As filed with the Securities and Exchange Commission on June 29, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

ý ANNUAL REPORT PURSUANT TO SECTION 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

December 31, 2014

or

o TRANSITION REPORT PURSUANT TO SECTION 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1933

For the transition period from __________ to __________

Commission File

No. 0 - 18645

|

| | |

| A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

TRIMBLE NAVIGATION SAVINGS AND RETIREMENT PLAN

|

| | |

| B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

TRIMBLE NAVIGATION LIMITED

935 Stewart Drive

Sunnyvale, CALIFORNIA 94085

TRIMBLE NAVIGATION SAVINGS AND RETIREMENT PLAN

Financial Statements and Supplemental Schedule

Years ended December 31, 2014 and 2013

Table of Contents |

| | |

| Page |

| |

| |

|

| |

|

Audited Financial Statements: | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Supplemental Schedule as of and for the year ended December 31, 2014 | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Exhibit 23.1 – Consent of Independent Registered Public Accounting Firm | 13 |

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Participants and

Plan Administrator of the

Trimble Navigation Savings

and Retirement Plan

We have audited the financial statements of the Trimble Navigation Savings and Retirement Plan (the Plan) as of December 31, 2014 and 2013, and for the years then ended, as listed in the accompanying table of contents. These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by the Plan's management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2014 and 2013, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

The supplemental information in the accompanying schedule of assets (held at end of year) as of December 31, 2014 have been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but include supplemental information required by the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedules, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedules is fairly stated in all material respects in relation to the financial statements as a whole.

/s/ MOSS ADAMS LLP

San Francisco, California

June 24, 2015

TRIMBLE NAVIGATION SAVINGS AND RETIREMENT PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

|

| | | | | | | | |

| | December 31, |

| | 2014 | | 2013 |

Assets: | | | | |

Investments, at fair value | | $ | 380,081,758 |

| | $ | 343,943,802 |

|

Assets held for investment purposes | | 380,081,758 |

| | 343,943,802 |

|

Notes receivable from participants | | 4,841,793 |

| | 4,061,620 |

|

Other receivables | | 1,758 |

| | 19,397 |

|

Employee receivables | | 168,929 |

| | 107,992 |

|

Employer receivables | | 209,569 |

| | 161,150 |

|

Net assets available for benefits | | $ | 385,303,807 |

| | $ | 348,293,961 |

|

See accompanying notes

TRIMBLE NAVIGATION SAVINGS AND RETIREMENT PLAN

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

|

| | | | | | | | |

| | Years ended December 31, |

| | 2014 | | 2013 |

Additions to net assets attributed to: | | | | |

Investment income: | | | | |

Dividends and interest | | $ | 19,678,800 |

| | $ | 13,664,612 |

|

Net realized and unrealized appreciation (depreciation) in fair value of investments | | (4,654,884 | ) | | 44,323,469 |

|

| | 15,023,916 |

| | 57,988,081 |

|

Contributions: | | |

| | |

|

Participants' | | 34,639,096 |

| | 33,714,208 |

|

Employer's | | 6,766,332 |

| | 5,864,776 |

|

| | 41,405,428 |

| | 39,578,984 |

|

Total additions | | 56,429,344 |

| | 97,567,065 |

|

Deductions from net assets attributed to: | | |

| | |

|

Withdrawals and distributions | | 21,010,021 |

| | 18,180,927 |

|

Administrative expenses | | 28,948 |

| | 63,985 |

|

Total deductions | | 21,038,969 |

| | 18,244,912 |

|

Net increase in net assets before transfer | | 35,390,375 |

| | 79,322,153 |

|

Transfer of assets to the Plan | | 1,619,471 |

| | 19,334,148 |

|

Net increase in net assets | | 37,009,846 |

| | 98,656,301 |

|

Net assets available for benefits: | | |

| | |

|

Beginning of year | | 348,293,961 |

| | 249,637,660 |

|

End of year | | $ | 385,303,807 |

| | $ | 348,293,961 |

|

See accompanying notes

TRIMBLE NAVIGATION SAVINGS AND RETIREMENT PLAN

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2014 and 2013

NOTE 1 - THE PLAN AND ITS SIGNIFICANT ACCOUNTING POLICIES

General - The following description of the Trimble Navigation Savings and Retirement Plan (the “Plan”) provides only general information. Participants should refer to the Plan document for a more complete description of the Plan's provisions.

The Plan is a defined contribution plan that was established in 1988 by Trimble Navigation Limited (the “Company”) to provide benefits to eligible employees. The Plan administrator believes that the Plan is currently designed to be qualified under the applicable requirements of the Internal Revenue Code, as amended, and the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended.

On October 2, 2012, the Company acquired privately-held TMW Systems Holding LLC, including its operating subsidiary, TMW Systems, Inc. (TMW) of Beachwood, Ohio, a provider of enterprise software to transportation and logistics companies. On May 1, 2013, TMW 401(k) Profit Sharing Plan and Trust merged into the Plan and approximately $19,239,000 of assets were transferred into the Plan, which excludes approximately $95,000 in loans from other terminated plans that were transferred into the Plan during 2013.

On July 8, 2011, the Company acquired Tekla Corporation (Tekla), headquartered in Espoo, Finland, and its subsidiaries. Tekla is a leading provider of BIM software and offers model driven solutions for customers in the infrastructure and energy industries (in particular energy distribution, public administration and civil engineering and utilities). On April 23, 2014, Tekla 401(k) Profit Sharing Plan and Trust merged into the Plan and approximately $1,563,000 of assets were transferred into the Plan, which excludes approximately $56,000 in loans from other terminated plans that were transferred into the Plan during 2014.

During 2014 and 2013, the Company acquired several companies that sponsored 401(k) plans. Each of the plans sponsored by these companies were resolved to either be terminated or merged, with assets transferring into the Plan. Each of the employees hired by the Company became eligible to participate in the Plan and were allowed to rollover existing balances from their former plan to the Plan.

Administration - The Company has appointed an Administrative Committee (the “Committee”) to manage the operation and administration of the Plan. The Company contracted with Fidelity Management Trust Company (“Fidelity”) to act as the custodian and trustee, and with an affiliate of Fidelity to act as the third-party administrator and record keeper. Substantially all expenses incurred for administering the Plan are paid by the Company.

Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Basis of accounting - The financial statements of the Plan are prepared on the accrual method of accounting in accordance with accounting principles generally accepted in the United States of America.

Investment valuation and income recognition - The Plan’s investments are stated at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. See Note 2 for discussion of fair value measurements.

Investments of the Plan are held by Fidelity and invested primarily in mutual funds, a money market fund and the Company's common stock based solely upon instructions received from participants. The Plan’s investments in mutual funds, the money market fund and the Company's common stock are valued at fair value as of the last day of the Plan year, as measured by quoted market prices.

Purchases and sales of securities are recorded on a trade date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation (depreciation) includes the Plan’s gains and losses on investments bought or sold as well as held during the year.

Notes receivable from participants - Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent notes receivable from participants are reclassified as distributions upon the occurrence of a distributable event based upon the terms of the Plan document.

Income taxes - The Plan received a favorable determination letter dated April 8, 2015. The Plan administrator believes that the Plan is operated in accordance with, and qualifies under, the applicable requirements of the Internal Revenue Code, as amended, and related state statutes, and that the trust, which forms part of the Plan, is exempt from federal income and state franchise taxes.

Accounting principles generally accepted in the United States of America require plan management to evaluate tax positions taken by the plan and recognize a tax liability (or asset) if the plan has taken an uncertain position that more likely than not would not be sustained upon examination by the Internal Revenue Service. No uncertain positions have been identified that would require recognition of a liability (or asset) or disclosure in the financial statements as of December 31, 2014 and 2013. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan Administrator believes the Plan is no longer subject to income tax examinations for years prior to 2011.

Risks and uncertainties - The Plan provides for various investment options in any combination of investment securities offered by the Plan. In addition, Company common stock is included in the Plan. Investment securities are exposed to various risks, such as interest rate, market fluctuations and credit risks. Due to the risk associated with certain investment securities, it is at least reasonably possible that changes in market values, interest rates or other factors in the near term would materially affect participants' account balances and the amounts reported in the statements of net assets available for benefits and the statements of changes in net assets available for benefits.

Recent accounting pronouncements - In April 2015, the Financial Accounting Standards board (FASB) issued Accounting Standards Update (ASU) 2015-07, Fair Value Measurement (Topic 820): Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent). The ASU is effective for public business entities for fiscal years beginning after December 15, 2015, with earlier application permitted.

The amendment removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient (NAV). Once adopted, the Plan will apply the amendment retrospectively to all periods presented. Plan management is determining the specific impact on Plan reporting. However when adopted, certain investments held by the Plan and measured using NAV will be no longer presented within the fair value hierarchy table.

NOTE 2 - FAIR VALUE DISCLOSURES

The fair value measurements standard clarifies the definition of fair value, establishes a framework for measuring fair value, and expands the disclosures for fair value measurements. The standard applies under other accounting pronouncements that require or permit fair value measurements and does not require any new fair value measurements.

The fair value measurements standard provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. In general, fair values determined by Level 1 inputs use quoted prices in active markets for identical assets or liabilities that the Plan has the ability to access. Fair values determined by Level 2 inputs use other inputs that are observable, either directly or indirectly. These Level 2 inputs include quoted prices for similar assets and liabilities in active markets, and other inputs such as interest rates and yield curves that are observable at commonly quoted intervals. Level 3 inputs are unobservable inputs, including inputs that are available in situations where there is little, if any, market activity for the related asset or liability. In instances where inputs used to measure fair value fall into different levels of the fair value hierarchy, fair value measurements in their entirety are categorized based on the lowest level input that is significant to the valuation. The Plan’s assessment of the significance of particular inputs to these fair value measurements requires judgment and considers factors specific to each asset or liability.

Following are the major categories of assets measured at fair value on a recurring basis at December 31, 2014 and 2013:

|

| | | | | | | | | | | | | | | | |

| | Investment Assets at Fair Value as of December 31, 2014 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

Investments: | |

Money market fund (1) | | $ | 29,138,593 |

| | $ | — |

| | $ | — |

| | $ | 29,138,593 |

|

Employer securities (1) | | 25,186,034 |

| | — |

| | — |

| | 25,186,034 |

|

Common stocks (1) | | 3,919,922 |

| | — |

| | — |

| | 3,919,922 |

|

Mutual funds: (1) | | | | | | | |

|

|

Bond funds | | 19,580,026 |

| | — |

| | — |

| | 19,580,026 |

|

Growth funds | | 105,528,607 |

| | — |

| | — |

| | 105,528,607 |

|

Value funds | | 20,204,882 |

| | — |

| | — |

| | 20,204,882 |

|

Blend funds | | 98,686,626 |

| | — |

| | — |

| | 98,686,626 |

|

Target date funds | | 76,218,482 |

| | — |

| | — |

| | 76,218,482 |

|

Other funds | | 1,401,700 |

| | — |

| | — |

| | 1,401,700 |

|

Total mutual funds | | 321,620,323 |

| | — |

| | — |

| | 321,620,323 |

|

Other (2) | | 89,246 |

| | 127,640 |

| | — |

| | 216,886 |

|

Total investments | | $ | 379,954,118 |

| | $ | 127,640 |

| | $ | — |

| | $ | 380,081,758 |

|

|

| | | | | | | | | | | | | | | | |

| | Investment Assets at Fair Value as of December 31, 2013 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

Investments: | |

Money market fund (1) | | $ | 29,479,036 |

| | $ | — |

| | $ | — |

| | $ | 29,479,036 |

|

Employer securities (1) | | 32,116,609 |

| | — |

| | — |

| | 32,116,609 |

|

Common stocks (1) | | 3,199,231 |

| | — |

| | — |

| | 3,199,231 |

|

Mutual funds: (1) | | | | | | | | |

Bond funds | | 19,252,721 |

| | — |

| | — |

| | 19,252,721 |

|

Growth funds | | 98,482,960 |

| | — |

| | — |

| | 98,482,960 |

|

Value funds | | 20,393,992 |

| | — |

| | — |

| | 20,393,992 |

|

Blend funds | | 81,492,466 |

| | — |

| | — |

| | 81,492,466 |

|

Target date funds | | 58,296,381 |

| | — |

| | — |

| | 58,296,381 |

|

Other funds | | 994,628 |

| | — |

| | — |

| | 994,628 |

|

Total mutual funds | | 278,913,148 |

| | — |

| | — |

| | 278,913,148 |

|

Common/collective trust (2) | | — |

| | 18 |

| | — |

| | 18 |

|

Other (2) | | 90,015 |

| | 145,745 |

| | — |

| | 235,760 |

|

Total investments | | $ | 343,798,039 |

| | $ | 145,763 |

| | $ | — |

| | $ | 343,943,802 |

|

(1) The fair values are determined using the closing price reported on the active market on which the individual securities are traded.

(2) The fair values are valued at the net asset value (NAV) of shares held by the Plan at year end.

NOTE 3 - RELATED PARTY AND PARTY IN INTEREST TRANSACTIONS

Certain Plan investments are managed by an affiliate of Fidelity, the trustee of the Plan. Any purchases and sales of these funds are performed in the open market at fair value. Such transactions, while considered party-in-interest transactions under ERISA regulations, are permitted under the provisions of the Plan and are specifically exempt from the prohibition of party-in-interest transactions under ERISA.

As allowed by the Plan, participants may elect to invest a portion of their accounts in the common stock of the Company. Aggregate investment in Company common stock at December 31, 2014 and 2013 was as follows:

|

| | | | | | |

Date | | Number of shares | | Fair value | | Cost |

2014 | | 948,940 | | $25,186,034 | | $11,584,981 |

2013 | | 925,514 | | $32,116,609 | | $9,493,039 |

NOTE 4 - PARTICIPATION AND BENEFITS

Participant contributions - Participants may elect to have the Company contribute from 1% to 50% of their eligible pre-tax or Roth after-tax compensation up to the amount allowable under current income tax regulations. Effective February 1, 2013, the Plan permits the automatic enrollment of eligible employees in the Plan with a contribution of 2% of eligible compensation, unless the employee affirmatively elects otherwise. Participants who have the Company contribute a portion of their compensation to the Plan agree to accept an equivalent reduction in taxable or taxed compensation. Contributions withheld are invested in accordance with the participant’s direction.

Participants are also allowed to make rollover contributions of amounts received from other tax-qualified employer-sponsored retirement plans. Such contributions are deposited in the appropriate investment funds in accordance with the participant’s direction and the Plan’s provisions.

Employer contributions - The Company is allowed to make matching contributions as defined in the Plan and as approved by the Board of Directors. For 2014 and 2013, the Company matched 50% of the participant’s contribution up to 5% of eligible compensation with a maximum of $2,500 per year. Effective March 1, 2013, the Company makes a non-elective employer contribution equal to 2% of base salary for non-highly compensated employees in specified job codes as approved by the Board of Directors. Contributions for the years ended December 31, 2014 and 2013 were approximately $6,766,000 and $5,865,000 respectively.

Vesting - Participants are immediately vested in their entire account, including employer contributions.

Participant accounts - Each participant's account is credited with the participant's contribution, Plan earnings or losses and an allocation of the Company's contributions. The allocation of the Company’s contributions is based on participant contributions and eligible compensation, as defined in the Plan.

Payment of benefits - Upon termination, each participant or beneficiary may elect to leave their account balance in the Plan, or receive their total benefits in a lump sum amount equal to the value of the participant's interest in their account. The Plan allows for automatic distribution of participant account balances that do not exceed $5,000.

Notes receivable from participants - The Plan allows each participant to borrow not less than $1,000 and up to the lesser of $50,000 or 50% of their account balance. The notes receivable are secured by the participant's balance. Such notes receivable bear interest at the available market financing rates and must be repaid to the Plan within a five-year period, unless the notes receivable are used for the purchase of a principal residence in which case the maximum repayment period is ten years. The specific terms and conditions of such notes receivable are established by the Committee. Outstanding notes receivable at December 31, 2014 carry interest rates ranging from 3.25% to 9.5%.

NOTE 5 - INVESTMENTS

The following table presents the fair values of investments and investment funds that include 5% or more of the Plan’s net assets at December 31:

|

| | | | | | | | |

| | 2014 | | 2013 |

PIMCO Total Return Fund Institutional Class | | $ | 19,580,026 |

| | $ | 19,252,723 |

|

Fidelity Contrafund Class K | | 47,669,474 |

| | 44,038,057 |

|

Fidelity Balanced Fund Class K | | 26,364,074 |

| | 23,238,261 |

|

Fidelity Diversified International Fund Class K | | * |

| | 19,793,045 |

|

Fidelity Low Price Stock Fund Class K | | 20,621,180 |

| | 18,781,645 |

|

Fidelity Capital Appreciation Fund Class K | | 21,307,400 |

| | 17,965,656 |

|

Fidelity Retirement Money Market Fund | | ** |

| | 28,148,549 |

|

Fidelity Institutional Money Market Fund | | 27,454,308 |

| | ** |

|

Spartan 500 Index Fund | | 19,427,206 |

| | * |

|

Trimble Navigation Limited Common Stock | | 25,186,034 |

| | 32,116,609 |

|

* Less than 5% at year end

** Not an investment at year end

The Plan's investments, including gains and losses on investments bought and sold, as well as held during the year, appreciated in value as follows for the years ended December 31:

|

| | | | | | | | |

| | 2014 | | 2013 |

Common stocks | | $ | (7,555,645 | ) | | $ | 5,078,717 |

|

Mutual funds | | 2,900,761 |

| | 39,244,752 |

|

| | $ | (4,654,884 | ) | | $ | 44,323,469 |

|

NOTE 6 - PLAN TERMINATION OR MODIFICATION

The Company intends to continue the Plan indefinitely for the benefit of its employees; however, it reserves the right to terminate or modify the Plan at any time by resolution of its Board of Directors and subject to the provisions of ERISA.

SUPPLEMENTAL SCHEDULE

TRIMBLE NAVIGATION SAVINGS AND RETIREMENT PLAN

Schedule H, Line 4i - Schedule of Assets (Held at the End of Year)

Employer Identification Number 94-2802192

Plan Number: 001

December 31, 2014

|

| | | | | |

| | Description of investment including | |

| Identity of issue, borrower, | maturity date, rate of interest, | Current |

| lessor or similar party | collateral, par or maturity value | value |

| | | |

| PIMCO Total Return Fund Institutional Class | Mutual Fund | $ | 19,580,026 |

|

* | Brokeragelink | Self directed brokerage accounts | 7,222,793 |

|

| Hartford International Opportunities HLS Class IA | Mutual Fund | 1,900,127 |

|

* | Spartan Global ex U.S. Index Fund - Fidelity Advantage Class | Mutual Fund | 581,009 |

|

| Wells Fargo Advantage Common Stock Fund Class R6 | Mutual Fund | 17,615,894 |

|

| Weitz Partners Value Fund | Mutual Fund | 10,803,624 |

|

| T. Rowe Price Equity Income Fund | Mutual Fund | 9,401,258 |

|

| Vanguard Retirement Income Fund | Mutual Fund | 1,678,572 |

|

| Vanguard Target Retirement Fund 2010 | Mutual Fund | 2,413,868 |

|

| Vanguard Target Retirement Fund 2015 | Mutual Fund | 4,602,411 |

|

| Vanguard Target Retirement Fund 2020 | Mutual Fund | 9,092,543 |

|

| Vanguard Target Retirement Fund 2025 | Mutual Fund | 12,669,764 |

|

| Vanguard Target Retirement Fund 2030 | Mutual Fund | 14,127,368 |

|

| Vanguard Target Retirement Fund 2035 | Mutual Fund | 11,979,816 |

|

| Vanguard Target Retirement Fund 2040 | Mutual Fund | 9,250,472 |

|

| Vanguard Target Retirement Fund 2045 | Mutual Fund | 7,441,034 |

|

| Vanguard Target Retirement Fund 2050 | Mutual Fund | 3,330,973 |

|

| Vanguard Target Retirement Fund 2055 | Mutual Fund | 1,310,234 |

|

* | Fidelity Value Fund Class K | Mutual Fund | 2,844,951 |

|

* | Fidelity Institutional Money Market Fund | Mutual Fund | 27,454,308 |

|

* | Fidelity Contrafund Class K | Mutual Fund | 47,669,474 |

|

* | Fidelity Balanced Fund Class K | Mutual Fund | 26,364,074 |

|

* | Fidelity Diversified International Fund Class K | Mutual Fund | 18,935,839 |

|

* | Fidelity Dividend Growth Fund Class K | Money Market Fund | 18,709,158 |

|

* | Fidelity Low Price Stock Fund Class K | Mutual Fund | 20,621,180 |

|

* | Fidelity Capital Appreciation Fund Class K | Mutual Fund | 21,307,400 |

|

* | Spartan 500 Index Fund | Mutual Fund | 19,427,206 |

|

* | Royce Pennsylvania Mutual Fund Institutional Class | Mutual Fund | 6,560,348 |

|

* | Trimble Navigation Limited Common Stock | Employer securities | 25,186,034 |

|

* | Notes receivable from participants | Interest rates ranging from 3.25% to 9.5% | 4,841,793 |

|

| | Total | $ | 384,923,551 |

|

* | Party-in-interest | | |

|

SIGNATURE

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 26, 2015

|

| | |

| By: /s/ Steven W. Berglund | |

| Steven W. Berglund |

| Title: President and Chief Executive Officer |

| Trimble Navigation Limited |

| |

| On behalf of the administrator of the |

| Trimble Navigation Savings and |

| Retirement Plan |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statements (Nos. 33-37384, 33-39647, 33-45167, 33-45604, 33-46719, 33-50944, 33-57522, 33-62078, 33-78502, 33-84362, 33-91858, 333-04670, 333-28429, 333-53703, 333-84949, 333-38264, 333-65758, 333-97979, 333-118212, 333-138551, 333-161295, and 333-183229) on Form S-8 of Trimble Navigation Limited of our report dated June 24, 2015, with respect to the statements of net assets available for benefits of the Trimble Navigation Savings and Retirement Plan as of December 31, 2014 and 2013, the related statements of changes in net assets available for benefits for the years then ended, and the related supplemental Schedule H, Line 4i - Schedule of Assets (Held at End of Year), appearing in this Annual Report (Form 11-K) of the Trimble Navigation Savings and Retirement Plan.

/s/ MOSS ADAMS LLP

Campbell, California

June 24, 2015

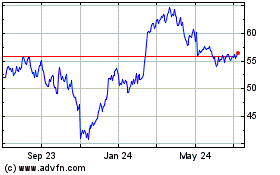

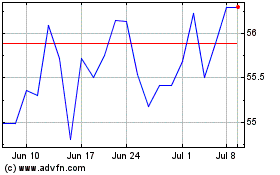

Trimble (NASDAQ:TRMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trimble (NASDAQ:TRMB)

Historical Stock Chart

From Apr 2023 to Apr 2024