Texas Roadhouse, Inc. (NasdaqGS: TXRH), today announced

financial results for the 13 week period ended March 29, 2016.

First Quarter ($000's)

2016

2015

% Change

Total revenue $ 515,559 $ 460,230 12 Income from operations

52,811 48,600 9 Net income 35,593 32,292 10 Diluted EPS $ 0.50 $

0.46 10

Results for the first quarter included the following

highlights:

- Comparable restaurant sales growth of

4.6% at company restaurants and 3.1% at franchise restaurants;

- Restaurant margin, as a percentage of

restaurant sales, increased 116 basis points to 20.1%, primarily

driven by lower food costs;

- Diluted earnings per share increased

9.8% to $0.50 from $0.46 in the prior year;

- The Company recorded a pre-tax charge

of $5.5 million ($3.4 million after-tax) related to a pending legal

settlement which had a $0.05 impact on diluted earnings per share

and a 10.0% impact on diluted earnings per share growth;

- Seven company-owned restaurants were

opened, including two Bubba’s 33 restaurants; and,

- The Company repurchased 114,700 shares

of its common stock for $4.1 million.

Kent Taylor, Chief Executive Officer of Texas Roadhouse, Inc.,

commented, "We are pleased that our top-line momentum continued in

the first quarter, driven by solid traffic growth. Strong comp

sales, along with commodity deflation driven by lower beef costs

helped us deliver near double digit earnings growth this quarter.

As of today, we have opened ten company restaurants, as well as two

international franchise openings, including our first in the

Philippines. Beyond restaurant development, our balance sheet and

cash flow remain healthy and we believe we are well-positioned for

long-term growth."

2016 Outlook

The Company reported that comparable restaurant sales growth at

company restaurants for the first four weeks of its second quarter

of fiscal 2016 was approximately 5.1% compared to the prior year

period.

Management reiterated the following expectations for 2016:

- Positive comparable restaurant sales

growth;

- Approximately 30 company restaurant

openings, including approximately seven Bubba’s 33

restaurants;

- 1.0% to 2.0% food cost deflation;

- An income tax rate of approximately

30.0%; and,

- Total capital expenditures of $165.0

million to $175.0 million.

Conference Call

The Company is hosting a conference call today, May 2, 2016 at

5:00 p.m. Eastern Time to discuss these results. The dial-in number

is (877) 675-4756 or (719) 325-4940 for international calls. A

replay of the call will be available for one week following the

conference call. To access the replay, please dial (877) 870-5176

or (858) 384-5517 for international calls, and use 4379719 as the

pass code. There will be a simultaneous Web cast conducted at

www.texasroadhouse.com.

About the Company

Texas Roadhouse is a casual dining concept that first opened in

1993 and today operates 495 restaurants system-wide in 49 states

and five foreign countries. For more information, please visit the

Company’s Web site at www.texasroadhouse.com.

Forward-looking Statements

Certain statements in this release that are not historical

facts, including, without limitation, those relating to our

anticipated financial performance, are forward-looking statements

that involve risks and uncertainties. Such statements are based

upon the current beliefs and expectations of the management of the

Company. Actual results may vary materially from those contained in

forward-looking statements based on a number of factors including,

without limitation, the actual number of restaurants opening; the

sales at these and our other company and franchise restaurants;

changes in restaurant development or operating costs, such as food

and labor; our ability to acquire franchise restaurants; our

ability to integrate the franchise restaurants we acquire or other

concepts we develop; our ability to continue to generate the

necessary cash flows to fund our new restaurant growth, continue

our share repurchase program and pay a quarterly cash dividend;

strength of consumer spending; pending or future legal claims;

breaches of security; conditions beyond our control such as

weather, natural disasters, disease outbreaks, epidemics or

pandemics impacting our customers or food supplies; food safety and

food borne illness concerns; acts of war or terrorism and other

factors disclosed from time to time in our filings with the U.S.

Securities and Exchange Commission. Investors should take such

risks into account when making investment decisions. Shareholders

and other readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

on which they are made. We undertake no obligation to update any

forward-looking statements.

Texas Roadhouse, Inc. and

Subsidiaries Condensed Consolidated Statements of Income

(in thousands, except per share data) (unaudited)

13 Weeks Ended March 29,

2016 March 31, 2015 Revenue: Restaurant sales $

511,284 $ 456,293 Franchise royalties and fees 4,275

3,937 Total revenue 515,559 460,230

Costs and expenses: Restaurant operating costs (excluding

depreciation and amortization shown separately below): Cost

of sales 173,128 159,980 Labor 147,546 131,404 Rent 10,027 8,979

Other operating 77,612 69,317 Pre-opening 4,825 3,818 Depreciation

and amortization 19,539 16,335 Impairment and closure 11 - General

and administrative 30,060 21,797 Total costs

and expenses 462,748 411,630 Income from

operations 52,811 48,600 Interest expense, net 305 515

Equity income from investments in

unconsolidated affiliates

352 372 Income before taxes 52,858 48,457

Provision for income taxes 15,857 14,876 Net

income including noncontrolling interests $ 37,001 $ 33,581 Less:

Net income attributable to noncontrolling interests 1,408

1,289 Net income attributable to Texas Roadhouse, Inc. and

subsidiaries $ 35,593 $ 32,292

Net income per common share attributable

to Texas Roadhouse, Inc. and subsidiaries:

Basic $ 0.51 $ 0.46 Diluted $ 0.50 $ 0.46 Weighted average

shares outstanding: Basic 70,169 69,841 Diluted

70,764 70,528

Texas Roadhouse, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (in thousands)

(unaudited) March 29,

2016 December 29, 2015 Cash and cash equivalents $

95,992 $ 59,334 Other current assets 51,218 74,479 Property and

equipment, net 766,331 751,288 Goodwill 116,571 116,571 Intangible

assets, net 4,488 4,827 Other assets 27,014 26,207

Total assets $ 1,061,614 $ 1,032,706 Current

maturities of long-term debt 147 144 Other current liabilities

233,097 256,498 Long-term debt, excluding current maturities 50,512

25,550 Other liabilities 78,566 73,332 Texas Roadhouse, Inc. and

subsidiaries stockholders' equity 691,537 669,662 Noncontrolling

interests 7,755 7,520 Total liabilities and equity $

1,061,614 $ 1,032,706

Texas Roadhouse, Inc. and Subsidiaries Condensed

Consolidated Statements of Cash Flows (in thousands)

(unaudited)

13 Weeks Ended March 29, 2016 March 31, 2015

Cash

flows from operating activities: Net income including

noncontrolling interests $ 37,001 $ 33,581 Adjustments to reconcile

net income to net cash provided by operating activities

Depreciation and amortization 19,539 16,335 Share-based

compensation expense 5,788 4,904 Other noncash adjustments 802 (41

) Change in working capital 1,758 2,913

Net cash provided by operating activities 64,888

57,692

Cash flows from investing

activities: Capital expenditures - property and equipment

(34,179 ) (33,437 ) Proceeds from sale of property and equipment,

including insurance proceeds - 9 Net

cash used in investing activities (34,179 ) (33,428 )

Cash flows from financing activities: Proceeds from

revolving credit facility 25,000 - Repurchase shares of common

stock (4,110 ) - Dividends paid (11,919 ) (10,443 ) Other financing

activities (3,022 ) (1,431 ) Net cash provided by

(used in) financing activities 5,949 (11,874 )

Net increase in cash and cash equivalents 36,658 12,390 Cash

and cash equivalents - beginning of period 59,334

86,122 Cash and cash equivalents - end of period $

95,992 $ 98,512

Texas Roadhouse, Inc. and Subsidiaries

Supplemental Financial and Operating Information ($

amounts in thousands, except weekly sales by group)

(unaudited) First

Quarter Change

2016

2015

vs LY

Restaurant openings Company - Texas Roadhouse 5 2 3 Company

- Bubba's 33 2 1 1 Company - Other 0 0 0 Franchise - Texas

Roadhouse 1 0 1 Total 8 3 5 Restaurants open at the end of

the quarter Company - Texas Roadhouse 397 370 27 Company - Bubba's

33 9 4 5 Company - Other 2 1 1 Franchise - Texas Roadhouse 83 79 4

Total 491 454 37 Company-owned restaurants Restaurant sales

$ 511,284 $ 456,293 12.1

%

Store weeks 5,262 4,857 8.3

%

Comparable restaurant sales growth (1) 4.6 % 8.9 % Texas Roadhouse

restaurants only: Comparable restaurant sales growth (1) 4.6 % 8.8

% Average unit volume (2) $ 1,270 $ 1,220 4.1

%

Weekly sales by group: Comparable restaurants (358 units) $ 98,156

Average unit volume restaurants (18 units) (3) $ 88,094 Restaurants

less than 6 months old (21 units) $ 98,583 Restaurant

operating costs (as a % of restaurant sales) Cost of sales 33.9 %

35.1 % (120 ) bps Labor 28.9 % 28.8 % 6 bps Rent 2.0 % 2.0 % (1 )

bps Other operating 15.2 % 15.2 % (1 ) bps Total 79.9 % 81.0 % (116

) bps Restaurant margin (4) 20.1 % 19.0 % 116 bps

Restaurant margin ($ in thousands) $ 102,970 $ 86,613 18.9

%

Restaurant margin $/Store week $ 19,569 $ 17,833 9.7

%

Franchise-owned restaurants Franchise royalties and fees $

4,275 $ 3,937 8.6

%

Store weeks 1,070 1,027 4.2

%

Comparable restaurant sales growth (1) 3.1 % 8.0 % Average unit

volume (2) $ 1,317 $ 1,306 0.8

%

Pre-opening expense $ 4,825 $ 3,818 26.4

%

Depreciation and amortization $ 19,539 $ 16,335 19.6

%

As a % of revenue 3.8 % 3.5 % 24 bps General and

administrative expenses $ 30,060 $ 21,797 37.9

%

As a % of revenue 5.8 % 4.7 % 109 bps (1) Comparable

restaurant sales growth reflects the change in year-over-year sales

for restaurants open a full 18 months before the beginning of the

period measured, excluding sales from restaurants closed during the

period. (2) Average unit volume includes sales from Texas Roadhouse

restaurants open for a full six months before the beginning of the

period measured, excluding any sales at restaurants closed during

the period. (3) Average unit volume restaurants include restaurants

open a full six to 18 months before the beginning of the period

measured. (4) Restaurant margin represents restaurant sales less

cost of sales, labor, rent and other operating costs (as a

percentage of restaurant sales). Restaurant margin is widely

regarded in the restaurant industry as a useful metric by which to

evaluate restaurant-level operating efficiency and performance.

Restaurant margin is not a measurement determined in accordance

with GAAP and should not be considered in isolation, or as an

alternative, to income from operations or other similarly titled

measures of other companies. Amounts may not foot due

to rounding.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160502006143/en/

Texas Roadhouse, Inc.Investor Relations:Tonya Robinson,

502-515-7269orMedia:Travis Doster, 502-638-5457

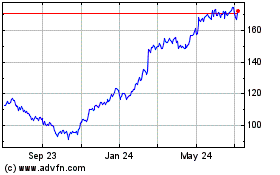

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Mar 2024 to Apr 2024

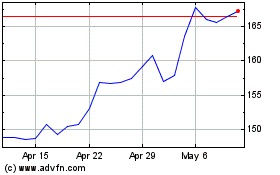

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Apr 2023 to Apr 2024