UFPI Reports Record First Quarter Results

April 20 2016 - 4:05PM

Universal Forest Products, Inc. (Nasdaq:UFPI) today announced

first-quarter net earnings attributable to controlling interest of

$19.2 million, up 89 percent over the same period of 2015. Diluted

earnings per share were $0.95, compared to $0.51 for the first

quarter of 2015. Net sales for the first quarter were $682.2

million, up 7.8 percent over the first quarter of 2015. The net

earnings and net sales results are first-quarter records for the

Company.

“The record-breaking results we have enjoyed since the third

quarter of 2015 are a testament to the outstanding efforts of our

people and the strategies we have implemented to grow and improve

the business,” said CEO Matt Missad. “Rather than become

complacent, we are targeting new opportunities for growth and

improved profitability, while enhancing value for our

customers.”

The first-quarter sales growth is attributable to increases in

the Company’s retail and construction markets, which grew 17

percent and 9.3 percent, respectively, despite a 12 percent decline

in year-over-year lumber prices in the first quarter.

“While the milder winter contributed to improved

quarter-over-quarter results, we also benefitted from increased new

product sales, operational efficiency improvements, and a better

sales mix,” Matt reported. New product sales for the quarter rose

32 percent to $67.5 million, up from $51 million during the same

period in 2015.

By market, the Company posted the following first-quarter 2016

gross sales results:

Retail: $270.7 million, up 17 percent over the

same period of 2015

The Company saw increases in unit sales to both its big box and

independent retail customers as a result of improving demand and

success in the Company’s new product sales initiative. The sales

were partially offset by a 2 percent decrease in selling prices due

to the commodity lumber market. The Company believes it is

well-positioned to meet the growing demand of customers as the

spring building season begins. It remains focused on enhancing its

product offerings by creating new products and improving upon

existing products, and increasing its market share with independent

retailers.

Industrial: $204.2 million, down 3 percent from

the first quarter of 2015

This market includes packaging, material handling and related

products, and other wood-based products for many other applications

that serve a variety of industrial customers. The Company’s unit

sales increased 5 percent as a result of organic growth from adding

new customers and growing market share with existing customers.

Gross sales fell 3 percent due to an 8 percent decrease in selling

prices due to lower lumber costs. The Company remains focused on

adding new customers, expanding its product and service offering,

adding capacity in certain regions, and growing its business in

non-wood packaging materials.

Construction: $218.9 million, up 9 percent over

the same period of 2015

This market includes residential and manufactured housing and

commercial construction. The Company’s growth in this market was

attributable to a 15 percent increase in unit sales, led by strong

sales in commercial and residential construction. Gross sales were

partially offset by a 6 percent decrease in selling prices.

CONFERENCE CALL

Universal Forest Products will conduct a conference call to

discuss information included in this news release and related

matters at 8:30 a.m. ET on Thurs., April 21, 2016. The call will be

hosted by CEO Matthew J. Missad and CFO Michael Cole, and will be

available for analysts and institutional investors domestically at

(888) 685-5759 and internationally at (503) 343-6031. Use

conference pass code 88497073. The conference call will be

available simultaneously and in its entirety to all interested

investors and news media through a webcast at http://www.ufpi.com.

A replay of the call will be available through May 15, 2016, at

855-859-2056 or 404-537-3406 or 800-585-8367.

UNIVERSAL FOREST PRODUCTS, INC.

Universal Forest Products, Inc. is a holding company that

provides capital, management and administrative resources to

subsidiaries in three robust markets: retail, construction and

industrial. Founded in 1955, the Company is headquartered in Grand

Rapids, Mich., with affiliates throughout North America and

Australia. For more about Universal Forest Products, go to

www.ufpi.com.

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act, as

amended, that are based on management’s beliefs, assumptions,

current expectations, estimates and projections about the markets

we serve, the economy and the Company itself. Words like

“anticipates,” “believes,” “confident,” “estimates,” “expects,”

“forecasts,” “likely,” “plans,” “projects,” “should,” variations of

such words, and similar expressions identify such forward-looking

statements. These statements do not guarantee future performance

and involve certain risks, uncertainties and assumptions that are

difficult to predict with regard to timing, extent, likelihood and

degree of occurrence. The Company does not undertake to update

forward-looking statements to reflect facts, circumstances, events,

or assumptions that occur after the date the forward-looking

statements are made. Actual results could differ materially from

those included in such forward-looking statements. Investors are

cautioned that all forward-looking statements involve risks and

uncertainty. Among the factors that could cause actual results to

differ materially from forward-looking statements are the

following: fluctuations in the price of lumber; adverse or unusual

weather conditions; adverse economic conditions in the markets we

serve; government regulations, particularly involving environmental

and safety regulations; and our ability to make successful business

acquisitions. Certain of these risk factors as well as other risk

factors and additional information are included in the Company's

reports on Form 10-K and 10-Q on file with the Securities and

Exchange Commission.

| CONSOLIDATED CONDENSED STATEMENTS OF EARNINGS

AND COMPREHENSIVE INCOME (UNAUDITED) |

|

| FOR THE THREE MONTHS ENDED |

|

| MARCH 2016/2015 |

|

|

|

|

Quarter Period |

|

|

|

Year to Date |

|

|

|

|

(In thousands, except per share data) |

|

|

2016 |

|

|

|

|

|

2015 |

|

|

|

|

|

2016 |

|

|

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET SALES |

|

$ |

682,151 |

|

|

|

100 |

% |

|

$ |

633,025 |

|

|

|

100 |

% |

|

$ |

682,151 |

|

|

|

100 |

% |

|

$ |

633,025 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF GOODS SOLD |

|

|

579,412 |

|

|

|

84.9 |

|

|

|

553,443 |

|

|

|

87.4 |

|

|

|

579,412 |

|

|

|

84.9 |

|

|

|

553,443 |

|

|

|

87.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

|

102,739 |

|

|

|

15.1 |

|

|

|

79,582 |

|

|

|

12.6 |

|

|

|

102,739 |

|

|

|

15.1 |

|

|

|

79,582 |

|

|

|

12.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SELLING,

GENERAL

AND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADMINISTRATIVE

EXPENSES |

|

|

70,838 |

|

|

|

10.4 |

|

|

|

61,705 |

|

|

|

9.7 |

|

|

|

70,838 |

|

|

|

10.4 |

|

|

|

61,705 |

|

|

|

9.7 |

|

|

|

NET (GAIN) LOSS ON DISPOSITION AND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPAIRMENT OF ASSETS |

|

|

(10 |

) |

|

|

- |

|

|

|

14 |

|

|

|

- |

|

|

|

(10 |

) |

|

|

- |

|

|

|

14 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS FROM OPERATIONS |

|

|

31,911 |

|

|

|

4.7 |

|

|

|

17,863 |

|

|

|

2.8 |

|

|

|

31,911 |

|

|

|

4.7 |

|

|

|

17,863 |

|

|

|

2.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER EXPENSE, NET |

|

|

891 |

|

|

|

0.1 |

|

|

|

955 |

|

|

|

0.2 |

|

|

|

891 |

|

|

|

0.1 |

|

|

|

955 |

|

|

|

0.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS BEFORE INCOME TAXES |

|

|

31,020 |

|

|

|

4.5 |

|

|

|

16,908 |

|

|

|

2.7 |

|

|

|

31,020 |

|

|

|

4.5 |

|

|

|

16,908 |

|

|

|

2.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME TAXES |

|

|

10,765 |

|

|

|

1.6 |

|

|

|

6,104 |

|

|

|

1.0 |

|

|

|

10,765 |

|

|

|

1.6 |

|

|

|

6,104 |

|

|

|

1.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS |

|

|

20,255 |

|

|

|

3.0 |

|

|

|

10,804 |

|

|

|

1.7 |

|

|

|

20,255 |

|

|

|

3.0 |

|

|

|

10,804 |

|

|

|

1.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LESS NET EARNINGS ATTRIBUTABLE TO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONCONTROLLING

INTEREST |

|

|

(1,043 |

) |

|

|

(0.2 |

) |

|

|

(642 |

) |

|

|

(0.1 |

) |

|

|

(1,043 |

) |

|

|

(0.2 |

) |

|

|

(642 |

) |

|

|

(0.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS ATTRIBUTABLE TO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTROLLING INTEREST |

|

$ |

19,212 |

|

|

|

2.8 |

|

|

$ |

10,162 |

|

|

|

1.6 |

|

|

$ |

19,212 |

|

|

|

2.8 |

|

|

$ |

10,162 |

|

|

|

1.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS PER SHARE -

BASIC |

|

$ |

0.95 |

|

|

|

|

$ |

0.51 |

|

|

|

|

$ |

0.95 |

|

|

|

|

$ |

0.51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS PER SHARE - DILUTED |

|

$ |

0.95 |

|

|

|

|

$ |

0.51 |

|

|

|

|

$ |

0.95 |

|

|

|

|

$ |

0.51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME |

|

|

20,697 |

|

|

|

|

|

9,801 |

|

|

|

|

|

20,697 |

|

|

|

|

|

9,801 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LESS COMPREHENSIVE INCOME ATTRIBUTABLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO NONCONTROLLING

INTEREST |

|

|

(846 |

) |

|

|

|

|

(498 |

) |

|

|

|

|

(846 |

) |

|

|

|

|

(498 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ATTRIBUTABLE TO CONTROLLING

INTEREST |

|

$ |

19,851 |

|

|

|

|

$ |

9,303 |

|

|

|

|

$ |

19,851 |

|

|

|

|

$ |

9,303 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL SALES DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Period |

|

Year to Date |

|

|

Market Classification |

|

|

2016 |

|

|

|

|

|

2015 |

|

|

% |

|

|

2016 |

|

|

|

|

|

2015 |

|

|

% |

|

|

Retail |

|

$ |

270,743 |

|

|

|

|

$ |

231,447 |

|

|

|

17 |

% |

|

$ |

270,743 |

|

|

|

|

$ |

231,447 |

|

|

|

17 |

% |

|

|

Industrial |

|

|

204,245 |

|

|

|

|

|

210,016 |

|

|

|

-3 |

% |

|

|

204,245 |

|

|

|

|

|

210,016 |

|

|

|

-3 |

% |

|

|

Construction |

|

|

218,876 |

|

|

|

|

|

200,306 |

|

|

|

9 |

% |

|

|

218,876 |

|

|

|

|

|

200,306 |

|

|

|

9 |

% |

|

|

Total Gross Sales |

|

|

693,864 |

|

|

|

|

|

641,769 |

|

|

|

8 |

% |

|

|

693,864 |

|

|

|

|

|

641,769 |

|

|

|

8 |

% |

|

|

Sales Allowances |

|

|

(11,713 |

) |

|

|

|

|

(8,744 |

) |

|

|

|

|

(11,713 |

) |

|

|

|

|

(8,744 |

) |

|

|

|

|

Total Net Sales |

|

$ |

682,151 |

|

|

|

|

$ |

633,025 |

|

|

|

|

$ |

682,151 |

|

|

|

|

$ |

633,025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED CONDENSED BALANCE SHEETS

(UNAUDITED) |

|

| MARCH 2016/2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

2016 |

|

|

|

2015 |

|

|

LIABILITIES AND EQUITY |

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

43,065 |

|

|

$ |

22,888 |

|

|

|

Cash

overdraft |

|

$ |

- |

|

|

$ |

21,585 |

|

|

|

|

Restricted cash |

|

|

1,139 |

|

|

|

710 |

|

|

|

Accounts payable |

|

|

116,525 |

|

|

|

114,225 |

|

|

|

|

Investments |

|

|

6,737 |

|

|

|

- |

|

|

|

Accrued liabilities |

|

|

97,910 |

|

|

|

79,326 |

|

|

|

|

Accounts receivable |

|

|

287,374 |

|

|

|

260,926 |

|

|

|

Current portion of debt |

|

|

886 |

|

|

|

21 |

|

|

|

|

Inventories |

|

|

327,177 |

|

|

|

404,711 |

|

|

|

|

|

|

|

|

|

|

|

|

Other current assets |

|

|

16,889 |

|

|

|

19,984 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL CURRENT ASSETS |

|

|

682,381 |

|

|

|

709,219 |

|

|

TOTAL CURRENT LIABILITIES |

|

|

215,321 |

|

|

|

215,157 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER ASSETS |

|

|

10,424 |

|

|

|

9,674 |

|

|

LONG-TERM DEBT AND |

|

|

|

|

|

| INTANGIBLE ASSETS, NET |

|

|

198,338 |

|

|

|

193,113 |

|

|

|

CAPITAL LEASE OBLIGATIONS |

|

|

84,525 |

|

|

|

187,020 |

|

|

| PROPERTY, PLANT |

|

|

|

|

|

OTHER LIABILITIES |

|

|

51,003 |

|

|

|

50,309 |

|

|

|

|

AND EQUIPMENT,

NET |

|

|

254,634 |

|

|

|

255,462 |

|

|

EQUITY |

|

|

794,928 |

|

|

|

714,982 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

1,145,777 |

|

|

$ |

1,167,468 |

|

|

TOTAL LIABILITIES AND EQUITY |

|

$ |

1,145,777 |

|

|

$ |

1,167,468 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED CONDENSED STATEMENTS OF CASH

FLOWS (UNAUDITED) |

|

| FOR THE THREE MONTHS ENDED |

|

| MARCH 2016/2015 |

|

| (In thousands) |

|

|

|

|

2016 |

|

|

|

|

|

2015 |

|

|

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

|

|

|

| Net earnings |

|

|

|

$ |

20,255 |

|

|

|

|

$ |

10,804 |

|

|

| Adjustments to reconcile net earnings to net cash from

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

|

|

9,492 |

|

|

|

|

|

8,996 |

|

|

|

Amortization of intangibles |

|

|

|

693 |

|

|

|

|

|

983 |

|

|

|

Expense associated with share-based compensation arrangements |

|

|

432 |

|

|

|

|

|

378 |

|

|

|

Expense associated with stock grant plans |

|

|

|

37 |

|

|

|

|

|

27 |

|

|

|

Deferred income tax credit |

|

|

|

(156 |

) |

|

|

|

|

(193 |

) |

|

|

Equity in earnings of investee |

|

|

|

(81 |

) |

|

|

|

|

(83 |

) |

|

|

Net loss (gain) on disposition and impairment of assets |

|

|

(10 |

) |

|

|

|

|

14 |

|

|

|

Changes in: |

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

|

(64,276 |

) |

|

|

|

|

(63,148 |

) |

|

|

Inventories |

|

|

|

|

(22,159 |

) |

|

|

|

|

(64,422 |

) |

|

|

Accounts payable and cash overdraft |

|

|

|

21,498 |

|

|

|

|

|

45,219 |

|

|

|

Accrued liabilities and other |

|

|

|

4,318 |

|

|

|

|

|

10,880 |

|

|

|

NET CASH FROM OPERATING ACTIVITIES |

|

|

(29,957 |

) |

|

|

|

|

(50,545 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

|

|

|

| Purchases of property, plant, and equipment |

|

|

|

(12,941 |

) |

|

|

|

|

(15,102 |

) |

|

| Proceeds from sale of property, plant and

equipment |

|

|

132 |

|

|

|

|

|

50 |

|

|

| Acquisitions, net of cash received |

|

|

|

- |

|

|

|

|

|

(2,585 |

) |

|

| Advances of notes receivable |

|

|

|

(1,259 |

) |

|

|

|

|

(1,273 |

) |

|

| Collections of notes receivable and related

interest |

|

|

1,408 |

|

|

|

|

|

5,790 |

|

|

| Cash restricted as to use |

|

|

|

(553 |

) |

|

|

|

|

(305 |

) |

|

|

Other, net |

|

|

|

|

|

(173 |

) |

|

|

|

|

(16 |

) |

|

|

NET CASH FROM INVESTING ACTIVITIES |

|

|

(13,386 |

) |

|

|

|

|

(13,441 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

|

|

|

| Borrowings under revolving credit facilities |

|

|

|

1,235 |

|

|

|

|

|

140,303 |

|

|

| Repayments under revolving credit facilities |

|

|

|

(1,495 |

) |

|

|

|

|

(52,718 |

) |

|

| Proceeds from issuance of common stock |

|

|

|

130 |

|

|

|

|

|

469 |

|

|

| Distributions to noncontrolling interest |

|

|

|

(1,170 |

) |

|

|

|

|

(939 |

) |

|

| Repurchase of common stock |

|

|

|

- |

|

|

|

|

|

(78 |

) |

|

|

Other, net |

|

|

|

|

|

(5 |

) |

|

|

|

|

(9 |

) |

|

|

NET CASH FROM FINANCING ACTIVITIES |

|

|

(1,305 |

) |

|

|

|

|

87,028 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash |

|

|

|

(43 |

) |

|

|

|

|

(154 |

) |

|

| NET CHANGE IN CASH AND CASH

EQUIVALENTS |

|

|

(44,691 |

) |

|

|

|

|

22,888 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH AND CASH EQUIVALENTS, BEGINNING OF

PERIOD |

|

|

87,756 |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH AND CASH EQUIVALENTS, END OF

PERIOD |

|

$ |

43,065 |

|

|

|

|

$ |

22,888 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Lynn Afendoulis

Director, Corporate Communications

(616) 365-1502

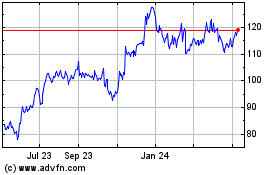

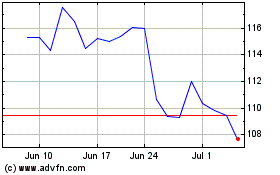

UFP Industries (NASDAQ:UFPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

UFP Industries (NASDAQ:UFPI)

Historical Stock Chart

From Apr 2023 to Apr 2024