The Bancorp Releases Fourth Finetics™ Studio Interview Series: “The Impact of EMV on Fraud”

January 25 2016 - 8:00AM

Business Wire

Exclusive Interviews Feature Julie Conroy, Dan Rosen, Render

Dahiya and Charles Crawford

The Bancorp, Inc. (NASDAQ: TBBK), today announces the release of

its next Finetics™ Studio interview series: “The Impact of EMV on

Fraud” featuring Julie Conroy, Research Director, Aite Group; Dan

Rosen, Founder and General Partner, Commerce Ventures; Render

Dahiya, CEO, Arroweye Solutions; and Charles Crawford, Senior Vice

President, Payment Acceptance, The Bancorp.

Filmed from the Money20/20 show floor, the videos highlight

exclusive conversations with some of the industry’s most

influential players about the evolution of fraud in payments,

including the impact of EMV in the U.S., as well as key trends to

watch out for in 2016.

“We did a study and only 16 percent of merchants had planned any

formal training on EMV for their frontline staff, so we’ve had a

little bit of early pain with regards to the liability shift,” said

Conroy. “I even spoke with merchants that were planning to turn EMV

off during the holidays, because they were worried about long lines

and confusion. So, they were actually willing to absorb more fraud

rather than inconvenience their customers with EMV.”

“I think there is still a lot of work to do on fraud,” added

Dahiya. “And our research shows similar deficiencies in EMV

preparation, with more than 70 percent of cardholders receiving no

information about EMV from their card issuer in 2015. EMV puts a

stop gap measure in terms of swipe fraud, but increased

card-not-present fraud will drive more card reissuance going

forward, creating a new challenge for issuers and cardholders.”

“It’s a very interesting time for e-commerce because mobile

commerce is becoming more and more prevalent and your chance of

fraud is twice as likely on a mobile transaction as any other

transaction,” explained Crawford. “So if the increase we saw in

online fraud in Europe and Canada takes place in the U.S., which I

think is very likely, then those merchants are going to have to be

all the more careful and new techniques will have to be built to

make it safer for mobile and e-commerce in general.”

The release of these four videos supports The Bancorp’s

Finetics™ Studio video series, which features one-on-one

conversations with more than 30 of the financial services

industry’s most influential and innovative executives, launched

late last year.

The interviews, conducted by Sarah Gill, senior reporter with

PaymentEye, cover topics ranging from the future of payments

innovation to financial inclusion and the customer experience to

prepaid and will be released on The Bancorp’s fineticsblog.com

throughout early 2016.

Finetics™ Studio participants include the following

executives:

- Rene Lacerte, CEO and Founder,

Bill.com

- Talbott Roche, President, Blackhawk

Network

- Ben Katz, CEO and Founder,

Card.com

- Robert Carr, Founder, Chairman and CEO,

Heartland Payment Systems

- Brent Warrington, CEO, Hyperwallet

- Lars Sandtorv, CEO, MeaWallet

- Hamed Shahbazi, CEO, TIO Networks

- Stefan Happ, Executive Vice President

and General Manager, Global Emerging Payments, American

Express

- Janet O. Estep, CEO, NACHA—The

Electronic Payments Association

- Brad Fauss, President and CEO, Network

Branded Prepaid Card Association

- Tony Craddock, Director General,

Emerging Payments Association

- Cherian Abraham, Mobile Payments &

Commerce, Experian Plc.

- Dan Rosen, Founder and General Partner,

Commerce Ventures

- Suresh Vaghjiani, Executive Vice

President, Global Processing Services (GPS)

- Barrie VanBrackle, Partner and Payments

Specialist, Manatt, Phelps and Phillips

- Marilyn Bochicchio, CEO and Founder,

Hidden Brain

- Chris Byrd, Executive Vice

President–Healthcare Operations Officer, Evolution1

- Rahul Gupta, Group President, Billing

and Payments, Fiserv

- Julie Conroy, Research Director, Aite

Group

- Peter Read, President, Peoples Card

Services

- Kenneth M. Goins, Jr., CEO and Board

Member, Brightwell Payments

- Render Dahiya, CEO, Arroweye

Solutions

- Sean Rodriguez, Faster Payments

Strategy Leader and Senior Vice President, Federal Reserve

System

- Steve Kirsch, CEO, Token

- Ryan Caldwell, Founder and CEO, MX

- Anil Aggarwal, Founder and Chairman,

Money20/20

- Pat Patel, Content Director, Money20/20

Europe

- Pawneet Abramowski, Senior Vice

President, Director AML & Sanctions Risk Management, The

Bancorp

- Jeremy Kuiper, Managing Director,

Payment Solutions, The Bancorp

- Frank Mastrangelo, Technologist in

Residence, The Bancorp

- Matt Carberry, Vice President Business

Development, Payments, The Bancorp

- Gail Ball, Executive Vice President and

Chief Operating Officer, The Bancorp

- Pete Chiccino, Executive Vice President

and Chief Information Officer, The Bancorp

- Kriya Patel, Managing Director, Payment

Solutions, Europe, The Bancorp

- Charles Crawford, Senior Vice

President, Payment Acceptance, The Bancorp

About The Bancorp

With operations in the US and Europe, The Bancorp, Inc. (NASDAQ:

TBBK) is dedicated to serving the unique needs of non-bank

financial service companies, ranging from entrepreneurial start-ups

to those on the Fortune 500. The company’s chief financial

institution, The Bancorp Bank (Member FDIC, Equal Housing Lender),

has been repeatedly recognized in the payments industry as the Top

Issuer of Prepaid Cards (US), a top merchant sponsor bank, and a

top ACH originator. Specialized lending distinctions include

National Preferred SBA Lender, a leading provider of

securities-backed lines of credit, and one of the few bank-owned

commercial leasing groups in the

nation. thebancorp.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160125005349/en/

The Bancorp Finetics™ StudioCommunications Strategy

GroupSarah Nickell, 720-726-5454snickell@csg-pr.comorThe

Bancorp, Inc. Investor RelationsThe BancorpAndres Viroslav,

215-861-7990aviroslav@thebancorp.com

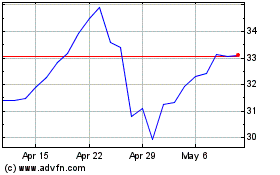

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

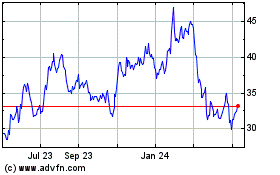

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Apr 2023 to Apr 2024