Electronic Arts to Cut Back on Reporting Adjusted Figures

July 19 2016 - 7:30PM

Dow Jones News

Electronic Arts Inc. will stop reporting many of the adjusted

financial measures it has used for years, addressing regulators'

stepped-up criticism of how companies apply customized metrics in

earnings.

The Securities and Exchange Commission in May issued new

guidelines for the use of adjusted measures that don't comply with

U.S. generally accepted accounting principles over concerns such

metrics could make earnings appear better than they are.

In a conference call with analysts Tuesday, EA said results for

its most recently ended quarter, due Aug. 2, will be the last to

include revenue, gross margin and per-share earnings on a non-GAAP

basis.

The changes won't have an impact on financial performance but

could make it harder to compare to past results, analysts said. EA

said it would provide the data it used to calculate non-GAAP

figures so others can make historical comparisons. Cash flow

remains a key valuation measure for the business, the company

said.

"At the end of the day, every company should be valued on its

ability to generate cash," said Robert W. Baird & Co. analyst

Colin Sebastian.

The SEC's guidance applies to all publicly traded companies,

though the issue is particularly relevant to the videogame

industry. Under GAAP rules, revenue from games with online

components is deferred for however long companies think players

will use those services—typically six to nine months.

It reflects continuing expenses that go into online games, such

as keeping servers running and fixing bugs, Mr. Sebastian said. The

same rules apply to other software companies that accept payment

from customers upfront for services provided over time, such as

cloud-storage providers, he said.

Non-GAAP figures paint a more accurate picture of near-term

financial performance since they show the full amount of revenue

from games sold in the quarter, companies and analysts have

said.

Adjusted figures also might also exclude other expenses

companies consider irregular or unimportant to investors. Some

technology companies, for example, report non-GAAP numbers that

strip out hundreds of millions of dollars in stock

compensation.

EA will still report free cash flow, as well as earnings before

interest, taxes, depreciation and amortization, also called Ebitda,

on a non-GAAP basis, the company said.

Activision Blizzard Inc. and Take-Two Interactive Software Inc.,

which both report earnings Aug. 4, declined to comment.

Write to Sarah E. Needleman at sarah.needleman@wsj.com

(END) Dow Jones Newswires

July 19, 2016 19:15 ET (23:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

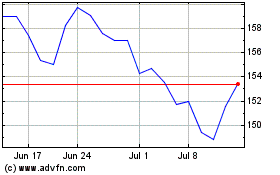

TakeTwo Interactive Soft... (NASDAQ:TTWO)

Historical Stock Chart

From Mar 2024 to Apr 2024

TakeTwo Interactive Soft... (NASDAQ:TTWO)

Historical Stock Chart

From Apr 2023 to Apr 2024