The Bancorp Releases Finetics™ Studio Interview Series: “The Shift from Traditional Banking”

February 22 2016 - 8:00AM

Business Wire

Exclusive Interviews Feature Ben Katz, Ryan Caldwell, Hamed

Shahbazi, Lars Sandtorv and Pete Chiccino

The Bancorp, Inc. (NASDAQ: TBBK), today announces the release of

its next Finetics™ Studio interview series: “The Shift from

Traditional Banking” featuring Ben Katz, CEO and Founder, Card.com;

Ryan Caldwell, Founder and CEO, MX; Hamed Shahbazi, CEO, TIO

Networks; Lars Sandtorv, CEO, MeaWallet; and Pete Chiccino,

Executive Vice President and Chief Information Officer, The

Bancorp.

Filmed from the Money20/20 show floor, the exclusive videos

focus on the widespread shift away from traditional banking

solutions and products as more innovative alternative banking

providers enter the market.

“Historically, there hasn’t been a lot of choice for consumers

in terms of banking so they didn’t have a lot of power and banks

and credit unions didn’t have to cater to and worry about taking

care of consumers as a result,” said Caldwell. “But the shift we

are going to see as more entrants bring innovation to the market is

that banks are going to have to become obsessed with figuring out

how to deliver more value to their end users. And if they don’t

figure that out, their customers will just pick up and go somewhere

else.”

“There are 90,000 branches in the United States, but the top

five banks only control about 30,000 of those. So, there are 60,000

community banks that are going to have a hard time surviving, in

the same way regional booksellers have struggled with the

introduction of Amazon,” added Katz. “So, if you’re a community

bank who isn’t the best lender in your community and is just

surviving on consumer deposits, you’re toast because I can service

the customer better and for 80 percent less.”

In addition to alternative banking solutions, mobile payments

and mobile banking were a key focus of conversation in the studio,

including predictions for the future of mobile technology in

financial services.

“When you look over the history of technology change, there

hasn’t been any technology that has changed and been adopted as

quickly as mobile has and that makes the future possibilities for

mobile banking very exciting,” said Chiccino.

“I think the proliferation of mobile will play a huge role in

increasing financial inclusion and there’s a lot of literature out

there that demonstrates that the underbanked have a higher degree

of penetration in smartphones than higher income groups,” added

Shahbazi. “But I do think there is still an opportunity for service

providers to create those compelling, simple and powerful

experiences for end users in the way Apple does. And I think the

major disruptors that you’ll see pole vault in the marketplace are

going to be the ones that are able to create solutions that are

increasingly simple and easy.”

The release of these videos supports The Bancorp’s Finetics™

Studio video series, which features exclusive, one-on-one

conversations with more than 30 of the financial services

industry’s most influential and innovative executives, launched

late last year.

The interviews, conducted by Sarah Gill, senior reporter with

PaymentEye, cover topics ranging from the future of payments

innovation to regulation and fraud and will be released on The

Bancorp’s fineticsblog.com throughout early 2016.

Finetics™ Studio participants include the following

executives:

- Rene Lacerte, CEO and Founder,

Bill.com

- Talbott Roche, President, Blackhawk

Network

- Ben Katz, CEO and Founder,

Card.com

- Robert Carr, Founder, Chairman and CEO,

Heartland Payment Systems

- Brent Warrington, CEO, Hyperwallet

- Lars Sandtorv, CEO, MeaWallet

- Hamed Shahbazi, CEO, TIO Networks

- Stefan Happ, Executive Vice President,

Global Prepaid and Alternative Payments, American Express

- Janet O. Estep, CEO, NACHA—The

Electronic Payments Association

- Brad Fauss, President and CEO, Network

Branded Prepaid Card Association

- Tony Craddock, Director General,

Emerging Payments Association

- Cherian Abraham, Mobile Payments &

Commerce, Experian Plc.

- Dan Rosen, Founder and General Partner,

Commerce Ventures

- Suresh Vaghjiani, Executive Vice

President, Global Processing Services (GPS)

- Barrie VanBrackle, Partner and Payments

Specialist, Manatt, Phelps and Phillips

- Marilyn Bochicchio, CEO and Founder,

Hidden Brain

- Chris Byrd, Executive Vice

President–Healthcare Operations Officer, Evolution1

- Rahul Gupta, Group President, Billing

and Payments, Fiserv

- Julie Conroy, Research Director, Aite

Group

- Peter Read, President, Peoples Card

Services

- Kenneth M. Goins, Jr., Vice Chairman,

Brightwell Payments

- Render Dahiya, CEO, Arroweye

Solutions

- Sean Rodriguez, Faster Payments

Strategy Leader and Senior Vice President, Federal Reserve

System

- Steve Kirsch, CEO, Token

- Ryan Caldwell, Founder and CEO, MX

- Anil Aggarwal, Founder and Chairman,

Money20/20

- Pat Patel, Content Director, Money20/20

Europe

- Pawneet Abramowski, Senior Vice

President, Director AML & Sanctions Risk Management, The

Bancorp

- Jeremy Kuiper, Managing Director,

Payment Solutions, The Bancorp

- Frank Mastrangelo, Technologist in

Residence, The Bancorp

- Matt Carberry, Vice President Business

Development, Payments, The Bancorp

- Gail Ball, Executive Vice President and

Chief Operating Officer, The Bancorp

- Pete Chiccino, Executive Vice President

and Chief Information Officer, The Bancorp

- Kriya Patel, Managing Director, Payment

Solutions, Europe, The Bancorp

- Charles Crawford, Senior Vice

President, Payments Acceptance, The Bancorp

About The Bancorp

With operations in the US and Europe, The Bancorp, Inc. (NASDAQ:

TBBK) is dedicated to serving the unique needs of non-bank

financial service companies, ranging from entrepreneurial start-ups

to those on the Fortune 500. The company’s chief financial

institution, The Bancorp Bank (Member FDIC, Equal Housing Lender),

has been repeatedly recognized in the payments industry as the Top

Issuer of Prepaid Cards (US), a top merchant sponsor bank, and a

top ACH originator. Specialized lending distinctions include

National Preferred SBA Lender, a leading provider of

securities-backed lines of credit, and one of the few bank-owned

commercial leasing groups in the

nation. thebancorp.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160222005382/en/

Press:The Bancorp Finetics™ StudioSarah Nickell,

720-726-5454Communications Strategy

Groupsnickell@csg-pr.comorThe Bancorp, Inc. Investor

RelationsAndres Viroslav,

215-861-7990aviroslav@thebancorp.com

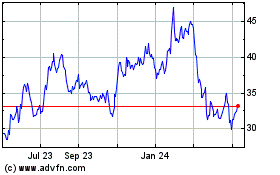

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

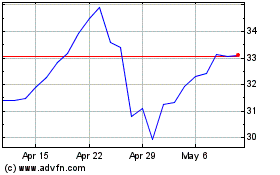

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Apr 2023 to Apr 2024