UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 5, 2015

TAKE-TWO INTERACTIVE SOFTWARE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-34003 |

|

51-0350842 |

|

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

622 Broadway, New York, New York |

|

10012 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (646) 536-2842

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On November 5, 2015, Take-Two Interactive Software, Inc. (the “Company”) issued a press release announcing the financial results of the Company for its second fiscal quarter ended September 30, 2015. A copy of the press release is attached to this Current Report as Exhibit 99.1 and is incorporated by reference herein.

The information included in this Current Report on Form 8-K, including Exhibit 99.1 hereto, that is furnished pursuant to this Item 2.02 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. In addition, the information included in this Current Report on Form 8-K, including Exhibit 99.1 hereto, that is furnished pursuant to this Item 2.02 shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference into such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

99.1 Press Release dated November 5, 2015 relating to Take-Two Interactive Software, Inc.’s financial results for its second fiscal quarter ended September 30, 2015.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TAKE-TWO INTERACTIVE SOFTWARE, INC. |

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

/s/ Daniel P. Emerson |

|

|

|

Daniel P. Emerson |

|

|

|

Executive Vice President & General Counsel |

|

|

|

|

Date: November 5, 2015 |

|

3

EXHIBIT INDEX

|

Exhibit |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release dated November 5, 2015 relating to Take-Two Interactive Software, Inc.’s financial results for its second fiscal quarter ended September 30, 2015. |

4

Exhibit 99.1

|

|

FOR IMMEDIATE RELEASE |

|

|

|

|

CONTACT: |

|

|

|

|

|

(Investor Relations) |

(Corporate Press) |

|

Henry A. Diamond |

Alan Lewis |

|

Senior Vice President |

Vice President |

|

Investor Relations & Corporate Communications |

Corporate Communications & Public Affairs |

|

Take-Two Interactive Software, Inc. |

Take-Two Interactive Software, Inc. |

|

(646) 536-3005 |

(646) 536-2983 |

|

Henry.Diamond@take2games.com |

Alan.Lewis@take2games.com |

Take-Two Interactive Software, Inc. Reports Stronger-Than-Expected Results for Fiscal Second Quarter 2016

Non-GAAP Net Revenue Grew 169% to $364.9 Million

Non-GAAP Net Income Increased to $0.30 Per Diluted Share

Company Repurchased Nearly 1 Million Shares for $26.6 Million

Raises Financial Outlook for Fiscal 2016

New York, NY — November 5, 2015 — Take-Two Interactive Software, Inc. (NASDAQ: TTWO) today reported stronger-than-expected financial results for fiscal second quarter 2016, ended September 30, 2015. In addition, the Company increased its financial outlook for the fiscal year ending March 31, 2016, and provided its initial financial outlook for the fiscal third quarter 2016, ending December 31, 2015.

GAAP Financial Results

For fiscal second quarter 2016, GAAP net revenue grew 175% to $347.0 million, as compared to $126.3 million for fiscal second quarter 2015. GAAP net income increased to $54.7 million, or $0.55 per diluted share, as compared to GAAP net loss of $41.4 million, or $0.51 per diluted share, for the year-ago period.

As of September 30, 2015, the Company had cash and short-term investments of $1.065 billion.

Non-GAAP Financial Results

For fiscal second quarter 2016, Non-GAAP net revenue grew 169% to $364.9 million, as compared to $135.4 million for the year-ago period. Non-GAAP net income increased to $32.7 million, or $0.30 per diluted share, as compared to Non-GAAP net loss of $35.4 million, or $0.44 per diluted share, for the year-ago period.

The largest contributors to Non-GAAP net revenue in fiscal second quarter 2016 were NBA® 2K16, Grand Theft Auto® V and Grand Theft Auto Online, NBA 2K15, and Borderlands®: The Handsome Collection. Non-GAAP net revenue from digitally-delivered content grew 57% year-over-year to $141.0 million. The largest contributors to Non-GAAP net revenue from digitally-delivered content were the Grand Theft Auto, NBA 2K, Borderlands and WWE 2K series. Revenue from recurrent consumer spending (virtual currency, downloadable add-on content and online games) grew 39% year-over-year and accounted for 51% of Non-GAAP net revenue from digitally-delivered content, or 20% of total Non-GAAP net revenue. Catalog sales accounted for $165.8 million of Non-GAAP net revenue led by the Grand Theft Auto, NBA 2K and Borderlands series.

Management Comments

“Take-Two once again delivered better-than-expected Non-GAAP revenue and earnings growth,” said Strauss Zelnick, Chairman and CEO of Take-Two. “Our second quarter results were anchored by the series record-breaking launch of NBA 2K16, along with ongoing demand for Grand Theft Auto V and strong growth in recurrent consumer spending.

“Our holiday season is off to a great start, including the successful release of WWE 2K16, and we expect the installed base of new-gen consoles to expand further and broaden our global audience. We are raising our fiscal 2016 financial outlook to reflect our outperformance in the second quarter and positive forecast for the balance of the year. With our robust development pipeline and increasing contribution from recurrent consumer spending, Take-Two is better positioned than ever to generate revenue growth and margin expansion in future years, and returns for our shareholders over the long-term.”

Business and Product Highlights

Since July 1, 2015:

· During the fiscal second quarter, Take-Two repurchased 953,647 shares of its common stock for $26.6 million.

Rockstar Games:

· Released new free content updates for Grand Theft Auto Online, including:

· Ill Gotten Gains Part 2, featuring new vehicles, weapons, outfits and the addition of The Lab radio station to consoles;

· Freemode Events, the first update exclusively for PlayStation 4, Xbox One and PC, which seamlessly integrates dozens of games and challenges directly into the game’s open world without lobbies or menus, adds two new Adversary Modes, and brings the Rockstar Editor to consoles with additional new features;

· Lowriders, which adds new and upgraded vehicles including specific lowrider customization options such as hydraulics, new Adversary Modes, new Lowrider-themed Contact Missions, an array of new clothing, tattoo and accessory options, as well as upgrades to both Freemode and the Rockstar Editor’s Director Mode; and

· Halloween Surprise, featuring a new Halloween-themed adversary mode plus special vehicles, masks and more.

2K:

· Launched NBA 2K16 on PlayStation 4, PlayStation 3, Xbox One, Xbox 360 and PC, as well as on iOS and Android devices. The title is the highest-rated sports game of 2015 on Xbox One* and set an unprecedented record for the series, selling-in over four million units worldwide within the first week of release. According to The NPD Group, adjusting for days in market, NBA 2K16 had the best launch month of any sports game during the new console cycle.

· Launched WWE 2K16 on Xbox One, Xbox 360, PlayStation 4 and PlayStation 3. Developed collaboratively by Yukes and Visual Concepts, the title has received strong reviews from the gaming press, which reflect its significant improvements versus last year’s release and are among the best ever received by the series. IGN scored WWE 2K16 an 8.8 out of 10, stating that the title is “as close to a fusion of performance and competition as a wrestling game has ever gotten.” WWE 2K16 is being supported with downloadable add-on content, including a Season Pass.

· Released Sid Meier’s Civilization®: Beyond Earth™ — Rising Tide for PC. Developed by Firaxis Games, Rising Tide is a massive expansion pack for the 2014 turn-based strategy title, Civilization: Beyond Earth.

· Released WWE SuperCard — Season 2 for iOS and Android devices. Season 2 updates the content of WWE SuperCard, the renowned collectible card-battling game that is Take-Two’s most financially successful free-to-play mobile offering.

· Launched NHL® SuperCard, an action-packed NHL collectible card-battling game that is available as a free download for iOS and Android devices.

· Battleborn™, which is currently in development for PlayStation 4, Xbox One and PC by the creators of Borderlands at Gearbox Software, is now planned for release on May 3, 2016.

· Announced that XCOM® 2, which is the sequel to the Game of the Year award-winning strategy title XCOM: Enemy Unknown and is currently in development at Firaxis Games, is planned for release on February 5, 2016 for PC.

· Announced that Mafia® III, the next installment in 2K’s successful organized crime series, is currently in development for Xbox One, PlayStation 4 and PC at Hangar 13, 2K’s new development studio. Mafia III is planned for release during calendar 2016 (fiscal year 2017).

*According to Metacritic.com.

Financial Outlook for Fiscal 2016

Take-Two is increasing its financial outlook for fiscal year 2016 to reflect its better-than-expected fiscal second quarter results, strong forecast for the balance of the fiscal year and an expected tax benefit, partially offset by the impact of moving the planned launches of Battleborn to May 3, 2016, and XCOM 2 to February 5, 2016. In addition, the Company is providing its initial financial outlook for the fiscal third quarter ending December 31, 2015 as follows:

|

|

|

Third Quarter

Ending 12/31/2015 |

|

Fiscal Year

Ending 3/31/2016 |

|

|

|

|

|

|

|

|

|

Non-GAAP net revenue |

|

$400 to $450 Million |

|

$1.325 to $1.425 Billion |

|

|

Non-GAAP net income per diluted share (1) |

|

$0.40 to $0.50 |

|

$1.00 to $1.15 |

|

|

GAAP to Non-GAAP Reconciling Items (2): |

|

|

|

|

|

|

Net effect from deferral in net revenues and related cost of goods sold |

|

$0.52 |

|

$0.22 |

|

|

Stock-based compensation expense (3) |

|

$0.11 |

|

$0.43 |

|

|

Business reorganization, restructuring and related expenses |

|

$0.03 |

|

$0.04 |

|

|

Non-cash amortization of discount on convertible notes |

|

$0.04 |

|

$0.15 |

|

|

Non-cash tax expense |

|

$0.00 |

|

$0.02 |

|

|

(Income) related to gain on sale of long-term investment |

|

$(0.02) |

|

$(0.02) |

|

(1) For the fiscal third quarter ending December 31, 2015 and fiscal year ending March 31, 2016, our Non-GAAP net income per diluted share outlook is calculated using the “if-converted” method as a result of the issuances of our 1.75% Convertible Notes in November 2011 and 1.00% Convertible Notes in June 2013, and Non-GAAP diluted net income for the third quarter and fiscal year is adjusted by adding-back $1.4 million and $5.5 million, respectively, related to coupon interest and debt issuance costs, net of tax. Shares used to calculate our Non-GAAP net income per diluted share outlook are as follows:

|

Weighted average basic shares |

83.5 Million |

83.5 Million |

|

Add: Weighted average participating shares |

3.0 Million |

4.0 Million |

|

Add: Potential Dilution from convertible notes |

26.5 Million |

26.5 Million |

|

Total weighted average diluted shares |

113.0 Million |

114.0 Million |

(2) All GAAP to Non-GAAP reconciling items are net of tax and per share.

(3) The Company’s stock-based compensation expense for the periods above includes the cost of approximately 1.1 million restricted stock units previously granted to ZelnickMedia that are subject to variable accounting. Actual expense to be recorded in connection with these shares is dependent upon several factors, including future changes in Take-Two’s stock price.

Key assumptions and dependencies underlying the Company’s financial outlook include: the timely delivery of the titles included in this financial outlook; continued consumer acceptance of the Xbox One and PlayStation 4; the ability to develop and publish products that capture market share for these new-generation systems while continuing to leverage opportunities on the Xbox 360, PlayStation 3 and PC; and stable foreign exchange rates. See also “Cautionary Note Regarding Forward Looking Statements” below.

Product Releases

The following titles were released since July 1, 2015:

|

Label |

|

Title |

|

Platforms |

|

Release Date |

|

2K |

|

WWE SuperCard - Season 2 |

|

iOS and Android Devices |

|

August 20, 2015 |

|

2K |

|

NBA 2K16 |

|

Xbox 360, Xbox One, PS3, PS4, PC |

|

September 29, 2015 |

|

2K |

|

My NBA 2K16 |

|

iOS and Android Devices |

|

October 1, 2015 |

|

2K |

|

NHL SuperCard |

|

iOS and Android Devices |

|

October 8, 2015 |

|

2K |

|

Sid Meier’s Civilization Beyond Earth — Rising Tide (expansion pack) |

|

PC |

|

October 9, 2015 |

|

2K |

|

NBA 2K16 |

|

iOS and Android Devices |

|

October 15, 2015 |

|

2K |

|

WWE 2K16 |

|

Xbox 360, Xbox One, PS3, PS4 |

|

October 27, 2015* |

|

2K |

|

Evolve Ultimate Edition |

|

Xbox One, PS4 |

|

November 3, 2015 |

*North American release date; international release date followed three days after.

Take-Two’s lineup of future titles announced to date includes:

|

Label |

|

Title |

|

Platforms |

|

Release Date |

|

2K |

|

Borderlands Triple Pack |

|

Xbox 360, PS3 |

|

November 17, 2015 |

|

2K |

|

Civilization® Revolution™ 2 Plus |

|

PlayStation Vita |

|

December 3, 2015 |

|

2K |

|

WWE 2K16: Accelerator (DLC) |

|

Xbox 360, Xbox One, PS3, PS4 |

|

TBA |

|

2K |

|

WWE 2K16: MyPlayer Kickstart (DLC) |

|

Xbox One, PS4 |

|

TBA |

|

2K |

|

WWE 2K16: Legends Pack (DLC) |

|

Xbox 360, Xbox One, PS3, PS4 |

|

TBA |

|

2K |

|

WWE 2K16: 2015 Hall of Fame Showcase (DLC) |

|

Xbox 360, Xbox One, PS3, PS4 |

|

TBA |

|

2K |

|

WWE 2K16: New Moves Pack (DLC) |

|

Xbox 360, Xbox One, PS3, PS4 |

|

TBA |

|

2K |

|

WWE 2K16: Future Stars Pack (DLC) |

|

Xbox 360, Xbox One, PS3, PS4 |

|

TBA |

|

2K |

|

XCOM 2 |

|

PC, Mac, Linux |

|

February 5, 2016 |

|

2K |

|

Battleborn |

|

Xbox One, PS4, PC |

|

May 3, 2016 |

|

2K |

|

Mafia III |

|

Xbox One, PS4, PC |

|

Fiscal Year 2017 |

Conference Call

Take-Two will host a conference call today at 4:30 p.m. Eastern Time to review these results and discuss other topics. The call can be accessed by dialing (877) 407-0984 or (201) 689-8577. A live listen-only webcast of the call will be available by visiting http://ir.take2games.com and a replay will be available following the call at the same location.

Non-GAAP Financial Measures

In addition to reporting financial results in accordance with U.S. generally accepted accounting principles (GAAP), the Company uses Non-GAAP measures of financial performance. The Company believes that these Non-GAAP financial measures, when taken into consideration with the corresponding GAAP financial measures, are important in gaining an understanding of the Company’s ongoing business. These Non-GAAP financial measures also provide for comparative results from period to period. Therefore, the Company believes it is appropriate to exclude the following Non-GAAP items, net of applicable taxes, as discussed below:

· Net effect from deferral in net revenues and related cost of goods sold - the Company defers revenue and related costs from the sale of certain titles that have undelivered elements upon the sale of the game and recognizes that revenue upon the delivery of the undelivered elements. The Company also defers revenue and related costs for certain sales generated from certain titles for which we have or expect to provide certain additional add-on content. These amounts are deferred over the estimated remaining life of the game to which they pertain. As there is no impact to the Company’s operating cash flow, management excludes the impact of deferred net revenue and related costs from its Non-GAAP financial measures when evaluating the Company’s operating performance, when planning, forecasting and analyzing future periods, and when assessing the performance of its management team. In addition, we believe that these Non-GAAP financial measures provide a more timely indication of trends in our business, provide comparability with the way our business is measured by analysts, and provide consistency with industry data sources.

· Stock-based compensation — the Company does not consider stock-based compensation charges when evaluating business performance and management does not contemplate stock-based compensation expense in its short- and long-term operating plans. As a result, the Company has excluded such expenses from its Non-GAAP financial measures.

· Business reorganization, restructuring and related expenses — although the Company has incurred business reorganization expenses in the past, each charge relates to a discrete event based on a unique set of business objectives. Management does not believe these charges reflect the Company’s primary business, ongoing operating results or future outlook. As such, the

Company believes it is appropriate to exclude these expenses and related charges from its Non- GAAP financial measures.

· Non-cash amortization of discount on convertible notes — the Company records non-cash amortization of discount on convertible notes as interest expense in addition to the interest expense already recorded for coupon payments. The Company excludes the non-cash portion of the interest expense from its Non-GAAP financial measures because these amounts are unrelated to its ongoing business operations.

· Non-cash tax expense for the impact of deferred tax liabilities associated with tax deductible amortization of goodwill — due to the nature of the adjustment as well as the expectation that it will not have any cash impact in the foreseeable future, the Company believes it is appropriate to exclude this expense from its Non-GAAP financial measures.

· Gain on sale of long-term investment — from time to time, the Company makes strategic investments. The Company excludes the impact of any gains and losses on such investments from its Non-GAAP financial measures.

These Non-GAAP financial measures are not intended to be considered in isolation from, as a substitute for, or superior to, GAAP results. These Non-GAAP financial measures may be different from similarly titled measures used by other companies. In the future, Take-Two may also consider whether other items should also be excluded in calculating the Non-GAAP financial measures used by the Company. Management believes that the presentation of these Non-GAAP financial measures provides investors with additional useful information to measure Take-Two’s financial and operating performance. In particular, the measures facilitate comparison of operating performance between periods and help investors to better understand the operating results of Take-Two by excluding certain items that may not be indicative of the Company’s core business, operating results or future outlook. Internally, management may use these Non-GAAP financial measures in assessing the company’s operating results and in planning and forecasting. In addition to the Non-GAAP financial measures provided in this press release, see the Company’s website for additional information regarding our non-GAAP results.

Final Results

The financial results discussed herein are presented on a preliminary basis; final data will be included in Take-Two’s Quarterly Report on Form 10-Q for the period ended September 30, 2015.

About Take-Two Interactive Software

Headquartered in New York City, Take-Two Interactive Software, Inc. is a leading developer, publisher and marketer of interactive entertainment for consumers around the globe. The Company develops and publishes products through its two wholly-owned labels Rockstar Games and 2K. Our products are designed for console systems and personal computers, including smartphones and tablets, and are delivered through physical retail, digital download, online platforms and cloud streaming services. The Company’s common stock is publicly traded on NASDAQ under the symbol TTWO. For more corporate and product information please visit our website at http://www.take2games.com.

All trademarks and copyrights contained herein are the property of their respective holders.

Cautionary Note Regarding Forward-Looking Statements

The statements contained herein which are not historical facts are considered forward-looking statements under federal securities laws and may be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “will,” or words of similar meaning and include, but are not limited to, statements regarding the outlook for the Company’s future business and financial performance. Such forward-looking statements are based on the current beliefs of our management as well as assumptions made by and information currently available to them, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may vary materially from these forward-looking statements based on a variety of risks and uncertainties including: our dependence on key management and product development personnel, our dependence on our Grand Theft Auto products and our ability to develop other hit titles, the timely release and significant market acceptance of our games, the ability to maintain acceptable pricing levels on our games, our ability to raise capital if needed and risks associated with international operations. Other important factors and information are contained in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2015, including the risks summarized in the section entitled “Risk Factors,” the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2015, and the Company’s other periodic filings with the SEC, which can be accessed at www.take2games.com. All forward-looking statements are qualified by these cautionary statements and apply only as of the date they are made. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

# # #

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(in thousands, except per share amounts)

|

|

|

Three months ended September 30, |

|

Six months ended September 30, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenue |

|

$ |

346,974 |

|

$ |

126,277 |

|

$ |

622,271 |

|

$ |

251,702 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold: |

|

|

|

|

|

|

|

|

|

|

Internal royalties |

|

54,918 |

|

12,413 |

|

160,747 |

|

20,711 |

|

|

Software development costs and royalties |

|

40,014 |

|

16,343 |

|

90,507 |

|

36,649 |

|

|

Product costs |

|

38,777 |

|

18,761 |

|

78,718 |

|

37,353 |

|

|

Licenses |

|

10,231 |

|

4,499 |

|

16,583 |

|

11,459 |

|

|

Total cost of goods sold |

|

143,940 |

|

52,016 |

|

346,555 |

|

106,172 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

203,034 |

|

74,261 |

|

275,716 |

|

145,530 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and marketing |

|

54,876 |

|

49,136 |

|

100,443 |

|

85,982 |

|

|

General and administrative |

|

49,961 |

|

43,975 |

|

98,996 |

|

83,327 |

|

|

Research and development |

|

24,413 |

|

24,533 |

|

58,555 |

|

48,665 |

|

|

Depreciation and amortization |

|

7,353 |

|

5,130 |

|

13,928 |

|

9,278 |

|

|

Total operating expenses |

|

136,603 |

|

122,774 |

|

271,922 |

|

227,252 |

|

|

Income (loss) from operations |

|

66,431 |

|

(48,513 |

) |

3,794 |

|

(81,722 |

) |

|

Interest and other, net |

|

(8,396 |

) |

(7,512 |

) |

(15,930 |

) |

(15,231 |

) |

|

Gain on long-term investments, net |

|

— |

|

18,976 |

|

— |

|

18,976 |

|

|

Income (loss) from operations before income taxes |

|

58,035 |

|

(37,049 |

) |

(12,136 |

) |

(77,977 |

) |

|

Provision for (benefit from) for income taxes |

|

3,300 |

|

4,320 |

|

152 |

|

(1,205 |

) |

|

Net income (loss) |

|

$ |

54,735 |

|

$ |

(41,369 |

) |

$ |

(12,288 |

) |

$ |

(76,772 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per share |

|

$ |

0.63 |

|

$ |

(0.51 |

) |

$ |

(0.15 |

) |

$ |

(0.96 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings (loss) per share |

|

$ |

0.55 |

|

$ |

(0.51 |

) |

(0.15 |

) |

$ |

(0.96 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

87,560 |

|

80,355 |

|

83,280 |

|

79,862 |

|

|

Diluted |

|

114,015 |

|

80,355 |

|

83,280 |

|

79,862 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Computation of Basic EPS: |

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

54,735 |

|

$ |

(41,369 |

) |

$ |

(12,288 |

) |

$ |

(76,772 |

) |

|

Less: net income allocated to participating securities |

|

(2,320 |

) |

— |

|

$ |

— |

|

— |

|

|

Net income (loss) for basic EPS calculation |

|

$ |

52,415 |

|

$ |

(41,369 |

) |

$ |

(12,288 |

) |

$ |

(76,772 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

87,560 |

|

80,355 |

|

$ |

83,280 |

|

79,862 |

|

|

Less: weighted average participating shares outstanding |

|

(3,711 |

) |

— |

|

— |

|

— |

|

|

Weighted average common shares outstanding - basic |

|

83,849 |

|

80,355 |

|

$ |

83,280 |

|

79,862 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic EPS |

|

$ |

0.63 |

|

$ |

(0.51 |

) |

$ |

(0.15 |

) |

$ |

(0.96 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Computation of Diluted EPS: |

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

54,735 |

|

$ |

(41,369 |

) |

$ |

(12,288 |

) |

$ |

(76,772 |

) |

|

Less: net income allocated to participating securities |

|

(1,782 |

) |

— |

|

— |

|

— |

|

|

Add: interest expense, net of tax, on Convertible Notes |

|

7,994 |

|

— |

|

— |

|

— |

|

|

Net income (loss) for diluted EPS calculation |

|

$ |

60,947 |

|

$ |

(41,369 |

) |

$ |

(12,288 |

) |

$ |

(76,772 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

83,849 |

|

80,355 |

|

83,280 |

|

79,862 |

|

|

Add: dilutive effect of common stock equivalents |

|

30,166 |

|

— |

|

— |

|

— |

|

|

Total weighted average shares outstanding - diluted |

|

114,015 |

|

80,355 |

|

83,280 |

|

79,862 |

|

|

Less: weighted average participating shares outstanding |

|

(3,711 |

) |

— |

|

— |

|

— |

|

|

Weighted average common shares outstanding - diluted |

|

110,304 |

|

80,355 |

|

83,280 |

|

79,862 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted EPS |

|

$ |

0.55 |

|

$ |

(0.51 |

) |

$ |

(0.15 |

) |

$ |

(0.96 |

) |

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts)

|

|

|

September 30, |

|

March 31, |

|

|

|

|

2015 |

|

2015 |

|

|

|

|

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

711,713 |

|

$ |

911,120 |

|

|

Short-term investments |

|

352,961 |

|

186,929 |

|

|

Restricted cash |

|

215,226 |

|

169,678 |

|

|

Accounts receivable, net of allowances of $55,105 and $70,471 at September 30, 2015 and March 31, 2015, respectively |

|

240,859 |

|

217,860 |

|

|

Inventory |

|

24,020 |

|

20,051 |

|

|

Software development costs and licenses |

|

240,329 |

|

163,385 |

|

|

Deferred cost of goods sold |

|

111,885 |

|

56,779 |

|

|

Prepaid expenses and other |

|

67,615 |

|

55,506 |

|

|

Total current assets |

|

1,964,608 |

|

1,781,308 |

|

|

|

|

|

|

|

|

|

Fixed assets, net |

|

81,694 |

|

69,792 |

|

|

Software development costs and licenses, net of current portion |

|

128,939 |

|

124,329 |

|

|

Deferred cost of goods sold, net of current portion |

|

5,428 |

|

19,869 |

|

|

Goodwill |

|

217,731 |

|

217,288 |

|

|

Other intangibles, net |

|

4,609 |

|

4,769 |

|

|

Other assets |

|

13,490 |

|

13,745 |

|

|

Total assets |

|

$ |

2,416,499 |

|

$ |

2,231,100 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

69,138 |

|

$ |

38,789 |

|

|

Accrued expenses and other current liabilities |

|

467,856 |

|

444,738 |

|

|

Deferred revenue |

|

676,891 |

|

482,733 |

|

|

Total current liabilities |

|

1,213,885 |

|

966,260 |

|

|

|

|

|

|

|

|

|

Long-term debt |

|

487,601 |

|

476,057 |

|

|

Non-current deferred revenue |

|

85,242 |

|

164,618 |

|

|

Other long-term liabilities |

|

65,706 |

|

61,077 |

|

|

Total liabilities |

|

1,852,434 |

|

1,668,012 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $.01 par value, 5,000 shares authorized |

|

— |

|

— |

|

|

Common stock, $.01 par value, 200,000 shares authorized; 104,160 and 104,594 shares issued and 86,968 and 88,356 outstanding at September 30, 2015 and March 31, 2015, respectively |

|

1,042 |

|

1,046 |

|

|

Additional paid-in capital |

|

1,066,743 |

|

1,028,197 |

|

|

Treasury stock, at cost; 17,192 and 16,238 common shares at September 30, 2015 and March 31, 2015, respectively |

|

(303,388 |

) |

(276,836 |

) |

|

Accumulated deficit |

|

(170,983 |

) |

(158,695 |

) |

|

Accumulated other comprehensive loss |

|

(29,349 |

) |

(30,624 |

) |

|

Total stockholders’ equity |

|

564,065 |

|

563,088 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

2,416,499 |

|

$ |

2,231,100 |

|

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(in thousands)

|

|

|

Six months ended September 30, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

Operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(12,288 |

) |

$ |

(76,772 |

) |

|

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

Amortization and impairment of software development costs and licenses |

|

40,719 |

|

10,136 |

|

|

Depreciation and amortization |

|

13,928 |

|

9,278 |

|

|

Amortization and impairment of intellectual property |

|

160 |

|

259 |

|

|

Stock-based compensation |

|

35,406 |

|

23,846 |

|

|

Deferred income taxes |

|

68 |

|

599 |

|

|

Amortization of discount on Convertible Notes |

|

11,544 |

|

10,840 |

|

|

Amortization of debt issuance costs |

|

792 |

|

853 |

|

|

Gain on of long-term investments, net |

|

— |

|

(18,976 |

) |

|

Other, net |

|

1,102 |

|

181 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Restricted cash |

|

(45,548 |

) |

116,296 |

|

|

Accounts receivable |

|

(22,668 |

) |

27,716 |

|

|

Inventory |

|

(3,755 |

) |

(26,168 |

) |

|

Software development costs and licenses |

|

(117,959 |

) |

(104,492 |

) |

|

Prepaid expenses, other current and other non-current assets |

|

(13,250 |

) |

(5,847 |

) |

|

Deferred revenue |

|

113,042 |

|

46,765 |

|

|

Deferred cost of goods sold |

|

(38,440 |

) |

(1,644 |

) |

|

Accounts payable, accrued expenses and other liabilities |

|

57,161 |

|

(144,692 |

) |

|

Net cash provided by (used in) operating activities |

|

20,014 |

|

(131,822 |

) |

|

|

|

|

|

|

|

|

Investing activities: |

|

|

|

|

|

|

Purchase of fixed assets |

|

(25,793 |

) |

(23,054 |

) |

|

Purchases of short-term investments, net |

|

(167,388 |

) |

(49,591 |

) |

|

Cash received from the sale of long-term investment |

|

— |

|

21,976 |

|

|

Net cash used in investing activities |

|

(193,181 |

) |

(50,669 |

) |

|

|

|

|

|

|

|

|

Financing activities: |

|

|

|

|

|

|

Excess tax benefit from stock-based compensation |

|

9,529 |

|

4,843 |

|

|

Tax payment related to net share settlements on restricted stock awards |

|

(10,386 |

) |

— |

|

|

Repurchasae of common stock |

|

(26,552 |

) |

— |

|

|

Net cash provided by (used in) financing activities |

|

(27,409 |

) |

4,843 |

|

|

|

|

|

|

|

|

|

Effects of foreign exchange rates on cash and cash equivalents |

|

1,169 |

|

(3,342 |

) |

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents |

|

(199,407 |

) |

(180,990 |

) |

|

Cash and cash equivalents, beginning of year |

|

911,120 |

|

935,400 |

|

|

Cash and cash equivalents, end of period |

|

$ |

711,713 |

|

$ |

754,410 |

|

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

RECONCILIATION OF GAAP TO Non-GAAP MEASURES (Unaudited)

(in thousands, except per share amounts)

|

|

|

Three months ended September 30, |

|

Six months ended September 30, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

Net Revenues |

|

|

|

|

|

|

|

|

|

|

GAAP Net Revenues |

|

$ |

346,974 |

|

$ |

126,277 |

|

$ |

622,271 |

|

$ |

251,702 |

|

|

Net effect from deferral in net revenues |

|

17,956 |

|

9,165 |

|

109,051 |

|

35,351 |

|

|

Non-GAAP Net Revenues |

|

$ |

364,930 |

|

$ |

135,442 |

|

731,322 |

|

$ |

287,053 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Digital Online Revenues (included in Net Revenues above) |

|

|

|

|

|

|

|

|

|

|

GAAP Digital Online Revenues |

|

$ |

202,426 |

|

$ |

80,646 |

|

$ |

356,411 |

|

$ |

160,847 |

|

|

Net effect from deferral in digital online revenues |

|

(61,414 |

) |

9,165 |

|

38,564 |

|

35,351 |

|

|

Non-GAAP Digital Online Revenues |

|

$ |

141,012 |

|

$ |

89,811 |

|

$ |

394,975 |

|

$ |

196,198 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit |

|

|

|

|

|

|

|

|

|

|

GAAP Gross Profit |

|

$ |

203,034 |

|

$ |

74,261 |

|

$ |

275,716 |

|

$ |

145,530 |

|

|

Net effect from deferral in net revenues and related cost of goods sold |

|

(31,075 |

) |

3,831 |

|

59,890 |

|

19,149 |

|

|

Stock-based compensation |

|

4,110 |

|

1,268 |

|

8,804 |

|

2,739 |

|

|

Non-GAAP Gross Profit |

|

176,069 |

|

$ |

79,360 |

|

$ |

344,410 |

|

$ |

167,418 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) from Operations |

|

|

|

|

|

|

|

|

|

|

GAAP Income (Loss) from Operations |

|

$ |

66,431 |

|

$ |

(48,513 |

) |

$ |

3,794 |

|

$ |

(81,722 |

) |

|

Net effect from deferral in net revenues and related cost of goods sold |

|

(31,075 |

) |

3,831 |

|

59,890 |

|

19,149 |

|

|

Stock-based compensation |

|

16,321 |

|

13,867 |

|

35,406 |

|

23,846 |

|

|

Business reorganization, restructuring and related expenses |

|

— |

|

— |

|

1,228 |

|

195 |

|

|

Non-GAAP Income (Loss) from Operations |

|

$ |

51,677 |

|

$ |

(30,815 |

) |

$ |

100,318 |

|

$ |

(38,532 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) |

|

|

|

|

|

|

|

|

|

|

GAAP Net Income (Loss) |

|

$ |

54,735 |

|

$ |

(41,369 |

) |

$ |

(12,288 |

) |

$ |

(76,772 |

) |

|

Net effect from deferral in net revenues and related cost of goods sold |

|

(37,258 |

) |

2,408 |

|

47,906 |

|

14,165 |

|

|

Stock-based compensation |

|

11,237 |

|

10,082 |

|

22,564 |

|

17,741 |

|

|

Gain on long-term investments, net |

|

— |

|

(10,940 |

) |

— |

|

(10,940 |

) |

|

Business reorganization, restructuring and related expenses |

|

— |

|

— |

|

773 |

|

156 |

|

|

Non-cash amortization of discount on Convertible Notes |

|

3,660 |

|

3,938 |

|

7,263 |

|

8,065 |

|

|

Non-cash tax expense |

|

326 |

|

472 |

|

690 |

|

945 |

|

|

Non-GAAP Net Income (Loss) |

|

$ |

32,700 |

|

$ |

(35,409 |

) |

$ |

66,908 |

|

$ |

(46,640 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings (Loss) Per Share |

|

|

|

|

|

|

|

|

|

|

GAAP earnings (loss) per share |

|

$ |

0.55 |

|

$ |

(0.51 |

) |

$ |

(0.15 |

) |

$ |

(0.96 |

) |

|

Non-GAAP earnings (loss) per share |

|

$ |

0.30 |

|

$ |

(0.44 |

) |

$ |

0.61 |

|

$ |

(0.58 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Number of diluted shares used in computation |

|

|

|

|

|

|

|

|

|

|

GAAP |

|

114,015 |

|

80,355 |

|

83,280 |

|

79,862 |

|

|

Non-GAAP |

|

114,015 |

|

80,355 |

|

114,157 |

|

79,862 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Computation of Diluted GAAP EPS: |

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

54,735 |

|

$ |

(41,369 |

) |

$ |

(12,288 |

) |

$ |

(76,772 |

) |

|

Less: net income allocated to participating securities |

|

(1,782 |

) |

— |

|

— |

|

— |

|

|

Add: interest expense, net of tax, on Convertible Notes |

|

7,994 |

|

— |

|

— |

|

— |

|

|

Net income (loss) for diluted EPS calculation |

|

$ |

60,947 |

|

$ |

(41,369 |

) |

$ |

(12,288 |

) |

$ |

(76,772 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

83,849 |

|

80,355 |

|

83,280 |

|

79,862 |

|

|

Add: dilutive effect of common stock equivalents |

|

30,166 |

|

— |

|

— |

|

— |

|

|

Total weighted average shares outstanding - diluted |

|

114,015 |

|

80,355 |

|

83,280 |

|

79,862 |

|

|

Less: weighted average participating shares outstanding |

|

(3,711 |

) |

— |

|

— |

|

— |

|

|

Weighted average common shares outstanding - diluted |

|

110,304 |

|

80,355 |

|

83,280 |

|

79,862 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings (loss) per share |

|

$ |

0.55 |

|

$ |

(0.51 |

) |

$ |

(0.15 |

) |

$ |

(0.96 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Computation of Diluted Non-GAAP EPS: |

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income (loss) |

|

$ |

32,700 |

|

$ |

(35,409 |

) |

$ |

66,908 |

|

$ |

(46,640 |

) |

|

Less: net income (loss) allocated to participating securities |

|

(1,064 |

) |

— |

|

(2,592 |

) |

— |

|

|

Add: interest expense, net of tax, on Convertible Notes |

|

1,371 |

|

— |

|

2,742 |

|

— |

|

|

Net income (loss) for diluted earnings per share calculation |

|

$ |

33,007 |

|

$ |

(35,409 |

) |

$ |

67,058 |

|

$ |

(46,640 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

83,849 |

|

80,355 |

|

83,280 |

|

79,862 |

|

|

Add: dilutive effect of common stock equivalents |

|

30,166 |

|

— |

|

30,877 |

|

— |

|

|

Total weighted average shares outstanding - diluted |

|

114,015 |

|

80,355 |

|

114,157 |

|

79,862 |

|

|

Less: weighted average participating shares outstanding |

|

(3,711 |

) |

— |

|

(4,422 |

) |

— |

|

|

Weighted average common shares outstanding - diluted |

|

110,304 |

|

80,355 |

|

109,735 |

|

79,862 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings (loss) per share |

|

$ |

0.30 |

|

$ |

(0.44 |

) |

$ |

0.61 |

|

$ |

(0.58 |

) |

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Net Revenue by Geographic Region, Distribution Channel, and Platform Mix

(in thousands)

|

|

|

Three Months Ended

September 30, 2015 |

|

Three Months Ended

September 30, 2014 |

|

|

|

|

Amount |

|

% of Total |

|

Amount |

|

% of Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Net Revenues by Geographic Region |

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

185,102 |

|

53 |

% |

$ |

59,322 |

|

47 |

% |

|

International |

|

161,872 |

|

47 |

% |

66,955 |

|

53 |

% |

|

Total GAAP net revenues |

|

346,974 |

|

100 |

% |

126,277 |

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Change in Deferred Net Revenues |

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

33,740 |

|

|

|

$ |

3,436 |

|

|

|

|

International |

|

(15,784 |

) |

|

|

5,729 |

|

|

|

|

Total changes in deferred net revenues |

|

17,956 |

|

|

|

9,165 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Net Revenues by Geographic Region |

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

218,842 |

|

60 |

% |

$ |

62,758 |

|

46 |

% |

|

International |

|

146,088 |

|

40 |

% |

72,684 |

|

54 |

% |

|

Total non-GAAP net revenues |

|

$ |

364,930 |

|

100 |

% |

$ |

135,442 |

|

100 |

% |

|

|

|

Three Months Ended

September 30, 2015 |

|

Three Months Ended

September 30, 2014 |

|

|

|

|

Amount |

|

% of Total |

|

Amount |

|

% of Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Net Revenues by Distribution Channel |

|

|

|

|

|

|

|

|

|

|

Digital online |

|

$ |

202,426 |

|

58 |

% |

$ |

80,646 |

|

64 |

% |

|

Physical retail and other |

|

144,548 |

|

42 |

% |

45,631 |

|

36 |

% |

|

Total GAAP net revenues |

|

346,974 |

|

100 |

% |

126,277 |

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Change in Deferred Net Revenues |

|

|

|

|

|

|

|

|

|

|

Digital online |

|

$ |

(61,414 |

) |

|

|

$ |

9,165 |

|

|

|

|

Physical retail and other |

|

79,370 |

|

|

|

— |

|

|

|

|

Total changes in deferred net revenues |

|

17,956 |

|

|

|

9,165 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Net Revenues by Distribution Channel |

|

|

|

|

|

|

|

|

|

|

Digital online |

|

$ |

141,012 |

|

39 |

% |

$ |

89,811 |

|

66 |

% |

|

Physical retail and other |

|

223,918 |

|

61 |

% |

45,631 |

|

34 |

% |

|

Total non-GAAP net revenues |

|

$ |

364,930 |

|

100 |

% |

135,442 |

|

100 |

% |

|

|

|

Three Months Ended

September 30, 2015 |

|

Three Months Ended

September 30, 2014 |

|

|

|

|

Amount |

|

% of Total |

|

Amount |

|

% of Total |

|

|

GAAP Net Revenues by Platform Mix |

|

|

|

|

|

|

|

|

|

|

Console |

|

$ |

301,029 |

|

87 |

% |

$ |

93,684 |

|

74 |

% |

|

PC and other |

|

45,945 |

|

13 |

% |

32,593 |

|

26 |

% |

|

Total GAAP net revenues |

|

346,974 |

|

100 |

% |

126,277 |

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Change in Deferred Net Revenues |

|

|

|

|

|

|

|

|

|

|

Console |

|

$ |

15,621 |

|

|

|

$ |

6,901 |

|

|

|

|

PC and other |

|

2,335 |

|

|

|

2,264 |

|

|

|

|

Total changes in deferred net revenues |

|

17,956 |

|

|

|

9,165 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Net Revenues by Platform Mix |

|

|

|

|

|

|

|

|

|

|

Console |

|

$ |

316,650 |

|

87 |

% |

$ |

100,585 |

|

74 |

% |

|

PC and other |

|

48,280 |

|

13 |

% |

34,857 |

|

26 |

% |

|

Total non-GAAP net revenues |

|

$ |

364,930 |

|

100 |

% |

135,442 |

|

100 |

% |

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Net Revenue by Geographic Region, Distribution Channel, and Platform Mix

(in thousands)

|

|

|

Six Months Ended

September 30, 2015 |

|

Six Months Ended

September 30, 2014 |

|

|

|

|

Amount |

|

% of Total |

|

Amount |

|

% of Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Net Revenues by Geographic Region |

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

328,540 |

|

53 |

% |

$ |

124,166 |

|

49 |

% |

|

International |

|

293,731 |

|

47 |

% |

127,536 |

|

51 |

% |

|

Total GAAP net revenues |

|

622,271 |

|

100 |

% |

251,702 |

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Change in Deferred Net Revenues |

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

41,658 |

|

|

|

$ |

19,170 |

|

|

|

|

International |

|

67,393 |

|

|

|

16,181 |

|

|

|

|

Total changes in deferred net revenues |

|

109,051 |

|

|

|

35,351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Net Revenues by Geographic Region |

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

370,198 |

|

51 |

% |

$ |

143,336 |

|

50 |

% |

|

International |

|

361,124 |

|

49 |

% |

143,717 |

|

50 |

% |

|

Total non-GAAP net revenues |

|

$ |

731,322 |

|

100 |

% |

$ |

287,053 |

|

100 |

% |

|

|

|

Six Months Ended

September 30, 2015 |

|

Six Months Ended

September 30, 2014 |

|

|

|

|

Amount |

|

% of Total |

|

Amount |

|

% of Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Net Revenues by Distribution Channel |

|

|

|

|

|

|

|

|

|

|

Digital online |

|

$ |

356,411 |

|

57 |

% |

$ |

160,847 |

|

64 |

% |

|

Physical retail and other |

|

265,860 |

|

43 |

% |

90,855 |

|

36 |

% |

|

Total GAAP net revenues |

|

622,271 |

|

100 |

% |

251,702 |

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Change in Deferred Net Revenues |

|

|

|

|

|

|

|

|

|

|

Digital online |

|

$ |

38,564 |

|

|

|

$ |

35,351 |

|

|

|

|

Physical retail and other |

|

70,487 |

|

|

|

— |

|

|

|

|

Total changes in deferred net revenues |

|

109,051 |

|

|

|

35,351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Net Revenues by Distribution Channel |

|

|

|

|

|

|

|

|

|

|

Digital online |

|

$ |

394,975 |

|

54 |

% |

$ |

196,198 |

|

68 |

% |

|

Physical retail and other |

|

336,347 |

|

46 |

% |

90,855 |

|

32 |

% |

|

Total non-GAAP net revenues |

|

$ |

731,322 |

|

100 |

% |

$ |

287,053 |

|

100 |

% |

|

|

|

Six Months Ended

September 30, 2015 |

|

Six Months Ended

September 30, 2014 |

|

|

|

|

Amount |

|

% of Total |

|

Amount |

|

% of Total |

|

|

GAAP Net Revenues by Platform Mix |

|

|

|

|

|

|

|

|

|

|

Console |

|

$ |

523,603 |

|

84 |

% |

$ |

177,454 |

|

71 |

% |

|

PC and other |

|

98,668 |

|

16 |

% |

74,248 |

|

29 |

% |

|

Total GAAP net revenues |

|

622,271 |

|

100 |

% |

251,702 |

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Change in Deferred Net Revenues |

|

|

|

|

|

|

|

|

|

|

Console |

|

$ |

(21,684 |

) |

|

|

$ |

31,317 |

|

|

|

|

PC and other |

|

130,735 |

|

|

|

4,034 |

|

|

|

|

Total changes in deferred net revenues |

|

109,051 |

|

|

|

35,351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Net Revenues by Platform Mix |

|

|

|

|

|

|

|

|

|

|

Console |

|

$ |

501,919 |

|

69 |

% |

$ |

208,771 |

|

73 |

% |

|

PC and other |

|

229,403 |

|

31 |

% |

78,282 |

|

27 |

% |

|

Total non-GAAP net revenues |

|

$ |

731,322 |

|

100 |

% |

287,053 |

|

100 |

% |

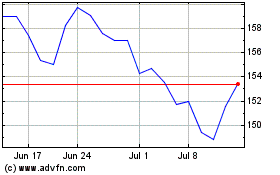

TakeTwo Interactive Soft... (NASDAQ:TTWO)

Historical Stock Chart

From Mar 2024 to Apr 2024

TakeTwo Interactive Soft... (NASDAQ:TTWO)

Historical Stock Chart

From Apr 2023 to Apr 2024