Take-Two Beats Profit Expectations Despite Thin Slate of Holiday Releases

February 03 2016 - 5:00PM

Dow Jones News

The videogame industry's embrace of digital content and its

unwavering demand for popular franchises helped Take-Two

Interactive Software Inc. turn out a solid holiday quarter despite

a thin slate of releases.

The publisher of the hit "Grand Theft Auto" franchise Wednesday

beefed up its full-year outlook and reported adjusted revenue and

profit for the fiscal third quarter that topped Wall Street's

forecasts.

Take-Two didn't release big titles during the October through

December period on par with what it put out a year earlier, when it

published "Grand Theft Auto Online" and a refresh of "Grand Theft

Auto V" for newer consoles. The dearth showed up in adjusted

revenue that sank 49% to $486.8 million. Adjusted profit,

meanwhile, dropped to 89 cents a share from $1.87 a year

earlier.

Still, the strength of previously released titles, namely the

latest "Grand Theft Auto" releases and a new "NBA 2K" game in

September, bolstered the company's coffers. Analysts surveyed by

Thomson Reuters had expected Take-Two to report $452.8 million in

revenue and profit of 50 cents a share on an adjusted basis.

"Grand Theft Auto V" has now sold more than 60 million units to

retailers world-wide, the company said.

Take-Two benefited from an industrywide trend of gamers ditching

discs for digitally delivered content, such as expansion packs and

virtual goods. While spending on total digital items fell 1.7% to

$213.6 million, the company said it recorded its highest amount of

"recurrent consumer spending" ever. Such recurrent spending

includes virtual currency and downloadable add-ons that keep buyers

coming back for more.

For the fiscal year ending March 31, Take-Two now expects

per-share profit of $1.65 to $1.75, above the $1 to $1.15 it

previously had forecast. It expects adjusted revenue between $1.48

billion and $1.53 billion, up from a prior range of $1.33 billion

to $1.43 billion.

Take-Two, like other videogame companies, focuses on adjusted

figures because U.S. accounting rules require deferring a portion

of revenue from online-enabled games.

Under generally accepted account principles, Take-Two said

revenue fell 22% to $414.2 million for its fiscal third quarter. It

reported a GAAP loss of $42.4 million, compared with net income of

$40.1 million for the year-ago period. The loss partly reflected

business-reorganization charges of $71.2 million that were offset

by about $25 million in tax benefits related to game-development

costs, the company said.

Write to Sarah E. Needleman at sarah.needleman@wsj.com

(END) Dow Jones Newswires

February 03, 2016 16:45 ET (21:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

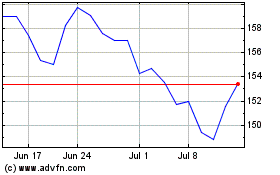

TakeTwo Interactive Soft... (NASDAQ:TTWO)

Historical Stock Chart

From Mar 2024 to Apr 2024

TakeTwo Interactive Soft... (NASDAQ:TTWO)

Historical Stock Chart

From Apr 2023 to Apr 2024