Net revenue grew 21% to $420.2 million

GAAP net income was $0.39 per diluted share

Non-GAAP net income was $0.45 per diluted

share

Bookings grew 28% to $452.8 million

Take-Two Interactive Software, Inc. (NASDAQ:TTWO) today reported

strong results for its fiscal second quarter 2017, ended September

30, 2016. In addition, the Company provided its initial financial

outlook for its fiscal third quarter 2017, ending December 31,

2016, and updated its financial outlook for its fiscal year ending

March 31, 2017.

Financial Results

For fiscal second quarter 2017, net revenue grew 21% to $420.2

million, as compared to $347.0 million for fiscal second quarter

2016. The largest contributors to net revenue in fiscal second

quarter 2017 were NBA® 2K16, Grand Theft Auto V® and Grand Theft

Auto Online, BioShock®: The Collection, and XCOM® 2.

The change in deferred net revenue, which represents revenue

recognized during the current period that was deferred in prior

periods, net of revenue that is being deferred into future periods,

was $59.3 million in fiscal second quarter 2017 versus $18.0

million in fiscal second quarter 2016.

Digitally-delivered net revenue grew 14% to $230.8 million, as

compared to $202.4 million for fiscal second quarter 2016.

Recurrent consumer spending (virtual currency, downloadable add-on

content and online games) accounted for 56% of digitally-delivered

net revenue, or 31% of total net revenue. The largest contributors

to digitally-delivered net revenue in fiscal second quarter 2017

were NBA 2K16, and Grand Theft Auto V and Grand Theft Auto

Online.

The change in deferred digitally-delivered net revenue was $3.4

million in fiscal second quarter 2017 versus ($61.4) million in

fiscal second quarter 2016.

GAAP cost of goods sold was $205.6 million, as compared to

$143.9 million for fiscal second quarter 2016.

Non-GAAP cost of goods sold was $200.0 million, as compared to

$139.8 million for fiscal second quarter 2016.

The change in deferred cost of goods sold, which represents cost

of goods sold recognized during the current period that were

deferred in prior periods, net of cost of goods sold that are being

deferred into future periods, was $28.8 million in fiscal second

quarter 2017 versus $49.0 million in fiscal second quarter

2016.

GAAP net income was $36.4 million, or $0.39 per diluted share,

as compared to $54.7 million, or $0.55 per diluted share, for the

year-ago period.

Non-GAAP net income was $50.7 million, or $0.45 per diluted

share, as compared to $56.2 million, or $0.51 per diluted share,

for the year-ago period.

The net effect from deferral of net revenue and related cost of

goods sold, which represents the after-tax net effect on net income

(loss) from the change in deferred revenue and the change in

deferred cost of goods sold, was $23.4 million (including tax

expense of $7.1 million) in fiscal second quarter 2017 versus

($23.5) million (including tax benefit of $7.6 million) in fiscal

second quarter 2016.

As of September 30, 2016, the Company had cash and short-term

investments of $1.175 billion.

Operational Metric -

Bookings

During fiscal second quarter 2017, total bookings, which

represents the total amount billed by the Company from sales of

physical product sold-in to retail and available to consumers, net

of allowances, plus product digitally-delivered to consumers during

the period, grew 28% to $452.8 million, as compared to $353.0

million during fiscal second quarter 2016. The largest contributors

to bookings were NBA 2K17 and NBA 2K16, Grand Theft Auto V and

Grand Theft Auto Online, BioShock: The Collection, and XCOM 2.

Catalog accounted for $193.7 million of bookings led by Grand Theft

Auto and NBA 2K. Digitally-delivered bookings grew 59% to $210.8

million, as compared to $132.4 million in last year’s fiscal second

quarter, led by NBA 2K17 and NBA 2K16, and Grand Theft Auto V and

Grand Theft Auto Online. Bookings from recurrent consumer spending

(virtual currency, downloadable add-on content and online games)

grew 63% year-over-year and accounted for 52% of

digitally-delivered bookings, or 24% of total bookings.

Management Comments

“Take-Two’s business continued to outperform during the second

quarter, enabling us to deliver strong net revenue and

better-than-expected bookings growth,” said Strauss Zelnick,

Chairman and CEO of Take-Two. “Our outstanding results were

highlighted by the series' record-breaking launch of NBA 2K17,

ongoing robust demand for Grand Theft Auto V, and increased

recurrent consumer spending, including year-over-year bookings

growth from Grand Theft Auto Online.

“Our holiday season is off to a great start with a diverse array

of successful new releases, including Mafia III, WWE 2K17 and Sid

Meier’s Civilization VI, as well as our first virtual reality

offering – Carnival Games VR. We intend to support our titles with

innovative offerings designed to promote ongoing engagement and

drive recurrent consumer spending, including additional free

content for Grand Theft Auto Online. Looking ahead, fiscal 2018 is

poised to be another strong year for our Company. We expect to grow

both bookings and net cash provided by operating activities driven

by our release slate led by Rockstar Games’ highly anticipated

launch of Red Dead Redemption 2.”

Business and Product

Highlights

Since July 1, 2016:

Rockstar Games:

- Released new free content updates for

Grand Theft Auto Online, including:

- Bikers, which brings underground

Motorcycle Clubs to the forefront of the Los Santos and Blaine

County criminal underworld with a range of all new competitive and

co-operative gameplay, as well as new modes, vehicles, weapons,

clothing and much more.

- Cunning Stunts, which features a total

of 27 brand-new, high-octane Stunt Races utilizing ramps, loops,

wall rides, tubes, raised tracks and dynamic objects for a radical

new take on Grand Theft Auto Online racing, along with 19 new

vehicles, clothing and the launch of the Stunt Race Creator tools,

which allow the community to make and share their own custom stunt

races. Also added on August 2, 2016 was the Entourage Adversary

Mode.

- Made Red Dead Redemption available as

part of Microsoft’s Xbox One Backward Compatibility program,

enabling owners of the Xbox 360 versions of Red Dead Redemption,

Red Dead Redemption Undead Nightmare, and Red Dead Redemption: Game

of the Year Edition to play on Xbox One. In addition, Red Dead

Redemption is now available for purchase through digital download

from the Games Store on Xbox One.

- Announced that the highly-anticipated

Red Dead Redemption 2® is planned for release worldwide in Fall

2017 for PlayStation 4 and Xbox One. Developed by the creators of

Grand Theft Auto V and Red Dead Redemption, Red Dead Redemption

2 is an epic tale of life in America’s unforgiving heartland.

The game's vast and atmospheric open world will also provide the

foundation for a brand new online multiplayer experience.

2K:

- Launched Sid Meier’s Civilization® VI

for PC. Developed by Firaxis Games, Sid Meier’s Civilization VI is

the next entry in the award-winning turn-based strategy franchise

that has sold-in over 37 million units. The title has received

outstanding reviews from critics, including 9.5 out of 10 from Game

Informer, 9.4 out of 10 from IGN, 93 out of 100 from PC Gamer, and

90 out of 100 from GameSpot.

- Launched WWE® 2K17 for PlayStation 4,

PlayStation 3, Xbox One and Xbox 360. Developed collaboratively by

Yuke's and Visual Concepts, WWE 2K17 is being supported with

downloadable add-on content, including a Season Pass.

- Launched Mafia III, the next

installment in 2K’s successful organized crime series, for Xbox

One, PlayStation 4 and PC. Developed by Hangar 13, Mafia III is the

fastest-selling game in 2K’s history, generating week one sell-in

of more than 4.5 million units. Mafia III is being supported with

downloadable add-on content, including a Season Pass, as well as a

free-to-play mobile battle RPG game, Mafia III Rivals, for iOS and

Android devices.

- Released XCOM 2 on PlayStation 4 and

Xbox One. XCOM 2 initially launched for PC in February 2016 and

received outstanding review scores, with Game Informer Magazine,

GameSpot and IGN each scoring the title in the 9-out-of-10

range.

- Launched NBA 2K17 on PlayStation 4,

PlayStation 3, Xbox One, Xbox 360 and PC, as well as on iOS and

Android devices. The title received stellar reviews, becoming the

highest-rated annual sports game of the current console generation

and the highest-rated title in the history of the NBA 2K series.*

NBA 2K17 delivered record first week sell-in for the series and has

continued to grow versus the prior-year’s release, with sell-in to

date of more than 4.5 million units.

- Released BioShock: The Collection for

PlayStation 4, Xbox One, and PC**. BioShock: The Collection

includes BioShock, BioShock 2, and BioShock Infinite completely

remastered for new-generation consoles in full high-resolution and

up to 60 frames per second, complete with all single-player DLC and

a never-before-seen video series, “Director’s Commentary: Imagining

BioShock,” which includes insights from series creator Ken

Levine.

- Released Carnival Games® VR for HTC

Vive™ and PlayStation®VR. A new take on the hit franchise created

by Cat Daddy Games that has sold-in more than 9 million copies

worldwide, Carnival Games VR is 2K’s first virtual reality

offering. The title will also be available on December 6, 2016 for

Oculus Rift.

- Released NHL SuperCard 2K17 for iOS and

Android devices. Developed by Cat Daddy Games, NHL SuperCard 2K17

is a free-to-play NHL collectible card-battling game that includes

more than 400 cards with current NHL players, season-based action,

exhibition games and more.

- Announced that WWE SuperCard - Season 3

will be available for iOS and Android devices in November 2016.

Developed by Cat Daddy Games, WWE SuperCard Season 3 will be a free

update to the popular WWE collectible card-battling game that has

been downloaded more than 11 million times, featuring new modes of

play, Superstars and more.

* According to Metacritic.com.

** BioShock: The Collection is only available for PC through

digital-download.

Financial Outlook for Fiscal

2017

Take-Two is providing its initial financial outlook for its

fiscal third quarter ending December 31, 2016 and is updating its

financial outlook for its fiscal year ending March 31, 2017,

including maintaining its outlook for net revenue and increasing

its outlook for bookings. Additional details regarding the

Company's financial outlook are available by visiting

http://ir.take2games.com.

Third Quarter

Fiscal Year

Ending 12/31/2016 (1)

Ending 3/31/2017 (1)

Net revenue

$475 to $525 million

$1.75 to $1.85 billion

GAAP Net income

$17 to $30 million

$180 to $213 million

Stock-based compensation expense (2)

$20 million $71 million

Non-cash amortization of discount on

convertible notes

$5 million $22 million

Gain on long-term investment, net

- $1 million

Income tax adjustment

($8) to ($10) million

($48) to ($52) million

Non-GAAP net income

$34 to $45 million

$226 to $255 million

GAAP Net income per diluted

share

$0.18 to $0.32

$1.80 to $2.09

Non-GAAP net income per diluted

share

$0.30 to $0.40

$2.00 to $2.25

Net cash provided by operating

activities

$300 million

Capital expenditures $50 million

Deferred Net

Revenue and Cost of Goods Sold

Change in deferred net revenue $200 million ($80) million Net

effect from deferral of net revenue and related cost of goods sold

$62 million (3) ($49) million (4)

Operational

Metric

Bookings

$650 to $700 million

$1.6 to $1.7 billion

1) The individual components of

the financial outlook may not foot to the totals as the Company

does not expect actual results for every component to be at the low

end or high end of the outlook range simultaneously. 2) The

Company's stock-based compensation expense for the periods above

includes the cost of approximately 0.9 million restricted stock

units previously granted to ZelnickMedia that are subject to

variable accounting. Actual expense to be recorded in connection

with these shares is dependent upon several factors, including

future changes in Take-Two's stock price. 3) Includes tax impact of

$18 million. 4) Includes tax impact of ($14) million.

Key assumptions and dependencies

underlying the Company’s financial outlook include: the timely

delivery of the titles included in this financial outlook;

continued consumer acceptance of the Xbox One and PlayStation 4;

the ability to develop and publish products that capture market

share for these new-generation systems while continuing to leverage

opportunities on the Xbox 360, PlayStation 3 and PC; and stable

foreign exchange rates. See also “Cautionary Note Regarding Forward

Looking Statements” below.

Product Releases

The following titles were released since July 1, 2016:

Label

Title

Platforms

Release Date

2K

Evolve Stage 2

PC July 7, 2016 2K

MyNBA 2K17

iOS and Android devices September 8, 2016 2K

BioShock: The Collection

PS4, Xbox One, PC* September 13, 2016 2K

NBA 2K17

PS4, PS3, Xbox One, Xbox 360, PC

September 20, 2016 2K

NBA 2K17

iOS and Android Devices September 22, 2016 2K

XCOM 2

PS4, Xbox One September 27, 2016** 2K

Mafia III

PS4, Xbox One, PC October 7, 2016 2K

Mafia III Rivals

iOS and Android Devices October 7, 2016 2K

WWE 2K17

PS4, PS3, Xbox One, Xbox 360 October 11, 2016 2K

NHL SuperCard 2017

iOS and Android Devices October 13, 2016 2K

Sid Meier’s Civilization VI

PC October 21, 2016 2K

Carnival Games VR

HTC Vive, PlayStation VR October 28, 2016

* BioShock: The Collection is only

available for PC through digital-download.

** North American release date;

international followed three days later.

Take-Two's lineup of future titles

announced to date includes:

Label

Title

Platforms

Release Date

2K

WWE SuperCard - Season 3

iOS and Android Devices November 2016 2K

Carnival Games VR

Oculus Rift December 6, 2016 Rockstar Games

Red Dead Redemption 2

PS4, Xbox One Fall 2017

Conference Call

Take-Two will host a conference call today at 4:30 p.m. Eastern

Time to review these results and discuss other topics. The call can

be accessed by dialing (877) 407-0984 or (201) 689-8577. A live

listen-only webcast of the call will be available by visiting

http://ir.take2games.com and a replay will be available following

the call at the same location.

Non-GAAP Financial

Measures

In addition to reporting financial results in accordance with

U.S. generally accepted accounting principles (GAAP), the Company

uses Non-GAAP measures of financial performance. These Non-GAAP

financial measures are not intended to be considered in isolation

from, as a substitute for, or superior to, the corresponding GAAP

financial measures, and may be different from similarly titled

measures used by other companies. Management believes that the

presentation of these Non-GAAP financial measures facilitates

comparison of the Company’s operating performance between periods

and helps investors to better understand the operating results of

Take-Two by excluding certain items that may not be indicative of

the Company's core business, operating results or future outlook,

such as stock-based compensation and non-cash amortization of

discount on convertible notes; charges relating to business

reorganizations; and gains on strategic non-core business

investments. Internally, management makes Non-GAAP adjustments to

the Company’s financial measures as set forth below to assess the

company's operating results and in planning and forecasting. The

Non-GAAP adjustments to the Company’s financial measures are as

follows:

- Stock-based compensation – stock-based

compensation is a non-cash expense that is subject to stock price

volatility. The Company does not consider stock-based compensation

charges when evaluating business performance and management does

not contemplate stock-based compensation expense in its short- and

long-term operating plans. In addition, when considering the impact

of equity award grants, the Company places a greater emphasis on

overall shareholder dilution rather than the accounting charges

associates with such grants. As a result, the Company has excluded

such expenses from its Non-GAAP financial measures.

- Business reorganization – although the

Company has incurred business reorganization expenses in the past,

each charge relates to a discrete event based on a unique set of

business objectives and circumstances. Management does not believe

these charges reflect the Company's primary business, ongoing

operating results or future outlook. As such, the Company believes

it is appropriate to exclude these expenses and related charges

from its Non-GAAP financial measures.

- Non-cash amortization of discount on

convertible notes – the Company records non-cash amortization of

discount on convertible notes as interest expense in addition to

the interest expense recorded for coupon payments. The Company

believes the non-cash portion of the interest expense, which

represents the accretion of the bifurcated equity component of the

conversion option of our convertible notes, is not core to our

operations given our intent and ability to settle the notes in

shares of our common stock. The convertible notes are accounted for

under the assumption that they will be settled in shares, and the

Company includes the related underlying shares when calculating

if-converted net income per diluted share. Therefore, the exclusion

of the non-cash amortization from the Company’s non-GAAP financial

measures provides management with a consistent measure for

assessing financial results.

- Gain on long-term investment, net –

from time to time, the Company makes strategic non-core business

investments. Because the Company does not exercise significant

control over these investments, it excludes the impact of any gains

and losses on such investments from its Non-GAAP financial

measures.

- Income tax adjustment – the Company

calculates a provision/benefit for income taxes on a standalone,

Non-GAAP basis inclusive of the adjustments noted above. The income

tax adjustment reflects the difference between our GAAP and

Non-GAAP provision/benefit for income taxes.

In the future, Take-Two may also consider whether other items

should also be excluded in calculating the Non-GAAP financial

measures used by the Company.

Final Results

The financial results discussed herein are presented on a

preliminary basis; final data will be included in Take-Two’s

Quarterly Report on Form 10-Q for the period ended September 30,

2016.

About Take-Two Interactive

Software

Headquartered in New York City, Take-Two Interactive

Software, Inc. is a leading developer, publisher and marketer

of interactive entertainment for consumers around the globe. The

Company develops and publishes products through its two

wholly-owned labels Rockstar Games and 2K. Our products are

designed for console systems and personal computers, including

smartphones and tablets, and are delivered through physical retail,

digital download, online platforms and cloud streaming services.

The Company’s common stock is publicly traded on NASDAQ under the

symbol TTWO. For more corporate and product information please

visit our website at http://www.take2games.com.

All trademarks and copyrights contained herein are the property

of their respective holders.

Cautionary Note Regarding

Forward-Looking Statements

The statements contained herein which are not historical facts

are considered forward-looking statements under federal securities

laws and may be identified by words such as "anticipates,"

"believes," "estimates," "expects," "intends," "plans,"

"potential," "predicts," "projects," "seeks," "will," or words of

similar meaning and include, but are not limited to, statements

regarding the outlook for the Company's future business and

financial performance. Such forward-looking statements are based on

the current beliefs of our management as well as assumptions made

by and information currently available to them, which are subject

to inherent uncertainties, risks and changes in circumstances that

are difficult to predict. Actual outcomes and results may vary

materially from these forward-looking statements based on a variety

of risks and uncertainties including: our dependence on key

management and product development personnel, our dependence on our

Grand Theft Auto products and our ability to develop other hit

titles, the timely release and significant market acceptance of our

games, the ability to maintain acceptable pricing levels on our

games, and risks associated with international operations. Other

important factors and information are contained in the Company's

most recent Annual Report on Form 10-K, including the risks

summarized in the section entitled "Risk Factors," the Company’s

most recent Quarterly Report on Form 10-Q, and the Company's other

periodic filings with the SEC, which can be accessed at

www.take2games.com. All forward-looking statements are qualified by

these cautionary statements and apply only as of the date they are

made. The Company undertakes no obligation to update any

forward-looking statement, whether as a result of new information,

future events or otherwise.

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) (in

thousands, except per share amounts)

Three months ended September 30, Six months ended

September 30, 2016 2015

2016 2015

Net revenue

$ 420,167 $ 346,974

$ 731,719 $ 622,271 Cost of

goods sold: Internal royalties

77,425 54,918

137,098

160,747 Software development costs and royalties

45,194

40,014

108,853 90,507 Product costs

55,059 38,777

100,038 78,718 Licenses

27,927

10,231

50,996 16,583

Total cost of goods sold

205,605

143,940

396,985 346,555

Gross profit

214,562 203,034

334,734 275,716

Selling and marketing

80,187 54,876

151,321

100,443 General and administrative

49,685 49,961

96,428 98,996 Research and development

30,005 24,413

63,905 58,555 Depreciation and amortization

7,491 7,353

14,869

13,928 Total operating expenses

167,368

136,603

326,523

271,922 Income from operations

47,194 66,431

8,211 3,794 Interest and other, net

(7,078 )

(8,396 )

(11,584 ) (15,930 ) Gain on long-term

investment

- -

1,350 - Income (loss) before income

taxes

40,116 58,035

(2,023 ) (12,136 )

Provision for income taxes

3,684 3,300

112 152 Net income (loss)

$ 36,432 $ 54,735

$

(2,135 ) $ (12,288 ) Earnings (Loss) per

share: Basic earnings (loss) per share

$ 0.42

$ 0.63

$ (0.03 ) $ (0.15 ) Diluted

earnings (loss) per share

$ 0.39 $ 0.55

(0.03 ) $ (0.15 ) Weighted average shares

outstanding: Basic

87,176 87,560

84,990 83,280 Diluted

115,202 114,015

84,990

83,280

Computation of Basic EPS:

Net income (loss)

$ 36,432 $ 54,735

$

(2,135 ) $ (12,288 ) Less: net income allocated to

participating securities

(745 ) (2,320

)

- - Net income (loss) for

basic EPS calculation

$ 35,687 $ 52,415

$ (2,135 ) $ (12,288 ) Weighted average

shares outstanding - basic

87,176 87,560

$

84,990 83,280 Less: weighted average participating shares

outstanding

(1,783 ) (3,711 )

- - Weighted average common shares

outstanding - basic

85,393 83,849

84,990 83,280

Basic earnings (loss) per share

$

0.42 $ 0.63

$ (0.03 ) $

(0.15 )

Computation of Diluted EPS: Net income (loss)

$ 36,432 $ 54,735

$ (2,135 ) $

(12,288 ) Less: net income allocated to participating securities

(564 ) (1,782 )

- - Add: interest expense, net

of tax, on Convertible Notes

8,669

7,994

- - Net income

(loss) for diluted EPS calculation

$ 44,537 $

60,947

$ (2,135 ) $ (12,288 )

Weighted average common shares outstanding - basic

85,393

83,849

84,990 83,280 Add: dilutive effect of common stock

equivalents

29,809 30,166

- - Total weighted average shares

outstanding - diluted

115,202 114,015

84,990 83,280

Less: weighted average participating shares outstanding

(1,783 ) (3,711 )

-

- Weighted average common shares outstanding -

diluted

113,419 110,304

84,990 83,280

Diluted earnings (loss) per share

$ 0.39

$ 0.55

$ (0.03 ) $ (0.15 )

TAKE-TWO INTERACTIVE SOFTWARE, INC. and

SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in

thousands, except per share amounts) September

30, March 31, 2016

2016 ASSETS (Unaudited) Current

assets: Cash and cash equivalents

$ 770,003 $ 798,742

Short-term investments

404,591 470,820 Restricted cash

368,109 261,169

Accounts receivable, net of allowances of

$70,480 and $45,552 at September 30, 2016 and March 31, 2016,

respectively

381,587 168,527 Inventory

77,561 15,888 Software

development costs and licenses

178,629 178,387 Deferred cost

of goods sold

129,396 98,474 Prepaid expenses and other

60,894 53,269 Total current

assets

2,370,770 2,045,276

Fixed assets, net

68,531 77,127 Software development

costs and licenses, net of current portion

300,340 214,831

Deferred cost of goods sold, net of current portion

3,033

17,915 Goodwill

215,658 217,080 Other intangibles, net

4,609 4,609 Other assets

16,139

13,439 Total assets

$ 2,979,080 $

2,590,277

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities: Accounts payable

$ 144,756 $

30,448 Accrued expenses and other current liabilities

753,069 607,479 Deferred revenue

821,409

582,484 Total current liabilities

1,719,234 1,220,411 Long-term

debt

511,636 497,935 Non-current deferred revenue

54,741 216,319 Other long-term liabilities

110,716 74,227 Total liabilities

2,396,327 2,008,892

Stockholders' equity: Preferred stock, $.01 par value, 5,000 shares

authorized

- - Common stock, $.01 par value, 200,000 shares

authorized; 104,558 and 103,765 shares issued and 87,366 and 86,573

outstanding at September 30, 2016 and March 31, 2016, respectively

1,046 1,038 Additional paid-in capital

1,097,098

1,088,628 Treasury stock, at cost; 17,192 common shares at

September 30, 2016 and March 31, 2016, respectively

(303,388

) (303,388 ) Accumulated deficit

(169,132 )

(166,997 ) Accumulated other comprehensive loss

(42,871 ) (37,896 ) Total stockholders' equity

582,753 581,385 Total

liabilities and stockholders' equity

$ 2,979,080

$ 2,590,277

TAKE-TWO INTERACTIVE SOFTWARE, INC. and

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(in thousands)

Six months ended September 30, 2016

2015

Operating activities:

Net loss

$ (2,135 ) $ (12,288 ) Adjustments to

reconcile net loss to net cash provided by (used in) operating

activities: Amortization and impairment of software development

costs and licenses

63,459 40,719 Depreciation and

amortization

14,869 13,928 Amortization and impairment of

intellectual property

- 160 Stock-based compensation

33,333 35,406 Deferred income taxes

(15 ) 68

Amortization of discount on Convertible Notes

12,981 11,544

Amortization of debt issuance costs

779 792 Other, net

(2,897 ) 1,102 Changes in assets and liabilities:

Restricted cash

(106,940 ) (45,548 ) Accounts

receivable

(212,032 ) (22,668 ) Inventory

(62,555 ) (3,755 ) Software development costs and

licenses

(148,512 ) (117,959 ) Prepaid expenses,

other current and other non-current assets

(8,560 )

(13,250 ) Deferred revenue

80,913 113,042 Deferred cost of

goods sold

(17,287 ) (38,440 ) Accounts payable,

accrued expenses and other liabilities

303,790

57,161 Net cash (used in) provided by operating

activities

(50,809 ) 20,014

Investing activities:

Change in bank time deposits

66,841 (162,401 ) Proceeds from

available-for-sale securities

72,387 - Purchases of

available-for-sale securities

(74,552 ) (4,987 )

Purchases of fixed assets

(8,283 ) (25,793 ) Proceeds

from sale of long-term investments

1,350 - Purchase of

long-term investments

(1,885 ) -

Net cash provided by (used in) investing activities

55,858 (193,181 )

Financing activities:

Excess tax benefit from stock-based compensation

1,143 9,529

Tax payment related to net share settlements on restricted stock

awards

(30,621 ) (10,386 ) Repurchase of common stock

- (26,552 ) Net cash used in financing

activities

(29,478 ) (27,409 )

Effects of foreign exchange rates on cash and cash equivalents

(4,310 ) 1,169 Net

decrease in cash and cash equivalents

(28,739 )

(199,407 ) Cash and cash equivalents, beginning of year

798,742 911,120 Cash and cash

equivalents, end of period

$ 770,003 $ 711,713

TAKE-TWO

INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES RECONCILIATION

OF GAAP TO Non-GAAP MEASURES (Unaudited) (in thousands,

except per share amounts) Three months ended

September 30, Six months ended September 30,

2016 2015 2016

2015 Cost of Goods Sold

GAAP Cost of Goods Sold $ 205,605 $ 143,940

$ 396,985 $ 346,555 Stock-based compensation

(5,566 ) (4,110 )

(9,952

) (8,804 )

Non-GAAP Cost of Goods Sold

200,039 $ 139,830

387,033

$ 337,751

Gross Profit GAAP Gross

Profit $ 214,562 $ 203,034

$

334,734 $ 275,716 Stock-based compensation

5,566 4,110

9,952

8,804

Non-GAAP Gross Profit

220,128 $ 207,144

344,686

$ 284,520

Income (Loss) from Operations

GAAP Income from Operations $ 47,194 $ 66,431

$ 8,211 $ 3,794 Stock-based compensation

18,233 16,320

33,333 35,406 Business reorganization,

restructuring and related expenses

- -

- 1,228

Non-GAAP

Income from Operations $ 65,427 $ 82,751

$ 41,544 $ 40,428

Net

Income (Loss) GAAP Net Income (Loss) $

36,432 $ 54,735

$ (2,135 ) $ (12,288 )

Stock-based compensation

18,233 16,320

33,333 35,406

Business reorganization, restructuring and related expenses

- -

- 1,228 Non-cash amortization of discount on

Convertible Notes

6,882 5,817

12,981 11,544 Gain on

long-term investment

- -

(1,350 ) - Income tax

adjustment

(10,826 ) (20,704 )

(9,693 ) (12,895 )

Non-GAAP Net Income

$ 50,721 $ 56,168

$

33,136 $ 22,995

Diluted Earnings

(Loss) Per Share GAAP earnings (loss) per share

$

0.39 $ 0.55

$ (0.03 ) $ (0.15 )

Non-GAAP earnings per share

$ 0.45 $ 0.51

$

0.31 $ 0.23 Number of diluted shares used in

computation GAAP

115,202 114,015

84,990 83,280

Non-GAAP

115,202 114,015

115,105 114,157

Computation of Diluted GAAP EPS: Net income (loss)

$ 36,432 $ 54,735

$ (2,135 ) $

(12,288 ) Less: net income allocated to participating securities

(564 ) (1,782 )

- - Add: interest expense, net

of tax, on Convertible Notes

8,669

7,994

- - Net income

(loss) for diluted EPS calculation

$ 44,537 $

60,947

$ (2,135 ) $ (12,288 )

Weighted average shares outstanding - diluted

85,393 83,849

84,990 82,833 Add: dilutive effect of common stock

equivalents

29,809 30,166

- - Total weighted average shares

outstanding - diluted

115,202 114,015

84,990 82,833

Less: weighted average participating shares outstanding

(1,783 ) (3,711 )

-

- Weighted average common shares outstanding -

diluted

113,419 110,304

84,990 82,833

Diluted earnings (loss) per share

$

0.39 $ 0.55

$ (0.03 ) $

(0.15 )

Computation of Diluted Non-GAAP EPS:

Non-GAAP net income

$ 50,721 $ 56,168

$

33,136 $ 22,995 Less: net income allocated to participating

securities

(785 ) (1,828 )

(570 ) (891

) Add: interest expense, net of tax, on Convertible Notes

1,518 1,370

3,031

2,742 Net income for diluted earnings per share

calculation

$ 51,454 $ 55,710

$

35,597 $ 24,846 Weighted average shares

outstanding - diluted

85,393 83,849

88,650 83,280

Add: dilutive effect of common stock equivalents

29,809 30,166

26,455

30,877 Total weighted average shares

outstanding - diluted

115,202 114,015

115,105 114,157

Less: weighted average participating shares outstanding

(1,783 ) (3,711 )

(1,979

) (4,422 ) Weighted average common shares outstanding

- diluted

113,419 110,304

113,126 109,735

Diluted earnings per share

$

0.45 $ 0.51

$ 0.31 $ 0.23

TAKE-TWO INTERACTIVE SOFTWARE, INC. and

SUBSIDIARIES

SELECTED DATA

(in thousands)

Three Months Ended September 30, Six Months

Ended September 30, 2016

2015 2016 2015

Net Revenues $ 420,167 $ 346,974

$ 731,719 $ 622,271 Change in deferred net revenues

59,274 17,956

20,277 109,051

Cost of Goods

Sold $ 205,605 $ 143,940

$ 396,985

$ 346,555 Non-GAAP Cost of Goods Sold

$ 200,039 $

139,830

$ 387,033 $ 337,751 Change in deferred cost

of goods sold (1)

28,779 49,031

4,155 49,161

Net Income (Loss) $ 36,432 $ 54,735

$

(2,135 ) $ (12,288 ) Non-GAAP Net Income

50,721 56,168

33,136 22,995 Net effect from deferral

of net revenue and related cost of goods sold, net of taxes (2)

23,407 (23,468 )

12,099 43,913 (1) Changes in

deferred cost of goods sold Change in deferred software development

costs

$ 4,796 $ 8,992

$ 2,069 $ 10,229

Change in deferred product costs

11,689 18,210

2,799

16,114 Change in deferred licenses

12,294

21,829

(713 ) 22,818

Total change in deferred cost of goods sold

28,779

49,031

4,155 49,161 (2) Net effect from

deferral of net revenue and related cost of goods sold, net of

taxes Change in deferred net revenues

$ 59,274 $

17,956

$ 20,277 $ 109,051 Change in deferred cost of

goods sold

(28,779 ) (49,031 )

(4,155 )

(49,161 ) Tax (benefit)/expense

7,088

(7,607 )

4,023 15,977 Net effect

from deferral of net revenue and related cost of goods sold, net of

taxes

23,407 (23,468 )

12,099 43,913

Bookings

Total Bookings

$ 452,835 $ 353,013

$

706,336 $ 706,844 Digital Bookings

$ 210,806 $

132,369

$ 383,506 $ 377,576

TAKE-TWO

INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES Net Revenue by

Geographic Region, Distribution Channel, and Platform Mix

(in thousands)

Three Months Ended

September 30, 2016

Three Months Ended

September 30, 2015

Amount % of Total Amount % of Total

Net Revenues by Geographic Region United States

$ 252,483 60 % $ 185,102 53 %

International

167,684 40 %

161,872 47 % Total net revenues

420,167

100 % 346,974 100 %

Change in Deferred Net Revenues United States

$

45,486 $ 33,740 International

13,788

(15,784 ) Total changes in deferred net revenues

59,274 17,956

Three Months

Ended

September 30, 2016

Three Months Ended

September 30, 2015

Amount % of Total Amount % of Total

Net Revenues by Distribution Channel Digital online

$ 230,759 55 % $ 202,426 58 % Physical

retail and other

189,408 45 %

144,548 42 % Total net revenues

420,167

100 % 346,974 100 %

Change in Deferred Net Revenues Digital online

$

3,419 $ (61,414 ) Physical retail and other

55,855 79,370 Total changes in deferred

net revenues

59,274 17,956

Three Months Ended

September 30, 2016

Three Months Ended

September 30, 2015

Amount % of Total Amount % of Total

Net Revenues by Platform Mix Console

$ 230,759

55 % $ 301,029 87 % PC and other

189,408 45 % 45,945 13 %

Total net revenues

420,167 100 %

346,974 100 %

Change in Deferred Net

Revenues Console

$ 190,625 $ 15,621 PC and other

(131,351 ) 2,335 Total changes

in deferred net revenues

59,274 17,956

TAKE-TWO INTERACTIVE SOFTWARE, INC. and

SUBSIDIARIES Net Revenue by Geographic Region, Distribution

Channel, and Platform Mix (in thousands)

Six Months Ended

September 30, 2016

Six Months Ended

September 30, 2015

Amount % of Total Amount % of Total

Net Revenues by Geographic Region United States

$ 445,584 61 % $ 328,540 53 %

International

286,135 39 %

293,731 47 % Total net revenues

731,719

100 % 622,271 100 %

Change in Deferred Net Revenues United States

$

(4,375 ) $ 41,658 International

24,652

67,393 Total changes in deferred net revenues

20,277 109,051

Six

Months Ended

September 30, 2016

Six Months Ended

September 30, 2015

Amount % of Total Amount % of Total

Net Revenues by Distribution Channel Digital online

$ 402,837 55 % $ 356,411 57 % Physical

retail and other

328,882 45 %

265,860 43 % Total net revenues

731,719

100 % 622,271 100 %

Change in Deferred Net Revenues Digital online

$

22,504 $ 38,564 Physical retail and other

(2,227 ) 70,487 Total changes in

deferred net revenues

20,277 109,051

Six Months Ended

September 30, 2016

Six Months Ended

September 30, 2015

Amount % of Total Amount % of Total

Net Revenues by Platform Mix Console

$ 607,064

83 % $ 523,603 84 % PC and other

124,655 17 % 98,668 16 %

Total net revenues

731,719 100 %

622,271 100 %

Change in Deferred Net

Revenues Console

$ 28,165 $ (21,684 ) PC and

other

(7,887 ) 130,735 Total

changes in deferred net revenues

20,277

109,051

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161102006444/en/

Take-Two Interactive Software, Inc.Investor

Relations:Henry A. Diamond, 646-536-3005Senior Vice

PresidentInvestor Relations & Corporate

CommunicationsHenry.Diamond@take2games.comorCorporate Press:Alan

Lewis, 646-536-2983Vice PresidentCorporate Communications &

Public AffairsAlan.Lewis@take2games.com

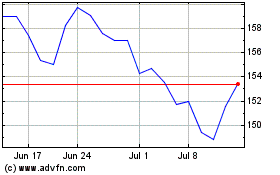

TakeTwo Interactive Soft... (NASDAQ:TTWO)

Historical Stock Chart

From Mar 2024 to Apr 2024

TakeTwo Interactive Soft... (NASDAQ:TTWO)

Historical Stock Chart

From Apr 2023 to Apr 2024