UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 30, 2015

LendingTree, Inc.

(Exact name of registrant as specified in charter)

|

| | | | |

Delaware | | 001-34063 | | 26-2414818 |

(State or other jurisdiction | | (Commission | | (IRS Employer |

of incorporation) | | File Number) | | Identification No.) |

|

| | |

11115 Rushmore Drive, Charlotte, NC | | 28277 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (704) 541-5351

Tree.com, Inc.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On April 30, 2015, LendingTree, Inc. (the “Registrant”) announced financial results for the quarter ended March 31, 2015. A copy of the related press release is furnished as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

|

| | |

Exhibit No. | | Exhibit Description |

| | |

99.1 | | Press Release, dated April 30, 2015, with respect to the Registrant’s financial results for the quarter ended March 31, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

Date: April 30, 2015 | |

| |

| LENDINGTREE, INC. |

| |

| |

| By: | /s/ Katharine F. Pierce |

| | Katharine F. Pierce |

| | Senior Vice President, General Counsel |

| | & Corporate Secretary |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| | |

99.1 | | Press Release, dated April 30, 2015, with respect to the Registrant’s financial results for the quarter ended March 31, 2015. |

Exhibit 99.1

LENDINGTREE REPORTS RECORD FIRST QUARTER RESULTS; INCREASING FULL-YEAR OUTLOOK

| |

• | Record Revenue of $50.9 million; up 27% over first quarter 2014 |

| |

• | Record Variable Marketing Margin of $21.2 million; up 39% over first quarter 2014 |

| |

• | Net Income from Continuing Operations of $5.4 million |

| |

• | Record Adjusted EBITDA of $8.9 million; up 98% over first quarter 2014 |

| |

• | Net Income per Diluted Share from Continuing Operations of $0.44; Adjusted Net Income per Share of $0.65 |

| |

• | Revenue growth from non-mortgage products continued to accelerate, up 140% over first quarter 2014; fifth consecutive quarter of triple-digit year-over-year growth |

| |

• | Increasing full-year 2015 guidance |

CHARLOTTE, NC - April 30, 2015 - LendingTree, Inc. (NASDAQ: TREE), operator of LendingTree.com, the nation's leading online loan marketplace, today announced results for the quarter ended March 31, 2015.

"Continuing our momentum from the fourth quarter, we once again achieved new record levels of revenue, variable marketing margin and adjusted EBITDA in the first quarter," said Doug Lebda, Chairman and CEO. "Revenue growth from our non-mortgage products continued to accelerate, increasing a record 140% versus the prior year. Helping fuel that acceleration, revenue from our personal loans marketplace was up more than 11 times compared to the first quarter 2014, and in the month of March, exceeded $3.1 million. More broadly, we saw year-over-year growth in each of our non-mortgage lending revenue streams. Based on our performance in the first quarter, we are increasingly optimistic about our prospects for the rest of the year."

Alex Mandel, Chief Financial Officer, added, "We're particularly focused on ramping our emerging lending categories over the next several quarters, including small business loans, credit cards and student loans; and promoting our brand, emphasizing LendingTree as 'the place to shop for money'. We anticipate debuting new TV spots late in the quarter in support of our full suite of loan and credit categories and the compelling value proposition offered by My LendingTree enrollment. Notwithstanding the investment contemplated in these marketing efforts, our platform and selective additions to our team, which we anticipate will reflect in our second quarter results, we are increasing our full-year 2015 outlook."

First Quarter 2015 Business Highlights

| |

• | Record revenue from mortgage products of $37.0 million represents an increase of 8% over first quarter 2014 and reflects our highest growth rate since annualizing the launch of our national brand campaign in Q2 2014. Our mortgage results benefitted, in part, from an influx of refinance volume which was well absorbed by our network of lenders. |

| |

• | Record revenue from non-mortgage products of $13.9 million in the first quarter represents an increase of 140% over the first quarter 2014 and our fifth consecutive quarter of triple-digit year-over-year growth. Revenue from non-mortgage products now comprises 27% of total revenue, up from 14% in the prior year's quarter. |

| |

• | Enrollment growth in My LendingTree continued to accelerate, as more than 900 thousand consumers have now joined the My LendingTree personalization platform, up from 600 thousand in late February. |

|

| | | | | | | | | | | | | | | | | | | |

LendingTree Selected Financial Metrics |

(In millions, except per share amounts) |

| | | | | | | | | | | |

| | | | | Q/Q | | | | | Y/Y | |

| Q1 2015 | | Q4 2014 | | % Change | | | Q1 2014 | | % Change | |

Revenue by Product | | | | | | | | | | | |

Mortgage Products (1) | $ | 37.0 |

| | $ | 33.2 |

| | 11 | % | | | $ | 34.2 |

| | 8 | % | |

Non-Mortgage Products (2) | 13.9 |

| | 10.7 |

| | 30 | % | | | 5.8 |

| | 140 | % | |

Total Revenue | $ | 50.9 |

| | $ | 43.9 |

| | 16 | % | | | $ | 40.0 |

| | 27 | % | |

Non-Mortgage % of Total | 27 | % | | 24 | % | | | | | 14 | % | | | |

| | | | | | | | | | | |

Selling and Marketing Expense | | | | | | | | | | | |

Exchanges Marketing Expense (3) | $ | 29.7 |

| | $ | 26.4 |

| | 13 | % | | | $ | 24.8 |

| | 20 | % | |

Other Marketing | 3.1 |

| | 2.8 |

| | 11 | % | | | 2.6 |

| | 19 | % | |

Selling and Marketing Expense | $ | 32.8 |

| | $ | 29.1 |

| | 13 | % | | | $ | 27.4 |

| | 20 | % | |

| | | | | | | | | | | |

Variable Marketing Margin (4) | $ | 21.2 |

| | $ | 17.5 |

| | 21 | % | | | $ | 15.2 |

| | 39 | % | |

Variable Marketing Margin % of Revenue | 42 | % | | 40 | % | | | | | 38 | % | | | |

| | | | | | | | | | | |

Net Income (Loss) from Continuing Operations | $ | 5.4 |

| | $ | 2.1 |

| | 157 | % | | | $ | (5.8 | ) | | NM |

| |

Net Income (Loss) from Cont. Ops. % of Revenue | 11 | % | | 5 | % | | | | | (15 | )% | | | |

| | | | | | | | | | | |

Net Income (Loss) per Share from Cont. Ops. | | | | | | | | | | | |

Basic | $ | 0.48 |

| | $ | 0.19 |

| | 153 | % | | | $ | (0.52 | ) | | NM |

| |

Diluted | $ | 0.44 |

| | $ | 0.18 |

| | 144 | % | | | $ | (0.52 | ) | | NM |

| |

| | | | | | | | | | | |

Adjusted EBITDA (5) | $ | 8.9 |

| | $ | 6.0 |

| | 48 | % | | | $ | 4.5 |

| | 98 | % | |

Adjusted EBITDA % of Revenue (5) | 18 | % | | 14 | % | | | | | 11 | % | | | |

| | | | | | | | | | | |

Adjusted Net Income (5) | $ | 7.9 |

| | $ | 5.7 |

| | 39 | % | | | $ | 3.7 |

| | 114 | % | |

| | | | | | | | | | | |

Adjusted Net Income per Share (5) | $ | 0.65 |

| | $ | 0.47 |

| | 38 | % | | | $ | 0.31 |

| | 110 | % | |

| | | | | | | | | | | |

|

| |

(1) | Includes the purchase mortgage, refinance mortgage and rate table products. |

(2) | Includes the home equity, reverse mortgage, personal loan, small business loan, student loan, auto loan, education, home services, insurance and personal credit products. |

(3) | Defined as the portion of selling and marketing expense attributable to variable costs paid for advertising, direct marketing and related expenses, which excludes overhead, fixed costs and personnel-related expenses. |

(4) | Defined as revenue minus Exchanges marketing expense and is considered an operating metric. |

(5) | Adjusted EBITDA, adjusted EBITDA % of revenue, adjusted net income and adjusted net income per share are non-GAAP measures. Please see "LendingTree's Reconciliation of Non-GAAP Measures to GAAP" and "LendingTree's Principles of Financial Reporting" below for more information. |

First Quarter 2015 Financial and Operating Highlights

| |

• | Record revenue in the first quarter 2015 of $50.9 million represents an increase of $10.9 million, or 27%, over revenue in the first quarter 2014. |

| |

• | Record Variable Marketing Margin of $21.2 million represents an increase of $6.0 million, or 39%, over first quarter 2014 and, at 42% of revenue, reflects the decline in interest rates in late December, which led to an influx of lower cost, higher margin consumer traffic in the quarter. |

| |

• | Adjusted EBITDA of $8.9 million, also a record, increased $4.5 million, or 98%, over first quarter 2014. |

| |

• | Adjusted Net Income per Share of $0.65 represents an increase of $0.34, or 110%, over first quarter 2014. |

| |

• | Working capital was $86.4 million at March 31, 2015, compared with $81.0 million at December 31, 2014. Working capital is calculated as current assets (including unrestricted and restricted cash) minus current liabilities (including loan loss reserves). |

Business Outlook - 2015

LendingTree is providing revenue, Variable Marketing Margin and Adjusted EBITDA guidance for the second quarter 2015 and increasing its full-year 2015 outlook, as follows:

For second quarter 2015:

| |

• | Revenue is anticipated to be in the range of $51 - $53 million, a 21% - 26% increase over second quarter 2014. |

| |

• | Variable Marketing Margin is anticipated to be $19 - $20 million, an increase of 20% - 27% over second quarter 2014. |

| |

• | Adjusted EBITDA is anticipated to be in the range of $7.0 - $7.5 million, up 27% - 36% over second quarter 2014. |

For full-year 2015:

| |

• | Revenue is now anticipated to be $202 - $208 million, or 21% - 24% over full-year 2014, an increase from previous guidance of 15% - 20% growth. |

| |

• | Variable Marketing Margin is now anticipated to be in the range of $78.0 - $82.0 million, an increase of 20% - 26% over full-year 2014 and up from previous guidance of $76.0 - $80.0 million. |

| |

• | Adjusted EBITDA is now anticipated to be in the range of $30 - $31 million, implying year-over-year growth of 37% - 42%, an increase from previous guidance of $27.0 - $29.0 million. |

Quarterly Conference Call

A conference call to discuss LendingTree's first quarter 2015 financial results will be webcast live today, April 30, 2015 at 11:00 AM Eastern Time (ET). The live audiocast is open to the public and will be available on LendingTree's investor relations website at http://investors.lendingtree.com/. The call may also be accessed toll-free via phone at (877) 606-1416. Callers outside the United States and Canada may dial (707) 287-9313. Following completion of the call, a recorded replay of the webcast will be available on LendingTree's investor relations website until 11:59 PM ET on Tuesday, May 5, 2015. To listen to the telephone replay, call toll-free (855) 859-2056 with passcode #31085817. Callers outside the United States and Canada may dial (404) 537-3406 with passcode #31085817.

LENDINGTREE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

| | | | | | | |

| Three Months Ended March 31, |

| 2015 | | 2014 |

| |

Revenue | $ | 50,935 |

| | $ | 40,036 |

|

Costs and expenses: | |

| | |

|

Cost of revenue (exclusive of depreciation) (1) | 1,975 |

| | 1,665 |

|

Selling and marketing expense (1) | 32,837 |

| | 27,449 |

|

General and administrative expense (1) | 7,228 |

| | 6,133 |

|

Product development (1) | 2,173 |

| | 1,932 |

|

Depreciation | 654 |

| | 755 |

|

Amortization of intangibles | 62 |

| | 28 |

|

Restructuring and severance | 6 |

| | 202 |

|

Litigation settlements and contingencies | 282 |

| | 7,707 |

|

Total costs and expenses | 45,217 |

| | 45,871 |

|

Operating income (loss) | 5,718 |

| | (5,835 | ) |

Other income (expense): | | | |

|

Interest income | 2 |

| | — |

|

Income (loss) before income taxes | 5,720 |

| | (5,835 | ) |

Income tax (expense) benefit | (307 | ) | | 1 |

|

Net income (loss) from continuing operations | 5,413 |

| | (5,834 | ) |

Loss from discontinued operations | (226 | ) | | (574 | ) |

Net income (loss) | $ | 5,187 |

| | $ | (6,408 | ) |

| | | |

Weighted average shares outstanding: | | | |

Basic | 11,304 |

| | 11,142 |

|

Diluted | 12,165 |

| | 11,142 |

|

Income (loss) per share from continuing operations: | | | |

|

Basic | $ | 0.48 |

| | $ | (0.52 | ) |

Diluted | $ | 0.44 |

| | $ | (0.52 | ) |

Income (loss) per share from discontinued operations: | |

| | |

|

Basic | $ | (0.02 | ) | | $ | (0.05 | ) |

Diluted | $ | (0.02 | ) | | $ | (0.05 | ) |

Net income (loss) per share: | |

| | |

|

Basic | $ | 0.46 |

| | $ | (0.58 | ) |

Diluted | $ | 0.43 |

| | $ | (0.58 | ) |

(1) Amounts include non-cash compensation, as follows: | | | |

Cost of revenue | $ | 20 |

| | $ | 6 |

|

Selling and marketing expense | 270 |

| | 233 |

|

General and administrative expense | 1,606 |

| | 1,061 |

|

Product development | 440 |

| | 316 |

|

LENDINGTREE, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

|

| | | | | | | |

| (Unaudited) | | |

| March 31,

2015 | | December 31,

2014 |

| (in thousands, except par value and share amounts) |

ASSETS: | |

| | |

|

Cash and cash equivalents | $ | 88,536 |

| | $ | 86,212 |

|

Restricted cash and cash equivalents | 18,617 |

| | 18,716 |

|

Accounts receivable, net | 19,596 |

| | 13,611 |

|

Prepaid and other current assets | 1,138 |

| | 931 |

|

Current assets of discontinued operations | 161 |

| | 189 |

|

Total current assets | 128,048 |

| | 119,659 |

|

Property and equipment, net | 5,743 |

| | 5,257 |

|

Goodwill | 3,632 |

| | 3,632 |

|

Intangible assets, net | 11,079 |

| | 11,141 |

|

Other non-current assets | 102 |

| | 102 |

|

Non-current assets of discontinued operations | — |

| | 100 |

|

Total assets | $ | 148,604 |

| | $ | 139,891 |

|

| | | |

LIABILITIES: | |

| | |

|

Accounts payable, trade | $ | 2,674 |

| | $ | 1,060 |

|

Accrued expenses and other current liabilities | 26,868 |

| | 25,521 |

|

Current liabilities of discontinued operations | 12,134 |

| | 12,055 |

|

Total current liabilities | 41,676 |

| | 38,636 |

|

Deferred income taxes | 4,738 |

| | 4,738 |

|

Non-current liabilities of discontinued operations | 30 |

| | 151 |

|

Total liabilities | 46,444 |

| | 43,525 |

|

SHAREHOLDERS' EQUITY: | |

| | |

|

Preferred stock $.01 par value; 5,000,000 shares authorized; none issued or outstanding | — |

| | — |

|

Common stock $.01 par value; 50,000,000 shares authorized; 12,920,525 and 12,854,517 shares issued, respectively, and 11,446,998 and 11,386,240 shares outstanding, respectively | 129 |

| | 129 |

|

Additional paid-in capital | 910,576 |

| | 909,751 |

|

Accumulated deficit | (792,984 | ) | | (798,171 | ) |

Treasury stock 1,473,527 and 1,468,277 shares, respectively | (15,561 | ) | | (15,343 | ) |

Total shareholders' equity | 102,160 |

| | 96,366 |

|

Total liabilities and shareholders' equity | $ | 148,604 |

| | $ | 139,891 |

|

LENDINGTREE'S RECONCILIATION OF NON-GAAP MEASURES TO GAAP

Below is a reconciliation of adjusted EBITDA and adjusted net income to net income (loss) from continuing operations, adjusted EBITDA % of revenue to net income (loss) from continuing operations % of revenue and adjusted net income per share to net income (loss) per diluted share from continuing operations. See "LendingTree's Principles of Financial Reporting" for further discussion of the Company's use of these non-GAAP measures.

|

| | | | | | | | | |

| Three Months Ended |

| March 31,

2015 | December 31,

2014 | March 31,

2014 |

| | | |

Adjusted EBITDA | $ | 8,936 |

| $ | 6,035 |

| $ | 4,481 |

|

Adjusted EBITDA % of revenue | 18 | % | 14 | % | 11 | % |

Adjustments to reconcile to net income (loss) from continuing operations: | | |

| |

Depreciation | (654 | ) | (704 | ) | (755 | ) |

Amortization of intangibles | (62 | ) | (40 | ) | (28 | ) |

Interest income (expense) | 2 |

| (1 | ) | — |

|

Income tax (expense) benefit | (307 | ) | 398 |

| 1 |

|

Adjusted net income | 7,915 |

| 5,688 |

| 3,699 |

|

| | | |

Non-cash compensation | (2,336 | ) | (2,454 | ) | (1,616 | ) |

Loss on disposal of assets | (28 | ) | (45 | ) | (8 | ) |

Impairment of assets | — |

| (805 | ) | — |

|

Acquisition expense | 150 |

| 54 |

| — |

|

Restructuring and severance | (6 | ) | (141 | ) | (202 | ) |

Litigation settlements and contingencies (1) | (282 | ) | (188 | ) | (7,707 | ) |

Net income (loss) from continuing operations | $ | 5,413 |

| $ | 2,109 |

| $ | (5,834 | ) |

Net income (loss) from continuing operations % of revenue | 11 | % | 5 | % | (15 | )% |

| | | |

Adjusted net income per share | $ | 0.65 |

| $ | 0.47 |

| $ | 0.31 |

|

Adjustments to reconcile adjusted net income to net income (loss) from continuing operations | $ | (0.21 | ) | $ | (0.29 | ) | $ | (0.86 | ) |

Adjustments to reconcile effect of dilutive securities | $ | — |

| $ | — |

| $ | 0.03 |

|

Net income (loss) per diluted share from continuing operations | $ | 0.44 |

| $ | 0.18 |

| $ | (0.52 | ) |

| | | |

Adjusted weighted average diluted shares outstanding | 12,165 |

| 12,031 |

| 11,888 |

|

Effect of dilutive securities | — |

| — |

| 746 |

|

Weighted average diluted shares outstanding | 12,165 |

| 12,031 |

| 11,142 |

|

Effect of dilutive securities | 861 |

| 819 |

| — |

|

Weighted average basic shares outstanding | 11,304 |

| 11,212 |

| 11,142 |

|

|

| |

(1) | Includes legal fees for certain patent litigation. |

LENDINGTREE’S PRINCIPLES OF FINANCIAL REPORTING

LendingTree reports Earnings Before Interest, Taxes, Depreciation and Amortization, as adjusted for certain items discussed below ("Adjusted EBITDA"), Adjusted EBITDA % of revenue, adjusted net income and adjusted net income per share as supplemental measures to GAAP.

Adjusted EBITDA and Adjusted EBITDA % of revenue are primary metrics by which LendingTree evaluates the operating performance of its businesses, on which its marketing expenditures and internal budgets are based and, in the case of adjusted EBITDA, by which management and many employees are compensated. LendingTree believes that investors should have access to the same set of tools that it uses in analyzing its results. LendingTree believes that adjusted net income and adjusted net income per share are useful financial indicators that provide a different view of the financial performance of the Company than adjusted EBITDA (the primary metric by which LendingTree evaluates the operating performance of its businesses) and the GAAP measures of net income (loss) from continuing operations and GAAP income (loss) per diluted share.

Adjusted net income and adjusted net income per share supplement GAAP income (loss) from continuing operations and GAAP income (loss) per diluted share by enabling investors to make period to period comparisons of those components of the nearest comparable GAAP measures that management believes better reflect the underlying financial performance of the Company’s business operations during particular financial reporting periods. Adjusted net income and adjusted net income per share exclude certain amounts, such as non-cash compensation, non-cash asset impairment charges, gain/loss on disposal of assets, restructuring and severance, litigation settlements, contingencies and legal fees for certain patent litigation, and acquisition expenses, which are recognized and recorded under GAAP in particular periods but which might be viewed as not necessarily coinciding with the underlying business operations for the periods in which they are so recognized and recorded.

These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. LendingTree provides and encourages investors to examine the reconciling adjustments between the GAAP and non-GAAP measures set forth above. LendingTree is not able to provide a reconciliation of projected adjusted EBITDA to expected reported results due to the unknown effect, timing and potential significance of the effects of the wind-down of discontinued operations and tax considerations.

Definition of LendingTree's Non-GAAP Measures

EBITDA is defined as operating income or loss (which excludes interest expense and taxes) excluding amortization of intangibles and depreciation.

Adjusted EBITDA is defined as EBITDA excluding (1) non-cash compensation expense, (2) non-cash asset impairment charges, (3) gain/loss on disposal of assets, (4) restructuring and severance expenses, (5) litigation settlements, contingencies and legal fees for certain patent litigation, (6) adjustments for acquisitions or dispositions, and (7) one-time items.

Adjusted net income is defined as net income (loss) from continuing operations excluding (1) non-cash compensation expense, (2) non-cash asset impairment charges, (3) gain/loss on disposal of assets, (4) restructuring and severance expenses, (5) litigation settlements, contingencies and legal fees for certain patent litigation, (6) adjustments for acquisitions or dispositions, and (7) one-time items.

Adjusted net income per share is defined as adjusted net income divided by the adjusted weighted average diluted shares outstanding. In cases where the Company reported GAAP losses from continuing operations, the effects of potentially dilutive securities are excluded from the calculation of net loss per diluted share from continuing operations because their inclusion would have been anti-dilutive. In such instances where the Company reports GAAP net loss from continuing operations but reports positive non-GAAP adjusted net income, the effects of potentially dilutive securities are included in the denominator for calculating adjusted net income per share.

LendingTree endeavors to compensate for the limitations of these non-GAAP measures by also providing the comparable GAAP measures with equal or greater prominence and descriptions of the reconciling items, including quantifying such items, to derive the non-GAAP measures. These non-GAAP measures may not be comparable to similarly titled measures used by other companies.

One-Time Items

Adjusted EBITDA and adjusted net income are adjusted for one-time items, if applicable. Items are considered one-time in nature if they are non-recurring, infrequent or unusual, and have not occurred in the past two years or are not expected to recur in the next two years, in accordance with SEC rules. For the periods presented in this report, there are no adjustments for one-time items.

Non-Cash Expenses That Are Excluded From LendingTree's Adjusted EBITDA and Adjusted Net Income

Non-cash compensation expense consists principally of expense associated with the grants of restricted stock, restricted stock units and stock options. These expenses are not paid in cash and LendingTree includes the related shares in its calculations of fully diluted shares outstanding. Upon settlement of restricted stock units, exercise of certain stock options or vesting of restricted stock awards, the awards may be settled on a net basis, with LendingTree remitting the required tax withholding amounts from its current funds.

Amortization of intangibles are non-cash expenses relating primarily to acquisitions. At the time of an acquisition, the intangible assets of the acquired company, such as purchase agreements, technology and customer relationships, are valued and amortized over their estimated lives. Amortization of intangibles are only excluded from Adjusted EBITDA.

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

The matters contained in the discussion above may be considered to be “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. Those statements include statements regarding the intent, belief or current expectations or anticipations of LendingTree and members of our management team. Factors currently known to management that could cause actual results to differ materially from those in forward-looking statements include the following: adverse conditions in the primary and secondary mortgage markets and in the economy, particularly interest rates; willingness of lenders to make unsecured personal loans and purchase leads for such products from the Company; seasonality of results; potential liabilities to secondary market purchasers; changes in the Company's relationships with network lenders; breaches of network security or the misappropriation or misuse of personal consumer information; failure to provide competitive service; failure to maintain brand recognition; ability to attract and retain customers in a cost-effective manner; ability to develop new products and services and enhance existing ones; competition; allegations of failure to comply with existing or changing laws, rules or regulations, or to obtain and maintain required licenses; failure of network lenders or other affiliated parties to comply with regulatory requirements; failure to maintain the integrity of systems and infrastructure; liabilities as a result of privacy regulations; failure to adequately protect intellectual property rights or allegations of infringement of intellectual property rights; and changes in management. These and additional factors to be considered are set forth under “Risk Factors” in our Annual Report on Form 10-K for the period ended December 31, 2014 and in our other filings with the Securities and Exchange Commission. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results or expectations.

About LendingTree, Inc.

LendingTree, Inc. (NASDAQ: TREE) operates the nation's leading online loan marketplace and provides consumers with an array of online tools and information to help them find the best loans for their needs. LendingTree's online marketplace connects consumers with multiple lenders that compete for their business, empowering consumers as they comparison-shop across a full suite of loans and credit-based offerings. Since its inception, LendingTree has facilitated more than 35 million loan requests. LendingTree provides access to lenders offering home loans, home equity loans/lines of credit, reverse mortgages, personal loans, auto loans, small business loans, credit cards, student loans and more.

LendingTree, Inc. is headquartered in Charlotte, NC and maintains operations solely in the United States. For more information, please visit www.lendingtree.com.

Contacts:

Investor Relations

877-640-4856

investors@lendingtree.com

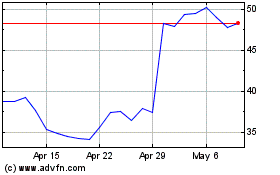

LendingTree (NASDAQ:TREE)

Historical Stock Chart

From Mar 2024 to Apr 2024

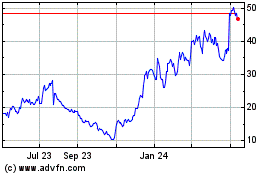

LendingTree (NASDAQ:TREE)

Historical Stock Chart

From Apr 2023 to Apr 2024