The Bancorp, Inc. ("Bancorp") (NASDAQ:TBBK), a financial holding

company, today reported financial results for fourth quarter and

fiscal 2015.

Bancorp reported net income of $19.6 million or diluted earnings

per share of $0.52 for fourth quarter 2015 compared to net income

of $20.2 million or $0.52 earnings per diluted share in fourth

quarter 2014. Year to date net income was $14.4 million or diluted

earnings per share of $0.38 for 2015 compared to net income of

$57.1 million or $1.49 earnings per diluted share in 2014. Net

income from continuing operations for fourth quarter 2015 was $19.1

million or $0.51 per diluted share compared to net income of $11.1

million or $0.30 per diluted share in fourth quarter 2014. Income

from continuing operations does not include any income which may

result upon the reinvestment of the proceeds of sales we are

pursuing from the approximately $568.3 million of commercial and

residential loans in the Bancorp’s discontinued operations.

Financial Highlights

Continuing Operations:

- Gain of $33.5 million on the sale of

the majority of the health savings account (“H.S.A.”)

administration business.

- Gain of $14.5 million on sales of tax

exempt securities for tax planning purposes.

- Increases over prior year loan balances

in security-backed lines of credit (“SBLOC”) 37%, Small Business

Administration (“SBA”) 45% and Leasing 19%.

- 18% increase in net interest income to

$18.6 million in fourth quarter 2015 compared to $15.7 million in

fourth quarter 2014.

- Regulatory lookback expense of $14.8

million.*

- Loans and continuing operations loans

held for sale totaled $1.57 billion at December 31, 2015 compared

to $1.09 billion at December 31, 2014, a 44% increase.

- Tier one capital to assets, tier one

capital to risk-weighted assets, total capital to

risk-weighted assets and common equity-tier 1 were 7.21%, 14.74%,

14.93% and 14.74%, compared to well capitalized minimums of 5%, 8%,

10% and 6.5%.

John Chrystal, Bancorp’s Interim Chief Executive Officer, said,

“The fourth quarter continued to show progress in the transition to

what we believe, and our historical results evidence, are better

performing lines of business. Our portfolio loans exceeded the $1

billion threshold at year end 2015, with a 44% increase over the

prior year end for the total of portfolio loans and loans held for

sale. We earn carry interest on loans held for sale until such

loans are sold. This growth was achieved in loan segments with

historically low loan losses, which continued to be the case in

2015. Growth in those SBLOC, SBA, and Leasing segments drove a net

interest income increase of 18% to $18.6 million for the quarter.

Prepaid and payment sponsorship fee income, our principal

non-interest income driver, reflected an exited relationship and

other factors; however, we believe that year over year increases

will result in 2016. During the quarter we sold the majority of

our health savings account (“H.S.A.”) administration business

and approximately $385 million of related deposits with higher

interest costs than the majority of our other deposits. With

expense savings, this exit is projected to be accretive. Those

H.S.A. client relationships were sold at a gain of $33.5 million.

Additionally during the quarter, we sold approximately $400 million

of tax exempt municipal securities to accelerate the Bank’s

utilization of deferred tax assets. The majority of the sales

proceeds have been reinvested in taxable securities with slightly

higher rates and lower duration. The balance of the sales proceeds

are anticipated to be similarly invested by the end of first

quarter 2016. The gains on the H.S.A. and the investment securities

sales also increased our regulatory capital ratios. The H.S.A.

deposit exit reduced excess balances maintained at the Federal

Reserve Bank (“FRB”). While that reduction was partially offset by

other deposit increases, future scheduled deposit exits are

projected to further reduce balances maintained at the FRB in 2016.

These balances earn relatively low rates of interest and increase

average assets thereby lowering capital ratios. The deposits being

exited do not have significant impact on profitability, nor do they

provide opportunities for future non-interest income.

While the lookback consultant has continued to make progress

toward final completion, costs continue to be in excess of

estimates and amounted to $14.8 million during the quarter. Based

on estimates by the consultant, this work should be complete

sometime in the second quarter of 2016.

Book value per common share at December 31, 2015 amounted to

$8.50 compared to $8.46 at December 31, 2014. The Bancorp and its

subsidiary, The Bancorp Bank, remain well capitalized.”

Non-recurring income/expense Three months ended Year

ended

December 31, 2015 December 31, 2015

(dollars in thousands) Pre-tax income - continuing operations $

31,156 $ 8,416 Pre-tax income - discontinued operations 3,607

13,800 Continuing operations Gain on sale of health savings

portfolio (33,531 ) (33,531 ) Gain on sale of securities (14,497 )

(14,435 ) Gain on sale of warrants (2,691 ) (2,691 ) BSA consultant

and lookback fees * 14,801 41,444 Civil money penalty 3,000 3,000

Additional FDIC assessment 920 920 Severance for health savings

division 550 550 Regulatory/governance related legal fees 603 2,292

Discontinued operations Restatement related audit fees - 2,560

Other real estate owned expense 1,423 3,199

Pre-tax income after analysis of non-recurring

income/expense $ 5,341 $ 25,524 * Lookback expense is being

incurred to analyze historical transactions for compliance with

suspicious activity reporting requirements.

Conference Call Webcast

You may access the LIVE webcast of Bancorp's Quarterly Earnings

Conference Call at 10:00 AM ET Monday, February 1, 2016 by clicking

on the webcast link on Bancorp's homepage at www.thebancorp.com.

Or, you may dial 877.787.4143, access code 31514831. You may listen

to the replay of the webcast following the live call on Bancorp's

investor relations website or telephonically until Monday, February

8, 2016 by dialing 855.859.2056, access code 31514831.

About Bancorp

With operations in the US and Europe, The Bancorp, Inc. (NASDAQ:

TBBK) is dedicated to serving the unique needs of non-bank

financial service companies, ranging from entrepreneurial start-ups

to those on the Fortune 500. The company’s chief financial

institution, The Bancorp Bank (Member FDIC, Equal Housing Lender),

has been repeatedly recognized in the payments industry as the Top

Issuer of Prepaid Cards (US), a top merchant sponsor bank, and a

top ACH originator. Specialized lending distinctions include

National Preferred SBA Lender, a leading provider of

securities-backed lines of credit, and one of the few bank-owned

commercial leasing groups in the nation. For more information

please visit www.thebancorp.com.

Forward-Looking Statements

Statements in this earnings release regarding Bancorp’s business

which are not historical facts are "forward-looking statements"

that involve risks and uncertainties. These statements may be

identified by the use of forward-looking terminology, including but

not limited to the words “may,” “believe,” “will,” “expect,”

“look,” “anticipate,” “estimate,” “continue,” or similar words. For

further discussion of the risks and uncertainties to which these

forward-looking statements may be subject, see Bancorp’s filings

with the SEC, including the “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” sections of those filings. These risks and

uncertainties could cause actual results to differ materially from

those projected in the forward-looking statements. The

forward-looking statements speak only as of the date of this press

release. The Bancorp does not undertake to publicly revise or

update forward-looking statements in this press release to reflect

events or circumstances that arise after the date of this

presentation, except as may be required under applicable law.

The Bancorp, Inc. Financial highlights

(unaudited) Three months ended Year ended

December 31, December 31,

Condensed income statement

2015 2014 2015 2014

(dollars in thousands except per share data) Net

interest income $ 18,582 $ 15,715 $ 69,931 $ 59,425

Provision for loan and lease losses 300 (1,404 )

2,100 1,202 Non-interest income Service fees

on deposit accounts 1,889 2,060 7,468 6,339 Card payment and ACH

processing fees 1,489 1,413 5,731 5,402 Prepaid card fees 11,744

12,614 47,496 51,287 Gain (loss) on sale of loans 3,333 (926 )

10,080 12,542 Gain on sale of investment securities 14,497 85

14,435 450 Gain on sale of health savings portfolio 33,531 - 33,531

- Leasing income 367 663 2,094 2,899 Debit card income 253 383

1,611 1,679 Affinity fees 967 745 3,358 2,596 Other non-interest

income 4,430 638 9,496 1,855

Total non-interest income 72,500 17,675 135,300 85,049

Non-interest expense Bank Secrecy Act and lookback consulting

expenses 14,801 3,883 41,444 8,801 Other non-interest expense

44,825 33,745 153,271 127,179

Total non-interest expense 59,626 37,628

194,715 135,980 Income (loss) from

continuing operations before income tax expense 31,156 (2,834 )

8,416 7,292 Income tax expense (benefit) 12,082

(13,929 ) 1,265 (14,523 ) Net income from continuing

operations 19,074 11,095 7,151 21,815 Net income from discontinued

operations, net of tax 498 9,096 7,234

35,294 Net income available to common shareholders $

19,572 $ 20,191 $ 14,385 $ 57,109 Net income

per share from continuing operations - basic $ 0.51 $ 0.31 $

0.19 $ 0.58 Net income per share from discontinued

operations - basic $ 0.01 $ 0.24 $ 0.19 $ 0.94 Net

income per share - basic $ 0.52 $ 0.55 $ 0.38 $ 1.52

Net income per share from continuing operations - diluted $

0.51 $ 0.30 $ 0.19 $ 0.57 Net income per share from

discontinued operations - diluted $ 0.01 $ 0.22 $ 0.19 $

0.92 Net income per share - diluted $ 0.52 $ 0.52 $

0.38 $ 1.49 Common stock shares outstanding 37,861,303

37,808,777 37,861,303 37,808,777

Balance sheet

December 31, September 30, June 30, December

31, 2015 2015 2015

2014 (dollars in thousands)

Assets: Cash and

cash equivalents Cash and due from banks $ 7,643 $ 4,002 $ 13,269 $

8,665 Interest earning deposits at Federal Reserve Bank 1,147,519

995,441 936,989 1,059,320 Securities sold under agreements to

resell - 37,970 40,068

46,250 Total cash and cash equivalents

1,155,162 1,037,413 990,326

1,114,235 Investment securities,

available-for-sale, at fair value 1,070,098 1,316,705 1,370,027

1,493,639 Investment securities, held-to-maturity 93,590 93,604

93,649 93,765 Loans held for sale, at fair value 489,938 354,600

284,501 217,080 Loans, net of deferred fees and costs 1,078,077

994,518 968,033 874,593 Allowance for loan and lease losses

(4,400 ) (4,194 ) (4,352 ) (3,638 ) Loans, net

1,073,677 990,324 963,681

870,955 Federal Home Loan Bank & Atlantic Central

Bankers Bank stock 1,062 1,063 1,063 1,002 Premises and equipment,

net 21,631 18,893 19,271 17,697 Accrued interest receivable 9,471

11,232 11,526 11,251 Intangible assets, net 4,929 5,248 5,541 6,228

Deferred tax asset, net 35,457 33,857 35,874 33,673 Investment in

unconsolidated entity 180,950 186,656 187,186 193,595 Assets held

for sale 584,916 611,729 651,158 887,929 Other assets 46,806

53,123 43,804 45,268

Total assets $ 4,767,687 $ 4,714,447 $

4,657,607 $ 4,986,317

Liabilities:

Deposits Demand and interest checking $ 3,602,376 $ 4,002,638 $

3,993,393 $ 4,289,586 Savings and money market 383,832 376,577

321,264 330,798 Time deposits 428,549 -

1,400 1,400 Total deposits

4,414,757 4,379,215 4,316,057

4,621,784 Securities sold under agreements to

repurchase 925 1,034 2,357 19,414 Subordinated debenture 13,401

13,401 13,401 13,401 Other liabilities 17,649

7,100 10,038 12,695 Total

liabilities $ 4,446,732 $ 4,400,750 $ 4,341,853

$ 4,667,294

Shareholders' equity:

Common stock - authorized, 50,000,000

shares of $1.00 par value;37,861,303 and 37,808,777 shares issued

at December 31, 2015and 2014, respectively

37,861 37,858 37,858 37,809 Treasury stock (100,000 shares) (866 )

(866 ) (866 ) (866 ) Additional paid-in capital 300,549 299,470

298,978 297,987 Accumulated deficit (14,495 ) (33,429 ) (27,854 )

(28,242 ) Accumulated other comprehensive income (loss)

(2,094 ) 10,664 7,638 12,335

Total shareholders' equity 320,955

313,697 315,754 319,023

Total liabilities and shareholders' equity $ 4,767,687 $

4,714,447 $ 4,657,607 $ 4,986,317

Average balance sheet and net interest income Three

months ended December 31, 2015 Three months ended December

31, 2014 (dollars in thousands) Average

Average Average Average

Assets: Balance

Interest Rate Balance Interest Rate Interest-earning assets: Loans

net of unearned fees and costs ** $ 1,416,176 $ 14,502 4.10% $

1,036,760 $ 9,869 3.81% Leases - bank qualified* 28,658 487 6.80%

16,341 229 5.61% Investment securities-taxable 1,022,914 5,290

2.07% 1,014,491 4,859 1.92% Investment securities-nontaxable*

248,662 2,203 3.54% 530,431 4,843 3.65%

Interest earning deposits at Federal

Reserve Bank

751,126 595 0.32% 504,612 332 0.26%

Federal funds sold and securities

purchased underagreement to resell

31,406 113 1.44% 49,250 166 1.35% Net interest earning assets

3,498,942 23,190 2.65% 3,151,885 20,298 2.58% Allowance for

loan and lease losses (4,178) (8,028) Assets held for sale 617,983

6,650 4.30% 1,234,255 11,161 3.62% Other assets 322,901 28,509 $

4,435,648 $ 4,406,621

Liabilities and Shareholders'

Equity: Deposits: Demand and interest checking $ 3,518,223 $

2,689 0.31% $ 3,709,957 $ 2,302 0.25% Savings and money market

378,301 581 0.61% 323,101 345 0.43% Time 174,530 263 0.60% 3,077 13

1.69% Total deposits 4,071,054 3,533 0.35% 4,036,135 2,660 0.26%

Short-term borrowings 18,152 12 0.26% - - 0.00% Repurchase

agreements 1,148 1 0.35% 18,191 13 0.29% Subordinated debt 13,401

120 3.58% 13,401 135 4.03% Total deposits and interest bearing

liabilities 4,103,755 3,666 0.36% 4,067,727 2,808 0.28%

Other liabilities 13,313 20,884 Total liabilities 4,117,068

4,088,611 Shareholders' equity 318,580 318,010 $ 4,435,648 $

4,406,621 Net interest income on tax equivalent basis* $ 26,174 $

28,651 Tax equivalent adjustment 942 1,775 Net

interest income $ 25,232 $ 26,876 Net interest margin * 2.52% 2.62%

* Full taxable

equivalent basis, using a 35% statutory tax rate. ** Includes loans

held for sale.

Average balance sheet and net interest

income Year ended December 31, 2015 Year ended

December 31, 2014 (dollars in thousands) Average

Average Average Average

Assets: Balance

Interest Rate Balance Interest Rate Interest-earning assets: Loans

net of unearned fees and costs ** $ 1,245,189 $ 48,733 3.91% $

903,681 $ 35,849 3.97% Leases - bank qualified* 25,126 1,734 6.90%

17,400 938 5.39% Investment securities-taxable 989,705 19,918 2.01%

1,031,584 20,662 2.00% Investment securities-nontaxable* 452,526

16,646 3.68% 477,384 17,454 3.66% Interest earning deposits at

Federal Reserve Bank 935,093 2,354 0.25% 720,240 1,792 0.25%

Federal funds sold and securities

purchased underagreement to resell

40,402 578 1.43% 33,814 462 1.37% Net interest-earning assets

3,688,041 89,963 2.44% 3,184,103 77,157 2.42% Allowance for

loan and lease losses (4,111) (3,521) Assets held for sale 715,116

28,925 4.04% 1,162,319 49,891 4.29% Other assets 313,232 109,888 $

4,712,278 $ 4,452,789

Liabilities and Shareholders'

Equity: Deposits: Demand and interest checking $ 3,975,475 $

10,982 0.28% $ 3,746,958 $ 9,097 0.24% Savings and money market

337,168 1,867 0.55% 366,160 1,574 0.43% Time 44,789 275 0.61% 7,974

96 1.20% Total deposits 4,357,432 13,124 0.30% 4,121,092 10,767

0.26% Short-term borrowings 4,575 12 0.26% 5 - 0.00%

Repurchase agreements 5,224 15 0.29% 17,496 50 0.29% Subordinated

debt 13,401 448 3.34% 13,401 478 3.57% Total deposits and interest

bearing liabilities 4,380,632 13,599 0.31% 4,151,994 11,295 0.27%

Other liabilities 10,403 17,721 Total liabilities 4,391,035

4,169,715 Shareholders' equity 321,243 283,074 $ 4,712,278 $

4,452,789 Net interest income on tax equivalent basis* 105,289

115,753 Tax equivalent adjustment 6,433 6,437 Net

interest income $ 98,856 $ 109,316 Net interest margin * 2.37%

2.60% * Full

taxable equivalent basis, using a 35% statutory tax rate. **

Includes loans held for sale.

Allowance for loan and lease

losses: Year ended December

31, December 31, 2015 2014

(dollars in thousands) Balance in the allowance for loan and

lease losses at beginning of period (1) $ 3,638 $ 3,881

Loans charged-off: SBA non real estate 112 307 Direct

lease financing 30 323 SBLOC - 3 Other consumer loans 1,219

871 Total 1,361 1,504

Recoveries: SBA non real estate - 12 Direct lease

financing - 25 Other consumer loans 23 22

Total 23 59 Net charge-offs

1,338 1,445 Provision charged to operations 2,100

1,202 Balance in allowance for loan and lease

losses at end of period $ 4,400 $ 3,638 Net

charge-offs/average loans 0.11 % 0.16 % Net charge-offs/average

assets 0.03 % 0.03 % (1) Excludes activity from assets held for

sale

Loan portfolio: December 31, September 30, June

30, December 31, 2015 2015 2015 2014 (dollars in thousands)

SBA non real estate $ 68,887 $ 64,988 $ 63,390 $ 62,425 SBA

commercial mortgage 114,029 116,545 85,234 82,317 SBA construction

6,977 5,191 16,977 20,392

Total SBA loans 189,893 186,724 165,601 165,134 Direct lease

financing 231,514 223,929 222,169 194,464 SBLOC 575,948 539,240

512,269 421,862 Other specialty lending 48,315 12,119 32,118 48,625

Other consumer loans 23,180 23,502

27,044 36,168 1,068,850 985,514 959,201 866,253

Unamortized loan fees and costs 9,227 9,004

8,832 8,340 Total loans, net of deferred loan

fees and costs $ 1,078,077 $ 994,518 $ 968,033 $

874,593

Small business lending portfolio: December

31, September 30, June 30, December 31, 2015 2015 2015 2014

(dollars in thousands) SBA loans, including deferred fees

and costs 197,966 194,612 173,357 172,660 SBA loans included in HFS

109,174 86,245 65,885

38,704 Total SBA loans $ 307,140 $ 280,857 $ 239,242

$ 211,364

Capital Ratios Tier 1 capital

Tier 1 capital Total capital Common equity to average

to risk-weighted to risk-weighted tier 1 to risk assets ratio

assets ratio assets ratio weighted assets As of December 31, 2015

The Bancorp 7.21% 14.74% 14.93% 14.74% The Bancorp Bank 6.94%

14.03% 14.22% 14.03% "Well capitalized" institution (under FDIC

regulations) 5.00% 8.00% 10.00% 6.50% As of December 31,

2014 The Bancorp 7.07% 11.54% 11.67% n/a The Bancorp Bank 6.46%

10.46% 10.59% n/a "Well capitalized" institution (under FDIC

regulations) 5.00% 6.00% 10.00% n/a Three months

ended Year ended December 31, December 31, 2015 2014

2015 2014

Selected operating ratios: Return on

average assets (annualized) 1.75 % nm 0.31 % nm Return on average

equity (annualized) 24.47 % nm 4.50 % nm Net interest margin 2.52 %

2.62 % 2.37 % 2.60 % Book value per share $ 8.50 $ 8.46 $ 8.50 $

8.46 December 31, September 30, June 30, December 31,

2015 2015 2015 2014

Asset quality ratios: Nonperforming loans to total

loans (1) 0.22 % 0.25 % 0.34 % 0.24 % Nonperforming assets to total

assets (1) 0.05 % 0.05 % 0.07 % 0.04 % Allowance for loan and lease

losses to total loans 0.41 % 0.42 % 0.45 % 0.42 % Nonaccrual

loans $ 1,927 $ 2,157 $ 2,666 $ 1,907 Other real estate owned

- - - -

Total nonperforming assets $ 1,927 $ 2,157 $ 2,666

$ 1,907 Loans 90 days past due still accruing

interest $ 403 $ 294 $ 620 $ 149

(1) Nonperforming loan and asset ratios include nonaccrual loans

and loans 90 days past due still accruing interest. Three

months ended December 31, September 30, June 30, December 31, 2015

2015 2015 2014 (in thousands)

Gross dollar volume (GDV):

Prepaid card GDV $ 9,839,782 $ 9,465,687 $ 10,006,333

$ 9,119,682

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160201005608/en/

The Bancorp, Inc.Andres Viroslav,

215-861-7990aviroslav@thebancorp.com

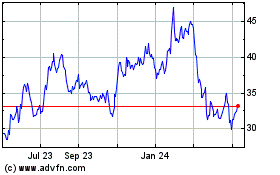

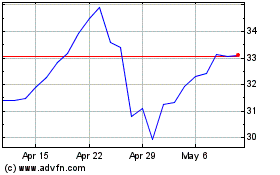

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Apr 2023 to Apr 2024