Current Report Filing (8-k)

August 18 2015 - 6:50AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 17, 2015

TAKE-TWO INTERACTIVE SOFTWARE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-34003 |

|

51-0350842 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

622 Broadway |

|

|

|

New York, New York |

|

10012 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (646) 536-2842

Registrant’s Former Name or Address, if changed since last report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

x Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events

Effective August 17, 2015, senior management and certain members of the Board of Directors of Take-Two Interactive Software, Inc. (the “Company”) began using the materials included in Exhibit 99.1 to this report (the “Investor Presentation”) in connection with presentations to existing shareholders of the Company.

The Investor Presentation is incorporated into this Item 8.01 by reference and will be available on the Company’s website at www.take2games.com.

Cautionary Note Regarding Forward-Looking Statements

The statements contained in the Investor Presentation in Exhibit 99.1 which are not historical facts are considered forward-looking statements under federal securities laws and may be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “will,” or words of similar meaning and include, but are not limited to, statements regarding the outlook for the Company’s future business and financial performance. Such forward-looking statements are based on the current beliefs of our management as well as assumptions made by and information currently available to them, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may vary materially from these forward-looking statements based on a variety of risks and uncertainties including, but not limited to, those discussed in “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended March 31, 2015. All forward-looking statements are qualified by these cautionary statements and speak only as of the date they are made. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

Exhibit Number |

|

Description of Exhibit |

|

|

|

|

|

99.1 |

|

Investor presentation materials used beginning August 17, 2015 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TAKE-TWO INTERACTIVE SOFTWARE, INC. |

|

|

|

|

|

By: |

/s/ Linda Zabriskie |

|

|

Name: |

Linda Zabriskie |

|

|

Title: |

Vice President, Associate General Counsel and Secretary |

Date: August 18, 2015

3

EXHIBIT INDEX

|

Exhibits |

|

Description |

|

|

|

|

|

99.1 |

|

Investor presentation materials used beginning August 17, 2015 |

4

Exhibit 99.1

|

|

Shareholder Outreach August 2015 |

|

|

Forward-Looking Statements 2 The statements contained herein which are not historical facts are considered forward-looking statements under federal securities laws and may be identified by words such as "anticipates," "believes," "estimates," "expects," "intends," "plans," "potential," "predicts," "projects," "seeks," "will," or words of similar meaning and include, but are not limited to, statements regarding the outlook for the Company's future business and financial performance. Such forward-looking statements are based on the current beliefs of our management as well as assumptions made by and information currently available to them, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may vary materially from these forward-looking statements based on a variety of risks and uncertainties including: our dependence on key management and product development personnel, our dependence on our Grand Theft Auto products and our ability to develop other hit titles, the timely release and significant market acceptance of our games, the ability to maintain acceptable pricing levels on our games, our ability to raise capital if needed and risks associated with international operations. Other important factors and information are contained in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2015, including the risks summarized in the section entitled "Risk Factors," and the Company's other periodic filings with the SEC, which can be accessed at www.take2games.com. All forward-looking statements are qualified by these cautionary statements and apply only as of the date they are made. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. |

|

|

Take-Two: Industry Leader We seek to be the most creative, most innovative and most efficient company in our business Our commitment to creativity and innovation enables us to consistently differentiate our products We combine leading technology with deep creative content to provide unique gameplay experiences We build compelling franchises by publishing a select number of titles for which we can create sequels and incremental revenue opportunities The talent at our wholly-owned labels, Rockstar Games and 2K, is the essential ingredient to building what we believe is the strongest portfolio of intellectual property in the business We have assembled a diversified portfolio of proprietary interactive entertainment that spans all major hardware platforms and broad consumer demographics Our intellectual property is primarily internally owned and developed, which we believe best positions us financially and competitively 3 Take-Two Interactive is a leading developer, marketer and publisher of interactive entertainment |

|

|

Performance Update 4 See the attached Glossary for a discussion of Non-GAAP financial measures and cautionary statement, and a reconciliation of Non-GAAP results to GAAP results. Non-GAAP financial outlook as of August 10, 2015. 2014 was a record year due to initial launch of Grand Theft Auto V Strong Share Price Growth: 5-Year Performance vs. Peers 17% CAGR Non-GAAP Net Revenue ($M) (1) Peer Group UBI: Ubisoft EA: Electronic Arts ATVI: Activision TTWO: Take-Two TTWO: +158.0% Non-GAAP Net Income Per Share (1) 0 50 100 150 200 250 300 350 03/31/2010 03/31/2011 03/31/2012 03/31/2013 03/31/2014 03/31/2015 TTWO +158.0% ATVI +88.6% EA +215.2% UBI +69.0% |

|

|

Delivered very strong results: Non-GAAP Net Revenue of $1.7 billion1 Non-GAAP Net Income of $1.98 per share – initial guidance was $0.80 to $1.05 per share1 Results driven by: Outperformance of strong holiday lineup: Successful launch of our new IP Evolve in February Record digitally-delivered revenue, including highest-ever revenue from recurrent consumer spending FY2015: One of Take-Two’s Best Years Ever 5 FY2015 Financial Results Exceeded Expectations Cash & Short-Term Investments as of 3/31/15: $1.1 billion Non-GAAP Digital Revenue: $616 million Recurrent Consumer Spending: 49% of Non-GAAP Digital Revenue 17% 42% 45% Y-O-Y % Increase FY2015 Results See the attached Glossary for a discussion of Non-GAAP financial measures and cautionary statement, and a reconciliation of Non-GAAP results to GAAP results. |

|

|

World-Class Creative Teams Fundamental to Success 6 Industry’s most iconic and critically acclaimed brand Series has sold-in over 220 million units, including over 54 million units of Grand Theft Auto V Grand Theft Auto V reached $1 billion in retail sales faster than any entertainment release in history Extending franchise with Grand Theft Auto Online The foundation of our success is the creative talent at our labels – Rockstar Games and 2K Developed 4 of the 10 highest-rated titles for Xbox 360 and PS3, and the highest-rated title for Xbox One and PS41 11 franchises with at least one 5 million unit selling release More than 45 individual, multi-million unit selling titles Top-selling and top-rated NBA simulation game Five most recent annual releases each sold-in over 5 million units NBA 2K15 has sold-in more than 7 million units and generated substantial y-o-y revenue growth Highly successful virtual currency Extending franchise with NBA 2K Online in China One of the world’s top strategy titles for PC Franchise has sold-in more than 31 million units Successful add-on episodes Expanding brand in Asia with Civilization Online Rejuvenated the western entertainment genre Red Dead Redemption has sold-in more than 14 million units Commercially successful expansion content Critically acclaimed, role-playing shooter Franchise has sold-in more than 26 million units Borderlands 2 is 2K’s highest-selling title with over 13 million units sold-in to date Successful add-on content WWE video game franchise released annually WWE 2K15 has sold-in over than 3 million units, up more than 40% versus last year’s release WWE SuperCard is T2’s most financially successful free-to-play mobile offering Metacritic.com as of August 11, 2015. |

|

|

Compensation Program Overview 7 We have adopted the following: Clawback policy Anti-hedging and anti-pledging policy Double trigger acceleration of vesting on a change in control for future grants made under an equity plan Strong stock ownership requirements for ZelnickMedia, other NEOs and directors Annual compensation risk assessment for employee plans Equity incentive plan provisions that prohibit re-pricing of stock options without stockholder approval Limited perquisites No tax gross ups in respect of any excise taxes on parachute payments Retention of independent compensation consultants by the Compensation Committee Balanced compensation approach between short- and long-term incentive opportunities Compensation “Best Practices” Compensation Component % Linked to Performance Delivery Form Performance Link Annual Base Salary N/A Cash N/A Annual Incentive 100% Cash Non-GAAP EBITDA Long-Term Incentive (RSUs) 66.7% at target 80% at maximum Time-Based Awards N/A Performance-Based Awards Relative TSR Compensation Component % Linked to Performance Delivery Form Performance Link Annual Base Fee N/A Cash N/A Annual Incentive 100% Cash Non-GAAP EBITDA Long-Term Incentive (Equity Grants) 55% at target 71% at maximum Time-Based Awards N/A Performance-Based Awards 75% Relative TSR Performance 12.5% New IP Performance 12.5% Major IP Performance Compensation Components for Other Take-Two NEOs(1) Management Agreement with ZelnickMedia(1) For further detail, refer to Take-Two’s Proxy Statement filed on July 28, 2015. |

|

|

Take-Two Program1 (Max Compensation) Highly Performance-Based Compensation Program 8 Equity is a major component of our compensation program Our Compensation Committee considers this a critical compensation element that motivates our executives and creative talent and aligns them with our shareholders The performance-based nature of our compensation plan creates a strong link between our executives’ compensation and the Company’s performance The annual bonus opportunity is fully performance-based for all Take-Two NEOs and under the ZelnickMedia management agreement Two-thirds of equity grants for Take-Two NEOs and more than half of equity grants to ZelnickMedia are performance-based The majority of the pay opportunity for Take-Two’s NEOs is performance-based ZelnickMedia Agreement2 (Max Compensation) Annual Base Salary LTI (Time-Based Shares) Performance-Based Compensation (Annual Incentive + LTI Performance-Based Shares) Annual incentives determined by performance against a pre-set, objective financial metric Performance metric for annual incentive plans is Non-GAAP EBITDA Caps on annual incentive awards Majority of compensation is delivered in equity Majority of long-term incentive compensation is performance-based Vesting of performance equity is based on relative TSR performance and product performance Design Features that Support Pay and Performance Alignment Performance- Based Performance- Based Based on fiscal 2015 compensation for Take-Two NEOs (Lainie Goldstein and Daniel Emerson). 2014 ZelnickMedia Management Agreement, based on incentive awards granted at effective date. 28% 12% 60% 14% 18% 68% |

|

|

Since 2007, Take-Two has had a management relationship with ZelnickMedia (ZM), under which ZM provides executive management and other services to Take-Two

Our Executive Chairman and CEO, Strauss Zelnick, and our President, Karl Slatoff, serve in their current roles pursuant to the Management Agreement with ZelnickMedia.

In 2014, a special committee of the Board negotiated a new management agreement with ZM that established terms that were more favorable to Take-Two and its shareholders. Key changes:

Individual caps on compensation payable to Strauss Zelnick and Karl Slatoff

Elimination of automatic annual fee increases

Transition from front-loaded equity to an annual grant structure

Lengthened performance measurement period of performance-based equity

Added new IP metric focused on key strategic goals

Fiscal 2015 compensation to ZelnickMedia reflects the first year of pay under the 2014 Management Agreement |

|

|

Independent Board with Deep Industry Experience 10 Independent Board (except for Chairman/CEO) Annually Elected Directors Strong Lead Independent Director Role No Supermajority Voting Requirements Shareholders Action By Written Consent Diverse Knowledge and Skills in the Boardroom and Strong Independent Leadership Effective Governance and Compensation Practices Independence Director Tenure (Avg.) Well-balanced between fresh perspectives and institutional knowledge 7 years Director Backgrounds & Expertise Governance Committee Oversees Company Policies Significant Director Stock Ownership Requirement (5x annual cash retainer) Executive Stock Ownership Requirements (ZelnickMedia: 5x annual base fee; Other NEOs: 3x annual base salary) 1 For both Take-Two and ZelnickMedia compensation programs. Entertainment & Media Expertise Global Business Operations Leadership Governance Consulting Experience Financial & Investment Expertise Management & Creative Talent Marketing Insight 83% 17% Independent CEO/Executive Chairman |

|

|

11 Appendix |

|

|

Non-GAAP Financial Measures 12 In addition to reporting financial results in accordance with U.S. generally accepted accounting principles (GAAP), the Company uses Non-GAAP measures of financial performance. The Company believes that these Non-GAAP financial measures, when taken into consideration with the corresponding GAAP financial measures, are important in gaining an understanding of the Company’s ongoing business. These Non-GAAP financial measures also provide for comparative results from period to period. Therefore, the Company believes it is appropriate to exclude the following Non-GAAP items, net of applicable taxes, as discussed below: Net effect from deferral in net revenues and related cost of goods sold - the Company defers revenue and related costs from the sale of certain titles that have undelivered elements upon the sale of the game and recognizes that revenue upon the delivery of the undelivered elements. The Company also defers revenue and related costs for certain sales generated from certain titles for which we have or expect to provide certain additional add-on content. These amounts are deferred over the estimated remaining life of the game to which they pertain. As there is no impact to the Company’s operating cash flow, management excludes the impact of deferred net revenue and related costs from its Non-GAAP financial measures when evaluating the Company's operating performance, when planning, forecasting and analyzing future periods, and when assessing the performance of its management team. In addition, we believe that these Non-GAAP financial measures provide a more timely indication of trends in our business, provide comparability with the way our business is measured by analysts, and provide consistency with industry data sources. Stock-based compensation – the Company does not consider stock-based compensation charges when evaluating business performance and management does not contemplate stock-based compensation expense in its short- and long-term operating plans. As a result, the Company has excluded such expenses from its Non-GAAP financial measures. Business reorganization, restructuring and related expenses – although the Company has incurred business reorganization expenses in the past, each charge relates to a discrete event based on a unique set of business objectives. Management does not believe these charges reflect the Company's primary business, ongoing operating results or future outlook. As such, the Company believes it is appropriate to exclude these expenses and related charges from its Non- GAAP financial measures. Professional fees and expenses associated with unusual legal and other matters — the Company has incurred expenses for legal professional fees that are outside its ordinary course of business. As a result, the Company has excluded such expenses from its Non-GAAP financial measures. Non-cash amortization of discount on convertible notes – the Company records non-cash amortization of discount on convertible notes as interest expense in addition to the interest expense already recorded for coupon payments. The Company excludes the non-cash portion of the interest expense from its Non-GAAP financial measures because these amounts are unrelated to its ongoing business operations. Loss on extinguishment of debt – the Company recorded a loss on extinguishment of debt as a result of settling its 4.375% Convertible Notes in August 2013. The Company excludes the impact of such transactions when evaluating the Company’s operating performance. Management does not believe this loss reflects the Company's primary business, ongoing operating results or future outlook. As such, the Company believes it is appropriate to exclude this loss from its Non-GAAP financial measures. Gain on convertible note hedge and warrants, net – the Company entered into unwind agreements with respect to its convertible note hedge and warrant transactions. As a result of the unwind agreements, these transactions were accounted for as derivatives whereby gains and losses resulting from changes in the fair value were reported as a gain on convertible note hedge and warrants, net. The Company excludes the impact of such transactions when evaluating the Company’s operating performance. Management does not believe these gains and losses reflect the Company's primary business, ongoing operating results or future outlook. As such, the Company believes it is appropriate to exclude these gains and losses from its Non-GAAP financial measures. Non-cash tax expense for the impact of deferred tax liabilities associated with tax deductible amortization of goodwill – due to the nature of the adjustment as well as the expectation that it will not have any cash impact in the foreseeable future, the Company believes it is appropriate to exclude this expense from its Non-GAAP financial measures. Gain on long-term investments, net – from time to time, the Company makes strategic investments. The Company excludes the impact of any gains and losses on such investments from its Non-GAAP financial measures. Discontinued operations – the Company does not engage in sales of subsidiaries on a regular basis and therefore believes it is appropriate to exclude such gains (losses) from its Non-GAAP financial measures. As the Company is no longer active in its discontinued operations, it believes it is appropriate to exclude income (losses) thereon from its Non-GAAP financial measures. These Non-GAAP financial measures are not intended to be considered in isolation from, as a substitute for, or superior to, GAAP results. These Non-GAAP financial measures may be different from similarly titled measures used by other companies. |

|

|

Reconciliation of GAAP to Non-GAAP Measures 13 Reconciliation of GAAP to Non-GAAP Measures (in millions, except per share data, totals may not foot due to rounding) Fiscal 2010 Fiscal 2011 Fiscal 2012 Fiscal 2013 Fiscal 2014 Fiscal 2015 Net Revenues GAAP Net Revenues $ 762.9 $1,136.9 $ 825.8 $1,214.5 $2,350.6 $1,082.9 Net effect from deferral in net revenues - - - 7.8 63.1 585.8 Non-GAAP Net Revenues $ 762.9 $1,136.9 $ 825.8 $1,222.3 $2,413.7 $1,668.8 Net Income (Loss) GAAP Net Income (Loss) $(123.0) $ 48.5 $(108.8) $ (29.5) $ 361.6 $ (279.5) Net effect from deferral in net revenues - - - 6.7 36.2 451.7 Stock-based compensation 26.5 28.8 33.5 35.8 78.1 36.2 Business reorganization and related 1.1 1.7 1.0 0.9 4.5 0.2 Professional fees and legal matters 0.1 0.8 0.2 - - - Non-cash amortization of discount on Convertible Notes 5.5 7.4 11.7 18.9 22.8 18.9 Gain on long-term investment, net - - - - - (10.0) Loss on extinguishment of debt - - - - 9.0 - Gain on convertible note hedge and warrants, net - - - - (3.5) - Non-cash tax expense 5.1 1.9 1.9 2.0 1.9 1.7 Discontinued operations 18.8 5.3 1.1 (1.7) 0.1 - Non-GAAP Net Income (Loss) $ (65.9) $ 94.3 $ (59.4) $ 33.1 $ 510.7 $ 219.2 Diluted Earnings (Loss) Per Share GAAP earnings (loss) per share $ (1.58) $ 0.56 $ (1.31) $ (0.34) $ 3.20 $ (3.48) Non-GAAP earnings (loss) per share $ (0.85) $ 1.02 $ (0.71) $ 0.36 $ 4.26 $ 1.98 Number of diluted shares used in computation GAAP 77.9 86.1 83.4 85.6 124.7 80.4 Non-GAAP 77.9 99.1 83.4 92.3 122.6 114.0 |

|

|

Reconciliation of GAAP to Non-GAAP Measures (cont’d) 14 Reconciliation of GAAP to Non-GAAP Measures (in millions, except per share data, totals may not foot due to rounding) Fiscal 2010 Fiscal 2011 Fiscal 2012 Fiscal 2013 Fiscal 2014 Fiscal 2015 Computation of Diluted GAAP EPS Net Income (loss) $ (123.0) $ 48.5 $ (108.8) $ (29.5) $ 361.6 $ ( 279.5) Less: net income allocated to participating securities - - - - (31.4) - Add: interests expense, net of tax, on Convertible Notes - - - - 33.7 - Net income (loss) for diluted EPS Calculation $ (123.0) $ 48.5 $ (108.8) $ (29.5) $ 363.9 $ (279.5) Weighted averages shares outstanding – diluted 77.9 86.0 83.4 85.6 95.3 80.4 Add: dilutive effect of common stock equivalents - - - - 29.4 - Total weighted average shares outstanding – diluted 77.9 86.0 83.4 85.6 124.7 80.4 Less: weighted average participating shares outstanding - - - - (10.8) - Weighted average common shares outstanding – diluted 77.9 86.0 83.4 85.6 113.9 80.4 Diluted earnings (loss) per share $ (1.58) $ 0.56 $ (1.31) $ (0.34) $ 3.20 $ (3.48) Computation of Diluted Non-GAAP EPS Non-GAAP net earnings (loss) $ (65.9) $ 94.4 $ (59.4) $ 33.1 $ 510.7 $ 219.2 Less: net income (loss) allocated to participating securities - - - - (45.1) (13.7) Add: interests expense, net of tax, on Convertible Notes - 6.7 - - 10.9 5.5 Net income for diluted earnings (loss) per share calculations $ (65.9) $ 101.0 $ (59.4) $ 33.1 $ 476.5 $ 211.0 Weighted averages shares outstanding – basic 77.9 86.1 83.4 85.6 96.0 87.5 Add: dilutive effect of common stock equivalents - 12.9 - 6.7 26.6 26.5 Total weighted average shares outstanding – diluted 77.9 99.1 83.4 92.3 122.6 114.0 Less: weighted average participating shares outstanding - - - - (10.8) (7.1) Weighted average common shares outstanding – diluted 77.9 99.1 83.4 92.3 111.8 106.8 Diluted earnings (loss) per share $ (0.85) $ 1.02 $ (0.71) $ 0.36 $ 4.26 $ 1.98 |

|

|

15 Take-Two Interactive Software, Inc. (the “Take-Two”) filed a definitive proxy statement with the Securities and Exchange Commission ("SEC") with respect to its 2015 Annual Meeting of Stockholders. Stockholders should read the definitive proxy statement carefully, before making any voting decision because it contains important information. Stockholders may obtain that proxy statement, any amendments or supplements to that proxy statement and other documents filed by Take-Two with the SEC free of charge at the SEC's website (www.sec.gov) or at Take-Two’s website at www.take2games.com. Take-Two and its directors, executive officers and other employees may be deemed to be participants in any solicitation of proxies from Take-Two stockholders in connection with the matters to be considered at the 2015 Annual Meeting. Information about Take-Two’s directors and executive officers is available in the proxy statement. Proxy Materials |

|

|

[LOGO] |

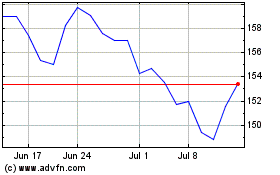

TakeTwo Interactive Soft... (NASDAQ:TTWO)

Historical Stock Chart

From Mar 2024 to Apr 2024

TakeTwo Interactive Soft... (NASDAQ:TTWO)

Historical Stock Chart

From Apr 2023 to Apr 2024