Seagate Technology plc (NASDAQ:STX), a world leader in storage

solutions, today announced selected preliminary financial

information for its fiscal fourth quarter of 2015, which ended on

July 3, 2015.

Seagate expects to report revenue of approximately $2.9 billion

and non-GAAP gross margin of approximately 27.0% for the

fiscal fourth quarter 2015. These preliminary results compare to

the Company’s previously forecasted range for fiscal fourth

quarter of revenue of $3.2 to $3.3 billion and non-GAAP gross

margin of approximately 28.5%. The difference was driven primarily

by lower than expected intra-quarter demand. Non-GAAP operating

expenses are expected to be approximately $530 million, below

previously forecasted non-GAAP operating expenses of approximately

$555 million.

Seagate expects to report unit shipments for the fiscal fourth

quarter of approximately 45 million, maintaining approximately

40% market share and reflecting approximately 52 exabytes. Cash,

cash equivalents, restricted cash and short term

investments totaled approximately $2.5 billion at the end of

the quarter.

Conference Call Details for Fiscal Fourth Quarter and Year End

2015 Financial Results

Seagate will report its fiscal fourth quarter and year-end

2015 financial results before the market opens on Friday July

31, 2015. The investment community conference call to discuss

these results will take place that day at 6:00

a.m. Pacific/9:00 a.m. Eastern Time. The live event can

be accessed online at Seagate’s Investor Relations website

at www.seagate.com/investors.

An archived audio webcast of this event will be available

shortly following the event conclusion.

About Seagate

Seagate creates space for the human experience by innovating how

data is stored, shared and used. Learn more at www.seagate.com.

This Press Release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, each as

amended, including, in particular, statements about the Company’s

financial results for the fiscal quarter ended July 3, 2015. These

statements identify prospective information and may include words

such as “expects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “projects” and similar expressions. These

forward-looking statements are based on information available to

the Company as of the date of this Press Release and are based on

management’s current views and assumptions. These forward-looking

statements are conditioned upon and also involve a number of known

and unknown risks, uncertainties, and other factors that could

cause actual results, performance or events to differ materially

from those anticipated by these forward-looking statements. Such

risks, uncertainties, and other factors may be beyond the Company’s

control and may cause the Company’s financial results to differ

materially from the expectations described in this Press Release

and may pose a risk to the Company’s operating and financial

condition. Such risks and uncertainties include, but are not

limited to: items may be identified during the Company’s financial

statement closing process that cause adjustments to the estimates

included in the Press Release, the uncertainty in global economic

conditions, as consumers and businesses may defer purchases in

response to tighter credit and financial news; the impact of the

variable demand and adverse pricing environment for disk drives,

particularly in view of current business and economic conditions;

the Company’s ability to successfully qualify, manufacture and sell

its disk drive products in increasing volumes on a cost-effective

basis and with acceptable quality, particularly the new disk drive

products with lower cost structures; the impact of competitive

product announcements; currency fluctuations that may impact our

margins and international sales; possible excess industry supply

with respect to particular disk drive products; disruptions to our

supply chain or production capabilities; and fluctuations in

interest rates. Information concerning risks, uncertainties and

other factors that could cause results to differ materially from

the expectations described in this Press Release is contained in

the Company’s Annual Report on Form 10-K filed with the U.S.

Securities and Exchange Commission on August 7, 2014, the “Risk

Factors” section of which is incorporated into this Press Release

by reference, and other documents filed with or furnished to the

Securities and Exchange Commission. These forward-looking

statements should not be relied upon as representing the Company’s

views as of any subsequent date and the Company undertakes no

obligation to update forward-looking statements to reflect events

or circumstances after the date they were made.

The inclusion of Seagate’s website address in this press release

is intended to be an inactive textual reference only and not an

active hyperlink. The information contained in, or that can be

accessed through, Seagate’s website and social media channels are

not part of this press release.

Use of Non-GAAP Information

The Company has provided non-GAAP measures of gross margin and

operating expenses, which are adjusted from results based on GAAP

to exclude certain expenses, gains and losses. The Company believes

non-GAAP results provide useful information to both management and

investors as these non-GAAP results exclude certain expenses, gains

and losses that we believe are not indicative of our core operating

results and because they are consistent with the financial models

and estimates published by financial analysts who follow the

Company.

For the ThreeMonths

EndedJuly 3, 2015

Reconciliation of GAAP Gross Margin: Preliminary GAAP Gross Margin

26.3 % Non-GAAP adjustments:

A

0.7 % Preliminary non-GAAP Gross Margin 27.0 %

A Gross margin has been adjusted on a non-GAAP basis to

exclude the write off of certain discontinued inventory and the

amortization of intangibles associated with acquisitions and other

acquisition related expenses.

For the ThreeMonths

EndedJuly 3, 2015

Reconciliation of Operating Expense: Preliminary GAAP Operating

Expense $ 586 Non-GAAP adjustments: Product Development

A (2

) Marketing and administrative

B (12 ) Amortization of

intangibles

C (33 ) Restructuring and other, net

D

(9 ) Preliminary non-GAAP Operating Expense $ 530

A Product development expense has been adjusted on a

non-GAAP basis to exclude the impact of integration costs

associated with acquisitions.

B Marketing and administrative expense has been adjusted

on a non-GAAP basis primarily to exclude the write off of certain

fixed assets and the impact of integration costs associated with

acquisitions.

C Amortization of intangibles primarily related to our

acquisitions has been excluded on a non-GAAP basis.

D Restructuring and other, net, has been adjusted on a

non-GAAP basis primarily related to a reduction in our work force

as a result of our ongoing focus on cost efficiencies in all areas

of our business.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150713005363/en/

Investor Relations Contact:Seagate Technology plcMichael

Busselen, 408-658-1222IR@Seagate.com

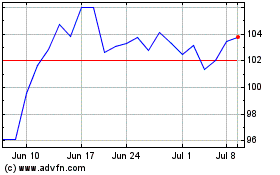

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Mar 2024 to Apr 2024

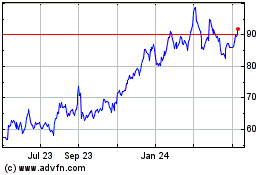

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Apr 2023 to Apr 2024