PHILADELPHIA, PA, November 22,

2016 - Urban Outfitters, Inc. (NASDAQ:URBN), a portfolio of global

consumer brands comprised of Anthropologie, Bhldn, Free People,

Terrain, Urban Outfitters and Vetri Family brands, today announced

net income of $47 million and $154 million for the three and nine

months ended October 31, 2016, respectively. Earnings per diluted

share were $0.40 and $1.31 for the three and nine months ended

October 31, 2016, respectively.

Total Company net sales for the

third quarter of fiscal 2017 increased 5% over the same quarter

last year to a record $862 million. Comparable Retail segment net

sales, which include our comparable direct-to-consumer channel,

increased 1.0%. Comparable Retail segment net sales increased 5.2%

at Urban Outfitters and decreased 1.5% at Free People and 2.7% at

the Anthropologie Group. Wholesale segment net sales increased 30%,

which benefited from approximately $9 million of shipments moving

out of the third quarter of fiscal 2016 into the fourth quarter of

fiscal 2016 due to delays at our recently opened east coast

fulfillment center

"I am pleased to announce our

teams delivered record third quarter sales," said Richard A. Hayne,

Chief Executive Officer. "These results were driven by the third

consecutive quarter of positive Retail segment 'comps' and

continued strength in our Wholesale segment," finished Mr.

Hayne.

Net sales by brand and segment for the three and

nine month periods were as follows:

|

|

Three Months

Ended |

|

Nine Months

Ended |

|

|

October 31, |

|

October 31, |

| Net sales by brand |

2016 |

|

2015 |

|

2016 |

|

2015 |

| Urban

Outfitters |

$ 348,471 |

|

$ 339,187 |

|

$1,001,197 |

|

$ 976,592 |

|

Anthropologie Group |

340,727 |

|

339,652 |

|

1,021,410 |

|

1,019,418 |

| Free

People |

167,445 |

|

144,530 |

|

476,380 |

|

431,070 |

| Food and

Beverage |

5,848 |

|

1,889 |

|

16,649 |

|

4,648 |

| Total

Company |

$862,491 |

|

$ 825,258 |

|

$2,515,636 |

|

$ 2,431,728 |

|

|

|

|

|

|

|

|

|

| Net sales by segment |

|

|

|

|

|

|

|

| Retail

Segment |

$785,026 |

|

$ 765,525 |

|

$2,300,981 |

|

$ 2,246,274 |

| Wholesale

Segment |

77,465 |

|

59,733 |

|

214,655 |

|

185,454 |

| Total

Company |

$862,491 |

|

$ 825,258 |

|

$2,515,636 |

|

$ 2,431,728 |

For the three months ended October 31, 2016, the

gross profit rate decreased by 15 basis points versus the prior

year's comparable period. The reduction in gross profit rate

was primarily driven by the increased penetration of the

direct-to-consumer channel resulting in increased customer delivery

and overall logistics expense rates. Within gross profit,

maintained margins for the quarter were approximately flat compared

to the prior year comparable period with initial mark-up lower on a

year over year basis and markdowns coming in favorable on a year

over year basis. Initial mark-up was lower due to increased

penetration of the Wholesale segment sales at Free People which has

a lower initial mark-up compared to the Retail segment. Initial

mark-up in the Retail segment increased due to improvements at each

of the brands. Markdowns were favorable due to lower markdowns at

the Urban Outfitters brand which were partially offset by higher

markdowns at the Free People and Anthropologie brands. For

the nine months ended October 31, 2016, the gross profit rate

increased by 88 basis points versus the prior year's comparable

period. The increase in gross profit rate was primarily driven by

improvement in the Urban Outfitters brand maintained margins due to

lower merchandise markdowns compared to the prior year. This

increase was partially offset by a lower gross profit rate at the

Free People brand, which was primarily driven by lower maintained

margins due to higher merchandise markdowns.

As of October 31, 2016, total inventory increased

by $12 million, or 3%, on a year-over-year basis. The increase in

inventory is primarily due to an increase in non-comparable

inventory to support our new and expanded stores. Comparable Retail

segment inventory increased 1% at cost.

For the three and nine months

ended October 31, 2016, selling, general and administrative

expenses, expressed as a percentage of net sales, increased by 143

basis points and 114 basis points when compared to the prior year's

comparable periods, respectively. The deleverage in the three

months ended October 31, 2016 was partially due to the net effect

of one-time legal settlements, which accounted for approximately 50

basis points of deleverage. The remaining deleverage related

to an increase in direct store controllable expenses largely due to

pre-opening expenses and initial staffing levels for several large

format Anthropologie stores recently opened or opened in the

quarter. The deleverage in the nine months ended October 31,

2016 was primarily due to direct store controllable expenses to

support our 5% square footage growth and an increase in direct

marketing and technology related expenses to support our

direct-to-consumer growth.

The Company's effective tax rate

for the third quarter of fiscal 2017 was 33.5% compared to 35.3% in

the prior year period. The decrease in the third quarter tax

rate was due to the ratio of foreign taxable losses to global

taxable profits for the year. The effective tax rate for the first

nine months of fiscal 2017 is 35.7% compared to 35.3% in the first

nine months of fiscal 2016.

On February 23, 2015, the

Company's Board of Directors authorized the repurchase of 20

million common shares under a share repurchase program. Under this

authorization, the Company repurchased and subsequently retired 1.3

million common shares for approximately $46 million during the nine

months ended October 31, 2016. The Company repurchased and

subsequently retired a total of 12.7 million common shares for

approximately $382 million during fiscal 2016 under this

authorization. As of October 31, 2016, 6.0 million common shares

are remaining under this authorization.

On May 27, 2014, the

Company's Board of Directors authorized the repurchase of 10

million common shares under a share repurchase program. During

fiscal 2016, the Company repurchased and subsequently retired 2.3

million shares at a total cost of $83 million, which completed this

authorization.

During the nine months ended

October 31, 2016, the Company opened a total of 23 new stores

including: 11 Free People stores, 9 Anthropologie Group stores and

3 Urban Outfitters stores; and closed 3 stores including: 1 Free

People store, 1 Anthropologie Group store and 1 Urban Outfitters

store. During the nine months ended October 31, 2016, the Company

opened 2 new restaurants and acquired 6 Vetri Family restaurants

which are included in the Food and Beverage division.

Urban Outfitters, Inc. is a

portfolio of global consumer brands which offers a variety of

lifestyle merchandise and consumer products to highly defined

customer niches through 242 Urban Outfitters stores in the United

States, Canada, and Europe, catalogs and websites; 226

Anthropologie Group stores in the United States, Canada and Europe,

catalogs and websites; 124 Free People stores in the United States

and Canada, catalogs and websites; Free People wholesale, which

sells its product to approximately 1,800 specialty stores and

select department stores worldwide; and 11 Food and Beverage

restaurants, as of October 31, 2016.

A conference call will be held today to discuss

third quarter results and will be webcast at 5:00 pm. ET

at:

http://edge.media-server.com/m/p/qjw5enes

This news release

is being made pursuant to the "safe harbor" provisions of the

Private Securities Litigation Reform Act of 1995. Certain matters contained in this release may

constitute forward-looking statements. When used in this release,

the words "project," "believe," "plan," "will," "anticipate,"

"expect" and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. Any one, or all, of the

following factors could cause actual financial results to differ

materially from those financial results mentioned in the

forward-looking statements: the difficulty in predicting and

responding to shifts in fashion trends, changes in the level of

competitive pricing and promotional activity and other industry

factors, overall economic and market conditions and the resultant

impact on consumer spending patterns, lowered levels of consumer

confidence and higher levels of unemployment, continuation of

lowered levels of consumer spending resulting from a worldwide

political and economic crisis, any effects of terrorist acts or

war, natural disasters or severe weather conditions, availability

of suitable retail space for expansion, timing of store openings,

risks associated with international expansion, seasonal

fluctuations in gross sales, the departure of one or more key

senior executives, import risks, including potential disruptions

and changes in duties, tariffs and quotas, the closing of any of

our distribution centers, our ability to protect our intellectual

property rights, risks associated with internet sales, response to

new store concepts, failure of our manufacturers to comply with our

social compliance program, changes in accounting standards and

subjective assumptions, regulatory changes and legal matters and

other risks identified in the Company's filings with the Securities

and Exchange Commission. The Company disclaims any intent or

obligation to update forward-looking statements even if experience

or future changes make it clear that actual results may differ

materially from any projected results expressed or implied

therein.

###

(Tables follow)

URBAN OUTFITTERS,

INC.

Condensed Consolidated Statements of Income

(in thousands,

except share and per share data)

(unaudited)

|

|

|

Three Months Ended

October 31, |

|

Nine Months Ended

October 31, |

|

|

|

2016 |

|

2015 |

|

2016 |

|

2015 |

| Net

sales |

|

$862,491 |

|

$ 825,258 |

|

$2,515,636 |

|

$ 2,431,728 |

| Cost

of sales |

|

562,594 |

|

537,070 |

|

1,611,337 |

|

1,579,014 |

|

Gross profit |

|

299,897 |

|

288,188 |

|

904,299 |

|

852,714 |

|

Selling, general, and administrative expenses |

|

229,592 |

|

207,863 |

|

665,299 |

|

615,584 |

|

Income from operations |

|

70,305 |

|

80,325 |

|

239,000 |

|

237,130 |

| Other

income (expense), net |

|

854 |

|

63 |

|

348 |

|

(2,654) |

|

Income before income taxes |

|

71,159 |

|

80,388 |

|

239,348 |

|

234,476 |

| Income

tax expense |

|

23,804 |

|

28,394 |

|

85,516 |

|

82,865 |

|

Net income |

|

$47,355 |

|

$ 51,994 |

|

$153,832 |

|

$ 151,611 |

|

|

|

|

|

|

|

|

|

|

| Net

income per common share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ 0.41 |

|

$ 0.42 |

|

$ 1.31 |

|

$ 1.19 |

|

Diluted |

|

$ 0.40 |

|

$ 0.42 |

|

$ 1.31 |

|

$ 1.18 |

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares and |

|

|

|

|

|

|

|

|

|

common share equivalents outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

116,829,912 |

|

123,442,931 |

|

117,087,696 |

|

127,478,092 |

|

Diluted |

|

117,393,710 |

|

123,725,581 |

|

117,453,005 |

|

128,506,955 |

|

|

|

|

|

|

|

|

|

|

| AS A

PERCENT OF NET SALES |

|

|

|

|

|

|

|

|

| Net

sales |

|

100.0% |

|

100.0% |

|

100.0% |

|

100.0% |

| Cost

of sales |

|

65.2% |

|

65.1% |

|

64.1% |

|

64.9% |

|

Gross profit |

|

34.8% |

|

34.9% |

|

35.9% |

|

35.1% |

|

Selling, general, and administrative expenses |

|

26.6% |

|

25.2% |

|

26.4% |

|

25.3% |

|

Income from operations |

|

8.2% |

|

9.7% |

|

9.5% |

|

9.8% |

| Other

income (expense), net |

|

0.1% |

|

0.0% |

|

0.0% |

|

(0.2%) |

|

Income before income taxes |

|

8.3% |

|

9.7% |

|

9.5% |

|

9.6% |

| Income

tax expense |

|

2.8% |

|

3.4% |

|

3.4% |

|

3.4% |

|

Net income |

|

5.5% |

|

6.3% |

|

6.1% |

|

6.2% |

URBAN OUTFITTERS,

INC.

Condensed Consolidated Balance

Sheets

(in thousands, except share and per share

data)

(unaudited)

|

|

|

October 31,

2016 |

|

January 31,

2016 |

|

October 31,

2015 |

|

ASSETS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$234,886 |

|

$ 265,276 |

|

$ 149,597 |

|

Marketable securities |

|

24,644 |

|

61,061 |

|

69,545 |

Accounts receivable, net of allowance for doubtful

accounts

of $568, $664 and $675, respectively |

|

68,896 |

|

75,723 |

|

68,332 |

|

Inventory |

|

453,826 |

|

330,223 |

|

441,550 |

|

Prepaid expenses, deferred taxes and other current assets |

|

107,767 |

|

102,078 |

|

118,202 |

|

Total current assets |

|

890,019 |

|

834,361 |

|

847,226 |

|

Property and equipment, net |

|

872,309 |

|

863,137 |

|

891,871 |

|

Marketable securities |

|

5,605 |

|

36,600 |

|

54,138 |

|

Deferred income taxes and other assets |

|

117,258 |

|

99,203 |

|

83,300 |

|

Total Assets |

|

$1,885,191 |

|

$ 1,833,301 |

|

$ 1,876,535 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$199,421 |

|

$ 118,035 |

|

$ 190,542 |

|

Accrued expenses, accrued compensation and other current

liabilities |

|

205,812 |

|

211,196 |

|

187,345 |

|

Total current liabilities |

|

405,233 |

|

329,231 |

|

377,887 |

|

Long-term debt |

|

- |

|

150,000 |

|

115,000 |

|

Deferred rent and other liabilities |

|

232,325 |

|

216,843 |

|

211,979 |

|

Total Liabilities |

|

637,558 |

|

696,074 |

|

704,866 |

|

|

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

|

|

Preferred shares; $.0001 par value, 10,000,000 shares

authorized,

none issued |

|

- |

|

- |

|

- |

Common shares; $.0001 par value, 200,000,000 shares

authorized,

116,233,584, 117,321,120 and 121,545,740 shares issued

and

outstanding, respectively |

|

12 |

|

12 |

|

12 |

|

Additional paid-in capital |

|

- |

|

- |

|

- |

|

Retained earnings |

|

1,285,268 |

|

1,160,666 |

|

1,184,308 |

|

Accumulated other comprehensive loss |

|

(37,647) |

|

(23,451) |

|

(12,651) |

|

Total Shareholders' Equity |

|

1,247,633 |

|

1,137,227 |

|

1,171,669 |

|

Total Liabilities and Shareholders' Equity |

|

$1,885,191 |

|

$ 1,833,301 |

|

$ 1,876,535 |

Contact:

Oona McCullough

Director of Investor Relations

(215) 454-4806

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Urban Outfitters via Globenewswire

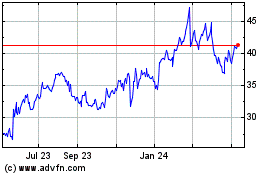

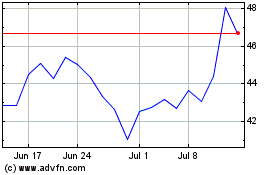

Urban Outfitters (NASDAQ:URBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Urban Outfitters (NASDAQ:URBN)

Historical Stock Chart

From Apr 2023 to Apr 2024