UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2015

TechTarget, Inc.

(Exact

Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

1-33472 |

|

04-3483216 |

| (State or Other Jurisdiction

of Incorporation |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 275 Grove Street, Newton MA |

|

02466 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (617) 431-9200

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On November 9, 2015, TechTarget, Inc. (the “Company”) disclosed its results for the quarter and nine months ended September 30, 2015 in its

Shareholder Letter, which is posted on the Investor Information section of its website at www.techtarget.com. The Shareholder Letter is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information contained in Item 2.02

of this Form 8-K (including Exhibit 99.1) is furnished in accordance with SEC Release No. 33-8216 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation by

reference language in such filing, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and

Exhibits

The following exhibits relating to Item 2.02 shall be deemed to be furnished, and not filed:

|

|

|

| 99.1 |

|

Shareholder Letter dated November 9, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TechTarget, Inc. |

|

|

|

| Date: November 9, 2015 |

|

By: |

|

/s/ Janice Kelliher |

|

|

|

|

Janice Kelliher

Chief Financial Officer and Treasurer |

Exhibit 99.1

November 9, 2015

Dear Fellow Shareholders:

Despite a very challenging environment for many of our largest customers, we were able to deliver 12% online revenue growth, 40% adjusted EBITDA growth, 75%

online gross margins and adjusted EBITDA at 24% of revenue. We believe these solid results in a flat budget environment are driven by the effectiveness of our innovative marketing solutions and our rapidly growing IT Deal Alert™ offering.

It is a period of great uncertainty for many of the world’s largest technology companies. The strong US dollar is a significant headwind for US-based

global companies. To quantify this challenge, IBM, HP and Microsoft’s combined revenue dropped by more than $8 billion in their most recently reported quarter. In addition, HP, Symantec, Dell, EMC and VMware are in the middle of major corporate

transactions. These factors impact our customers’ short-term spending patterns with us. Since our mid-sized and smaller customers are not affected as much by these factors, we are benefitting from higher growth rates from them.

While we are dealing with this volatility in the short-term, we are very focused on the large, long-term opportunity as our customers continue their migration

to becoming data-driven sales and marketing organizations. They are increasingly relying on our proprietary purchase intent data to become more efficient and to grow their revenue and market share.

For Q4 2015, we are projecting revenue of between $30 million and $31 million and adjusted EBITDA between $7.4 million and $8.2 million, with the caveat that

often in the fourth quarter, there is end of the year spending that is not visible at the time of the forecast. With respect to last year’s Q4, this accounted for approximately $2 million of revenue. Taking into account the current environment

of weak CAPEX spending, the strong dollar and short-term situations with some large clients and preferring to be conservative, we are not including extra end-of-the-year revenue in this quarter’s forecast. If we are able to capture

un-forecasted end-of-the-year revenue again this year, it is upside to the guidance.

Our preliminary outlook for 2016 is for double digit revenue growth

and adjusted EBITDA growth of approximately 25%. This assumes that our core North American business will grow in the low single digits, international revenue will grow in the mid-double digits and the IT Deal Alert suite of products will grow 40% to

50%.

Based on our current execution and our optimism about our future prospects combined with what we consider an attractive valuation of our stock, we

continue to purchase shares under our stock repurchase plan.

1

Q3 2015 and YTD 2015 Results (Unaudited; $’s in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended September 30 |

|

|

Nine months ended September 30 |

|

| |

|

2015 |

|

|

2014 |

|

|

Growth |

|

|

2015 |

|

|

2014 |

|

|

Growth |

|

| Core Online |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North America Core Online |

|

$ |

12,813 |

|

|

$ |

12,477 |

|

|

|

3 |

% |

|

$ |

38,375 |

|

|

$ |

37,766 |

|

|

|

2 |

% |

| International Core Online |

|

|

7,814 |

|

|

|

6,986 |

|

|

|

12 |

% |

|

|

22,172 |

|

|

|

19,936 |

|

|

|

11 |

% |

| Total Core Online |

|

|

20,627 |

|

|

|

19,463 |

|

|

|

6 |

% |

|

|

60,547 |

|

|

|

57,702 |

|

|

|

5 |

% |

| IT Deal Alert |

|

|

|

|

|

|

|

|

| North America IT Deal Alert |

|

|

5,322 |

|

|

|

4,102 |

|

|

|

30 |

% |

|

|

14,397 |

|

|

|

10,567 |

|

|

|

36 |

% |

| International IT Deal Alert |

|

|

1,117 |

|

|

|

653 |

|

|

|

71 |

% |

|

|

2,906 |

|

|

|

1,681 |

|

|

|

73 |

% |

| Total IT Deal Alert |

|

|

6,439 |

|

|

|

4,755 |

|

|

|

35 |

% |

|

|

17,303 |

|

|

|

12,248 |

|

|

|

41 |

% |

| Overall Online |

|

|

|

|

|

|

|

|

| North America Online |

|

|

18,135 |

|

|

|

16,579 |

|

|

|

9 |

% |

|

|

52,772 |

|

|

|

48,333 |

|

|

|

9 |

% |

| International Online |

|

|

8,931 |

|

|

|

7,639 |

|

|

|

17 |

% |

|

|

25,078 |

|

|

|

21,617 |

|

|

|

16 |

% |

| Total Overall Online |

|

|

27,066 |

|

|

|

24,218 |

|

|

|

12 |

% |

|

|

77,850 |

|

|

|

69,950 |

|

|

|

11 |

% |

| Events |

|

|

1,941 |

|

|

|

2,214 |

|

|

|

-12 |

% |

|

|

4,572 |

|

|

|

5,607 |

|

|

|

-18 |

% |

| Total Revenues |

|

$ |

29,007 |

|

|

$ |

26,432 |

|

|

|

10 |

% |

|

$ |

82,422 |

|

|

$ |

75,557 |

|

|

|

9 |

% |

| Adjusted EBITDA* |

|

$ |

6,879 |

|

|

$ |

4,920 |

|

|

|

40 |

% |

|

$ |

16,941 |

|

|

$ |

13,225 |

|

|

|

28 |

% |

| * |

Adjusted EBITDA is a non-GAAP financial measure that is defined and reconciled to a GAAP measure later in this Shareholder Letter |

Gross Margins

Total gross profit margin for both Q3 2015

and Q3 2014 was 74%. Online gross profit margin was 75% in Q3 2015 and Q3 2014; events gross profit margin decreased to 63% for Q3 2015, from 64% for Q3 2014.

IT Deal Alert Update

IT Deal Alert revenues were $6.4

million in Q3 2015, up 35% from Q3 2014. IT Deal Alert revenues were up 41% for the first 9 months of the year compared to the prior year period. We had over 280 active IT Deal Alert customers in the third quarter of 2015, up from 260 customers in

Q2 2015 and 175 customers for the prior year period.

We added approximately a dozen new Priority Engine and Deal Data customers in the quarter and this

revenue represented approximately 15% of IT Deal Alert revenue in the quarter. Total bookings on Priority Engine and Deal Data since the products’ inception now exceed $3 million.

On the research front, we released our first report on the Flash Storage market. We have received our first orders and although it will be modest, we will

start to recognize some revenue from this product line in Q4 2015. Currently we are in the field with new research on the storage, data center and security markets. In early 2016, we expect to release new research on the cloud and business

intelligence markets. We have hired our first two dedicated research sales representatives and are encouraged by early conversations with potential customers, both vendors and investors.

2

For 2015, we expect IT Deal Alert revenue growth to be in the neighborhood of 40%. We expect 2016 IT Deal

Alert revenue growth to be higher as Priority Engine and Deal Data subscription revenue continues to scale and research revenue builds.

International

Update

Overall International Online revenue growth was 17% in the quarter compared to the prior year period. International IT Deal Alert revenue was

up 71% and Core International revenue was up 12%. Growth in EMEA stayed steady while growth in APAC slowed during the quarter. Total International Online revenue was up 16% in the first 9 months of 2015. We expect a similar online growth rate for

international revenue in 2016.

Traffic Update

Organic traffic grew over 50% in the quarter over the prior year period, setting another traffic record. Organic traffic represented 95% of overall traffic. We

believe this stellar performance speaks to the high quality of our targeted content model and less relevant content being produced by competitors as they have reduced their investment levels in response to the challenging environment. We are

consciously increasing our investment in content as we want to take advantage of this environment to increase market share.

Share Buyback

We repurchased 588,328 shares at an average price of $9.06 per share for approximately $5.3 million during the third quarter. We will continue to be

opportunistic with regard to buying back shares. As of September 30, 2015, we had approximately $5.9 million available in our existing buyback program.

Balance Sheet

The Company’s balance sheet remains

strong with approximately $33.2 million in cash and investments as of September 30, 2015. The Company has no bank debt.

Foreign Exchange Update

Foreign exchange adversely affected revenue growth by 1.2% in the quarter. The strong dollar continues to create revenue headwinds for large US based

technology vendors.

Q4 2015 Guidance

For Q4 2015,

we expect overall revenues to be between $30 million and $31 million. We expect online revenues to be between $28.4 million and $29.2 million. We expect event revenues to be between $1.6 million and $1.8 million. We expect adjusted EBITDA to be

between $7.4 million and $8.2 million. Often in the fourth quarter, there is end of the year spending that is not visible at the time of the forecast. With respect to last year’s Q4, this accounted for approximately $2 million of revenue. If we

are able to capture un-forecasted end-of-the-year revenue again this year, it is upside to the guidance.

Preliminary 2016 Outlook

Our preliminary outlook suggests that we can grow revenue by double digits and adjusted EBITDA by 25%. This assumes that our core North American business will

grow in the low singles digits, international revenue will grow in the mid-double digits and the IT Deal Alert suite of products will grow 40% to 50%.

3

Conclusion

We believe that our Q3 2015 performance was strong, particularly in light of the challenging environment. We will continue to invest in the large opportunity

as our customers increasingly rely on our purchase intent data to help their sales and marketing organizations take advantage of Big Data to be more efficient and grow their revenue and market share.

|

| Sincerely, |

|

| /s/ Greg Strakosch |

| Greg Strakosch |

| CEO |

4

Conference Call and Webcast

TechTarget will discuss these financial results in a conference call at 5:00 p.m. (Eastern Time) today (November 9, 2015). These results will be posted to the

Investor Information section of our website simultaneously with our press release.

NOTE: Our Chief Executive Officer’s Letter to

Shareholders will not be read on the conference call. The conference call will include only brief remarks followed by questions and answers.

The

public is invited to listen to a live webcast of TechTarget’s conference call, which can be accessed on the Investor Information section of our website at http://investor.techtarget.com/. The conference call can also be heard via

telephone by dialing 1-888-339-0724 (US callers), 1-855-669-9657 (Canadian callers) or 1-412-902-4191 (International callers).

For those investors unable

to participate in the live conference call, a replay of the conference call will be available via telephone beginning November 9, 2015 one (1) hour after the conference call through December 9, 2015 at 9:00 a.m. ET. To listen to the

replay, for US, dial 1-877-344-7529 and use the conference number 10073763. Canadian callers should dial 1-855-669-9658 and also use the conference number 10073763. International callers should dial 1-412-317-0088 and also use the conference

number 10073763. The webcast replay will also be available for replay on http://investor.techtarget.com/ during the same period.

Non-GAAP

Financial Measures

This letter and the accompanying tables include a discussion of adjusted EBITDA, adjusted net income and adjusted net income per

share, all of which are non-GAAP financial measures which are provided as a complement to results provided in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

“Adjusted EBITDA” means earnings before net interest, other income and expense, income taxes, depreciation and amortization, as further

adjusted to exclude secondary offering costs, stock-based compensation and restructuring charges, if any.

“Adjusted net income” means net

income adjusted for amortization, stock-based compensation, foreign exchange, secondary offering costs and restructuring charges, if any, as further adjusted for the related income tax impact of the adjustments.

“Adjusted net income per share” means adjusted net income divided by adjusted weighted average diluted shares outstanding.

These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for, or

superior to, GAAP results. In addition, our definition of adjusted EBITDA, adjusted net income and adjusted net income per share may not be comparable to the definitions as reported by other companies. We believe that adjusted EBITDA, adjusted net

income and adjusted net income per share provide relevant and useful information to enable us and investors to compare the Company’s operating performance using an additional measurement. We use these measures in our internal management

reporting and planning process as primary measures to evaluate the operating performance of our business, as well as potential acquisitions.

The

components of adjusted EBITDA include the key revenue and expense items for which our operating managers are responsible and upon which we evaluate their performance. In the case of senior management, adjusted EBITDA is used as one of the principal

financial metrics in their annual incentive compensation program. Adjusted

5

EBITDA is also used for planning purposes and in presentations to our board of directors. Adjusted net income is useful to us and investors because it presents an additional measurement of

our financial performance, taking into account depreciation, which we believe is an ongoing cost of doing business, but excluding the impact of certain non-cash expenses and items not directly tied to the core operations of our

business. Furthermore, we intend to provide these non-GAAP financial measures as part of our future earnings discussions and, therefore, the inclusion of these non-GAAP financial measures will provide consistency in our financial reporting. A

reconciliation of these non-GAAP measures to GAAP is provided in the accompanying tables.

Forward Looking Statements

Certain information included in this news release may contain “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, included or referenced in this release that address activities, events or developments which we expect will or may

occur in the future are forward-looking statements, including statements regarding the intent, belief or current expectations of the Company and members of our management team. The words “will,” “believe,”

“intend,” “expect,” “anticipate,” “project,” “estimate,” “predict” and similar expressions are also intended to identify forward-looking statements. Such statements may include those

regarding guidance on our future financial results and other projections or measures of our future performance; expectations concerning market opportunities and our ability to capitalize on them; and the amount and timing of the benefits expected

from acquisitions, new products or services and other potential sources of additional revenue. These statements speak only as of the date of this release and are based on our current plans and expectations. Such forward-looking statements are not

guarantees of future performance and involve risks and uncertainties that could cause actual future events or results to be different than those described in or implied by such forward-looking statements. These risks and uncertainties include, but

are not limited to, those relating to: market acceptance of our products and services, including continued increased sales of our IT Deal Alert offerings and continued increased international growth; relationships with customers, strategic partners

and employees; difficulties in integrating acquired businesses; changes in economic or regulatory conditions or other trends affecting the Internet, Internet advertising and information technology industries; and other matters included in our SEC

filings, including in our Annual Report on Form 10-K for the year ended December 31, 2014. Actual results may differ materially from those contemplated by the forward-looking statements. We undertake no obligation to update our forward-looking

statements to reflect future events or circumstances.

6

TECHTARGET, INC.

Consolidated Statements of Operations

(in 000’s, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Online |

|

$ |

27,066 |

|

|

$ |

24,218 |

|

|

$ |

77,850 |

|

|

$ |

69,950 |

|

| Events |

|

|

1,941 |

|

|

|

2,214 |

|

|

|

4,572 |

|

|

|

5,607 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

|

29,007 |

|

|

|

26,432 |

|

|

|

82,422 |

|

|

|

75,557 |

|

| Cost of revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Online(1) |

|

|

6,802 |

|

|

|

5,949 |

|

|

|

20,050 |

|

|

|

18,188 |

|

| Events(1) |

|

|

710 |

|

|

|

805 |

|

|

|

2,042 |

|

|

|

2,331 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of revenues |

|

|

7,512 |

|

|

|

6,754 |

|

|

|

22,092 |

|

|

|

20,519 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

21,495 |

|

|

|

19,678 |

|

|

|

60,330 |

|

|

|

55,038 |

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling and marketing(1) |

|

|

11,526 |

|

|

|

10,964 |

|

|

|

32,825 |

|

|

|

30,717 |

|

| Product development(1) |

|

|

1,915 |

|

|

|

1,854 |

|

|

|

5,723 |

|

|

|

5,201 |

|

| General and administrative(1) |

|

|

3,265 |

|

|

|

3,628 |

|

|

|

9,876 |

|

|

|

10,864 |

|

| Depreciation |

|

|

999 |

|

|

|

1,024 |

|

|

|

3,023 |

|

|

|

3,025 |

|

| Amortization of intangible assets |

|

|

337 |

|

|

|

451 |

|

|

|

1,054 |

|

|

|

1,356 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

18,042 |

|

|

|

17,921 |

|

|

|

52,501 |

|

|

|

51,163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

3,453 |

|

|

|

1,757 |

|

|

|

7,829 |

|

|

|

3,875 |

|

| Interest and other (expense), net |

|

|

(209 |

) |

|

|

(230 |

) |

|

|

(122 |

) |

|

|

(121 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before provision for income taxes |

|

|

3,244 |

|

|

|

1,527 |

|

|

|

7,707 |

|

|

|

3,754 |

|

| Provision for income taxes |

|

|

1,203 |

|

|

|

589 |

|

|

|

2,490 |

|

|

|

1,378 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

2,041 |

|

|

$ |

938 |

|

|

$ |

5,217 |

|

|

$ |

2,376 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.06 |

|

|

$ |

0.03 |

|

|

$ |

0.16 |

|

|

$ |

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.06 |

|

|

$ |

0.03 |

|

|

$ |

0.15 |

|

|

$ |

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

32,790 |

|

|

|

33,145 |

|

|

|

33,065 |

|

|

|

32,907 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

34,221 |

|

|

|

34,663 |

|

|

|

34,707 |

|

|

|

34,184 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Amounts include stock-based compensation expense as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of online revenues |

|

$ |

27 |

|

|

$ |

32 |

|

|

$ |

57 |

|

|

$ |

83 |

|

| Cost of events revenues |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8 |

|

| Selling and marketing |

|

|

1,106 |

|

|

|

905 |

|

|

|

2,445 |

|

|

|

2,145 |

|

| Product development |

|

|

37 |

|

|

|

34 |

|

|

|

74 |

|

|

|

92 |

|

| General and administrative |

|

|

858 |

|

|

|

651 |

|

|

|

2,215 |

|

|

|

1,890 |

|

7

TECHTARGET, INC.

Consolidated Balance Sheets

(in 000’s, except share and per share data)

|

|

|

|

|

|

|

|

|

| |

|

September 30,

2015 |

|

|

December 31,

2014 |

|

| |

|

(Unaudited) |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

14,894 |

|

|

$ |

19,275 |

|

| Short-term investments |

|

|

5,620 |

|

|

|

5,480 |

|

| Accounts receivable, net of allowance for doubtful accounts of $1,507 and $1,014 as of September 30, 2015 and December 31,

2014, respectively |

|

|

29,094 |

|

|

|

23,200 |

|

| Prepaid expenses and other current assets |

|

|

7,341 |

|

|

|

2,842 |

|

| Deferred tax assets |

|

|

2,605 |

|

|

|

2,674 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

59,554 |

|

|

|

53,471 |

|

| Property and equipment, net |

|

|

8,917 |

|

|

|

9,215 |

|

| Long-term investments |

|

|

12,719 |

|

|

|

13,428 |

|

| Goodwill |

|

|

93,787 |

|

|

|

93,979 |

|

| Intangible assets, net of accumulated amortization |

|

|

1,817 |

|

|

|

2,995 |

|

| Deferred tax assets |

|

|

2,473 |

|

|

|

3,230 |

|

| Other assets |

|

|

1,100 |

|

|

|

1,166 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

180,367 |

|

|

$ |

177,484 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

1,791 |

|

|

$ |

2,733 |

|

| Accrued expenses and other current liabilities |

|

|

2,640 |

|

|

|

2,719 |

|

| Accrued compensation expenses |

|

|

667 |

|

|

|

3,043 |

|

| Contingent consideration |

|

|

1,268 |

|

|

|

— |

|

| Income taxes payable |

|

|

362 |

|

|

|

1,088 |

|

| Deferred revenue |

|

|

8,938 |

|

|

|

6,940 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

15,666 |

|

|

|

16,523 |

|

| Long-term liabilities: |

|

|

|

|

|

|

|

|

| Deferred rent |

|

|

2,340 |

|

|

|

2,598 |

|

| Deferred tax liabilities |

|

|

484 |

|

|

|

473 |

|

| Contingent consideration |

|

|

— |

|

|

|

1,114 |

|

| Other liabilities |

|

|

— |

|

|

|

930 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

18,490 |

|

|

|

21,638 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Preferred stock, 5,000,000 shares authorized; no shares issued or outstanding |

|

|

— |

|

|

|

— |

|

| Common stock, $0.001 par value per share, 100,000,000 shares authorized, 50,821,143 shares issued and 32,612,666 shares outstanding at

September 30, 2015 and 49,587,137 shares issued and 32,371,251 shares outstanding at December 31, 2014 |

|

|

51 |

|

|

|

50 |

|

| Treasury stock, 18,208,477 shares at September 30, 2015 and 17,215,886 shares at December 31, 2014, at cost |

|

|

(107,990 |

) |

|

|

(98,851 |

) |

| Additional paid-in capital |

|

|

290,847 |

|

|

|

280,702 |

|

| Accumulated other comprehensive loss |

|

|

(280 |

) |

|

|

(87 |

) |

| Accumulated deficit |

|

|

(20,751 |

) |

|

|

(25,968 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

161,877 |

|

|

|

155,846 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

180,367 |

|

|

$ |

177,484 |

|

|

|

|

|

|

|

|

|

|

8

TECHTARGET, INC.

Reconciliation of Net Income to Adjusted EBITDA

(in 000’s)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended

September 30, |

|

|

For the Nine Months Ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

| Net income |

|

$ |

2,041 |

|

|

$ |

938 |

|

|

$ |

5,217 |

|

|

$ |

2,376 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and other expense, net |

|

|

209 |

|

|

|

230 |

|

|

|

122 |

|

|

|

121 |

|

| Income tax provision |

|

|

1,203 |

|

|

|

589 |

|

|

|

2,490 |

|

|

|

1,378 |

|

| Depreciation |

|

|

999 |

|

|

|

1,024 |

|

|

|

3,023 |

|

|

|

3,025 |

|

| Amortization of purchase price adjustment |

|

|

62 |

|

|

|

66 |

|

|

|

244 |

|

|

|

241 |

|

| Amortization of intangible assets |

|

|

337 |

|

|

|

451 |

|

|

|

1,054 |

|

|

|

1,356 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

|

4,851 |

|

|

|

3,298 |

|

|

|

12,150 |

|

|

|

8,497 |

|

| Secondary offering costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

510 |

|

| Stock-based compensation expense |

|

|

2,028 |

|

|

|

1,622 |

|

|

|

4,791 |

|

|

|

4,218 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

6,879 |

|

|

$ |

4,920 |

|

|

$ |

16,941 |

|

|

$ |

13,225 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9

TECHTARGET, INC.

Reconciliation of Net Income to Adjusted Net Income and Net Income per Diluted Share to

Adjusted Net Income per Share

(in 000’s, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months

Ended September 30, |

|

|

For the Nine Months

Ended September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

| Net income |

|

$ |

2,041 |

|

|

$ |

938 |

|

|

$ |

5,217 |

|

|

$ |

2,376 |

|

| Income tax provision |

|

|

1,203 |

|

|

|

589 |

|

|

|

2,490 |

|

|

|

1,378 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income before taxes |

|

$ |

3,244 |

|

|

$ |

1,527 |

|

|

$ |

7,707 |

|

|

$ |

3,754 |

|

| Amortization of intangible assets |

|

|

337 |

|

|

|

451 |

|

|

|

1,054 |

|

|

|

1,356 |

|

| Stock-based compensation expense |

|

|

2,028 |

|

|

|

1,622 |

|

|

|

4,791 |

|

|

|

4,218 |

|

| Secondary offering costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

510 |

|

| Amortization of purchase price adjustment |

|

|

62 |

|

|

|

66 |

|

|

|

244 |

|

|

|

241 |

|

| Foreign exchange loss |

|

|

226 |

|

|

|

212 |

|

|

|

160 |

|

|

|

82 |

|

| Adjusted income tax provision* |

|

|

(2,161 |

) |

|

|

(1,464 |

) |

|

|

(5,443 |

) |

|

|

(4,033 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income |

|

$ |

3,736 |

|

|

$ |

2,414 |

|

|

$ |

8,513 |

|

|

$ |

6,128 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per diluted share |

|

$ |

0.06 |

|

|

$ |

0.03 |

|

|

$ |

0.15 |

|

|

$ |

0.07 |

|

| Weighted average diluted shares outstanding |

|

|

34,221 |

|

|

|

34,663 |

|

|

|

34,707 |

|

|

|

34,184 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income per share |

|

$ |

0.11 |

|

|

$ |

0.07 |

|

|

$ |

0.25 |

|

|

$ |

0.18 |

|

| Adjusted weighted average diluted shares outstanding |

|

|

34,221 |

|

|

|

34,663 |

|

|

|

34,707 |

|

|

|

34,184 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

Adjusted income tax provision was calculated using our effective tax rate, excluding discrete items, for each respective period. |

10

TECHTARGET, INC.

Financial Guidance for the Three Months Ended December 31, 2015 and Revised Twelve Months

Ended December 31, 2015

(in 000’s)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months

Ended December 31, 2015 |

|

|

Revised November 2015

For the Twelve Months

Ended December 31, 2015 |

|

| |

|

Range |

|

|

Range |

|

| Online |

|

$ |

28,400 |

|

|

$ |

29,200 |

|

|

$ |

106,250 |

|

|

$ |

107,050 |

|

| Events |

|

|

1,600 |

|

|

|

1,800 |

|

|

|

6,172 |

|

|

|

6,372 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

30,000 |

|

|

$ |

31,000 |

|

|

$ |

112,422 |

|

|

$ |

113,422 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

7,400 |

|

|

$ |

8,200 |

|

|

$ |

24,349 |

|

|

$ |

25,158 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation, amortization and stock-based compensation |

|

|

3,275 |

|

|

|

3,275 |

|

|

|

12,390 |

|

|

|

12,390 |

|

| Interest and other expense, net |

|

|

— |

|

|

|

— |

|

|

|

122 |

|

|

|

122 |

|

| Provision for income taxes |

|

|

1,575 |

|

|

|

1,875 |

|

|

|

4,059 |

|

|

|

4,367 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

2,550 |

|

|

$ |

3,050 |

|

|

$ |

7,778 |

|

|

$ |

8,279 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

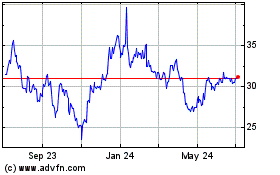

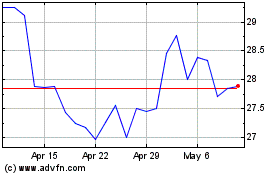

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Apr 2023 to Apr 2024