Seagate to Buy Dot Hill to Enhance Cloud Offerings

August 18 2015 - 9:00PM

Dow Jones News

Data-storage company Seagate Technology PLC has agreed to buy

Dot Hill Systems Corp., a maker of software and hardware storage

systems, to help enhance its cloud offerings. Seagate is set to pay

an 88% premium to Tuesday's closing stock price.

The transaction has an equity value of about $694 million.

Reflecting Dot Hill's June 30 balance-sheet cash, the deal has an

enterprise value of about $645 million, the companies said

Tuesday.

Seagate will pay $9.75 a share in the all-cash deal. Dot Hill

shares closed regular trading at $5.18, and rose 85% to $9.60 in

after-hours trading.

Seagate said the purchase will help it "accelerate the growth of

Seagate's OEM-focused cloud storage system and solutions

business."

The deal is expected to close in the fourth calendar quarter of

2015 and add to Seagate's fiscal 2016 earnings excluding items.

In its fourth quarter ended July 3, Seagate posted lower revenue

and profit. The company said in April that "near-term macro

uncertainty" has hurt its results.

Like other technology companies, Seagate has been aiming to

diversify its offerings in a shifting marketplace. In 2014, Seagate

bought the LSI flash business from Avago Technologies Ltd. for $450

million.

Dot Hill said earlier this month that it expects non-GAAP

revenue of $245 million to $260 million for 2015. Seagate's revenue

was $13.7 billion for the year ended July 3.

Write to Josh Beckerman at josh.beckerman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 18, 2015 20:45 ET (00:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

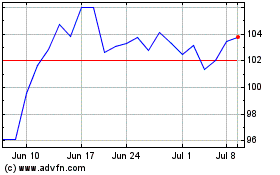

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Mar 2024 to Apr 2024

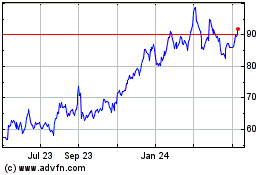

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Apr 2023 to Apr 2024