United Security Bancshares, Inc. Reports First Quarter Results

April 29 2016 - 4:05PM

United Security Bancshares, Inc. (Nasdaq:USBI) (the “Company”)

today reported net income of $0.3 million, or $0.05 per diluted

share, for the quarter ended March 31, 2016. The results

represent a decrease of $0.02 per share compared to the prior

quarter and a decrease of $0.08 per share compared to the first

quarter of 2015.

First Quarter Highlights

- Loan growth - Net loans increased $8.5 million, or 13.3% on an

annualized basis, compared to December 31, 2015. The growth

in loans was driven by increases at the Company’s banking

subsidiary, First US Bank (“FUSB” or the “Bank”), which grew net

loans by $9.8 million. This growth was partially offset by

seasonal decreases at the Bank’s finance company subsidiary,

Acceptance Loan Company (“ALC”), of approximately $1.2 million.

- Asset quality improvement - Non-performing assets decreased by

$0.5 million during the first quarter to $8.6 million as of March

31, 2016. Non-performing assets as a percentage of total

assets were reduced to 1.50% as of March 31, 2016, compared to

1.59% as of December 31, 2015 and 2.27% as of March 31, 2015.

- Branch expansion - During the first quarter, the Bank executed

on initiatives to expand its presence in contiguous metropolitan

markets by purchasing, for branch expansion, a parcel of land

located along U.S. Highway 280 in the Birmingham, Alabama

metropolitan area. It is expected that construction of a 40,000

square-foot office complex on the site will begin during the second

quarter of 2016. In addition to a retail branch, the office

complex will house the Bank’s Birmingham-based commercial lending

team, as well as certain of the Bank’s executive officers.

Approximately 25% of the square footage of the office complex will

be utilized by the Bank, with the remainder to be leased to

commercial tenants. It is expected that the office complex

will be operational by mid-2017. Until the new branch becomes

operational, the Birmingham commercial lending team will be housed

at a newly-opened loan production office in Mountain Brook,

Alabama.

“We are pleased to report a second consecutive quarter of loan

growth, continued improvement in asset quality, and forward

movement in expanding the Bank’s presence in the Birmingham area”

said James F. House, President and Chief Executive Officer of

United Security Bancshares, Inc. “The expansion of our

presence in a larger metropolitan market is a significant milestone

in our efforts to grow the Bank’s commercial loan portfolio.”

“Although we have experienced solid growth in

the Bank’s loan portfolio during the last two quarters, earnings

remain constrained. At both the Bank and ALC, management has

focused intently over the past several years on problem asset

resolution. We have sacrificed some volume and yield as a

result of these efforts; however, we believe that we have

substantially improved the health of our balance sheet and are now

well-positioned for growth at both entities. We are also

optimistic that the steps we have taken to open a new branch in

Tuscaloosa during the fourth quarter of 2015, and now to expand our

presence in Birmingham, will significantly enhance the Bank’s

opportunities to grow its commercial lending portfolio with high

quality assets,” continued Mr. House.

Results of Operations

- Pre-provision net interest income totaled $6.7 million in the

first quarter of 2016, compared to $7.0 million in the prior

quarter and $6.7 million in the first quarter of 2015. The

decrease compared to the prior quarter was primarily attributable

to seasonal reductions in loan volume at ALC and, to a lesser

extent, reduction in yield at both the Bank and ALC as management

continued efforts to reduce exposure to loans with higher credit

risk.

- The provision for loan losses totaled $0.2 million in the first

quarter of 2016, compared to $0.4 million in the fourth quarter of

2015 and a negative provision (reduction in reserve) of $0.2

million in the first quarter of 2015. The increases in loan

loss provisions during the last two quarters have resulted

primarily from growth in FUSB’s loan portfolio.

- Non-interest income totaled $1.0 million in the first quarter

of 2016, compared to $1.2 million in the prior quarter and $1.3

million in the first quarter of 2015. The decrease compared

to both prior quarters resulted primarily from gains on sale or

prepayment of securities that occurred in 2015 and that were not

repeated in the first quarter of 2016.

- Non-interest expense totaled $7.1 million in the first quarter

of 2016, remaining relatively consistent with the results in

previous quarters, which totaled $7.2 million in the fourth quarter

of 2015 and $7.0 million in the first quarter of 2015.

Balance Sheet Management

- Net loans increased to $264.0 million as of March 31, 2016,

compared to $255.4 million as of December 31, 2015. The loans

were funded through the Bank’s available cash balances. In

addition, the Bank funded the purchase of land in the Birmingham

area, as discussed above, from available cash balances. The

purchase price totaled approximately $3.0 million. Total cash

and cash equivalents were reduced to $30.5 million as of March 31,

2016, compared to $44.1 million as of December 31, 2015.

- Investment securities were maintained at consistent levels

during the first quarter of 2016, totaling $231.5 million as of

March 31, 2016, compared to $231.2 million as of December 31,

2015. In addition, the Company held $3.0 million in federal

funds sold as of March 31, 2016. No amounts were held in

federal funds sold as of December 31, 2015. The investment

securities portfolio and federal funds sold serve to both enhance

interest income and provide additional sources of

liquidity.

- Deposit levels increased $6.2 million during the first quarter,

totaling $485.5 million as of March 31, 2016, compared to $479.3

million as of December 31, 2015. In addition to deposits, the

Bank maintains significant external sources of liquidity, including

access to funding through federal funds lines, Federal Home Loan

Bank advances and brokered deposits.

- Shareholders’ equity increased to $77.7 million, or $12.87 per

common share, at March 31, 2016, compared to $76.3 million, or

$12.65 per common share, at December 31, 2015. The increase

in shareholders’ equity resulted from continued growth in retained

earnings, increases in other comprehensive income related to

changes in the fair value of investment securities

available-for-sale, and the classification of accruals for deferred

compensation in equity.

- The Bank maintained capital ratios at a higher level than the

ratios required to be considered a “well-capitalized” institution

under applicable regulations. As of March 31, 2016, the

Bank’s common equity Tier 1 capital and Tier 1 risk-based capital

ratios were 21.66%, its total capital ratio was 22.67%, and its

Tier 1 leverage ratio was 12.76%.

- The Company declared a cash dividend of $0.02 per share on its

common stock in the first quarter of 2016. This amount is

consistent with the Company’s quarterly dividend declarations for

each quarter of 2015.

About United Security Bancshares, Inc.

United Security Bancshares, Inc. is a bank

holding company that operates twenty-one banking offices in Alabama

through First US Bank. In addition, the Company’s operations

include Acceptance Loan Company, Inc., a consumer loan company, and

FUSB Reinsurance, Inc., an underwriter of credit life and credit

accident and health insurance policies sold to the Bank’s and ALC’s

consumer loan customers. The Company’s stock is traded on the

Nasdaq Capital Market under the symbol “USBI.”

Forward-Looking Statements

This press release contains forward-looking

statements, as defined by federal securities laws. Statements

contained in this press release that are not historical facts are

forward-looking statements. These statements may address

issues that involve significant risks, uncertainties, estimates and

assumptions made by management. The Company undertakes no

obligation to update these statements following the date of this

press release, except as required by law. In addition, the

Company, through its senior management, may make from time to time

forward-looking public statements concerning the matters described

herein. Such forward-looking statements are necessarily

estimates reflecting the best judgment of the Company’s senior

management based upon current information and involve a number of

risks and uncertainties. Certain factors that could affect

the accuracy of such forward-looking statements are identified in

the public filings made by the Company with the Securities and

Exchange Commission, and forward-looking statements contained in

this press release or in other public statements of the Company or

its senior management should be considered in light of those

factors. Specifically, with respect to statements relating to

loan demand, growth and earnings potential, geographic expansion

and the adequacy of the allowance for loan losses for the Company,

these factors include, but are not limited to, the rate of growth

(or lack thereof) in the economy generally and in the Bank’s and

ALC’s service areas, the availability of quality loans in the

Bank’s and ALC’s service areas, the relative strength and weakness

in the consumer and commercial credit sectors and in the real

estate markets and collateral values. There can be no

assurance that such factors or other factors will not affect the

accuracy of such forward-looking statements.

UNITED SECURITY BANCSHARES, INC. AND

SUBSIDIARIES SELECTED FINANCIAL DATA – LINKED

QUARTERS (Dollars in Thousands, Except Per

Share Data)

| |

Quarter

Ended |

| |

2016 |

2015 |

| |

March31, |

December31, |

September30, |

June30, |

March31, |

| |

|

|

|

|

|

| Results of Operations: |

|

|

|

|

|

| Interest income |

$ |

7,196 |

|

$ |

7,513 |

|

$ |

7,328 |

|

$ |

7,735 |

|

$ |

7,321 |

|

| Interest expense |

|

535 |

|

|

549 |

|

|

561 |

|

|

565 |

|

|

614 |

|

| Net Interest income |

|

6,661 |

|

|

6,964 |

|

|

6,767 |

|

|

7,170 |

|

|

6,707 |

|

| Provision (reduction in reserve) for loan

losses |

|

167 |

|

|

415 |

|

|

(78 |

) |

|

45 |

|

|

(166 |

) |

| Net interest income after provision (reduction in

reserve) for loan losses |

|

6,494 |

|

|

6,549 |

|

|

6,845 |

|

|

7,125 |

|

|

6,873 |

|

| Non-interest income |

|

989 |

|

|

1,176 |

|

|

996 |

|

|

1,068 |

|

|

1,291 |

|

| Non-interest expense |

|

7,066 |

|

|

7,203 |

|

|

7,090 |

|

|

7,107 |

|

|

6,977 |

|

| Income before income taxes |

|

417 |

|

|

522 |

|

|

751 |

|

|

1,086 |

|

|

1,187 |

|

| Provision for income taxes |

|

100 |

|

|

81 |

|

|

207 |

|

|

312 |

|

|

351 |

|

| Net income |

$ |

317 |

|

$ |

441 |

|

$ |

544 |

|

$ |

774 |

|

$ |

836 |

|

| Per Share Data: |

|

|

|

|

|

| Basic net income per share |

$ |

0.05 |

|

$ |

0.07 |

|

$ |

0.09 |

|

$ |

0.13 |

|

$ |

0.14 |

|

| Diluted net income per share |

$ |

0.05 |

|

$ |

0.07 |

|

$ |

0.09 |

|

$ |

0.12 |

|

$ |

0.13 |

|

| Dividends declared |

$ |

0.02 |

|

$ |

0.02 |

|

$ |

0.02 |

|

$ |

0.02 |

|

$ |

0.02 |

|

| |

|

|

|

|

|

| Period-End Balance Sheet: |

|

|

|

|

|

| Total assets |

$ |

575,582 |

|

$ |

575,782 |

|

$ |

548,537 |

|

$ |

560,650 |

|

$ |

564,882 |

|

| Loans, net of allowance for loan losses |

|

263,975 |

|

|

255,432 |

|

|

237,715 |

|

|

244,993 |

|

|

239,218 |

|

| Allowance for loan losses |

|

3,375 |

|

|

3,781 |

|

|

4,345 |

|

|

5,008 |

|

|

5,401 |

|

| Investment securities, net |

|

231,466 |

|

|

231,202 |

|

|

239,009 |

|

|

246,176 |

|

|

249,864 |

|

| Total deposits |

|

485,537 |

|

|

479,258 |

|

|

463,266 |

|

|

471,141 |

|

|

475,288 |

|

| Long-term debt |

|

5,000 |

|

|

5,000 |

|

|

- |

|

|

5,000 |

|

|

5,000 |

|

| Total shareholders’ equity |

|

77,727 |

|

|

76,316 |

|

|

76,283 |

|

|

75,783 |

|

|

75,745 |

|

| |

|

|

|

|

|

| Performance Ratios: |

|

|

|

|

|

| Return on average assets (annualized) |

|

0.22 |

% |

|

0.31 |

% |

|

0.39 |

% |

|

0.55 |

% |

|

0.59 |

% |

| Return on average equity (annualized) |

|

1.65 |

% |

|

2.28 |

% |

|

2.84 |

% |

|

4.09 |

% |

|

4.47 |

% |

| |

|

|

|

|

|

| Asset Quality: |

|

|

|

|

|

| Allowance for loan losses as % of loans |

|

1.26 |

% |

|

1.46 |

% |

|

1.80 |

% |

|

2.00 |

% |

|

2.21 |

% |

| Nonperforming assets as % of total assets |

|

1.50 |

% |

|

1.59 |

% |

|

1.98 |

% |

|

1.96 |

% |

|

2.27 |

% |

| |

|

|

|

|

|

UNITED SECURITY BANCSHARES, INC.

AND SUBSIDIARIESINTERIM CONDENSED CONSOLIDATED BALANCE

SHEETS (Dollars in Thousands, Except Share

and Per Share Data)

| |

March31, |

|

December31, |

| |

2016 |

|

2015 |

| |

(Unaudited) |

|

|

| ASSETS |

| Cash and due from

banks |

$ |

8,479 |

|

|

$ |

7,088 |

|

| Interest-bearing deposits

in banks |

|

22,007 |

|

|

|

36,984 |

|

| Total cash

and cash equivalents |

|

30,486 |

|

|

|

44,072 |

|

| Federal funds sold |

|

3,000 |

|

|

|

- |

|

| Investment securities

available-for-sale, at fair value |

|

199,488 |

|

|

|

198,843 |

|

| Investment securities

held-to-maturity, at amortized cost |

|

31,978 |

|

|

|

32,359 |

|

| Federal Home Loan Bank

stock, at cost |

|

730 |

|

|

|

1,025 |

|

| Loans, net of allowance

for loan losses of $3,375 and $3,781, respectively |

|

263,975 |

|

|

|

255,432 |

|

| Premises and equipment,

net |

|

15,058 |

|

|

|

12,084 |

|

| Cash surrender value of

bank-owned life insurance |

|

14,370 |

|

|

|

14,292 |

|

| Accrued interest

receivable |

|

1,756 |

|

|

|

1,833 |

|

| Other real estate

owned |

|

5,356 |

|

|

|

6,038 |

|

| Other assets |

|

9,385 |

|

|

|

9,804 |

|

| Total

assets |

$ |

575,582 |

|

|

$ |

575,782 |

|

| |

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

| Deposits |

$ |

485,537 |

|

|

$ |

479,258 |

|

| Accrued interest

expense |

|

179 |

|

|

|

180 |

|

| Other liabilities |

|

6,693 |

|

|

|

7,674 |

|

| Short-term borrowings |

|

446 |

|

|

|

7,354 |

|

| Long-term debt |

|

5,000 |

|

|

|

5,000 |

|

| Total

liabilities |

|

497,855 |

|

|

|

499,466 |

|

| |

|

|

|

| Shareholders’ equity: |

|

|

|

| Common stock, par value

$0.01 per share, 10,000,000 shares authorized; |

|

|

|

| 7,329,060 shares

issued; 6,038,554 shares outstanding |

|

73 |

|

|

|

73 |

|

| Surplus |

|

10,649 |

|

|

|

9,844 |

|

| Accumulated other

comprehensive income, net of tax |

|

946 |

|

|

|

536 |

|

| Retained earnings |

|

86,889 |

|

|

|

86,693 |

|

| Less treasury stock:

1,290,506 shares at cost |

|

(20,817 |

) |

|

|

(20,817 |

) |

| Noncontrolling

interest |

|

(13 |

) |

|

|

(13 |

) |

| |

|

|

|

| Total

shareholders’ equity |

|

77,727 |

|

|

|

76,316 |

|

| |

|

|

|

| Total

liabilities and shareholders’ equity |

$ |

575,582 |

|

|

$ |

575,782 |

|

| |

|

|

|

UNITED SECURITY BANCSHARES, INC. AND

SUBSIDIARIESINTERIM CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(Dollars in Thousands,

Except Per Share Data)

| |

Three Months Ended |

| |

March 31, |

| |

2016 |

|

2015 |

| |

(Unaudited) |

| Interest income: |

|

|

|

| Interest and fees on loans |

$ |

6,053 |

|

|

$ |

6,135 |

|

| Interest on investment

securities |

|

1,143 |

|

|

|

1,186 |

|

| Total interest income |

|

7,196 |

|

|

|

7,321 |

|

| |

|

|

|

| Interest expense: |

|

|

|

| Interest on deposits |

|

523 |

|

|

|

607 |

|

| Interest on borrowings |

|

12 |

|

|

|

7 |

|

| Total interest expense |

|

535 |

|

|

|

614 |

|

| |

|

|

|

| Net interest income |

|

6,661 |

|

|

|

6,707 |

|

| |

|

|

|

| Provision (reduction in

reserve) for loan losses |

|

167 |

|

|

|

(166 |

) |

| |

|

|

|

| Net interest income after

provision (reduction in reserve) for loan losses |

|

6,494 |

|

|

|

6,873 |

|

| |

|

|

|

| Non-interest income: |

|

|

|

| Service and other charges on

deposit accounts |

|

417 |

|

|

|

454 |

|

| Credit insurance income |

|

152 |

|

|

|

75 |

|

| Other income |

|

420 |

|

|

|

762 |

|

| Total non-interest income |

|

989 |

|

|

|

1,291 |

|

| |

|

|

|

| Non-interest expense: |

|

|

|

| Salaries and employee benefits |

|

4,164 |

|

|

|

4,192 |

|

| Net occupancy and equipment |

|

769 |

|

|

|

823 |

|

| Other real estate/foreclosure

expense, net |

|

117 |

|

|

|

220 |

|

| Other expense |

|

2,016 |

|

|

|

1,742 |

|

| Total non-interest expense |

|

7,066 |

|

|

|

6,977 |

|

| |

|

|

|

| Income before income taxes |

|

417 |

|

|

|

1,187 |

|

| Provision for income taxes |

|

100 |

|

|

|

351 |

|

| Net income |

$ |

317 |

|

|

$ |

836 |

|

| Basic net income per share |

$ |

0.05 |

|

|

$ |

0.14 |

|

| Diluted net income per share |

$ |

0.05 |

|

|

$ |

0.13 |

|

| Dividends per share |

$ |

0.02 |

|

|

$ |

0.02 |

|

| |

|

|

|

Thomas S. Elley

334-636-5424

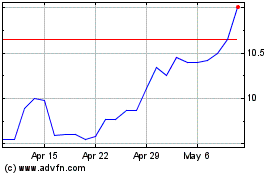

First US Bancshares (NASDAQ:FUSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

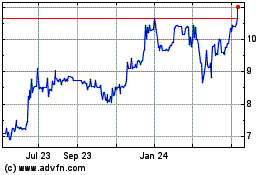

First US Bancshares (NASDAQ:FUSB)

Historical Stock Chart

From Apr 2023 to Apr 2024