US Casual-Dining Companies Explore Smaller-Format Restaurants

February 17 2011 - 11:54AM

Dow Jones News

Casual-dining companies, such as Cheesecake Factory Inc. (CAKE)

and Texas Roadhouse Inc. (TXRH), are experimenting with smaller

restaurant prototypes as a way to improve margins coming out of the

recession.

Cheesecake Factory is working on a new 8,000-square-foot model,

which it expects to generate similar cash flow margins as its

typical 10,000-square-foot locations. The cash investment required

for the smaller-format restaurants is reduced by more than 20%,

allowing the restaurant to reach peak margin levels with lower

sales. With the new model, Cheesecake Factory said it can exceed

20% return on investment with sales volumes of just over $8

million.

The smaller prototype also provides more site-selection

flexibility, said Chief Executive David Overton, during a

conference call. "We don't require only new mall development or

expansion of malls to build new restaurants," he said. "This is a

big advantage."

Smaller spaces require less capital investment, increase

efficiency, and make chains more adaptable to existing retail

space, at a time when new sites are hard to come by and restaurant

traffic still hasn't returned to pre-recession levels.

Texas Roadhouse is testing a 10% smaller version, which opened

last month.

"The smaller prototype certainly reduces development costs, but

it also allows us to open in some smaller markets that may not be

able to support a full-size restaurant," a spokesman said.

Often, these smaller markets can be more profitable because they

offer cheaper real estate and less competition in the steakhouse

category.

"Also, designing and working on the new prototype helped us to

identify some inefficiencies in the kitchen, which we will

incorporate in all new units [big or small] going forward," the

spokesman added.

Bill Fahy, senior restaurant analyst at Moody's, said that,

because restaurant companies reduced costs so drastically in the

downturn, it will be tougher to downsize now. "There's always ways

to cut costs," he said. "The biggest challenge is cutting costs

without impacting the customer experience."

The restaurant companies said they can cut square footage in

non-revenue-producing areas such as kitchens and waiting areas to

allow for a similar amount of seating as in larger models, creating

better margins.

WD Partners, a Columbus-based restaurant design and development

firm, estimated that reducing a restaurant's size to 7,250 square

feet from 8,100 square feet through engineering improvements could

save $153,000 per unit in development costs alone.

Dennis Lombardi, WD Partners' executive vice president of

food-service strategies, said reductions in the back of the

restaurant, or "house," if done right, "won't just avoid a negative

impact on customers, but can actually improve the customer

experience." Adding tables to waiting areas shortens wait times,

and decreasing kitchen size reduces the fatigue factor for

employees, he noted.

Darden Restaurants Inc. (DRI), which owns Olive Garden, Red

Lobster and Longhorn Steakhouse, is exploring a similar strategy

with a multi-brand restaurant opening March 7 in Florida. The

combination Olive Garden/Red Lobster includes a joint kitchen and

two separate dining rooms that are each about half the size of a

typical restaurant.

"It allows us to go in to new markets, which normally wouldn't

have the traffic to support one of our full-size restaurants," a

spokesman said.

P.F. Chang's China Bistro Inc. (PFCB) recently hired a new vice

president of real estate for its Pei Wei chain and is evaluating

alternatives to the chain's typical 3,200-square-feet design. With

fewer malls and shopping centers in development, the company said

it hopes to increase potential sites for Pei Wei. But Co-Chief

Executive Rick Federico warned, "We don't want to jump in with both

feet, before we get a couple of those in the ground, and risk

compromising the guest experience."

-By Annie Gasparro, Dow Jones Newswires; 212-416-2244;

annie.gasparro@dowjones.com

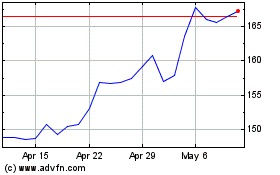

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Mar 2024 to Apr 2024

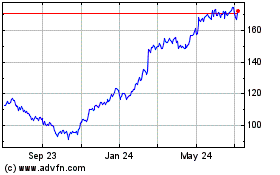

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Apr 2023 to Apr 2024