Restaurants To Manage Wait Times To Improve Customer Service

June 02 2011 - 10:03AM

Dow Jones News

Restaurant operators are investing in technology to better

estimate wait times and improve the process of alerting guests when

their tables are ready, hoping to keep patrons from fleeing at the

site of long lines.

With a constant stream of chains to choose from, competition in

the casual dining sector is fierce. Some major restaurant operators

could be losing up to $1 million in sales each week as guests leave

because of wait-time frustrations. When it comes to investing in

new technology, wait management has become a top priority for

chains.

Red Robin Gourmet Burgers Inc. (RRGB) is trying out a new system

of texting guests when their table is ready at one of its

mall-based locations. The move will allow people to shop, or simply

browse, while they're waiting to be seated. The chain is only in

the very early stages of testing it, a spokesman said.

Table Top Media's Chief Executive Jack Baum, a restaurant

industry veteran turned technology provider, says restaurants know

they're losing guests to long lines on a busy night, but it's not

just a one-time effect. If regular patrons have a bad wait

experience once, it will likely turn them away for good. "People

will come to a casual dining restaurant more frequently if they

know they can get in and out quicker," he said.

The capital investment for a chain is relatively small,

requiring a few thousand dollars for hardware such as pagers on a

per restaurant basis. Technology providers are also now offering

some products as software on a monthly subscription basis, making

them even more affordable.

The National Restaurant Association estimates that 16% of

restaurant businesses use technology for table management, and 21%

have increased their technology budgets this year over last

year.

Heartland Payment Systems Inc.'s (HPY) Freshtxt provides text

messaging services that integrate with restaurants' current pager

systems to allow guests to roam area shopping while waiting.

Heartland's Chief Information Officer Steve Elefant said texting

systems also encourage increased frequency by allowing restaurants

to contact customers with promotional deals to bring them back

again. "You'd be surprised how popular the outbound marketing

aspect is," Elefant said. "It's pushing restaurants to take that

step to invest in the customer service technology."

Built on the premise of Southern hospitality, Texas Roadhouse

Inc. (TXRH) is in the process of reverting back to the pager

system, after switching to a cheaper alternative in which guests

are given a number and watch for their number to light up on a

larger screen in the waiting area.

"People were confined to waiting in one area inside, so they

were blocking the door," said Travis Doster, company spokesman.

"And a lot of the time, people couldn't see the screen, and we'd

have to announce their numbers on the loud speaker, and that takes

away from the atmosphere. It just wasn't worth it."

Texas Roadhouse estimates it turns away an average of 100

customers at each restaurant per weekend night due to long

waits.

A big cost with the vibrating, light-up pagers that are often

used at casual dining chains is replacing the pagers when people

walk off with them. To help combat the issue this time around,

Texas Roadhouse is trying out drop boxes for the pagers outside the

restaurants.

Darden Restaurants Inc. (DRI) recently rolled out a new table

management system at its Olive Garden chain to better detect

wait-time estimations. A spokesman for the company said the new

system has made a noticeable difference in customer

satisfaction.

Mark Kalinowski, restaurant analyst at Janney Capital Markets,

said wait time management is a critical area for restaurants.

"It can be very frustrating when you're told the wrong wait

time, and you're stuck there," Kalinowski said. "So, if restaurants

can help make that process better, that is probably a better

investment," than some of the other swanky technology out there,

like tablet ordering systems at tables.

With the recession and its aftermath leaving restaurants

strapped for cash, investments in the latest technology have been

somewhat on hold.

Hudson Riehle, senior vice president of research for the

National Restaurant Association, says tech spending is starting to

pick up again.

"The restaurant industry has typically been slow to invest in

technology because it's not a high-margin industry. Casual dining,

specifically, has lagged behind quick-service restaurants," Riehle

said. "Casual dining concepts are now implementing more technology

to enhance customer service."

Dale Carr, technology tycoon and chief executive officer of

LeadBolt, says the drawback is the risk that always comes with

technological advancements: Potential software errors crippling a

busy restaurant.

-By Annie Gasparro, Dow Jones Newswires; 212-416-2244;

annie.gasparro@dowjones.com

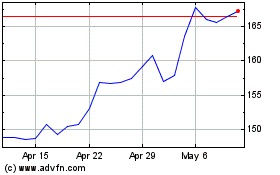

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Mar 2024 to Apr 2024

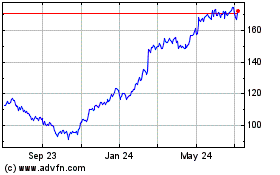

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Apr 2023 to Apr 2024