Prosper Shuts Off Borrowers From Two Loan Marketing Sites

June 08 2016 - 1:00PM

Dow Jones News

Online lender Prosper Marketplace Inc. has stopped courting new

borrowers from at least two large loan referral websites, according

to people familiar with the matter, the most recent sign of how

funding woes are leading online lenders to slow down sharply.

Prosper has put its relationship with LendingTree Inc. and

Credit Karma Inc. on hold as it tries to shore up new deals with

investors to buy loans, the people said. The websites serve as

platforms where millions of consumers shop for personal loans and

other financing, while comparing pricing and other terms between

lenders.

The moves by San Francisco-based Prosper follow problems at

larger rival LendingClub Corp., whose board pushed out CEO Renaud

Laplanche last month and which took steps this week to tighten loan

underwriting standards to an extent that could decrease loan volume

by about 5%.

Prosper and competitors including LendingClub for years have

relied on websites like LendingTree and Credit Karma to help grow

volume. The two sites are among the largest for comparison

shopping, drawing consumers who shop for personal loans as well as

auto loans and credit cards. Consumers select a lender they find

through the sites and begin an application with that company.

Lenders generally pay the websites a certain percentage of the loan

volume they receive.

A pullback in these relationships shows one result of lenders

continuing to face challenges finding investors to buy their loans.

Prosper's lending volume is expected to be down again in the second

quarter after falling 12% in the first quarter from the fourth

quarter of 2015, people familiar with the company said.

Unlike banks and some other finance companies, marketplace

lenders such as Prosper and LendingClub don't have customer

deposits or big balance sheets to fund loans.

"We use a variety of online and offline marketing channels and

we are able to quickly and efficiently adjust those channels to

best match borrower and investor demand," noted Prosper CEO Aaron

Vermut in a statement. "This ensures we maintain equilibrium, which

is the No. 1 priority when running a marketplace business."

The online lender stopped buying leads from Credit Karma last

month after making a similar move with LendingTree earlier in the

year, some of the people said.

LendingClub also scaled back in May after its CEO resigned,

though it has continued to buy loans from both websites, according

to people familiar with the matter.

It is unlikely that the pullback by the two lenders will hurt

LendingTree and Credit Karma, since both sites offer leads for many

consumer loan categories beyond general-purpose loans. In other

categories such as car loans and credit cards, LendingTree and

Credit Karma rely largely on banks. LendingTree also has a large

mortgage-shopping platform. Many banks and other lenders have also

expanded their personal loan businesses in the last couple of years

and are using the sites for leads.

"Our business moves in tandem with the collective demand of all

of our lenders instead of any individual ones," says Doug Lebda,

LendingTree's CEO.

If the slowdown in the sector broadens, however, it could become

an issue. LendingTree's stock has been a strong performer, rising

about 45% over the last year while shares of LendingClub, the

biggest public marketplace lender, have sunk about 75%.

The industry's growth was already slowing down due to a hiccup

in investor demand when LendingClub's Mr. Laplanche resigned

following a number of disclosure failures at the company—including

falsification of loan data. That has led investors to broader

questions about online lenders.

Prosper wants to limit the number of borrowers as it searches

for more investor capital. The company wanted to be sure it could

fund loans where it had already promised preapproval, according to

people familiar with the company.

The lender is also working with investment bankers to arrange

deals with investors who expressed interest in purchasing loans,

the people said. Mr. Vermut said in May that the company is "having

some productive conversations with potential loan buyers."

Already, Prosper has cut its costs back substantially by laying

off 28% of its employees and closing a Utah office.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

Telis Demos at telis.demos@wsj.com

(END) Dow Jones Newswires

June 08, 2016 12:45 ET (16:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

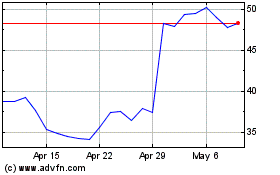

LendingTree (NASDAQ:TREE)

Historical Stock Chart

From Mar 2024 to Apr 2024

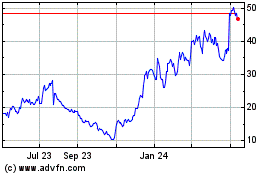

LendingTree (NASDAQ:TREE)

Historical Stock Chart

From Apr 2023 to Apr 2024