| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| |

| FORM 8-K |

| |

| |

|

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 |

| |

| |

|

Date of Report (Date of the earliest event reported)

January 20, 2016 (January 13,

2016) |

| |

| |

| |

| ULTRALIFE CORPORATION |

| (Exact name of registrant as specified in its charter) |

| |

| |

| |

| Delaware |

000-20852 |

16-1387013 |

| (State of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| |

| 2000

Technology Parkway, Newark, New York |

14513 |

| (Address of principal executive offices) |

(Zip Code) |

| |

| (315) 332-7100 |

| (Registrant’s telephone number, including area code) |

| |

| |

| |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| |

| [ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| [ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| [ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| [ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

| |

|

|

|

Item 1.01

Entry Into a Material Definitive Agreement.

On

January 13, 2016, Ultralife Corporation (the “Company”) and PNC Bank, National Association entered into a Fifth Amendment

to their Revolving Credit, Guaranty and Security Agreement, providing consent for the Company’s wholly-owned subsidiary

to complete the Acquisition described in Item 2.01 below.

A

copy of the Fifth Amendment is attached as an exhibit to this Form 8-K and incorporated herein by this reference.

Item 2.01 Completion of Acquisition

or Disposition of Assets

On January

13, 2016, Ultralife UK Limited (the “Merger Subsidiary”), a U.K. corporation and the Company’s wholly-owned

subsidiary, completed the acquisition of all of the outstanding stock of Accutronics Limited (“Accutronics”),

a U.K. corporation based in Newcastle-under-Lyme, U.K., from Intrinsic Equity Limited, Catapult Growth Fund Limited Partnership,

MJF Pension Trustees Limited, Robert Andrew Phillips and Michael Allen (collectively, the “Sellers”). There are no

material relationships between the Company or Merger Subsidiary and any of the Sellers, other than pertaining to this acquisition.

Accutronics is a leading independent designer and manufacturer of smart batteries and charger systems for high-performance, feature-laden

portable and handheld electronic devices.

The acquisition

was completed pursuant to the terms of a Share Purchase Agreement dated January 13, 2016, by and among the Merger Subsidiary and

the Sellers. The Merger Subsidiary paid an aggregate purchase price of £7.575 million (approximately $11.0 million) in cash,

and in exchange the Merger Subsidiary received all of the outstanding shares of Accutronics stock. Monies to fund the

purchase price were advanced to the Merger Subsidiary from the Company’s general corporate funds.

The purchase

price is subject to adjustment based on the difference between actual and estimated amounts of working capital of Accutronics

as well as the amount of net cash/indebtedness of Accutronics.

The

Company plans to file the Accutronics Stock Purchase Agreement with the Company’s Annual Report on Form

10-K.

Item 9.01 Financial Statements

and Exhibits

| (a) |

Financial Statements of Business Acquired |

The financial statements

required by this item are not being filed herewith. The Company will file the required financial statements as an amendment

to this Current Report on Form 8-K no later than 71 days after the date hereof.

| (b) |

Pro Forma Financial Information |

The pro forma

financial information required by this item is not being filed herewith. The Company will file the required pro forma

financial information as an amendment to this Current Report on Form 8-K no later than 71 days after the date

hereof.

| 10.1 | Fifth Amendment to Revolving Credit,

Guaranty and Security Agreement . |

| | | |

| 99.1 | Press Release, dated January 13, 2016, announcing the completion of the Acquisition of Accutronics

Limited. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ULTRALIFE

CORPORATION |

| |

|

| January

20, 2016 |

By: |

/s/

Philip A. Fain |

| |

|

Chief Financial

Officer and Treasurer |

EXHIBIT 10.1

FIFTH AMENDMENT TO

REVOLVING CREDIT, GUARANTY AND SECURITY AGREEMENT

This Fifth Amendment Agreement

to Revolving Credit, Guaranty and Security Agreement (this “Agreement”) is dated as of January 13, 2016 (the “Effective

Date”), by and between ULTRALIFE CORPORATION, a corporation organized under the laws of the State of Delaware (“Borrower”),

and PNC BANK, NATIONAL ASSOCIATION (“Lender”).

WHEREAS, Borrower and Lender

are party to a Revolving Credit, Guaranty and Security Agreement dated as of May 24, 2013 (as amended, restated or otherwise modified

from time to time, the “Credit Agreement”);

WHEREAS, Borrower and Lender

desire to amend the Credit Agreement to modify certain provisions thereof; and

WHEREAS, each term used

herein shall be defined in accordance with the Credit Agreement, except to the extent such term is otherwise defined herein.

NOW, THEREFORE,

in consideration of the premises and of the mutual covenants herein and for other valuable consideration, Borrower and Lender agree

as follows:

1. Section

1.2 of the Credit Agreement is hereby amended to insert the following new definitions thereto in the appropriate alphabetical order:

“Accutronics”

shall mean Accutronics Ltd., a company organized under the laws of England and Wales.

“Accutronics

Acquisition” shall mean the acquisition by Ultralife UK Holdco of all of the Equity Interests of Accutronics from Accutronics

Seller, and the consummation of the other transactions contemplated to occur under or pursuant to the Accutronics Acquisition Documents.

“Accutronics

Acquisition Agreement” shall mean the Share Purchase Agreement dated on or about the Fifth Amendment Closing Date, among

Accutronics Seller and Ultralife UK Holdco, together with all exhibits and schedules thereto, as the same may be amended, modified,

supplemented or restated from time to time.

“Accutronics

Acquisition Documents” shall mean the Accutronics Acquisition Agreement, and each other document, instrument or agreement

executed or delivered in connection with the Accutronics Acquisition, as each may be amended, modified, supplemented or restated

from time to time.

“Accutronics

Seller” shall mean Robert Andrew Phillips and the other sellers listed on Schedule 1 of the Accutronics Acquisition Agreement.

“Fifth

Amendment Closing Date” shall mean January 13, 2016.

“Ultralife

UK Holdco” shall mean Ultralife UK Limited, a company organized under the laws of England and Wales.

2. Section 2.21 of the

Credit Agreement is hereby amended to delete subpart (a) therefrom in its entirety and to insert in place thereof the following:

(a) Borrower shall

apply the proceeds of Advances to (i) repay existing indebtedness of Borrower, (ii) pay fees and expenses relating to the transactions

contemplated by this Agreement, (iii) fund a portion of the Accutronics Acquisition, (iv) fund Permitted Acquisitions and Capital

Expenditures (but without regard to the exclusion in the first parenthetical in the definition thereof), (v) provide for its working

capital needs and (vi) reimburse drawings under Letters of Credit

3. The Credit Agreement

is hereby amended to delete Section 5.17 therefrom in its entirety and to insert in place thereof the following:

5.17 Disclosure. No

representation or warranty made (x) to the best of Borrower’s knowledge, by the Accutronics Seller under the Accutronics

Acquisition Documents or (y) by any Credit Party in this Agreement, any Other Document, or in any financial statement, report,

certificate or any other document furnished in connection herewith or therewith contains any untrue statement of a material fact

or omits to state any material fact necessary to make the statements herein or therein not materially misleading. There is no fact

known to any Credit Party or which reasonably should be known to such Credit Party which such Credit Party has not disclosed to

Lender in writing with respect to the transactions contemplated by this Agreement or the Accutronics Acquisition Documents which

could reasonably be expected to have a Material Adverse Effect.

4. The Credit Agreement

is hereby amended to delete Section 5.19 therefrom in its entirety and to insert in place thereof the following:

5.19 Acquisition

Documents. Lender has received true and complete copies of the material Accutronics Acquisition Documents (including all

schedules and exhibits delivered in connection with any of the foregoing), and all amendments to any of the foregoing, and other

side letters or agreements affecting the terms thereof. None of such documents and agreements has been amended or supplemented,

nor have any of the provisions thereof been waived, except pursuant to a written agreement or instrument which has heretofore been

delivered to Lender. All of the transactions contemplated to occur under the Accutronics Acquisition Documents on or before the

Fifth Amendment Closing Date have been consummated pursuant to the terms thereof in all material respects, no party to any of the

Accutronics Acquisition Documents has waived the fulfillment of any material condition precedent set forth therein without Lender’s

written consent, and no party has failed to perform any of its material obligations thereunder.

5. Section 7.1 of the Credit

Agreement is hereby amended to delete subpart (a) therefrom in its entirety and to insert in place thereof the following:

(a)

Enter into any merger, consolidation or other reorganization with or into any other Person or acquire all or a substantial

portion of the assets or Equity Interests of any Person or permit any other Person to consolidate with or merge with it, except

the Accutronics Acquisition and except Permitted Acquisitions; provided, however, that in the event Borrower asks Lender to consider

consenting to any Acquisition (other than a Permitted Acquisition) then Lender agrees (i) to give such request all due consideration,

as determined by Lender in its Permitted Discretion, and (ii) not to unreasonable delay its decision with respect to such request.

6. The Credit Agreement

is hereby amended to delete Section 7.4 therefrom in its entirety and to insert in place thereof the following:

7.4 Investments. Purchase

or acquire obligations or Equity Interests of, or any other interest in, any Person, other than Permitted Investments, the Accutronics

Acquisition and Permitted Acquisitions.

7. Section 7.9 of the

Credit Agreement is hereby amended to insert the following new sentence thereto:

Ultralife UK Holdco shall not engage

in any business or activity other than the holding of Equity Interests of Accutronics and any activity reasonably related or incidental

thereto and the maintenance of its existence or the maintenance of Accutronics’ existence.

8. The Credit Agreement

is hereby amended to delete Section 7.12 therefrom in its entirety and to insert in place thereof the following:

7.12 Subsidiaries; Partnerships;

Joint Ventures. Form any Subsidiary (other than (i) Borrower forming Ultralife UK Holdco in connection with the Accutronics

Acquisition and (ii) a Subsidiary, the formation of which shall have been consented to in advance in writing by Lender and which

shall have satisfied certain conditions precedent as may be required by Lender in its Permitted Discretion), or enter into any

partnership, joint venture or similar arrangement.

9. Article VII of the

Credit Agreement is hereby amended to insert the following new Section thereto:

7.21 Amendments

to Acquisition Documents. Enter into any material amendment, waiver or modification of the Accutronics Acquisition Documents.

10. As a condition precedent

to the effectiveness of this Agreement:

(a)

Lender shall have received an executed counterpart original hereof;

(b)

Lender shall have received the fully executed Pledge Agreement executed by Borrower with respect to the Equity Interests

of Ultralife UK Holdco (the “UK Share Charge”), together with the delivery of share certificates (or control agreements),

appropriate stock powers (or equivalent), and such other documents in connection therewith as Lender shall reasonably request,

each in form and substance satisfactory to Lender;

(c)

Borrower shall have delivered to Lender an officer’s certificate certifying (i) the names of the officers of Borrower

authorized to sign this Fifth Amendment Agreement, the UK Share Charge and all other documents, agreements, instruments or writings

executed in connection with this Fifth Amendment Agreement (collectively, the “Amendment Documents” and each individually

an “Amendment Document”), together with the true signatures of such officers, (ii) the resolutions of the board of

directors of Borrower evidencing approval of the execution and delivery of the Amendment Documents to which Borrower is a party,

(iii) the articles of incorporation (or equivalent organizational document) of Borrower, having been certified, not more than ten

(10) days prior to this Agreement, by the Secretary of State of the jurisdiction under which Borrower is organized, and (iv) the

bylaws (or equivalent governance documents) of Borrower;

(d)

Lender shall have received final executed copies of the Accutronics Acquisition Documents (including all exhibits, schedules

and disclosure letters referred to therein or delivered pursuant thereto, if any) and all material amendments thereto, waivers

relating thereto and other side letters or agreements affecting the terms thereof, in each case having been certified by an Authorized

Officer of Borrower as true and correct;

(e)

Borrower shall have delivered to Lender revised schedules to the Credit Agreement giving effect to the Accutronics Acquisition,

in form and substance satisfactory to Lender; and

(f)

Borrower shall pay all reasonable out-of-pocket legal fees and expenses of Lender incurred in connection with this Agreement.

11. Borrower hereby

represents and warrants to Lender that as of the Effective Date: (a) Borrower has the legal power and authority to execute and

deliver this Agreement and each other Amendment Documents to which Borrower is a party; (b) the officers, managers, or members,

as the case may be, executing the Amendment Documents have been duly authorized to execute and deliver the same and bind Borrower

with respect to the provisions thereof; (c) the execution and delivery hereof by Borrower of the Amendment Documents and the performance

and observance by Borrower of the provisions thereof do not violate or conflict with the Organizational Documents of Borrower or

any law applicable to Borrower or result in a breach of any provision of or constitute a default under any other agreement, instrument

or document binding upon or enforceable against Borrower; (d) no Default or Event of Default exists under the Credit Agreement,

nor will any occur immediately after the execution and delivery of the Amendment Documents or by the performance or observance

of any provision thereof; (e) Borrower has no claim or offset against, or defense or counterclaim to, any of Borrower’s obligations

or liabilities under the Credit Agreement, the Other Documents or any document related thereto or otherwise with respect to the

Obligations; and (f) the Amendment Documents constitute the valid and binding obligation of Borrower, enforceable in accordance

with their respective terms.

12. In consideration of this Agreement,

Borrower hereby waives and releases Lender and its representatives, shareholders, directors, officers, employees, attorneys, affiliates

and subsidiaries from any and all such claims, offsets, defenses and counterclaims of which Borrower is aware or unaware as of

the Effective Date, such waiver and release being with full knowledge and understanding of the circumstances and effect thereof

and after having consulted legal counsel with respect thereto.

13. Each reference that is made in the

Credit Agreement shall hereafter be construed as a reference to the Credit Agreement as amended hereby. The Amendment Documents

shall each constitute “Other Documents” as defined in the Credit Agreement. Borrower hereby reaffirms its obligations

under the Credit Agreement and each Other Document to which it is a party, as any of them may from time to time be amended, restated

or otherwise modified, and further agrees that the Credit Agreement and each Other Document shall, except to the extent modified

herein, remain in full force and effect following the execution and delivery of this Agreement and all documents being executed

and delivered in connection herewith.

14. This Agreement may

be executed in any number of counterparts, by different parties hereto in separate counterparts and by electronic signature, each

of which when so executed and delivered shall be deemed to be an original and all of which taken together shall constitute but

one and the same agreement.

15. The rights and obligations of all

parties hereto shall be governed by the laws of the State of New York, without regard to principles of conflicts of laws.

16. BORROWER AND LENDER

WAIVE ANY RIGHT TO HAVE A JURY PARTICIPATE IN RESOLVING ANY DISPUTE, WHETHER SOUNDING IN CONTRACT, TORT OR OTHERWISE, BETWEEN BORROWER

AND LENDER, ARISING OUT OF, IN CONNECTION WITH, RELATED TO, OR INCIDENTAL TO THE RELATIONSHIP ESTABLISHED BETWEEN THEM IN CONNECTION

WITH THIS AGREEMENT OR ANY NOTE OR OTHER INSTRUMENT, DOCUMENT OR AGREEMENT EXECUTED OR DELIVERED IN CONNECTION HEREWITH OR THE

TRANSACTIONS RELATED THERETO. THIS WAIVER SHALL NOT IN ANY WAY AFFECT, WAIVE, LIMIT, AMEND OR MODIFY LENDER’S ABILITY TO

PURSUE REMEDIES PURSUANT TO ANY CONFESSION OF JUDGMENT OR COGNOVIT PROVISION CONTAINED IN ANY NOTE OR OTHER INSTRUMENT, DOCUMENT

OR AGREEMENT BETWEEN BORROWER AND LENDER.

[The remainder of this page is intentionally

left blank]

The parties have executed

this Agreement as of the date first written above.

BORROWER:

|

|

ULTRALIFE CORPORATION

By: /s/ Philip A. Fain

Print Name: Philip A. Fain

Its: CFO and Treasurer

|

LENDER:

|

PNC BANK, NATIONAL ASSOCIATION

By: /s/Kevin Rich

Kevin

Rich, Vice President

|

6

EXHIBIT 99.1

| Company Contact: |

|

Investor Relations Contact: |

| Ultralife Corporation |

|

LHA |

| Philip A. Fain |

|

Jody Burfening |

| (315) 332-7100 |

|

(212) 838-3777 |

| pfain@ulbi.com |

|

jburfening@lhai.com |

Ultralife Corporation Acquires Accutronics

Ltd. for Approximately $11.0 Million

Advances Ultralife’s Commercial Diversification

and Expands Geographic Reach

NEWARK, N.Y. – January 13, 2016 -- Ultralife Corporation (NASDAQ:

ULBI) has acquired all of the outstanding shares of Accutronics Ltd., for £7.575 million (approximately $11.0 million)

in cash, subject to customary working capital and net cash/debt adjustments. Based in Newcastle-under-Lyme, U.K., Accutronics Ltd.

is a leading independent designer and manufacturer of smart batteries and charger systems for high-performance, feature-laden portable

and handheld electronic devices.

With a portfolio encompassing custom battery design, development

and manufacturing for OEM’s; standard smart batteries, chargers and accessories; and pre-engineered batteries and power solutions

for specific applications, Accutronics primarily serves the portable medical device market throughout Europe. Medical applications

include digital imaging, ventilators, anaesthesia, endoscopy, patient monitoring, cardio pulmonary care, oxygen concentration and

aspiration. For their fiscal year ended August 31, 2015, Accutronics generated revenue of over £8 million (approximately

$12.5 million). The transaction is expected to be accretive on an EPS basis within 12 months.

“To further drive the proven operating leverage of our business

model, we are focused on revenue growth from new product development and market and sales reach expansion, while seeking acquisitions

that enhance our organic growth opportunities. Accutronics, a well-run, profitable company with a compatible business model, growth

profile and management approach, is a great bolt-on fit to our Battery and Energy Products business unit,” said Michael D.

Popielec, Ultralife's President and Chief Executive Officer. “Acquiring Accutronics advances our strategy of commercial revenue

diversification and expands our geographic reach within European OEM’s. With industry experts predicting mid-to-high single

digit growth in the global medical batteries market, this strategic investment positions Ultralife well for further penetration

of and growing revenue streams from an attractive commercial market.”

About Ultralife Corporation

Ultralife Corporation serves its markets with products and services

ranging from portable power solutions to communications and electronics systems. Through its engineering and collaborative approach

to problem solving, Ultralife serves government, defense and commercial customers across the globe.

Headquartered in Newark, New York, the Company's business segments

include: Battery & Energy Products and Communications Systems. Ultralife has operations in North America, Europe and Asia.

For more information, visit www.ultralifecorp.com.

This press release may contain forward-looking statements based

on current expectations that involve a number of risks and uncertainties. The potential risks and uncertainties that could cause

actual results to differ materially include: potential reductions in U.S. military spending, uncertain global economic conditions

and acceptance of our new products on a global basis. The Company cautions investors not to place undue reliance on forward-looking

statements, which reflect the Company's analysis only as of today's date. The Company undertakes no obligation to publicly update

forward-looking statements to reflect subsequent events or circumstances. Further information on these factors and other factors

that could affect Ultralife's financial results is included in Ultralife's Securities and Exchange Commission (SEC) filings, including

the latest Annual Report on Form 10-K.

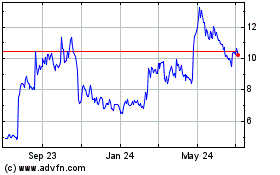

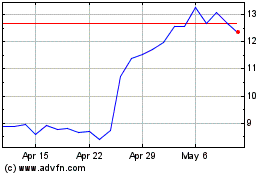

Ultralife (NASDAQ:ULBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ultralife (NASDAQ:ULBI)

Historical Stock Chart

From Apr 2023 to Apr 2024