Blue Chips Power Higher On IBM's Earnings

January 20 2012 - 2:23PM

Dow Jones News

Strong earnings from International Business Machines powered

blue-chip stocks higher even as discouraging quarterly reports from

other bellwethers kept a lid on broader market gains.

The Dow Jones Industrial Average rose 68 points, or 0.6%, to

12693. The Standard & Poor's 500-stock index declined two

points, or 0.1%, to 1313, and the Nasdaq Composite slipped three

points, or 0.1%, to 2785. Each were poised to finish with a

third-straight weekly gain in late Friday's trading.

Blue-chip tech stocks pushed the Dow toward its fourth-straight

gain. IBM rose 4.2% after reporting better-than-expected

fourth-quarter earnings, and indicated that 2012 earnings would

exceed current forecasts.

Microsoft advanced 5.2% after the company reported fiscal

second-quarter earnings that beat expectations, with revenue

essentially in line. The company also lowered its operating expense

outlook for 2012.

Intel gained 2.2% after the chip maker topped fourth-quarter

earnings and revenue forecasts, amid strength in the

personal-computer business, and provided a first-quarter revenue

outlook that was in line with current estimates.

"My sense is that [corporate earnings reports] so far seem to

support that the idea that companies have a greater ability to

sustain profits than had been anticipated," said Jeff Lancaster,

principal at Bingham, Osborn & Scarborough, which manages over

$2 billion in San Francisco.

Other widely followed tech stocks disappointed investors. Google

fell 8.4% and was S&P 500's biggest laggard after reporting

fourth-quarter earnings and revenue that fell short of

expectations. The average cost that advertisers paid Google per

click declined from year-ago levels. Despite Google's decline,

technology stocks on the S&P 500 were one of three sectors in

positive territory on Friday.

Elsewhere, GE recovered from early loses to edge higher. Shares

gained 0.1% after the conglomerate's fourth-quarter earnings topped

estimates but revenue came up short, with discontinued operations

weighing on results.

American Express fell 2% after the company beat earnings

estimates but revenue fell short of expectations.

Weakness in the credit service industry spilled into Capital One

Financial. Shares slumped 6.7% after the credit card-issuer-turned

bank reported disappointing fourth-quarter earnings as loan-loss

provisions increased.

SunTrust bolstered the financial sector. Shares rose 5.2% after

the regional bank announced fourth-quarter earnings slipped 16%,

but that credit costs continued to decline.

"Finally, we're getting to a point where we push Europe to the

back burner," said Randy Frederick, managing director of trading

and derivatives at Charles Schwab. "I had hoped that earnings

season would take over the front page for investors, and so far it

has."

Data on December's existing home sales did little to influence

the market's direction. December's reading on existing homes showed

a third-straight monthly increase, but sales rose less than

expected. Existing-home sales increased 5% from an annual rate of

4.61 million. Economists surveyed by Dow Jones Newswires had

expected home sales to rise by 5.2% to an annual rate of 4.65

million.

European markets slipped Friday, but managed to string together

a fifth consecutive weekly gain. The Stoxx Europe 600 fell 0.3% and

finished with the first decline in five sessions. Talks between

Greece and its private creditors over a debt restructuring plan

agreed to in October began, with reports suggesting an agreement

with private creditors was close.

Asian bourses were broadly higher, as data showed that

manufacturing activity in China contracted in January but at a

slightly slower pace than in December. China's Shanghai Composite

climbed 1%, and Japan's Nikkei Stock Average rallied 1.5%.

Gold futures rose 0.6% to $1,664.60 an ounce, while crude-oil

futures slipped 1.7% to $98.89 a barrel. The U.S. dollar gained

ground against both the euro and the yen.

Schlumberger climbed 0.8%. Fourth-quarter earnings rose 36% as

the oil-field services company saw revenue jump in North

America.

Skyworks climbed 11% after the semiconductor maker exceeded

forecasts for fiscal first-quarter earnings and revenue, and

indicated that second-quarter revenue would be above current

estimates.

Fifth Third Bancorp slid 4.4% as the regional bank's

fourth-quarter earnings and revenue missed expectations.

Intuitive Surgical reported that fourth-quarter earnings rose

25%, but the surgical-robot maker's shares dropped 6.7% on concerns

about slowing growth in the number of procedures using its surgery

machines.

-Chris Dieterich, Dow Jones Newswires; 212-416-2611;

christopher.dieterich@dowjones.com

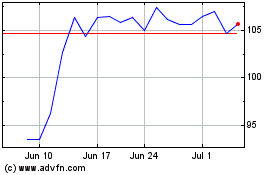

Skyworks Solutions (NASDAQ:SWKS)

Historical Stock Chart

From Mar 2024 to Apr 2024

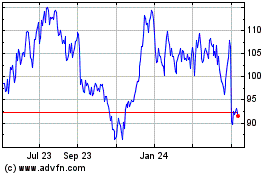

Skyworks Solutions (NASDAQ:SWKS)

Historical Stock Chart

From Apr 2023 to Apr 2024