Current Report Filing (8-k)

July 13 2015 - 8:19AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 13, 2015

SEAGATE TECHNOLOGY PUBLIC LIMITED COMPANY

(Exact name of registrant as specified in its charter)

|

Ireland |

|

001-31560 |

|

98-0648577 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

38/39 Fitzwilliam Square

Dublin 2, Ireland |

|

N/A |

|

(Address of principal executive office) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (353) (1) 234-3136

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On July 13, 2015, Seagate Technology plc (the “Company”) issued a press release (the “Press Release”) announcing selected preliminary financial information for the fiscal fourth quarter ended July 3, 2015. The full text of the Press Release is furnished as Exhibit 99.1 hereto.

The information in this Current Report on Form 8-K is “furnished” but shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of such section.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit is attached to this Current Report on Form 8-K:

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press release of Seagate Technology plc dated July 13, 2015. |

Cautionary Note Regarding Forward-Looking Statements

The press release included with this Current Report the (“Press Release”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended, including, in particular, statements about the Company’s financial results for the fiscal fourth quarter ended July 3, 2015. These statements identify prospective information and may include words such as “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects” and similar expressions. These forward-looking statements are based on information available to the Company as of the date of this Current Report and are based on management’s current views and assumptions. These forward-looking statements are conditioned upon and also involve a number of known and unknown risks, uncertainties, and other factors that could cause actual results, performance or events to differ materially from those anticipated by these forward-looking statements. Such risks, uncertainties, and other factors may be beyond the Company’s control and may cause the Company’s financial results to differ materially from the expectations described in the Press Release and may pose a risk to the Company’s operating and financial condition. Such risks and uncertainties include, but are not limited to: items may be identified during the Company’s financial statement closing process that cause adjustments to the estimates included in the Press Release, the uncertainty in global economic conditions, as consumers and businesses may defer purchases in response to tighter credit and financial news; the impact of the variable demand and adverse pricing environment for disk drives, particularly in view of current business and economic conditions; the Company’s ability to successfully qualify, manufacture and sell its disk drive products in increasing volumes on a cost-effective basis and with acceptable quality, particularly the new disk drive products with lower cost structures; the impact of competitive product announcements; currency fluctuations that may impact our margins and international sales; possible excess industry supply with respect to particular disk drive products; disruptions to our supply chain or production capabilities; and fluctuations in interest rates. Information concerning risks, uncertainties and other factors that could cause results to differ materially from the expectations described in the Press Release is contained in the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission on August 7, 2014, the “Risk Factors” section of which is incorporated into the Press Release by reference, and other documents filed with or furnished to the Securities and Exchange Commission. These forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date and the Company undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SEAGATE TECHNOLOGY PUBLIC LIMITED COMPANY |

|

|

|

|

|

|

|

|

By: |

/s/ KENNETH M. MASSARONI |

|

|

Name: |

Kenneth M. Massaroni |

|

|

Title: |

Executive Vice President, General Counsel and Chief Administrative Officer |

Date: July 13, 2015

3

Exhibit 99.1

Investor Relations Contact:

(408)658-1222

IR@seagate.com

SEAGATE ANNOUNCES PRELIMINARY FINANCIAL INFORMATION FOR FISCAL FOURTH QUARTER 2015

CUPERTINO, CA — July 13, 2015 — Seagate Technology plc (NASDAQ: STX), a world leader in storage solutions, today announced selected preliminary financial information for its fiscal fourth quarter of 2015, which ended on July 3, 2015.

Seagate expects to report revenue of approximately $2.9 billion and non-GAAP gross margin of approximately 27.0% for the fiscal fourth quarter 2015. These preliminary results compare to the Company’s previously forecasted range for fourth fiscal quarter of revenue of $3.2 to $3.3 billion and non-GAAP gross margin of approximately 28.5%. The difference was driven primarily by lower than expected intra-quarter demand. Non-GAAP operating expenses are expected to be approximately $530 million, below previously forecasted non-GAAP operating expenses of approximately $555 million.

Seagate expects to report unit shipments for the fiscal fourth quarter of approximately 45 million, maintaining approximately 40% market share and reflecting approximately 52 exabytes. Cash, cash equivalents, restricted cash and short term investments totaled approximately $2.5 billion at the end of the quarter.

Conference Call Details for Fiscal Fourth Quarter and Year End 2015 Financial Results

Seagate will report its fiscal fourth quarter and year-end 2015 financial results before the market opens on Friday July 31, 2015. The investment community conference call to discuss these results will take place that day at 6:00 a.m. Pacific/9:00 a.m. Eastern Time. The live event can be accessed online at Seagate’s Investor Relations website at www.seagate.com/investors.

An archived audio webcast of this event will be available shortly following the event conclusion.

About Seagate

Seagate creates space for the human experience by innovating how data is stored, shared and used. Learn more at www.seagate.com.

This Press Release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended, including, in particular, statements about the Company’s financial results for the fiscal quarter ended July 3, 2015. These statements identify prospective information and may include words such as “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects” and similar expressions. These forward-looking statements are based on information available to the Company as of the date of this Press Release and are based on management’s current views and assumptions. These forward-looking statements are conditioned upon and also involve a number of known and unknown risks, uncertainties, and other factors that could cause actual results, performance or events to differ materially from those anticipated by these forward-looking statements. Such risks, uncertainties, and other factors may be beyond the Company’s control and may cause the Company’s financial results to differ materially from the expectations described in this Press Release and may pose a risk to the Company’s operating and financial condition. Such risks and uncertainties include, but are not limited to: items may be identified during the Company’s financial statement closing process that cause adjustments to the estimates included in the Press Release, the uncertainty in global economic conditions, as consumers and businesses may defer purchases in response to tighter credit and financial news; the impact of the variable demand and adverse pricing environment for disk drives, particularly in view of current business and economic conditions; the Company’s ability to successfully qualify, manufacture and sell its disk drive products in increasing volumes on a cost-effective basis and with acceptable quality, particularly the new disk drive products with lower cost structures; the impact of competitive product announcements; currency fluctuations that may impact our margins and international sales; possible excess industry supply with respect to particular disk drive products; disruptions to our supply chain or production capabilities; and fluctuations in interest rates. Information concerning risks, uncertainties and other factors that could cause results to differ materially from the expectations described in this Press Release is contained in the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission on August 7, 2014, the “Risk Factors” section of which is incorporated into this Press Release by reference, and other documents filed with or furnished to the Securities and Exchange Commission. These forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date and the Company undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made.

The inclusion of Seagate’s website address in this press release is intended to be an inactive textual reference only and not an active hyperlink. The information contained in, or that can be accessed through, Seagate’s website and social media channels are not part of this press release.

Use of Non-GAAP Information

The Company has provided non-GAAP measures of gross margin and operating expenses, which are adjusted from results based on GAAP to exclude certain expenses, gains and losses. The Company believes non-GAAP results provide useful information to both management and investors as these non-GAAP results exclude certain expenses, gains and losses that we believe are not indicative of our core operating results and because they are consistent with the financial models and estimates published by financial analysts who follow the Company.

|

|

|

|

|

For the Three

Months Ended

July 3, 2015 |

|

|

Reconciliation of GAAP Gross Margin: |

|

|

|

|

|

|

Preliminary GAAP Gross Margin |

|

|

|

26.3 |

% |

|

Non-GAAP adjustments: |

|

(A) |

|

0.7 |

% |

|

Preliminary non-GAAP Gross Margin |

|

|

|

27.0 |

% |

(A) Gross margin has been adjusted on a non-GAAP basis to exclude the write off of certain discontinued inventory and the amortization of intangibles associated with acquisitions and other acquisition related expenses.

|

|

|

|

|

For the Three

Months Ended

July 3, 2015 |

|

|

Reconciliation of Operating Expense: |

|

|

|

|

|

|

Preliminary GAAP Operating Expense |

|

|

|

$ |

586 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

Product Development |

|

(A) |

|

(2 |

) |

|

Marketing and administrative |

|

(B) |

|

(12 |

) |

|

Amortization of intangibles |

|

(C) |

|

(33 |

) |

|

Restructuring and other, net |

|

(D) |

|

(9 |

) |

|

Preliminary non-GAAP Operating Expense |

|

|

|

$ |

530 |

|

(A) Product development expense has been adjusted on a non-GAAP basis to exclude the impact of integration costs associated with acquisitions.

(B) Marketing and administrative expense has been adjusted on a non-GAAP basis primarily to exclude the write off of certain fixed assets and the impact of integration costs associated with acquisitions.

(C) Amortization of intangibles primarily related to our acquisitions has been excluded on a non-GAAP basis.

(D) Restructuring and other, net, has been adjusted on a non-GAAP basis primarily related to a reduction in our work force as a result of our ongoing focus on cost efficiencies in all areas of our business.

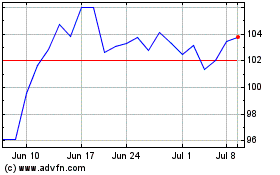

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Mar 2024 to Apr 2024

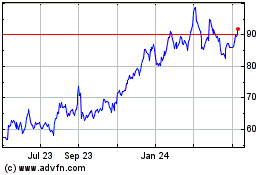

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Apr 2023 to Apr 2024