Seagate Completes Acquisition of Dot Hill Systems

October 06 2015 - 9:02AM

Business Wire

Seagate Technology plc (NASDAQ:STX), a world leader in storage

solutions, today announced it has completed its previously

announced acquisition of Dot Hill Systems Corp. (NASDAQ:HILL), a

trusted supplier of innovative software and hardware storage

systems.

Under the terms of the definitive agreement signed between

Seagate and Dot Hill, an indirect wholly owned subsidiary of

Seagate commenced a tender offer for all of the outstanding shares

of Dot Hill in an all-cash transaction valued at $9.75 per share,

or a total of approximately $696 million on a fully-diluted equity

value basis.

The tender offer and the second step merger contemplated by

Seagate’s definitive agreement with Dot Hill were completed on

October 6, 2015. As a result, Dot Hill has become an indirect

wholly owned subsidiary of Seagate and will no longer be listed for

trading on the NASDAQ Global Market.

About Seagate Technology

Seagate creates space for the human experience by innovating how

data is stored, shared and used. Learn more at www.Seagate.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements are based on information

available to Seagate as of the date of this press release. Current

expectations, forecasts and assumptions involve a number of risks,

uncertainties, and other factors that could cause actual results to

differ materially from those anticipated by these forward-looking

statements. Such risks, uncertainties, and other factors may be

beyond Seagate’s control. In particular, such statements include

anticipated benefits of the Dot Hill acquisition and Seagate’s

expectation that the Dot Hill acquisition will be accretive to

non-GAAP earnings. The following factors, among others, could cause

actual results to vary from the forward-looking statements: the

ability to achieve anticipated benefits and savings, risks related

to disruption of management’s attention due to integration matters

following the consummation of the merger, operating results and

businesses generally, the outcome of any legal proceedings related

to the proposed merger and the general risk associated with the

respective businesses of Seagate, including the general volatility

of the capital markets, terms and deployment of capital, volatility

of Seagate share prices, changes in the data storage industry,

interest rates or the general economy, underperformance of

Seagate’s assets and investments and decreased ability to raise

funds and the degree and nature of Seagate’s and Dot Hill’s

competition. Additional information concerning risks, uncertainties

and other factors that could cause results to differ materially

from those projected in the forward-looking statements is contained

in Seagate’s Report on Form 10-K filed with the U.S. Securities and

Exchange Commission on August 12, 2015, the “Risk Factors” section

of which is incorporated into this document by reference and other

documents filed with or furnished to the Securities and Exchange

Commission. These forward-looking statements should not be relied

upon as representing Seagate’s views as of any subsequent date and

Seagate undertakes no obligation to update forward-looking

statements to reflect events or circumstances after the date they

were made.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151006006127/en/

Seagate Technology plcEric DeRitis,

408-658-1561eric.deritis@seagate.com

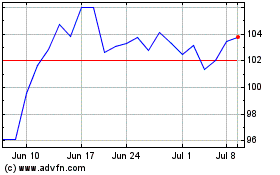

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Mar 2024 to Apr 2024

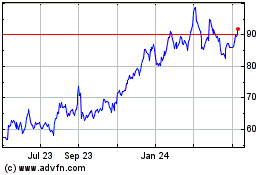

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Apr 2023 to Apr 2024