Current Report Filing (8-k)

February 17 2015 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 13, 2015

VERISIGN, INC.

(Exact Name of Registrant as Specified in its Charter)

Delaware

(State or Other Jurisdiction of

Incorporation)

|

| | |

| | |

000-23593 | | 94-3221585 |

(Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

| | |

12061 Bluemont Way, Reston, VA | | 20190 |

(Address of Principal Executive Offices) | | (Zip Code) |

(703) 948-3200

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

c | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

c | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

c | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

c | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(e) Executive officers of VeriSign, Inc. (the “Company”) are eligible to receive an annual performance bonus payment for the fiscal year ended December 31, 2014 (“Fiscal 2014”) under the VeriSign, Inc. Annual Incentive Compensation Plan (“AICP”) based on performance against goals established by the Compensation Committee of the Board of Directors (the “Committee”) for Fiscal 2014. At a meeting held on February 10, 2015, the Committee determined, subject to and conditional upon receipt of an unqualified signed opinion from our independent registered public accounting firm regarding the financial statements contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (which occurred on February 13, 2015), the amounts of annual performance bonuses to be paid under the AICP based on the Committee’s review with management of the performance of each eligible executive officer.

The Fiscal 2014 AICP bonuses that were approved for our chief executive officer, chief financial officer and other persons designated as a “Named Executive Officer” in our 2014 Annual Proxy Statement were as follows:

|

| | | | |

D. James Bidzos | Executive Chairman, President and Chief Executive Officer | $ | 885,000 |

|

George E. Kilguss, III | Senior Vice President and Chief Financial Officer | $ | 350,000 |

|

Patrick S. Kane | Senior Vice President, Naming | $ | 230,454 |

|

On February 17, 2015, VeriSign, Inc. (“Verisign” or the “Company”) announced that the upside trigger on its 3.25% junior subordinated convertible debentures due 2037 (CUSIP Nos. 92343EAD4 and 92343EAC6) has been met for the six-month interest payment period from February 15, 2015 to August 14, 2015. A copy of this press release is attached hereto as Exhibit 99.1.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

|

| | |

Exhibit Number | | Description |

| |

99.1 | | Text of press release of VeriSign, Inc. issued on February 17, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | VERISIGN, INC. |

| | |

Date: February 17, 2015 | | By: | | /s/ Thomas C. Indelicarto |

| | Thomas C. Indelicarto |

| | Senior Vice President, General Counsel and Secretary |

Exhibit Index

|

| | |

| | |

Exhibit No. | | Description |

Exhibit 99.1 | | Text of press release of VeriSign, Inc. issued on February 17, 2015. |

Exhibit 99.1

Verisign Announces 3.25% Junior Subordinated Convertible Debentures Due 2037 to Pay Contingent Interest

RESTON, VA - Feb. 17, 2015 - VeriSign, Inc. (NASDAQ: VRSN), a global leader in domain names and Internet security, announced that the upside trigger on its 3.25% junior subordinated convertible debentures due 2037 (CUSIP Nos. 92343EAD4 and 92343EAC6) (the “Notes”) has been met for the six-month interest payment period from Feb. 15, 2015, to Aug. 14, 2015. As a result, contingent interest will be paid on the Notes for that six-month interest payment period. Contingent interest of approximately $5.5 million on the $1.25 billion outstanding principal amount of the Notes, or approximately $4.4275 per $1,000 principal amount of the Notes, will be paid on Aug. 15, 2015, to the holders of record as of Aug. 1, 2015.

About Verisign

Verisign, a global leader in domain names and Internet security, enables Internet navigation for many of the world’s most recognized domain names and provides protection for websites and enterprises around the world. Verisign ensures the security, stability and resiliency of key Internet infrastructure and services, including the .com and .net domains and two of the Internet’s root servers, as well as performs the root-zone maintainer functions for the core of the Internet’s Domain Name System (DNS). Verisign’s Network Intelligence and Availability services include intelligence-driven Distributed Denial of Service Protection, iDefense Security Intelligence and Managed DNS. To learn more about what it means to be Powered by Verisign, please visit VerisignInc.com.

VRSNF

Statements in this announcement other than historical data and information constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 as amended and Section 21E of the Securities Exchange Act of 1934 as amended. These statements involve risks and uncertainties that could cause our actual results to differ materially from those stated or implied by such forward-looking statements. The potential risks and uncertainties include, among others, the uncertainty of whether the Company will be able to pay the contingent interest when it becomes due and whether the aggregate amount of contingent interest payable or the outstanding principal amount of the Notes will change between the date of this announcement and the contingent interest payment date. More information about potential factors that could affect our business and financial results is included in our filings with the SEC, including in our Annual Report on Form 10-K for the year ended Dec. 31, 2014, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Verisign undertakes no obligation to update any of the forward-looking statements after the date of this announcement.

Contacts

Investor Relations: David Atchley, datchley@verisign.com, 703-948-4643

Media Relations: Deana Alvy, dalvy@verisign.com, 703-948-4179

©2015 VeriSign, Inc. All rights reserved. VERISIGN, the VERISIGN logo, and other trademarks, service marks, and designs are registered or unregistered trademarks of VeriSign, Inc. and its subsidiaries in the United States and in foreign countries. All other trademarks are property of their respective owners.

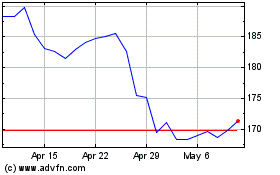

VeriSign (NASDAQ:VRSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

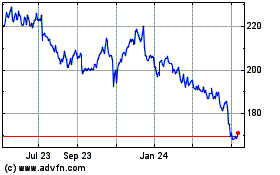

VeriSign (NASDAQ:VRSN)

Historical Stock Chart

From Apr 2023 to Apr 2024