Current Report Filing (8-k)

February 01 2016 - 8:50AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): 2/1/2016

The Bancorp, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 000-51018

|

Delaware

|

|

23-3016517

|

|

(State or other jurisdiction of

|

|

(IRS Employer

|

|

incorporation)

|

|

Identification No.)

|

409 Silverside Road

Wilmington, DE 19809

(Address of principal executive offices, including zip code)

302-385-5000

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

On February 1, 2016, The Bancorp, Inc. (the "Company") issued a press release regarding its earnings for the three and twelve months ended December 31, 2015. A copy of this press release is furnished with this report as exhibit 99.1. The information in this Current Report, including the exhibit hereto, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

The exhibit furnished as part of this Current Report on Form 8-K is identified in the Exhibit Index immediately following the signature page of this report. Such Exhibit Index is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

The Bancorp, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: February 1, 2016

|

|

|

|

By:

|

|

/s/Paul Frenkiel

|

|

|

|

|

|

|

|

|

|

Paul Frenkiel

|

|

|

|

|

|

|

|

|

|

Chief Financial Officer and Secretary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

EX-99.1

|

|

|

Exhibit 99.1

The Bancorp, Inc. Reports Fourth Quarter and Fiscal 2015 Financial Results

Wilmington, DE – February 1, 2016 – The Bancorp, Inc. ("Bancorp") (NASDAQ: TBBK), a financial holding company, today reported financial results for fourth quarter and fiscal 2015.

Bancorp reported net income of $19.6 million or diluted earnings per share of $0.52 for fourth quarter 2015 compared to net income of $20.2 million or $0.52 earnings per diluted share in fourth quarter 2014. Year to date net income was $14.4 million or diluted earnings per share of $0.38 for 2015 compared to net income of $57.1 million or $1.49 earnings per diluted share in 2014. Net income from continuing operations for fourth quarter 2015 was $19.1 million or $0.51 per diluted share compared to net income of $11.1 million or $0.30 per diluted share in fourth quarter 2014. Income from continuing operations does not include any income which may result upon the reinvestment of the proceeds of sales we are pursuing from the approximately $568.3 million of commercial and residential loans in the Bancorp's discontinued operations.

Financial Highlights

Continuing Operations:

|

•

|

Gain of $33.5 million on the sale of the majority of the health savings account ("H.S.A.") administration business.

|

|

•

|

Gain of $14.5 million on sales of tax exempt securities for tax planning purposes.

|

|

•

|

Increases over prior year loan balances in security-backed lines of credit ("SBLOC") 37%, Small Business Administration ("SBA") 45% and Leasing 19%.

|

|

•

|

18% increase in net interest income to $18.6 million in fourth quarter 2015 compared to $15.7 million in fourth quarter 2014.

|

|

•

|

Regulatory lookback expense of $14.8 million.*

|

|

•

|

Loans and continuing operations loans held for sale totaled $1.57 billion at December 31, 2015 compared to $1.09 billion at December 31, 2014, a 44% increase.

|

|

•

|

Tier one capital to assets, tier one capital to risk-weighted assets, total capital to risk-weighted assets and common equity-tier 1 were 7.21%, 14.74%, 14.93% and 14.74%, compared to well capitalized minimums of 5%, 8%, 10% and 6.5%.

|

John Chrystal, Bancorp's Interim Chief Executive Officer, said, "The fourth quarter continued to show progress in the transition to what we believe, and our historical results evidence, are better performing lines of business. Our portfolio loans exceeded the $1 billion threshold at year end 2015, with a 44% increase over the prior year end for the total of portfolio loans and loans held for sale. We earn carry interest on loans held for sale until such loans are sold. This growth was achieved in loan segments with historically low loan losses, which continued to be the case in 2015. Growth in those SBLOC, SBA, and Leasing segments drove a net interest income increase of 18% to $18.6 million for the quarter. Prepaid and payment sponsorship fee income, our principal non-interest income driver, reflected an exited relationship and other factors; however, we believe that year over year increases will result in 2016. During the quarter we sold the majority of our health savings account ("H.S.A.") administration business and approximately $385 million of related deposits with higher interest costs than the majority of our other deposits. With expense savings, this exit is projected to be accretive. Those H.S.A. client relationships were sold at a gain of $33.5 million. Additionally during the quarter, we sold approximately $400 million of tax exempt municipal securities to accelerate the Bank's utilization of deferred tax assets. The majority of the sales proceeds have been reinvested in taxable securities with slightly higher rates and lower duration. The balance of the sales proceeds are anticipated to be similarly invested by the end of first quarter 2016. The gains on the H.S.A. and the investment securities sales also increased our regulatory capital ratios. The H.S.A. deposit exit reduced excess balances maintained at the Federal Reserve Bank ("FRB"). While that reduction was partially offset by other deposit increases, future scheduled deposit exits are projected to further reduce balances maintained at the FRB in 2016. These balances earn relatively low rates of interest and increase average assets thereby lowering capital ratios. The deposits being exited do not have significant impact on profitability, nor do they provide opportunities for future non interest income.

While the lookback consultant has continued to make progress toward final completion, costs continue to be in excess of estimates and amounted to $14.8 million during the quarter. Based on estimates by the consultant, this work should be complete sometime in the second quarter of 2016.

Book value per common share at December 31, 2015 amounted to $8.50 compared to $8.46 at December 31, 2014. The Bancorp and its subsidiary, The Bancorp Bank, remain well capitalized."

|

Non-recurring income/expense

|

|

Three months ended

|

|

|

Year ended

|

|

| |

|

December 31, 2015

|

|

|

December 31, 2015

|

|

| |

|

(dollars in thousands)

|

|

|

Pre-tax income - continuing operations

|

|

$

|

31,156

|

|

|

$

|

8,416

|

|

|

Pre-tax income - discontinued operations

|

|

|

3,607

|

|

|

|

13,800

|

|

| |

|

|

|

|

|

|

|

|

|

Continuing operations

|

|

|

|

|

|

|

|

|

|

Gain on sale of health savings portfolio

|

|

|

(33,531

|

)

|

|

|

(33,531

|

)

|

|

Gain on sale of securities

|

|

|

(14,497

|

)

|

|

|

(14,435

|

)

|

|

Gain on sale of warrants

|

|

|

(2,691

|

)

|

|

|

(2,691

|

)

|

|

BSA consultant and lookback fees *

|

|

|

14,801

|

|

|

|

41,444

|

|

|

Civil money penalty

|

|

|

3,000

|

|

|

|

3,000

|

|

|

Additional FDIC assessment

|

|

|

920

|

|

|

|

920

|

|

|

Severance for health savings division

|

|

|

550

|

|

|

|

550

|

|

|

Regulatory/governance related legal fees

|

|

|

603

|

|

|

|

2,292

|

|

|

Discontinued operations

|

|

|

|

|

|

|

|

|

|

Restatement related audit fees

|

|

|

-

|

|

|

|

2,560

|

|

|

Other real estate owned expense

|

|

|

1,423

|

|

|

|

3,199

|

|

|

Pre-tax income after analysis of non-recurring income/expense

|

|

$

|

5,341

|

|

|

$

|

25,524

|

|

| |

|

|

|

|

|

|

|

|

|

* Lookback expense is being incurred to analyze historical transactions for compliance with suspicious activity reporting requirements.

|

|

Conference Call Webcast

You may access the LIVE webcast of Bancorp's Quarterly Earnings Conference Call at 10:00 AM ET Monday, February 1, 2016 by clicking on the webcast link on Bancorp's homepage at www.thebancorp.com. Or, you may dial 877.787.4143, access code 31514831. You may listen to the replay of the webcast following the live call on Bancorp's investor relations website or telephonically until Monday, February 8, 2016 by dialing 855.859.2056, access code 31514831.

About Bancorp

With operations in the US and Europe, The Bancorp, Inc. (NASDAQ: TBBK) is dedicated to serving the unique needs of non-bank financial service companies, ranging from entrepreneurial start-ups to those on the Fortune 500. The company's chief financial institution, The Bancorp Bank (Member FDIC, Equal Housing Lender), has been repeatedly recognized in the payments industry as the Top Issuer of Prepaid Cards (US), a top merchant sponsor bank, and a top ACH originator. Specialized lending distinctions include National Preferred SBA Lender, a leading provider of securities-backed lines of credit, and one of the few bank-owned commercial leasing groups in the nation. For more information please visit www.thebancorp.com.

Forward-Looking Statements

Statements in this earnings release regarding Bancorp's business which are not historical facts are "forward-looking statements" that involve risks and uncertainties. These statements may be identified by the use of forward-looking terminology, including but not limited to the words "may," "believe," "will," "expect," "look," "anticipate," "estimate," "continue," or similar words. For further discussion of the risks and uncertainties to which these forward-looking statements may be subject, see Bancorp's filings with the SEC, including the "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of those filings. These risks and uncertainties could cause actual results to differ materially from those projected in the forward-looking statements. The forward-looking statements speak only as of the date of this press release. The Bancorp does not undertake to publicly revise or update forward-looking statements in this press release to reflect events or circumstances that arise after the date of this presentation, except as may be required under applicable law.

The Bancorp, Inc. Contact

Andres Viroslav

215-861-7990

aviroslav@thebancorp.com

|

The Bancorp, Inc.

|

|

|

Financial highlights

|

|

|

(unaudited)

|

|

| |

|

Three months ended

|

|

|

Year ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

|

Condensed income statement

|

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

| |

|

(dollars in thousands except per share data)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

$

|

18,582

|

|

|

$

|

15,715

|

|

|

$

|

69,931

|

|

|

$

|

59,425

|

|

|

Provision for loan and lease losses

|

|

|

300

|

|

|

|

(1,404

|

)

|

|

|

2,100

|

|

|

|

1,202

|

|

|

Non-interest income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service fees on deposit accounts

|

|

|

1,889

|

|

|

|

2,060

|

|

|

|

7,468

|

|

|

|

6,339

|

|

|

Card payment and ACH processing fees

|

|

|

1,489

|

|

|

|

1,413

|

|

|

|

5,731

|

|

|

|

5,402

|

|

|

Prepaid card fees

|

|

|

11,744

|

|

|

|

12,614

|

|

|

|

47,496

|

|

|

|

51,287

|

|

|

Gain (loss) on sale of loans

|

|

|

3,333

|

|

|

|

(926

|

)

|

|

|

10,080

|

|

|

|

12,542

|

|

|

Gain on sale of investment securities

|

|

|

14,497

|

|

|

|

85

|

|

|

|

14,435

|

|

|

|

450

|

|

|

Gain on sale of health savings portfolio

|

|

|

33,531

|

|

|

|

-

|

|

|

|

33,531

|

|

|

|

-

|

|

|

Leasing income

|

|

|

367

|

|

|

|

663

|

|

|

|

2,094

|

|

|

|

2,899

|

|

|

Debit card income

|

|

|

253

|

|

|

|

383

|

|

|

|

1,611

|

|

|

|

1,679

|

|

|

Affinity fees

|

|

|

967

|

|

|

|

745

|

|

|

|

3,358

|

|

|

|

2,596

|

|

|

Other non-interest income

|

|

|

4,430

|

|

|

|

638

|

|

|

|

9,496

|

|

|

|

1,855

|

|

|

Total non-interest income

|

|

|

72,500

|

|

|

|

17,675

|

|

|

|

135,300

|

|

|

|

85,049

|

|

|

Non-interest expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank Secrecy Act and lookback consulting expenses

|

|

|

14,801

|

|

|

|

3,883

|

|

|

|

41,444

|

|

|

|

8,801

|

|

|

Other non-interest expense

|

|

|

44,825

|

|

|

|

33,745

|

|

|

|

153,271

|

|

|

|

127,179

|

|

|

Total non-interest expense

|

|

|

59,626

|

|

|

|

37,628

|

|

|

|

194,715

|

|

|

|

135,980

|

|

|

Income (loss) from continuing operations before income tax expense

|

|

|

31,156

|

|

|

|

(2,834

|

)

|

|

|

8,416

|

|

|

|

7,292

|

|

|

Income tax expense (benefit)

|

|

|

12,082

|

|

|

|

(13,929

|

)

|

|

|

1,265

|

|

|

|

(14,523

|

)

|

|

Net income from continuing operations

|

|

|

19,074

|

|

|

|

11,095

|

|

|

|

7,151

|

|

|

|

21,815

|

|

|

Net income from discontinued operations, net of tax

|

|

|

498

|

|

|

|

9,096

|

|

|

|

7,234

|

|

|

|

35,294

|

|

|

Net income available to common shareholders

|

|

$

|

19,572

|

|

|

$

|

20,191

|

|

|

$

|

14,385

|

|

|

$

|

57,109

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share from continuing operations - basic

|

|

$

|

0.51

|

|

|

$

|

0.31

|

|

|

$

|

0.19

|

|

|

$

|

0.58

|

|

|

Net income per share from discontinued operations - basic

|

|

$

|

0.01

|

|

|

$

|

0.24

|

|

|

$

|

0.19

|

|

|

$

|

0.94

|

|

|

Net income per share - basic

|

|

$

|

0.52

|

|

|

$

|

0.55

|

|

|

$

|

0.38

|

|

|

$

|

1.52

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share from continuing operations - diluted

|

|

$

|

0.51

|

|

|

$

|

0.30

|

|

|

$

|

0.19

|

|

|

$

|

0.57

|

|

|

Net income per share from discontinued operations - diluted

|

|

$

|

0.01

|

|

|

$

|

0.22

|

|

|

$

|

0.19

|

|

|

$

|

0.92

|

|

|

Net income per share - diluted

|

|

$

|

0.52

|

|

|

$

|

0.52

|

|

|

$

|

0.38

|

|

|

$

|

1.49

|

|

|

Common stock shares outstanding

|

|

|

37,861,303

|

|

|

|

37,808,777

|

|

|

|

37,861,303

|

|

|

|

37,808,777

|

|

|

Balance sheet

|

|

December 31,

|

|

|

September 30,

|

|

|

June 30,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2015

|

|

|

2015

|

|

|

2014

|

|

| |

|

(dollars in thousands)

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks

|

|

$

|

7,643

|

|

|

$

|

4,002

|

|

|

$

|

13,269

|

|

|

$

|

8,665

|

|

|

Interest earning deposits at Federal Reserve Bank

|

|

|

1,147,519

|

|

|

|

995,441

|

|

|

|

936,989

|

|

|

|

1,059,320

|

|

|

Securities sold under agreements to resell

|

|

|

-

|

|

|

|

37,970

|

|

|

|

40,068

|

|

|

|

46,250

|

|

|

Total cash and cash equivalents

|

|

|

1,155,162

|

|

|

|

1,037,413

|

|

|

|

990,326

|

|

|

|

1,114,235

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment securities, available-for-sale, at fair value

|

|

|

1,070,098

|

|

|

|

1,316,705

|

|

|

|

1,370,027

|

|

|

|

1,493,639

|

|

|

Investment securities, held-to-maturity

|

|

|

93,590

|

|

|

|

93,604

|

|

|

|

93,649

|

|

|

|

93,765

|

|

|

Loans held for sale, at fair value

|

|

|

489,938

|

|

|

|

354,600

|

|

|

|

284,501

|

|

|

|

217,080

|

|

|

Loans, net of deferred fees and costs

|

|

|

1,078,077

|

|

|

|

994,518

|

|

|

|

968,033

|

|

|

|

874,593

|

|

|

Allowance for loan and lease losses

|

|

|

(4,400

|

)

|

|

|

(4,194

|

)

|

|

|

(4,352

|

)

|

|

|

(3,638

|

)

|

|

Loans, net

|

|

|

1,073,677

|

|

|

|

990,324

|

|

|

|

963,681

|

|

|

|

870,955

|

|

|

Federal Home Loan Bank & Atlantic Central Bankers Bank stock

|

|

|

1,062

|

|

|

|

1,063

|

|

|

|

1,063

|

|

|

|

1,002

|

|

|

Premises and equipment, net

|

|

|

21,631

|

|

|

|

18,893

|

|

|

|

19,271

|

|

|

|

17,697

|

|

|

Accrued interest receivable

|

|

|

9,471

|

|

|

|

11,232

|

|

|

|

11,526

|

|

|

|

11,251

|

|

|

Intangible assets, net

|

|

|

4,929

|

|

|

|

5,248

|

|

|

|

5,541

|

|

|

|

6,228

|

|

|

Deferred tax asset, net

|

|

|

35,457

|

|

|

|

33,857

|

|

|

|

35,874

|

|

|

|

33,673

|

|

|

Investment in unconsolidated entity

|

|

|

180,950

|

|

|

|

186,656

|

|

|

|

187,186

|

|

|

|

193,595

|

|

|

Assets held for sale

|

|

|

584,916

|

|

|

|

611,729

|

|

|

|

651,158

|

|

|

|

887,929

|

|

|

Other assets

|

|

|

46,806

|

|

|

|

53,123

|

|

|

|

43,804

|

|

|

|

45,268

|

|

|

Total assets

|

|

$

|

4,767,687

|

|

|

$

|

4,714,447

|

|

|

$

|

4,657,607

|

|

|

$

|

4,986,317

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand and interest checking

|

|

$

|

3,602,376

|

|

|

$

|

4,002,638

|

|

|

$

|

3,993,393

|

|

|

$

|

4,289,586

|

|

|

Savings and money market

|

|

|

383,832

|

|

|

|

376,577

|

|

|

|

321,264

|

|

|

|

330,798

|

|

|

Time deposits

|

|

|

428,549

|

|

|

|

-

|

|

|

|

1,400

|

|

|

|

1,400

|

|

|

Total deposits

|

|

|

4,414,757

|

|

|

|

4,379,215

|

|

|

|

4,316,057

|

|

|

|

4,621,784

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities sold under agreements to repurchase

|

|

|

925

|

|

|

|

1,034

|

|

|

|

2,357

|

|

|

|

19,414

|

|

|

Subordinated debenture

|

|

|

13,401

|

|

|

|

13,401

|

|

|

|

13,401

|

|

|

|

13,401

|

|

|

Other liabilities

|

|

|

17,649

|

|

|

|

7,100

|

|

|

|

10,038

|

|

|

|

12,695

|

|

|

Total liabilities

|

|

$

|

4,446,732

|

|

|

$

|

4,400,750

|

|

|

$

|

4,341,853

|

|

|

$

|

4,667,294

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock - authorized, 50,000,000 shares of $1.00 par value; 37,861,303 and 37,808,777 shares issued at December 31, 2015 and 2014, respectively

|

|

|

37,861

|

|

|

|

37,858

|

|

|

|

37,858

|

|

|

|

37,809

|

|

|

Treasury stock (100,000 shares)

|

|

|

(866

|

)

|

|

|

(866

|

)

|

|

|

(866

|

)

|

|

|

(866

|

)

|

|

Additional paid-in capital

|

|

|

300,549

|

|

|

|

299,470

|

|

|

|

298,978

|

|

|

|

297,987

|

|

|

Accumulated deficit

|

|

|

(14,495

|

)

|

|

|

(33,429

|

)

|

|

|

(27,854

|

)

|

|

|

(28,242

|

)

|

|

Accumulated other comprehensive income (loss)

|

|

|

(2,094

|

)

|

|

|

10,664

|

|

|

|

7,638

|

|

|

|

12,335

|

|

|

Total shareholders' equity

|

|

|

320,955

|

|

|

|

313,697

|

|

|

|

315,754

|

|

|

|

319,023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity

|

|

$

|

4,767,687

|

|

|

$

|

4,714,447

|

|

|

$

|

4,657,607

|

|

|

$

|

4,986,317

|

|

|

Average balance sheet and net interest income

|

|

Three months ended December 31, 2015

|

|

|

Three months ended December 31, 2014

|

|

| |

|

(dollars in thousands)

|

|

| |

|

Average

|

|

|

|

|

|

Average

|

|

|

Average

|

|

|

|

|

|

Average

|

|

|

Assets:

|

|

Balance

|

|

|

Interest

|

|

|

Rate

|

|

|

Balance

|

|

|

Interest

|

|

|

Rate

|

|

|

Interest-earning assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans net of unearned fees and costs **

|

|

$

|

1,416,176

|

|

|

$

|

14,502

|

|

|

|

4.10

|

%

|

|

$

|

1,036,760

|

|

|

$

|

9,869

|

|

|

|

3.81

|

%

|

|

Leases - bank qualified*

|

|

|

28,658

|

|

|

|

487

|

|

|

|

6.80

|

%

|

|

|

16,341

|

|

|

|

229

|

|

|

|

5.61

|

%

|

|

Investment securities-taxable

|

|

|

1,022,914

|

|

|

|

5,290

|

|

|

|

2.07

|

%

|

|

|

1,014,491

|

|

|

|

4,859

|

|

|

|

1.92

|

%

|

|

Investment securities-nontaxable*

|

|

|

248,662

|

|

|

|

2,203

|

|

|

|

3.54

|

%

|

|

|

530,431

|

|

|

|

4,843

|

|

|

|

3.65

|

%

|

|

Interest earning deposits at Federal Reserve Bank

|

|

|

751,126

|

|

|

|

595

|

|

|

|

0.32

|

%

|

|

|

504,612

|

|

|

|

332

|

|

|

|

0.26

|

%

|

|

Federal funds sold and securities purchased under agreement to resell

|

|

|

31,406

|

|

|

|

113

|

|

|

|

1.44

|

%

|

|

|

49,250

|

|

|

|

166

|

|

|

|

1.35

|

%

|

|

Net interest earning assets

|

|

|

3,498,942

|

|

|

|

23,190

|

|

|

|

2.65

|

%

|

|

|

3,151,885

|

|

|

|

20,298

|

|

|

|

2.58

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan and lease losses

|

|

|

(4,178

|

)

|

|

|

|

|

|

|

|

|

|

|

(8,028

|

)

|

|

|

|

|

|

|

|

|

|

Assets held for sale

|

|

|

617,983

|

|

|

|

6,650

|

|

|

|

4.30

|

%

|

|

|

1,234,255

|

|

|

|

11,161

|

|

|

|

3.62

|

%

|

|

Other assets

|

|

|

322,901

|

|

|

|

|

|

|

|

|

|

|

|

28,509

|

|

|

|

|

|

|

|

|

|

| |

|

$

|

4,435,648

|

|

|

|

|

|

|

|

|

|

|

$

|

4,406,621

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand and interest checking

|

|

$

|

3,518,223

|

|

|

$

|

2,689

|

|

|

|

0.31

|

%

|

|

$

|

3,709,957

|

|

|

$

|

2,302

|

|

|

|

0.25

|

%

|

|

Savings and money market

|

|

|

378,301

|

|

|

|

581

|

|

|

|

0.61

|

%

|

|

|

323,101

|

|

|

|

345

|

|

|

|

0.43

|

%

|

|

Time

|

|

|

174,530

|

|

|

|

263

|

|

|

|

0.60

|

%

|

|

|

3,077

|

|

|

|

13

|

|

|

|

1.69

|

%

|

|

Total deposits

|

|

|

4,071,054

|

|

|

|

3,533

|

|

|

|

0.35

|

%

|

|

|

4,036,135

|

|

|

|

2,660

|

|

|

|

0.26

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term borrowings

|

|

|

18,152

|

|

|

|

12

|

|

|

|

0.26

|

%

|

|

|

-

|

|

|

|

-

|

|

|

|

0.00

|

%

|

|

Repurchase agreements

|

|

|

1,148

|

|

|

|

1

|

|

|

|

0.35

|

%

|

|

|

18,191

|

|

|

|

13

|

|

|

|

0.29

|

%

|

|

Subordinated debt

|

|

|

13,401

|

|

|

|

120

|

|

|

|

3.58

|

%

|

|

|

13,401

|

|

|

|

135

|

|

|

|

4.03

|

%

|

|

Total deposits and interest bearing liabilities

|

|

|

4,103,755

|

|

|

|

3,666

|

|

|

|

0.36

|

%

|

|

|

4,067,727

|

|

|

|

2,808

|

|

|

|

0.28

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other liabilities

|

|

|

13,313

|

|

|

|

|

|

|

|

|

|

|

|

20,884

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

4,117,068

|

|

|

|

|

|

|

|

|

|

|

|

4,088,611

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity

|

|

|

318,580

|

|

|

|

|

|

|

|

|

|

|

|

318,010

|

|

|

|

|

|

|

|

|

|

| |

|

$

|

4,435,648

|

|

|

|

|

|

|

|

|

|

|

$

|

4,406,621

|

|

|

|

|

|

|

|

|

|

|

Net interest income on tax equivalent basis*

|

|

|

|

|

|

$

|

26,174

|

|

|

|

|

|

|

|

|

|

|

$

|

28,651

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax equivalent adjustment

|

|

|

|

|

|

|

942

|

|

|

|

|

|

|

|

|

|

|

|

1,775

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

|

|

|

|

$

|

25,232

|

|

|

|

|

|

|

|

|

|

|

$

|

26,876

|

|

|

|

|

|

|

Net interest margin *

|

|

|

|

|

|

|

|

|

|

|

2.52

|

%

|

|

|

|

|

|

|

|

|

|

|

2.62

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Full taxable equivalent basis, using a 35% statutory tax rate.

|

|

|

** Includes loans held for sale.

|

|

|

|

Average balance sheet and net interest income

|

|

Year ended December 31, 2015

|

|

|

Year ended December 31, 2014

|

|

| |

|

(dollars in thousands)

|

|

| |

|

Average

|

|

|

|

|

|

Average

|

|

|

Average

|

|

|

|

|

|

Average

|

|

|

Assets:

|

|

Balance

|

|

|

Interest

|

|

|

Rate

|

|

|

Balance

|

|

|

Interest

|

|

|

Rate

|

|

|

Interest-earning assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans net of unearned fees and costs **

|

|

$

|

1,245,189

|

|

|

$

|

48,733

|

|

|

|

3.91

|

%

|

|

$

|

903,681

|

|

|

$

|

35,849

|

|

|

|

3.97

|

%

|

|

Leases - bank qualified*

|

|

|

25,126

|

|

|

|

1,734

|

|

|

|

6.90

|

%

|

|

|

17,400

|

|

|

|

938

|

|

|

|

5.39

|

%

|

|

Investment securities-taxable

|

|

|

989,705

|

|

|

|

19,918

|

|

|

|

2.01

|

%

|

|

|

1,031,584

|

|

|

|

20,662

|

|

|

|

2.00

|

%

|

|

Investment securities-nontaxable*

|

|

|

452,526

|

|

|

|

16,646

|

|

|

|

3.68

|

%

|

|

|

477,384

|

|

|

|

17,454

|

|

|

|

3.66

|

%

|

|

Interest earning deposits at Federal Reserve Bank

|

|

|

935,093

|

|

|

|

2,354

|

|

|

|

0.25

|

%

|

|

|

720,240

|

|

|

|

1,792

|

|

|

|

0.25

|

%

|

|

Federal funds sold and securities purchased under agreement to resell

|

|

|

40,402

|

|

|

|

578

|

|

|

|

1.43

|

%

|

|

|

33,814

|

|

|

|

462

|

|

|

|

1.37

|

%

|

|

Net interest-earning assets

|

|

|

3,688,041

|

|

|

|

89,963

|

|

|

|

2.44

|

%

|

|

|

3,184,103

|

|

|

|

77,157

|

|

|

|

2.42

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan and lease losses

|

|

|

(4,111

|

)

|

|

|

|

|

|

|

|

|

|

|

(3,521

|

)

|

|

|

|

|

|

|

|

|

|

Assets held for sale

|

|

|

715,116

|

|

|

|

28,925

|

|

|

|

4.04

|

%

|

|

|

1,162,319

|

|

|

|

49,891

|

|

|

|

4.29

|

%

|

|

Other assets

|

|

|

313,232

|

|

|

|

|

|

|

|

|

|

|

|

109,888

|

|

|

|

|

|

|

|

|

|

| |

|

$

|

4,712,278

|

|

|

|

|

|

|

|

|

|

|

$

|

4,452,789

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand and interest checking

|

|

$

|

3,975,475

|

|

|

$

|

10,982

|

|

|

|

0.28

|

%

|

|

$

|

3,746,958

|

|

|

$

|

9,097

|

|

|

|

0.24

|

%

|

|

Savings and money market

|

|

|

337,168

|

|

|

|

1,867

|

|

|

|

0.55

|

%

|

|

|

366,160

|

|

|

|

1,574

|

|

|

|

0.43

|

%

|

|

Time

|

|

|

44,789

|

|

|

|

275

|

|

|

|

0.61

|

%

|

|

|

7,974

|

|

|

|

96

|

|

|

|

1.20

|

%

|

|

Total deposits

|

|

|

4,357,432

|

|

|

|

13,124

|

|

|

|

0.30

|

%

|

|

|

4,121,092

|

|

|

|

10,767

|

|

|

|

0.26

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term borrowings

|

|

|

4,575

|

|

|

|

12

|

|

|

|

0.26

|

%

|

|

|

5

|

|

|

|

-

|

|

|

|

0.00

|

%

|

|

Repurchase agreements

|

|

|

5,224

|

|

|

|

15

|

|

|

|

0.29

|

%

|

|

|

17,496

|

|

|

|

50

|

|

|

|

0.29

|

%

|

|

Subordinated debt

|

|

|

13,401

|

|

|

|

448

|

|

|

|

3.34

|

%

|

|

|

13,401

|

|

|

|

478

|

|

|

|

3.57

|

%

|

|

Total deposits and interest bearing liabilities

|

|

|

4,380,632

|

|

|

|

13,599

|

|

|

|

0.31

|

%

|

|

|

4,151,994

|

|

|

|

11,295

|

|

|

|

0.27

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other liabilities

|

|

|

10,403

|

|

|

|

|

|

|

|

|

|

|

|

17,721

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

4,391,035

|

|

|

|

|

|

|

|

|

|

|

|

4,169,715

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity

|

|

|

321,243

|

|

|

|

|

|

|

|

|

|

|

|

283,074

|

|

|

|

|

|

|

|

|

|

| |

|

$

|

4,712,278

|

|

|

|

|

|

|

|

|

|

|

$

|

4,452,789

|

|

|

|

|

|

|

|

|

|

|

Net interest income on tax equivalent basis*

|

|

|

|

|

|

|

105,289

|

|

|

|

|

|

|

|

|

|

|

|

115,753

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax equivalent adjustment

|

|

|

|

|

|

|

6,433

|

|

|

|

|

|

|

|

|

|

|

|

6,437

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

|

|

|

|

$

|

98,856

|

|

|

|

|

|

|

|

|

|

|

$

|

109,316

|

|

|

|

|

|

|

Net interest margin *

|

|

|

|

|

|

|

|

|

|

|

2.37

|

%

|

|

|

|

|

|

|

|

|

|

|

2.60

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Full taxable equivalent basis, using a 35% statutory tax rate.

|

|

|

** Includes loans held for sale.

|

|

Allowance for loan and lease losses:

|

|

Year ended

|

|

|

|

|

|

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

|

|

|

|

|

|

| |

|

2015

|

|

|

2014

|

|

|

|

|

|

|

|

| |

|

(dollars in thousands)

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance in the allowance for loan and lease losses at beginning of period (1)

|

|

$

|

3,638

|

|

|

$

|

3,881

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans charged-off:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SBA non real estate

|

|

|

112

|

|

|

|

307

|

|

|

|

|

|

|

|

|

Direct lease financing

|

|

|

30

|

|

|

|

323

|

|

|

|

|

|

|

|

|

SBLOC

|

|

|

-

|

|

|

|

3

|

|

|

|

|

|

|

|

|

Other consumer loans

|

|

|

1,219

|

|

|

|

871

|

|

|

|

|

|

|

|

|

Total

|

|

|

1,361

|

|

|

|

1,504

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recoveries:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SBA non real estate

|

|

|

-

|

|

|

|

12

|

|

|

|

|

|

|

|

|

Direct lease financing

|

|

|

-

|

|

|

|

25

|

|

|

|

|

|

|

|

|

Other consumer loans

|

|

|

23

|

|

|

|

22

|

|

|

|

|

|

|

|

|

Total

|

|

|

23

|

|

|

|

59

|

|

|

|

|

|

|

|

|

Net charge-offs

|

|

|

1,338

|

|

|

|

1,445

|

|

|

|

|

|

|

|

|

Provision charged to operations

|

|

|

2,100

|

|

|

|

1,202

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance in allowance for loan and lease losses at end of period

|

|

$

|

4,400

|

|

|

$

|

3,638

|

|

|

|

|

|

|

|

|

Net charge-offs/average loans

|

|

|

0.11

|

%

|

|

|

0.16

|

%

|

|

|

|

|

|

|

|

Net charge-offs/average assets

|

|

|

0.03

|

%

|

|

|

0.03

|

%

|

|

|

|

|

|

|

|

(1) Excludes activity from assets held for sale

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan portfolio:

|

|

December 31,

|

|

|

September 30,

|

|

|

June 30,

|

|

|

December 31,

|

|

| |

|

2015 |

|

|

2015 |

|

|

2015 |

|

|

2014 |

|

| |

|

(dollars in thousands)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SBA non real estate

|

|

$

|

68,887

|

|

|

$

|

64,988

|

|

|

$

|

63,390

|

|

|

$

|

62,425

|

|

|

SBA commercial mortgage

|

|

|

114,029

|

|

|

|

116,545

|

|

|

|

85,234

|

|

|

|

82,317

|

|

|

SBA construction

|

|

|

6,977

|

|

|

|

5,191

|

|

|

|

16,977

|

|

|

|

20,392

|

|

|

Total SBA loans

|

|

|

189,893

|

|

|

|

186,724

|

|

|

|

165,601

|

|

|

|

165,134

|

|

|

Direct lease financing

|

|

|

231,514

|

|

|

|

223,929

|

|

|

|

222,169

|

|

|

|

194,464

|

|

|

SBLOC

|

|

|

575,948

|

|

|

|

539,240

|

|

|

|

512,269

|

|

|

|

421,862

|

|

|

Other specialty lending

|

|

|

48,315

|

|

|

|

12,119

|

|

|

|

32,118

|

|

|

|

48,625

|

|

|

Other consumer loans

|

|

|

23,180

|

|

|

|

23,502

|

|

|

|

27,044

|

|

|

|

36,168

|

|

| |

|

|

1,068,850

|

|

|

|

985,514

|

|

|

|

959,201

|

|

|

|

866,253

|

|

|

Unamortized loan fees and costs

|

|

|

9,227

|

|

|

|

9,004

|

|

|

|

8,832

|

|

|

|

8,340

|

|

|

Total loans, net of deferred loan fees and costs

|

|

$

|

1,078,077

|

|

|

$

|

994,518

|

|

|

$

|

968,033

|

|

|

$

|

874,593

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Small business lending portfolio:

|

|

December 31,

|

|

|

September 30,

|

|

|

June 30,

|

|

|

December 31,

|

|

| |

|

2015 |

|

|

2015 |

|

|

2015 |

|

|

2014 |

|

| |

|

(dollars in thousands)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SBA loans, including deferred fees and costs

|

|

|

197,966

|

|

|

|

194,612

|

|

|

|

173,357

|

|

|

|

172,660

|

|

|

SBA loans included in HFS

|

|

|

109,174

|

|

|

|

86,245

|

|

|

|

65,885

|

|

|

|

38,704

|

|

|

Total SBA loans

|

|

$

|

307,140

|

|

|

$

|

280,857

|

|

|

$

|

239,242

|

|

|

$

|

211,364

|

|

|

Capital Ratios

|

Tier 1 capital

|

|

Tier 1 capital

|

|

Total capital

|

|

Common equity

|

| |

to average

|

|

to risk-weighted

|

|

to risk-weighted

|

|

tier 1 to risk

|

| |

assets ratio

|

|

assets ratio

|

|

assets ratio

|

|

weighted assets

|

|

As of December 31, 2015

|

|

|

|

|

|

|

|

|

The Bancorp

|

7.21%

|

|

14.74%

|

|

14.93%

|

|

14.74%

|

|

The Bancorp Bank

|

6.94%

|

|

14.03%

|

|

14.22%

|

|

14.03%

|

|

"Well capitalized" institution (under FDIC regulations)

|

5.00%

|

|

8.00%

|

|

10.00%

|

|

6.50%

|

| |

|

|

|

|

|

|

|

|

As of December 31, 2014

|

|

|

|

|

|

|

|

|

The Bancorp

|

7.07%

|

|

11.54%

|

|

11.67%

|

|

n/a

|

|

The Bancorp Bank

|

6.46%

|

|

10.46%

|

|

10.59%

|

|

n/a

|

|

"Well capitalized" institution (under FDIC regulations)

|

5.00%

|

|

6.00%

|

|

10.00%

|

|

n/a

|

| |

|

Three months ended

|

|

|

Year ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

Selected operating ratios:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets (annualized)

|

|

|

1.75

|

%

|

|

nm

|

|

|

|

0.31

|

%

|

|

nm

|

|

|

Return on average equity (annualized)

|

|

|

24.47

|

%

|

|

nm

|

|

|

|

4.50

|

%

|

|

nm

|

|

|

Net interest margin

|

|

|

2.52

|

%

|

|

|

2.62

|

%

|

|

|

2.37

|

%

|

|

|

2.60

|

%

|

|

Book value per share

|

|

$

|

8.50

|

|

|

$

|

8.46

|

|

|

$

|

8.50

|

|

|

$

|

8.46

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31,

|

|

|

September 30,

|

|

|

June 30,

|

|

|

December 31,

|

|

| |

|

2015

|

|

|

2015

|

|

|

2015

|

|

|

2014

|

|

|

Asset quality ratios:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming loans to total loans (1)

|

|

|

0.22

|

%

|

|

|

0.25

|

%

|

|

|

0.34

|

%

|

|

|

0.24

|

%

|

|

Nonperforming assets to total assets (1)

|

|

|

0.05

|

%

|

|

|

0.05

|

%

|

|

|

0.07

|

%

|

|

|

0.04

|

%

|

|

Allowance for loan and lease losses to total loans

|

|

|

0.41

|

%

|

|

|

0.42

|

%

|

|

|

0.45

|

%

|

|

|

0.42

|

%

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonaccrual loans

|

|

$

|

1,927

|

|

|

$

|

2,157

|

|

|

$

|

2,666

|

|

|

$

|

1,907

|

|

|

Other real estate owned

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Total nonperforming assets

|

|

$

|

1,927

|

|

|

$

|

2,157

|

|

|

$

|

2,666

|

|

|

$

|

1,907

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans 90 days past due still accruing interest

|

|

$

|

403

|

|

|

$

|

294

|

|

|

$

|

620

|

|

|

$

|

149

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Nonperforming loan and asset ratios include nonaccrual loans and loans 90 days past due still accruing interest.

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

|

|

| |

|

December 31,

|

|

|

September 30,

|

|

|

June 30,

|

|

|

December 31,

|

|

| |

|

2015 |

|

|

2015 |

|

|

2015 |

|

|

2014 |

|

| |

|

(in thousands)

|

|

|

Gross dollar volume (GDV):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepaid card GDV

|

|

$

|

9,839,782

|

|

|

$

|

9,465,687

|

|

|

$

|

10,006,333

|

|

|

$

|

9,119,682

|

|

9

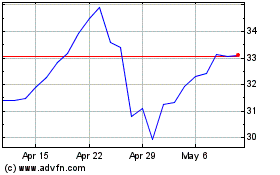

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

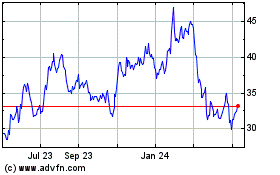

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Apr 2023 to Apr 2024