On July 23, 2015, VeriSign, Inc. (“Verisign” or the “Company”) announced its financial results for the fiscal quarter ended June 30, 2015, and certain other information, including information on the first quarter 2015 domain name renewal rate. A copy of this press release is attached hereto as Exhibit 99.1.

The information in this Item 2.02 of Form 8-K and the Exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

|

| | |

Exhibit Number | | Description |

| |

99.1 | | Text of press release of VeriSign, Inc. issued on July 23, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | VERISIGN, INC. |

| | |

Date: July 23, 2015 | | By: | | /s/ Thomas C. Indelicarto |

| | Thomas C. Indelicarto |

| | Senior Vice President, General Counsel and Secretary |

Exhibit Index

|

| | |

| | |

Exhibit No. | | Description |

Exhibit 99.1 | | Text of press release of VeriSign, Inc. issued on July 23, 2015. |

Verisign Reports Second Quarter 2015 Results

RESTON, VA - July 23, 2015 - VeriSign, Inc. (NASDAQ: VRSN), a global leader in domain names and Internet security, today reported financial results for the second quarter of 2015.

Second Quarter GAAP Financial Results

VeriSign, Inc. and subsidiaries (“Verisign”) reported revenue of $263 million for the second quarter of 2015, up 4.9 percent from the same quarter in 2014. Verisign reported net income of $93 million and diluted earnings per share of $0.70 for the second quarter of 2015, compared to net income of $100 million and diluted EPS of $0.71 in the same quarter in 2014. The operating margin was 56.7 percent for the second quarter of 2015 compared to 57.2 percent for the same quarter in 2014.

Second Quarter Non-GAAP Financial Results

Verisign reported, on a non-GAAP basis, net income of $99 million and diluted EPS of $0.74 for the second quarter of 2015, compared to net income of $96 million and diluted EPS of $0.68 for the same quarter in 2014. The non-GAAP operating margin was 61.3 percent for the second quarter of 2015 compared to 60.9 percent for the same quarter in 2014. A table reconciling the GAAP to the non-GAAP results (which excludes items described below) is appended to this release.

“I am pleased to report another quarter in which we have created and delivered value for our shareholders,” commented Jim Bidzos, Executive Chairman, President and Chief Executive Officer.

Financial Highlights

| |

• | Verisign ended the second quarter with cash, cash equivalents and marketable securities of $1.9 billion, an increase of $460 million as compared with year-end 2014. |

| |

• | Cash flow from operations was $175 million for the second quarter of 2015, compared with $121 million for the same quarter in 2014. |

| |

• | Deferred revenues on June 30, 2015, totaled $932 million, an increase of $41 million from year-end 2014. |

| |

• | Capital expenditures were $9 million in the second quarter of 2015. |

| |

• | During the second quarter, Verisign repurchased 2.5 million shares of its common stock for $156 million. At June 30, 2015, $761 million remained available and authorized under the current share repurchase program which has no expiration. |

| |

• | For purposes of calculating diluted EPS, the second quarter diluted share count included 17 million shares related to subordinated convertible debentures, compared with 11.3 million shares in the same quarter in 2014. These represent diluted shares and not shares that have been issued. |

Business Highlights

| |

• | Verisign Registry Services added 0.52 million net new names during the second quarter, ending with 133.5 million .com and .net domain names in the domain name base, which represents a 3.1 percent increase over the base at the end of the second quarter in 2014, as calculated including domain names on hold for both periods. |

| |

• | In the second quarter, Verisign processed 8.7 million new domain name registrations for .com and .net, as compared to 8.5 million for the same period in 2014. |

| |

• | The final .com and .net renewal rate for the first quarter of 2015 was 73.4 percent compared with 72.6 percent for the same quarter in 2014. Renewal rates are not fully measurable until 45 days after the end of the quarter. |

| |

• | Verisign announces an increase in the annual fee for a .net domain name registration from $6.79 to $7.46, effective Feb. 1, 2016, per its agreement with the Internet Corporation for Assigned Names and Numbers. (ICANN). |

Non-GAAP Items

Non-GAAP financial results exclude the following items that are included under GAAP: stock-based compensation, unrealized gain/loss on contingent interest derivative on subordinated convertible debentures, and non-cash interest expense. Non-GAAP net income is decreased by amounts accrued, if any, during the period for contingent interest payable resulting from upside or downside triggers related to the subordinated convertible debentures and is adjusted for an income tax rate of 26 percent for 2015 and 28 percent for 2014, both of which differ from the GAAP income tax rate. A table reconciling the GAAP to non-GAAP operating income and net income is appended to this release.

Today’s Conference Call

Verisign will host a live conference call today at 4:30 p.m. (EDT) to review the second quarter 2015 results. The call will be accessible by direct dial at (888) 676-VRSN (U.S.) or (913) 312-1233 (international), conference ID: Verisign. A listen-only live web cast of the conference call and accompanying slide presentation will also be available at http://investor.verisign.com. An audio archive of the call will be available at https://investor.verisign.com/events.cfm. This news release and the financial information discussed on today’s conference call are available at http://investor.verisign.com.

About Verisign

Verisign, a global leader in domain names and Internet security, enables Internet navigation for many of the world’s most recognized domain names and provides protection for websites and enterprises around the world. Verisign ensures the security, stability and resiliency of key Internet infrastructure and services, including the .com and .net domains and two of the Internet’s root servers, as well as performs the root-zone maintainer functions for the core of the Internet’s Domain Name System (DNS). Verisign’s Security Services include intelligence-driven Distributed Denial of Service Protection, iDefense Security Intelligence and Managed DNS. To learn more about what it means to be Powered by Verisign, please visit VerisignInc.com.

VRSNF

Statements in this announcement other than historical data and information constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 as amended and Section 21E of the Securities Exchange Act of 1934 as amended. These statements involve risks and uncertainties that could cause our actual results to differ materially from those stated or implied by such forward-looking statements. The potential risks and uncertainties include, among others, the uncertainty of the impact of the U.S. government’s transition of key Internet domain name functions (the Internet Assigned Numbers Authority (“IANA”) function) and related root zone management functions, whether the U.S. Department of Commerce will approve any exercise by us of our right to increase the price per .com domain name, under certain circumstances, the uncertainty of whether we will be able to demonstrate to the U.S. Department of Commerce that market conditions warrant removal of the pricing restrictions on .com domain names and the uncertainty of whether we will experience other negative changes to our pricing terms; the failure to renew key agreements on similar terms, or at all; the uncertainty of future revenue and profitability and potential fluctuations in quarterly operating results due to such factors as restrictions on increasing prices under the .com Registry Agreement, changes in marketing and advertising practices, including those of third-party registrars, increasing competition, and pricing pressure from competing services offered at prices below our prices; changes in search engine algorithms and advertising payment practices; the uncertainty of whether we will successfully develop and market new products and services, the uncertainty of whether our new products and services, if any, will achieve market acceptance or result in any revenues; challenging global economic conditions; challenges of ongoing changes to Internet governance and administration; the outcome of legal or other challenges resulting from our activities or the activities of registrars or registrants, or litigation generally; the uncertainty regarding what the ultimate outcome or amount of benefit we receive, if any, from the worthless stock deduction will be; new or existing governmental laws and regulations in the U.S. or other applicable foreign jurisdictions; changes in customer behavior, Internet platforms and web-browsing patterns; system interruptions; security breaches; attacks on the Internet by hackers, viruses, or intentional acts of vandalism; whether we will be able to continue to expand our infrastructure to meet demand; the uncertainty of the expense and timing of requests for indemnification, if any, relating to completed divestitures; and the impact of the introduction of new gTLDs, any delays in their introduction, the impact of ICANN’s Registry Agreement for new gTLDs, and whether our new gTLDs or the new gTLDs for which we have contracted to provide back-end registry services will be successful; and the uncertainty regarding the impact, if any, of the delegation into the root zone of a large number of new gTLDs. More information about potential factors that could affect our business and financial results is included in our filings with the SEC, including in our Annual Report on Form 10-K for the year ended Dec. 31, 2014, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Verisign undertakes no obligation to update any of the forward-looking statements after the date of this announcement.

Contacts

Investor Relations: David Atchley, datchley@verisign.com, 703-948-4643

Media Relations: Deana Alvy, dalvy@verisign.com, 703-948-4179

©2015 VeriSign, Inc. All rights reserved. VERISIGN, the VERISIGN logo, and other trademarks, service marks, and designs are registered or unregistered trademarks of VeriSign, Inc. and its subsidiaries in the United States and in foreign countries. All other trademarks are property of their respective owners.

VERISIGN, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except par value)

(Unaudited)

|

| | | | | | | |

| June 30,

2015 | | December 31,

2014 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 187,286 |

| | $ | 191,608 |

|

Marketable securities | 1,697,523 |

| | 1,233,076 |

|

Accounts receivable, net | 14,418 |

| | 13,448 |

|

Other current assets | 31,280 |

| | 41,905 |

|

Total current assets | 1,930,507 |

| | 1,480,037 |

|

Property and equipment, net | 304,360 |

| | 319,028 |

|

Goodwill | 52,527 |

| | 52,527 |

|

Long-term deferred tax assets | 260,892 |

| | 266,954 |

|

Other long-term assets | 22,378 |

| | 15,918 |

|

Total long-term assets | 640,157 |

| | 654,427 |

|

Total assets | $ | 2,570,664 |

| | $ | 2,134,464 |

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT | | | |

Current liabilities: | | | |

Accounts payable and accrued liabilities | $ | 166,558 |

| | $ | 190,278 |

|

Deferred revenues | 653,773 |

| | 621,307 |

|

Subordinated convertible debentures, including contingent interest derivative | 624,767 |

| | 620,620 |

|

Deferred tax liabilities | 500,433 |

| | 477,781 |

|

Total current liabilities | 1,945,531 |

| | 1,909,986 |

|

Long-term deferred revenues | 277,828 |

| | 269,047 |

|

Senior notes | 1,234,368 |

| | 740,175 |

|

Other long-term tax liabilities | 107,253 |

| | 98,722 |

|

Total long-term liabilities | 1,619,449 |

| | 1,107,944 |

|

Total liabilities | 3,564,980 |

| | 3,017,930 |

|

Commitments and contingencies | | | |

Stockholders’ deficit: | | | |

Preferred stock—par value $.001 per share; Authorized shares: 5,000; Issued and outstanding shares: none | — |

| | — |

|

Common stock—par value $.001 per share; Authorized shares: 1,000,000; Issued shares:322,781 at June 30, 2015 and 321,699 at December 31, 2014; Outstanding shares:114,028 at June 30, 2015 and 118,452 at December 31, 2014 | 323 |

| | 322 |

|

Additional paid-in capital | 17,828,075 |

| | 18,120,045 |

|

Accumulated deficit | (18,819,586 | ) | | (19,000,835 | ) |

Accumulated other comprehensive loss | (3,128 | ) | | (2,998 | ) |

Total stockholders’ deficit | (994,316 | ) | | (883,466 | ) |

Total liabilities and stockholders’ deficit | $ | 2,570,664 |

| | $ | 2,134,464 |

|

VERISIGN, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In thousands, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Revenues | $ | 262,539 |

| | $ | 250,382 |

| | $ | 520,961 |

| | $ | 499,178 |

|

Costs and expenses: | | | | | | | |

Cost of revenues | 48,221 |

| | 45,989 |

| | 96,574 |

| | 94,015 |

|

Sales and marketing | 24,329 |

| | 23,651 |

| | 46,711 |

| | 43,940 |

|

Research and development | 16,347 |

| | 15,694 |

| | 33,499 |

| | 34,133 |

|

General and administrative | 24,677 |

| | 21,927 |

| | 50,975 |

| | 44,384 |

|

Total costs and expenses | 113,574 |

| | 107,261 |

| | 227,759 |

| | 216,472 |

|

Operating income | 148,965 |

| | 143,121 |

| | 293,202 |

| | 282,706 |

|

Interest expense | (28,503 | ) | | (21,490 | ) | | (50,520 | ) | | (42,875 | ) |

Non-operating income (loss), net | 3,201 |

| | 4,994 |

| | (2,354 | ) | | 11,510 |

|

Income before income taxes | 123,663 |

| | 126,625 |

| | 240,328 |

| | 251,341 |

|

Income tax expense | (30,652 | ) | | (26,449 | ) | | (59,079 | ) | | (56,742 | ) |

Net income | 93,011 |

| | 100,176 |

| | 181,249 |

| | 194,599 |

|

Realized foreign currency translation adjustments, included in net income | (291 | ) | | — |

| | (291 | ) | | — |

|

Unrealized gain (loss) on investments | 147 |

| | (33 | ) | | 234 |

| | (25 | ) |

Realized (gain) loss on investments, included in net income | (69 | ) | | (2 | ) | | (73 | ) | | 3 |

|

Other comprehensive loss | (213 | ) | | (35 | ) |

| (130 | ) |

| (22 | ) |

Comprehensive income | $ | 92,798 |

| | $ | 100,141 |

| | $ | 181,119 |

| | $ | 194,577 |

|

| | | | | | | |

Income per share: | | | | | | | |

Basic | $ | 0.80 |

| | $ | 0.77 |

| | $ | 1.56 |

| | $ | 1.48 |

|

Diluted | $ | 0.70 |

| | $ | 0.71 |

| | $ | 1.36 |

| | $ | 1.34 |

|

Shares used to compute net income per share | | | | | | | |

Basic | 115,656 |

| | 129,350 |

| | 116,394 |

| | 131,372 |

|

Diluted | 133,251 |

| | 141,142 |

| | 133,546 |

| | 144,861 |

|

VERISIGN, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

|

| | | | | | | |

| Six Months Ended June 30, |

| 2015 | | 2014 |

Cash flows from operating activities: | | | |

Net income | $ | 181,249 |

| | $ | 194,599 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Depreciation of property and equipment | 31,620 |

| | 32,115 |

|

Stock-based compensation | 22,129 |

| | 19,365 |

|

Excess tax benefit associated with stock-based compensation | (11,366 | ) | | (15,309 | ) |

Unrealized loss (gain) on contingent interest derivative on Subordinated Convertible Debentures | 4,311 |

| | (10,515 | ) |

Payment of Contingent interest | (5,225 | ) | | — |

|

Other, net | 4,842 |

| | 3,802 |

|

Changes in operating assets and liabilities | | | |

Accounts receivable | (1,018 | ) | | (233 | ) |

Prepaid expenses and other assets | 7,369 |

| | 26,414 |

|

Accounts payable and accrued liabilities | (4,778 | ) | | (869 | ) |

Deferred revenues | 41,247 |

| | 34,615 |

|

Net deferred income taxes and other long-term tax liabilities | 37,245 |

| | (21,246 | ) |

Net cash provided by operating activities | 307,625 |

| | 262,738 |

|

Cash flows from investing activities: | | | |

Proceeds from maturities and sales of marketable securities | 1,283,367 |

| | 2,118,861 |

|

Purchases of marketable securities | (1,747,025 | ) | | (2,042,657 | ) |

Purchases of property and equipment | (21,891 | ) | | (18,747 | ) |

Other investing activities | (3,736 | ) | | 74 |

|

Net cash (used in) provided by investing activities | (489,285 | ) | | 57,531 |

|

Cash flows from financing activities: | | | |

Proceeds from issuance of common stock from option exercises and employee stock purchase plans | 9,014 |

| | 8,970 |

|

Repurchases of common stock | (335,885 | ) | | (446,676 | ) |

Proceeds from borrowings, net of issuance costs | 492,237 |

| | — |

|

Excess tax benefit associated with stock-based compensation | 11,366 |

| | 15,309 |

|

Net cash provided by (used in) financing activities | 176,732 |

| | (422,397 | ) |

Effect of exchange rate changes on cash and cash equivalents | 606 |

| | 266 |

|

Net decrease in cash and cash equivalents | (4,322 | ) | | (101,862 | ) |

Cash and cash equivalents at beginning of period | 191,608 |

| | 339,223 |

|

Cash and cash equivalents at end of period | $ | 187,286 |

| | $ | 237,361 |

|

Supplemental cash flow disclosures: | | | |

Cash paid for interest, net of capitalized interest | $ | 42,839 |

| | $ | 37,507 |

|

Cash paid for income taxes, net of refunds received | $ | 14,342 |

| | $ | 34,464 |

|

VERISIGN, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(In thousands, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, |

| 2015 | | 2014 |

| Operating Income | | Net Income | | Operating Income | | Net Income |

GAAP as reported | $ | 148,965 |

| | $ | 93,011 |

| | $ | 143,121 |

| | $ | 100,176 |

|

Adjustments: | | | | | | | |

Stock-based compensation | 12,001 |

| | 12,001 |

| | 9,372 |

| | 9,372 |

|

Unrealized (gain) loss on contingent interest derivative on the subordinated convertible debentures | | | (2,708 | ) | | | | (5,246 | ) |

Non-cash interest expense | | | 2,956 |

| | | | 2,547 |

|

Contingent interest payable on subordinated convertible debentures | | | (2,767 | ) | | | | — |

|

Tax adjustment | | | (3,965 | ) | | | | (10,875 | ) |

Non-GAAP | $ | 160,966 |

| | $ | 98,528 |

| | $ | 152,493 |

| | $ | 95,974 |

|

| | | | | | | |

Revenues | $ | 262,539 |

| | | | $ | 250,382 |

| | |

Non-GAAP operating margin | 61.3 | % | | | | 60.9 | % | | |

Diluted shares | | | 133,251 |

| | | | 141,142 |

|

Per diluted share, non-GAAP | | | $ | 0.74 |

| | | | $ | 0.68 |

|

Verisign provides quarterly and annual financial statements that are prepared in accordance with generally accepted accounting principles (GAAP). Along with this information, we typically disclose and discuss certain non-GAAP financial information in our quarterly earnings release, on investor conference calls and during investor conferences and related events. This non-GAAP financial information does not include the following types of financial measures that are included in GAAP: stock-based compensation, unrealized gain/loss on contingent interest derivative on subordinated convertible debentures, and non-cash interest expense. Non-GAAP net income is decreased by amounts accrued, if any, during the period for contingent interest payable resulting from upside or downside triggers related to the subordinated convertible debentures and is adjusted for an income tax rate of 26 percent for 2015 and 28 percent for 2014, both of which differ from the GAAP income tax rate.

Management believes that this non-GAAP financial data supplements the GAAP financial data by providing investors with additional information that allows them to have a clearer picture of our operations. The presentation of this additional information is not meant to be considered in isolation nor as a substitute for results prepared in accordance with GAAP. We believe that the non-GAAP information enhances investors’ overall understanding of our financial performance and the comparability of our operating results from period to period. Above, we have provided a reconciliation of the non-GAAP financial information that we provide each quarter with the comparable financial information reported in accordance with GAAP for the given period.

SUPPLEMENTAL FINANCIAL INFORMATION

The following table presents the classification of stock-based compensation: |

| | | | | | | |

| Three Months Ended June 30, |

| 2015 | | 2014 |

Cost of revenues | $ | 1,741 |

| | $ | 1,532 |

|

Sales and marketing | 1,818 |

| | 1,820 |

|

Research and development | 1,691 |

| | 1,639 |

|

General and administrative | 6,751 |

| | 4,381 |

|

Total stock-based compensation expense | $ | 12,001 |

| | $ | 9,372 |

|

VERISIGN, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(In thousands, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Six Months Ended June 30, |

| 2015 | | 2014 |

| Operating Income | | Net Income | | Operating Income | | Net Income |

GAAP as reported | $ | 293,202 |

| | $ | 181,249 |

| | $ | 282,706 |

| | $ | 194,599 |

|

Adjustments: | | | | | | | |

Stock-based compensation | 22,129 |

| | 22,129 |

| | 19,365 |

| | 19,365 |

|

Unrealized loss on contingent interest derivative on the subordinated convertible debentures | | | 4,311 |

| | | | (10,515 | ) |

Non-cash interest expense | | | 5,662 |

| | | | 4,991 |

|

Contingent interest payable on subordinated convertible debentures | | | (5,457 | ) | | | | — |

|

Tax adjustment | | | (10,334 | ) | | | | (17,509 | ) |

Non-GAAP | $ | 315,331 |

| | $ | 197,560 |

| | $ | 302,071 |

| | $ | 190,931 |

|

| | | | | | | |

Revenues | $ | 520,961 |

| | | | $ | 499,178 |

| | |

Non-GAAP operating margin | 60.5 | % | | | | 60.5 | % | | |

Diluted shares | | | 133,546 |

| | | | 144,861 |

|

Per diluted share, non-GAAP | | | $ | 1.48 |

| | | | $ | 1.32 |

|

Verisign provides quarterly and annual financial statements that are prepared in accordance with generally accepted accounting principles (GAAP). Along with this information, we typically disclose and discuss certain non-GAAP financial information in our quarterly earnings release, on investor conference calls and during investor conferences and related events. This non-GAAP financial information does not include the following types of financial measures that are included in GAAP: stock-based compensation, unrealized gain/loss on contingent interest derivative on subordinated convertible debentures, and non-cash interest expense. Non-GAAP net income is decreased by amounts accrued, if any, during the period for contingent interest payable resulting from upside or downside triggers related to the subordinated convertible debentures and is adjusted for an income tax rate of 26 percent for 2015 and 28 percent for 2014, both of which differ from the GAAP income tax rate.

Management believes that this non-GAAP financial data supplements the GAAP financial data by providing investors with additional information that allows them to have a clearer picture of our operations. The presentation of this additional information is not meant to be considered in isolation nor as a substitute for results prepared in accordance with GAAP. We believe that the non-GAAP information enhances investors’ overall understanding of our financial performance and the comparability of our operating results from period to period. Above, we have provided a reconciliation of the non-GAAP financial information that we provide each quarter with the comparable financial information reported in accordance with GAAP for the given period.

SUPPLEMENTAL FINANCIAL INFORMATION

The following table presents the classification of stock-based compensation: |

| | | | | | | |

| Six Months Ended June 30, |

| 2015 | | 2014 |

Cost of revenues | $ | 3,480 |

| | $ | 3,130 |

|

Sales and marketing | 3,117 |

| | 3,668 |

|

Research and development | 3,412 |

| | 3,511 |

|

General and administrative | 12,120 |

| | 9,056 |

|

Total stock-based compensation expense | $ | 22,129 |

| | $ | 19,365 |

|

VERISIGN, INC.

SUPPLEMENTAL FINANCIAL INFORMATION

(Unaudited)

On a quarterly basis we disclose our Adjusted EBITDA. Adjusted EBITDA is a non-GAAP financial measure and is calculated in accordance with the terms of the indentures governing our 4.625% senior notes due 2023 and our 5.25% senior notes due 2025. Adjusted EBITDA refers to net income before interest, taxes, depreciation and amortization, stock-based compensation, unrealized loss (gain) on contingent interest derivative on the subordinated convertible debentures and unrealized loss (gain) on hedging agreements.

The following table reconciles GAAP net income to Adjusted EBITDA for the periods shown below (in thousands): |

| | | | | | | |

| Three Months Ended June 30, |

| 2015 | | 2014 |

Net Income | $ | 93,011 |

| | $ | 100,176 |

|

Interest expense | 28,503 |

| | 21,490 |

|

Income tax expense | 30,652 |

| | 26,449 |

|

Depreciation and amortization | 15,873 |

| | 16,107 |

|

Stock-based compensation | 12,001 |

| | 9,372 |

|

Unrealized gain on contingent interest derivative on the subordinated convertible debentures | (2,708 | ) | | (5,246 | ) |

Unrealized loss (gain) on hedging agreements | 944 |

| | (150 | ) |

Adjusted EBITDA | $ | 178,276 |

| | $ | 168,198 |

|

|

| | | |

| Four Quarters Ended June 30, 2015 |

Net income | 341,911 |

|

Interest expense | 93,639 |

|

Income tax benefit | 130,388 |

|

Depreciation and amortization | 63,197 |

|

Stock-based compensation | 46,742 |

|

Unrealized loss on contingent interest derivative on the subordinated convertible debentures | 12,577 |

|

Unrealized loss on hedging agreements | 351 |

|

Adjusted EBITDA | $ | 688,805 |

|

Verisign’s management believes that presenting Adjusted EBITDA enhances investors’ overall understanding of our financial performance and the comparability of our operating results from period to period. However, Adjusted EBITDA has important limitations as an analytical tool. These limitations include, but are not limited to, the following:

| |

• | Adjusted EBITDA does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments; |

| |

• | Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| |

• | Adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; |

| |

• | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements; |

| |

• | non-cash compensation is and will remain a key element of our overall long-term incentive compensation package, although we exclude it as an expense when evaluating its ongoing operating performance for a particular period; and |

| |

• | other companies in our industry may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. |

Because of these limitations, Adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP.

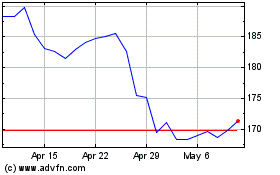

VeriSign (NASDAQ:VRSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

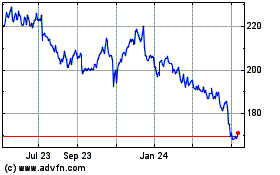

VeriSign (NASDAQ:VRSN)

Historical Stock Chart

From Apr 2023 to Apr 2024