U.S. stocks gained after investors took heart from stronger U.S.

economic data, but fell off session highs after the head of the

International Monetary Fund stoked fears that Europe's

sovereign-debt crisis is worsening.

The Dow Jones Industrial Average rose 59 points, or 0.5%, to

11883 in afternoon trading, after advancing by triple digits early

in the session. The gains followed a 131-point drop Wednesday that

stretched the measure's decline for the week to 361 points, or

3%.

The Standard & Poor's 500-stock index tacked on five points,

or 0.4%, to 1217, while the Nasdaq Composite rose five points, or

0.2%, to 2545. Sectors viewed as more defensive were faring best,

as utilities, health care and consumer staples shares led the

S&P 500.

Stocks rose after the Labor Department said a seasonally

adjusted 366,000 workers filed initial jobless claims in the week

ended Dec. 10, well below forecasts and the lowest since May 2008.

The figures were the latest indication the weak jobs market is

slowly building strength. The four-week moving average of new

jobless claims fell to its lowest level since July 2008.

Midmorning, the Federal Reserve Bank of Philadelphia's gauge of

mid-Atlantic manufacturing activity rose to 10.3 in December, from

3.6 in November, which also was much stronger than forecast.

But stocks lost some steam after IMF chief Christine Lagarde

said at a U.S. State Department conference that the sovereign-debt

crisis requires action by countries outside of the European Union.

She called the global economic outlook "quite gloomy."

"Europe can have a recession that doesn't drag the U.S. into

it," said Howard Ward, portfolio manager at Gamco Growth Fund.

"It's important for people to understand that we will certainly be

impacted in a negative way by the slowdown in Europe. But that

doesn't mean that we're going to have a recession as well."

"The market doesn't have a tremendous amount of conviction right

now," Ward added. "When the first buyers come into this market,

they're coming to the more defensive areas."

The euro gained slightly versus the dollar and was just above

$1.30 in recent trading. It dropped to its lowest point since

January on Wednesday, bogged down by doubts that the euro-zone

bailout fund will have enough firepower to stem the crisis.

European markets finished higher, with the Stoxx Europe 600 up

1%. Manufacturing activity in the euro zone contracted at a slower

pace than expected in December, while Germany's preliminary

December figures rose versus the previous month. A successful

Spanish bond auction also lifted investor spirits.

Asian exchanges fell, with China's Shanghai Composite shedding

2.1% to its lowest close since March 2009. Data showed China

manufacturing activity contracted again in December, although at a

slower rate than in November.

Gold futures lost 0.5% to $1,568.80 a troy ounce after plunging

4.6% Wednesday, while crude-oil futures lost $1.08 to settle at

$93.87 a barrel.

Novellus Systems was the biggest advancer in the S&P 500,

rallying 17% after the company agreed to be acquired by fellow

chip-equipment maker Lam Research in an all-stock deal that values

Novellus at about $3.3 billion. Lam shares slipped 5.4%.

FedEx was the measure's second-strongest stock, climbing 7.5%

after the package-delivery service reported fiscal second-quarter

earnings that exceeded expectations and affirmed its full-year

outlook.

Discover Financial Services was one of the S&P 500's biggest

decliners, shedding 3%. The company's fiscal fourth-quarter profit

jumped a better-than-expected 47%, but investors expressed concerns

that credit improvements have run their course.

Luxury-apparel designer Michael Kors Holdings surged 21% in its

first day of trading after an IPO on the New York Stock

Exchange.

International Business Machines lost 0.4%. Big Blue agreed to

acquire Emptoris as the tech giant continues to place an emphasis

on Web-based software-company purchases.

A slew of other U.S. economic data greeted investors. U.S.

wholesale prices rose slightly in November due to higher food

costs, but the underlying rate of increase in producer prices

remained tame, indicating little inflation pressure, while the U.S.

current-account deficit narrowed in the third quarter.

U.S. industrial production fell for the first time in seven

months during November, an unexpected drop caused by declining

output of cars, electronics, clothing and other products.

"It looks as though there is a decoupling between the United

States and Europe," said Paul Nolte, managing director at Dearborn

Partners. "We're starting to see some economic growth, though

modest at best. That's generally supportive of the market. [But]

the overarching concern is still anything that comes out of

Europe."

Elsewhere in corporate news, SonoSite leapt 27% after the

medical-equipment maker said it entered into an agreement to be

purchased by Fujifilm Holdings for $995 million.

BioSante Pharmaceuticals tumbled 77% after the company said

results from efficacy trials of its testosterone gel failed to meet

the co-primary and secondary endpoints.

-By Brendan Conway, Dow Jones Newswires; (212) 416-2670;

brendan.conway@dowjones.com

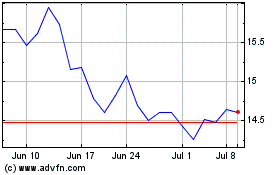

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Mar 2024 to Apr 2024

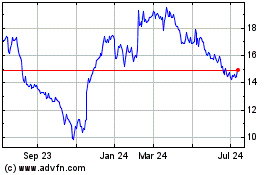

Sonos (NASDAQ:SONO)

Historical Stock Chart

From Apr 2023 to Apr 2024