Dow Closes Above 20000 for First Time

January 25 2017 - 4:33PM

Dow Jones News

By Aaron Kuriloff and Corrie Driebusch

The Dow Jones Industrial Average finished above 20000 for the

first time, the latest milestone in the U.S. stock market's

postelection rally.

The thousand-point climb to 20000 from 19000 was the

second-fastest such gain after it took 24 trading days to climb

from 10000 to 11000 during the dot-com boom in 1999.

(Please follow our live coverage here.)

The blue-chip index of 30 stocks gained 155 points, or 0.8%, to

20068 Wednesday. The S&P 500 added 0.8% and the Nasdaq

Composite climbed 1%.

The Dow industrials have soared since Election Day, buoyed by

investors' bets that the administration of President Donald Trump

will pursue policies such as tax cuts, regulatory rollbacks and

infrastructure spending that could improve the outlook for U.S.

companies.

The index has risen more than 9% since Nov. 8, notching several

highs, and closed above 19000 for the first time ever Nov. 22. The

S&P 500 and the Nasdaq Composite both closed at records

Tuesday.

The gains also came as earnings from companies including banks

highlighted improving corporate profits and ongoing U.S. economic

growth.

Boeing led gains in the Dow industrials Wednesday, rising 4.7%

after the aerospace company beat expectations for earnings in the

final quarter of the year.

Caterpillar, which makes construction and mining equipment, rose

2%, while J.P. Morgan Chase added 1.4% and Goldman Sachs gained

1.1% to push its postelection climb to roughly 30%. The KBW Nasdaq

Bank Index of large U.S commercial lenders has gained about 23%

since Election Day.

Boeing, Caterpillar and the two banks have been among the

biggest contributors to the Dow's rise since Election Day.

Investors' surge into manufacturing companies pushed stocks

higher Tuesday, as some bet that Mr. Trump's moves to revive

oil-pipeline projects and cut regulations signaled the first steps

toward clearing the way for a surge in infrastructure spending.

The sun had yet to rise over Los Angeles-based Wedbush

Securities on Wednesday morning when the Dow industrials crossed

the milestone.

"We were too busy to cheer," said Ian Winer, head of equities

trading. As the Dow reached 20000, Mr. Winer said he started

receiving lots of buy orders. "This kind of move draws people into

the market," he said. "It feels like guys are saying, 'I've got to

be there. I can't miss any more of this rally.'"

Haven assets were under pressure Wednesday, with selling in

government bonds sending the yield on the benchmark 10-year

Treasury note up to 2.517%, according to Tradeweb, from 2.471%

after its biggest daily rise of 2017. Gold fell 1.2% to $1,195.90

an ounce Wednesday.

On Monday, bonds rallied and stocks fell on concerns that Mr.

Trump's protectionist approach on trade could hurt growth, before

the president refocused attention on the possibility of increased

fiscal spending Tuesday. That helped send bonds to their biggest

one-day selloff in more than a month.

The WSJ Dollar Index, which measures the U.S. currency against

16 others, fell less than 0.1% Wednesday.

Stocks' surge has left some analysts and investors cautious.

Much of the rally has been built on hopes for policies that may not

emerge, or pan out as expected. And many investors worried stocks

were expensive even before the postelection runup, given several

recent quarters of weak earnings. Companies in the S&P 500

traded at roughly 21 times their past 12 months of earnings as of

Tuesday, above their 10-year average of about 16, according to

FactSet.

"On the one hand, it's great we're hitting all-time highs," said

Brett Mock, managing director at brokerage JonesTrading

Institutional Services LLC, referring to how major U.S. stock

indexes are trading around records. "But skeptics will say if we're

in record territory, how much further can we go? Are we seeing a

top forming? Obviously no one knows the answer to that."

--Riva Gold contributed to this article.

Write to Aaron Kuriloff at aaron.kuriloff@wsj.com and Corrie

Driebusch at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

January 25, 2017 16:18 ET (21:18 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

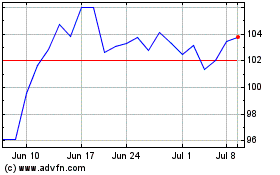

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Mar 2024 to Apr 2024

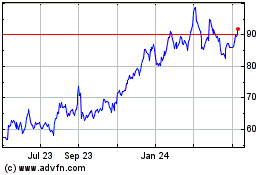

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Apr 2023 to Apr 2024