SmartPros Reports First Quarter 2014 Financial Results

May 06 2014 - 4:14PM

SmartPros Ltd. (Nasdaq:SPRO), a leader in the field of accredited

professional education and corporate training, today reported

results for the three month period ending March 31, 2014. For the

three months ending March 31, 2014, compared to March 31, 2013:

- Net revenues of $2.99 million, compared to $3.22 million

- Operating loss of $636,000, compared to operating loss of

$578,000

- Earnings Before Interest, Taxes, Depreciation, and Amortization

(EBITDA) of ($380,000) compared to ($313,000)

- Net loss of $384,000, or $.08 per diluted share, compared to a

net loss of $356,000, or $.08 per diluted share

| |

|

| |

THREE MONTHS

ENDED |

|

RECONCILIATION OF NET INCOME TO EBITDA |

MARCH

31, |

| |

2014 |

2013 |

| |

|

|

| Net (loss) |

$ (383,961) |

$ (356,482) |

| |

|

|

| Benefit from income taxes |

(246,219) |

(218,597) |

| Depreciation and amortization |

256,760 |

268,513 |

| Interest income, (net) |

(6,573) |

(6,495) |

| |

|

|

| EBITDA |

$ (379,993) |

$ (313,061) |

As of March 31, 2014, the Company had approximately $4.3 million

in cash and cash equivalents, $4.4 million in deferred revenue,

stockholders' equity of $9.3 million, and no debt. "Our 2014

quarterly loss of $.08 is fairly consistent with our Q1 2013

performance," said Allen Greene, SmartPros' Chairman and CEO. "Our

first quarter has historically been a slow quarter for us. While

our net revenue came in less than last year, our attention to

detail in managing expenses helped us offset the slight decline in

revenue. Our financial position is affected by a number of things,

including the timing of live seminars, contract renewals and

capitalization of assets. As we have stated in the past, timing can

have an effect on both the revenue and cash aspects of our

business."

Mr. Greene continued: "Over the last several years, and

during the economic recession, we have chosen to invest in

ourselves. We have built new products, revitalized our course

libraries and improved the capabilities of existing products. We

see this major building effort tapering down in the second

quarter of this year, with the expected completion of major

projects in the third quarter. We believe these new and improved

products will help us grow in the future. Throughout the recession

we have kept a long-term outlook of our company instead of focusing

on short-term quarterly results. That said, we will always need to

keep our libraries current to be competitive." In addition,

SmartPros' Board of Directors declared the Company's 18th

consecutive quarterly dividend. The $.015 per share dividend is

payable on July 7, 2014, to shareholders of record as of June 20,

2014. The Company cautions that any future dividend will be

affected by our results and by our ongoing requirement for cash to

make acquisitions. Shareholders and other interested parties are

encouraged to contact the Company with any specific questions

relating to the Company's public filings. Investor-related

questions can be addressed by calling 914-829-4974, or by visiting

SmartPros' Investor Relations site at http://ir.smartpros.com.

| |

| SMARTPROS LTD. AND

SUBSIDIARIES |

| Condensed Consolidated

Balance Sheets |

| |

March 31, |

December 31, |

| |

2014 |

2013 |

| |

(Unaudited) |

(Audited) |

| ASSETS |

|

|

| Current Assets: |

|

|

| Cash and cash equivalents |

$ 4,259,862 |

$ 5,303,657 |

| Accounts receivable, net of allowance for

doubtful accounts of approximately $20,000 at March 31, 2014, and

December 31, 2013, respectively |

1,909,738 |

2,430,495 |

| Prepaid expenses and other current

assets |

510,358 |

340,463 |

| Current income tax benefit |

250,000 |

— |

| Total Current Assets |

6,929,958 |

8,074,615 |

| Property and equipment, net |

543,917 |

566,475 |

| Goodwill |

2,807,257 |

2,807,257 |

| Other intangibles, net |

3,649,092 |

3,516,411 |

| Other assets, including restricted cash of

$75,000 |

104,165 |

104,515 |

| Deferred tax asset |

600,000 |

600,000 |

| Investment in joint venture |

1,893 |

2,268 |

| |

7,706,324 |

7,596,926 |

| Total Assets |

$ 14,636,282 |

$ 15,671,541 |

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

| Current Liabilities: |

|

|

| Accounts payable |

$ 681,933 |

$ 1,203,222 |

| Accrued expenses |

149,501 |

234,863 |

| Dividend payable |

70,267 |

70,289 |

| Deferred revenue |

4,404,535 |

4,395,166 |

| Total Current Liabilities |

5,306,236 |

5,903,540 |

| Other liabilities |

69,310 |

70,378 |

| Commitments and contingencies |

|

|

| Stockholders' Equity: |

|

|

| Preferred stock, $.001 par value,

authorized 1,000,000 shares, 0 shares issued and outstanding |

— |

— |

| Common stock, $.0001 par value,

authorized 30,000,000 shares, 5,665,433 shares issued as of March

31, 2014, and December 31, 2013, respectively; and 4,684,441 shares

outstanding as of March 31, 2014 and December 31, 2013,

respectively |

567 |

567 |

| Additional paid-in capital |

17,164,082 |

17,217,008 |

| Accumulated deficit |

(5,218,181 |

(4,834,220) |

| Common stock in treasury, at cost –

980,992 shares at March 31, 2014, and December 31, 2013,

respectively |

(2,685,732) |

(2,685,732) |

| |

|

|

| Total Stockholders' Equity |

9,260,736 |

9,697,623 |

| Total Liabilities and Stockholders'

Equity |

$ 14,636,282 |

$ 15,671,541 |

| |

|

|

| |

|

|

| SMARTPROS LTD. AND

SUBSIDIARIES |

|

|

| Condensed Consolidated Statements

of Operations (Unaudited) |

|

|

| |

Three Months

Ended |

| |

March

31, |

| |

2014 |

2013 |

| Net revenues |

$ 2,988,003 |

$ 3,218,667 |

| Cost of revenues |

1,545,668 |

1,427,454 |

| Gross profit |

1,442,335 |

1,791,213 |

| Operating Expenses: |

|

|

| Selling, general and administrative |

1,821,953 |

2,101,027 |

| Depreciation and amortization |

256,760 |

268,513 |

| |

2,078,713 |

2,369,540 |

| Operating (loss) |

(636,378) |

(578,327) |

| Other Income (Expense): |

|

|

| Interest income (net) |

6,573 |

6,495 |

| Equity loss from joint venture |

(375) |

(3,247) |

| |

6,198 |

3,248 |

| (Loss) before income tax |

(630,180) |

(575,079) |

| Benefit from income taxes |

246,219 |

218,597 |

| Net (loss) |

$ (383,961) |

$ (356,482) |

| Net (loss) per common share: |

|

|

| Basic net (loss) per common share |

$ (0.08) |

$ (0.08) |

| Diluted net(loss) per common share |

$ (0.08) |

$ (0.08) |

| Weighted Average Number of Shares

Outstanding: |

|

|

| Basic |

4,684,441 |

4,721,914 |

| Diluted |

4,684,441 |

4,721,914 |

About SmartPros

Founded in 1981, SmartPros Ltd. is an industry leader in the

field of accredited professional education and corporate training.

Its products and services are primarily focused in the accredited

professional areas of corporate accounting, financial management,

public accounting, governmental and not-for-profit accounting,

financial services, banking, engineering, legal, ethics and

compliance, and information technology. SmartPros is a leading

provider of professional education products to Fortune 500

companies, as well as the major firms and associations in each of

its professional markets. SmartPros provides education and content

publishing and development services in a variety of media including

Web, CD-ROM, video and live seminars and events. Our subscription

libraries feature hundreds of course titles and 2,300+ hours of

accredited education. SmartPros' proprietary Professional Education

Center (PEC) Learning Management System (LMS) offers enterprise

distribution and administration of education content and

information. In addition, SmartPros produces a popular news and

information portal for accounting and finance professionals serving

more than one million ads and distributing more than 200,000

subscriber email newsletters each month. SmartPros' network of Web

sites averages more than 1 million monthly visits, serving a user

base of more than 1.5 million profiled members. Visit:

www.smartpros.com.

Safe Harbor Statement

Statements in this press release that are not statements of

historical or current fact constitute "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. These

forward-looking statements involve risks and uncertainties,

including activities, events or developments, that the Company

expects, believes or anticipates will or may occur in the future.

In addition to statements that explicitly describe these risks and

uncertainties, readers are urged to consider statements that

contain terms such as "believes," "belief," "expects," "expect,"

"intends," "intend," "anticipate," "anticipates," "plans," "plan,"

to be uncertain and forward-looking. The forward-looking statements

contained herein are also subject generally to other risks and

uncertainties that are described from time to time in the Company's

filings with Securities and Exchange Commission. Specifically,

results reported within this press release should not be considered

an indication of future performance.

CONTACT: SmartPros Ltd

Shane Gillispie, VP Marketing Services & eCommerce

914-829-4974 - shanegillispie@smartpros.com

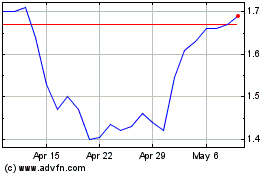

Spero Therapeutics (NASDAQ:SPRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Spero Therapeutics (NASDAQ:SPRO)

Historical Stock Chart

From Apr 2023 to Apr 2024