US Treasury Begins Two Secondary Public Offerings Of BAC Warrants

March 01 2010 - 4:50PM

Dow Jones News

The U.S. Treasury Dept. is poised to earn more than $1 billion

this week auctioning warrants in the nation's largest bank by

deposits.

The Treasury Dept. on Monday announced it would auction warrants

it obtained by rescuing the Bank of America Corp. (BAC) in 2008 and

2009 on Wednesday.

Treasury owns two separate blocks of warrants in Bank of

America.

Treasury plans to start bidding for 150.4 million warrants with

a strike price of $13.30 a share at $7.00 each. It plans to start

bidding on 121.8 million shares with a strike price of $30.79 at $7

each.

Taxpayers earned more than $1 billion in December when Treasury

auctioned warrants in three banks, including J.P. Morgan Chase

& Co. (JPM). The gain could be higher in this round of four

auctions headlined by Bank of America.

Warrants are essentially options with much longer exercise

periods--nine years in the case of these bank warrants. They give

the holder the right to buy common shares at a set price in the

future.

Linus Wilson, professor of finance at the University of

Louisiana, estimates the first 121 million warrants have modest

value of between $1.65 and $5, with a mid-range value of $2.90.

The second block of 150 million warrants is much more valuable,

according to Wilson. He estimates these warrants are worth between

$5.31 and $9.08, with a mid-range value of $6.87.

Combined, the two blocks of warrants are worth between $1

billion and $1.9 billion with a mid-range value of $1.3 billion, he

estimates.

In its annual report filed Friday, Bank of America discussed its

$45 billion federal Troubled Asset Relief Program, or TARP,

investment and said it expected the Treasury Dept. to auction its

warrants soon.

By comparison, Wells Fargo & Co. (WFC), which also filed its

annual report last week, didn't mention an auction. Wells Fargo

repaid its $25 billion TARP investment at nearly the same time as

Bank of America, but its annual filing only says that "Treasury

continues to hold the warrant."

In addition to Bank of America, Treasury has disclosed its

intent to sell warrants in three smaller banks: Texas Capital

Bancshares Inc. (TCBI), Signature Bank New York (SBNY), and

Washington Federal Inc. (WFSL) of Seattle.

Wilson estimates the mid-range of value for the warrants in

Texas Bancshares at about $4.3 million, Signature Bank $7.9 million

and Washington Federal at $11.2 million.

-By Meena Thiruvengadam and Steven D. Jones, Dow Jones

Newswires; 202-862-6629; meena.thiruvengadam@dowjones.com

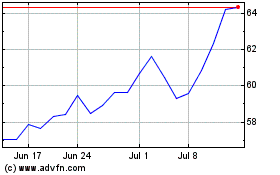

Texas Capital Bancshares (NASDAQ:TCBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

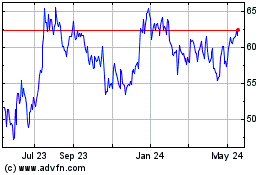

Texas Capital Bancshares (NASDAQ:TCBI)

Historical Stock Chart

From Apr 2023 to Apr 2024