UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 28, 2015 (April 28, 2015)

SIRIUS XM HOLDINGS INC.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

001-34295 |

38-3916511 |

(State or other

Jurisdiction

of Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

| |

|

|

| 1221 Avenue of the Americas, 36th Fl., New York, NY |

10020 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (212) 584-5100

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On April 28, 2015, we reported our financial

and operating results for the three months ended March 31, 2015. These results are discussed in the press release attached hereto

as Exhibit 99.1, which is incorporated by reference in its entirety.

Item 7.01 Regulation FD Disclosure.

The first quarter 2015 financial information

about our subsidiary, Sirius XM Radio Inc., will be posted to our website at investor.siriusxm.com. Sirius XM Radio Inc. is furnishing

this information in order to comply with the reporting obligations in the indentures governing its outstanding notes.

* * *

The information in this Current Report on

Form 8-K, including Exhibit 99.1 hereto, is being furnished pursuant to Item 2.02 and Item 7.01 of Form 8-K, as applicable, and

shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly

set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

The Exhibit Index attached hereto is incorporated

herein.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SIRIUS XM HOLDINGS INC. |

|

| |

|

|

|

| |

By: |

/s/ Patrick L. Donnelly |

|

| |

|

Patrick L. Donnelly |

|

| |

|

Executive Vice President, General Counsel and Secretary |

|

Dated: April 28, 2015

EXHIBITS

| Exhibit |

|

Description

of Exhibit |

| |

|

|

| 99.1 |

|

Press Release dated April 28, 2015 |

Exhibit 99.1

SiriusXM Reports First Quarter 2015 Results

| ● | First Quarter Revenue Increases 8% to $1.08 Billion |

| ● | Net Income Climbs 12% to $106 Million |

| ● | Adjusted EBITDA Jumps 19% to a Record $399 Million |

| ● | Free Cash Flow Reaches $276 Million, up 24% |

| ● | Company Increases 2015 Guidance for Revenue and Subscribers |

NEW YORK – April 28, 2015 – SiriusXM today

announced first quarter 2015 operating and financial results, including record first quarter revenue of $1.08 billion, up 8% versus

the first quarter of 2014.

Net income was $106 million, up 12% from $94 million in the first

quarter of 2014. Net income per diluted common share was $0.02 in the first quarter of 2015 and 2014. Adjusted EBITDA was $399

million in the first quarter of 2015, up 19% from $335 million in the first quarter of 2014.

“The year is off to a fantastic start at SiriusXM. We are

increasing our subscriber guidance to approximately 1.4 million net additions and revenue guidance to approximately $4.47 billion

after reporting our best first quarter for self-pay subscriber additions since 2008. Our results demonstrate that SiriusXM’s

bundle of live news and sports, exclusive talk and comedy, and curated, commercial-free music is resonating with more and more

consumers every day,” said Jim Meyer, Chief Executive Officer, SiriusXM.

“This month, we have aired great live performances from

the Coachella music festival and exclusive programming from the Masters golf tournament. Later this year, we will introduce new

channels led by Andy Cohen and Pitbull. We continually seek to add new and exclusive talent, shows, and channels that speak to

our growing base of paying subscribers,” added Meyer.

FIRST QUARTER 2015 HIGHLIGHTS

| ● | Subscriber growth off to a strong start. SiriusXM added 431 thousand net new subscribers in the first quarter, a 61%

increase from the 267 thousand net new subscribers added in the first quarter of 2014. Self-pay net subscriber additions were 394

thousand in the first quarter of 2015 compared to 173 thousand in the first quarter of 2014. Marking the strongest first quarter

for self-pay subscriber growth since 2008. |

| ● | First quarter EBITDA climbs 19%. Adjusted EBITDA of $399 million in the first quarter of 2015 was the highest quarterly

amount in the company’s history, an increase of 19% over the $335 million reported in the first quarter of 2014. Adjusted

EBITDA margin was 37%, also the highest in the company’s history. |

| ● | Free cash flow per diluted share climbs strongly. Free cash flow of $276 million was up 24% from $223 million in the

first quarter of 2014. Driven by higher cash flow and a lower share count from the share repurchase program, free cash flow per

diluted share climbed an even stronger 36% to 4.9 cents in the first quarter of 2015, up from 3.6 cents in the first quarter of

2014. |

“We repurchased 144 million shares for $534 million during

the first quarter and continue to see our shares as an attractive investment. With our growing free cash flow, the successful placement

of $1 billion of 5.375% Senior Notes in March, and $1.25 billion of unused revolver capacity, we have plenty of liquidity to continue

returning capital to shareholders while maintaining prudent leverage. In just over two years since we began our capital return

program with a special dividend, we have paid our shareholders nearly $5.3 billion and retired nearly 22% of our then outstanding

shares,” noted David Frear, Chief Financial Officer, SiriusXM.

INCREASED 2015 GUIDANCE

The company increased its 2015 guidance for revenue and subscribers,

originally given on January 7, 2015, and reiterated its guidance for adjusted EBITDA and free cash flow:

| ● | Net subscriber additions of approximately 1.4 million, |

| ● | Revenue of approximately $4.47 billion, |

| ● | Adjusted EBITDA of approximately $1.6 billion, and |

| ● | Free cash flow of approximately $1.25 billion. |

FIRST QUARTER 2015 RESULTS

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME

(UNAUDITED)

| | |

For the Three Months Ended

March 31, | |

| (in thousands, except per share data) | |

2015 | | |

2014 | |

| | |

| | |

| |

| Revenue: | |

| | | |

| | |

| Subscriber revenue | |

$ | 911,470 | | |

$ | 851,436 | |

| Advertising revenue | |

| 26,873 | | |

| 22,214 | |

| Equipment revenue | |

| 24,841 | | |

| 23,978 | |

| Other revenue | |

| 117,806 | | |

| 100,083 | |

| Total revenue | |

| 1,080,990 | | |

| 997,711 | |

| Operating expenses: | |

| | | |

| | |

| Cost of services: | |

| | | |

| | |

| Revenue share and royalties | |

| 212,978 | | |

| 195,411 | |

| Programming and content | |

| 71,146 | | |

| 74,870 | |

| Customer service and billing | |

| 92,097 | | |

| 91,069 | |

| Satellite and transmission | |

| 21,304 | | |

| 21,380 | |

| Cost of equipment | |

| 8,845 | | |

| 7,804 | |

| Subscriber acquisition costs | |

| 122,260 | | |

| 123,022 | |

| Sales and marketing | |

| 78,744 | | |

| 76,327 | |

| Engineering, design and development | |

| 14,960 | | |

| 15,911 | |

| General and administrative | |

| 79,823 | | |

| 76,243 | |

| Depreciation and amortization | |

| 65,027 | | |

| 68,267 | |

| Total operating expenses | |

| 767,184 | | |

| 750,304 | |

| Income from operations | |

| 313,806 | | |

| 247,407 | |

| Other income (expense): | |

| | | |

| | |

| Interest expense, net of amounts capitalized | |

| (69,908 | ) | |

| (54,092 | ) |

| Interest and investment income | |

| 981 | | |

| 4,349 | |

| Loss on change in value of derivatives | |

| - | | |

| (27,023 | ) |

| Other (loss) income | |

| (258 | ) | |

| 95 | |

| Total other expense | |

| (69,185 | ) | |

| (76,671 | ) |

| Income before income taxes | |

| 244,621 | | |

| 170,736 | |

| Income tax expense | |

| (138,929 | ) | |

| (76,748 | ) |

| Net income | |

$ | 105,692 | | |

$ | 93,988 | |

| Foreign currency translation adjustment, net of tax | |

| - | | |

| 118 | |

| Total comprehensive income | |

$ | 105,692 | | |

$ | 94,106 | |

| Net income per common share: | |

| | | |

| | |

| Basic | |

$ | 0.02 | | |

$ | 0.02 | |

| Diluted | |

$ | 0.02 | | |

$ | 0.02 | |

| Weighted average common shares outstanding: | |

| | | |

| | |

| Basic | |

| 5,570,748 | | |

| 6,094,784 | |

| Diluted | |

| 5,639,838 | | |

| 6,173,848 | |

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| | |

As of March 31, | | |

As of December 31, | |

| | |

2015 | | |

2014 | |

| (in thousands, except per share data) | |

(unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 482,043 | | |

$ | 147,724 | |

| Receivables, net | |

| 219,421 | | |

| 220,579 | |

| Inventory, net | |

| 22,937 | | |

| 19,397 | |

| Prepaid expenses | |

| 135,960 | | |

| 116,336 | |

| Related party current assets | |

| 3,374 | | |

| 4,344 | |

| Deferred tax asset | |

| 937,767 | | |

| 1,038,603 | |

| Other current assets | |

| 2,242 | | |

| 2,763 | |

| Total current assets | |

| 1,803,744 | | |

| 1,549,746 | |

| Property and equipment, net | |

| 1,477,657 | | |

| 1,510,112 | |

| Long-term restricted investments | |

| 9,888 | | |

| 5,922 | |

| Deferred financing fees, net | |

| 12,909 | | |

| 12,021 | |

| Intangible assets, net | |

| 2,631,823 | | |

| 2,645,046 | |

| Goodwill | |

| 2,205,107 | | |

| 2,205,107 | |

| Related party long-term assets | |

| - | | |

| 3,000 | |

| Long-term deferred tax asset | |

| 402,279 | | |

| 437,736 | |

| Other long-term assets | |

| 6,602 | | |

| 6,819 | |

| Total assets | |

$ | 8,550,009 | | |

$ | 8,375,509 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 548,863 | | |

$ | 587,755 | |

| Accrued interest | |

| 67,750 | | |

| 80,440 | |

| Current portion of deferred revenue | |

| 1,668,484 | | |

| 1,632,381 | |

| Current portion of deferred credit on executory contracts | |

| 558 | | |

| 1,394 | |

| Current maturities of long-term debt | |

| 7,546 | | |

| 7,482 | |

| Related party current liabilities | |

| 4,860 | | |

| 4,340 | |

| Total current liabilities | |

| 2,298,061 | | |

| 2,313,792 | |

| Deferred revenue | |

| 156,102 | | |

| 151,901 | |

| Long-term debt | |

| 5,101,886 | | |

| 4,493,863 | |

| Related party long-term liabilities | |

| 12,925 | | |

| 13,635 | |

| Other long-term liabilities | |

| 92,857 | | |

| 92,481 | |

| Total liabilities | |

| 7,661,831 | | |

| 7,065,672 | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, par value $0.001; 9,000,000 shares authorized; 5,513,664 and 5,653,529 shares issued; 5,507,239 and 5,646,119 outstanding at March 31, 2015 and December 31, 2014, respectively | |

| 5,514 | | |

| 5,653 | |

| Accumulated other comprehensive loss, net of tax | |

| (402 | ) | |

| (402 | ) |

| Additional paid-in capital | |

| 6,243,166 | | |

| 6,771,554 | |

| Treasury stock, at cost; 6,425 and 7,410 shares of common stock at March 31, 2015 and December 31, 2014, respectively | |

| (24,858 | ) | |

| (26,034 | ) |

| Accumulated deficit | |

| (5,335,242 | ) | |

| (5,440,934 | ) |

| Total stockholders’ equity | |

| 888,178 | | |

| 1,309,837 | |

| Total liabilities and stockholders’ equity | |

$ | 8,550,009 | | |

$ | 8,375,509 | |

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

For the Three Months Ended March 31, |

| (in thousands) | |

2015 | |

2014 |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 105,692 | | |

$ | 93,988 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 65,027 | | |

| 68,267 | |

| Non-cash interest expense, net of amortization of premium | |

| 1,852 | | |

| 5,231 | |

| Provision for doubtful accounts | |

| 10,885 | | |

| 10,634 | |

| Amortization of deferred income related to equity method investment | |

| (694 | ) | |

| (694 | ) |

| Gain on unconsolidated entity investments, net | |

| - | | |

| (4,326 | ) |

| Dividend received from unconsolidated entity investment | |

| 3,778 | | |

| 4,222 | |

| Loss on change in value of derivatives | |

| - | | |

| 27,023 | |

| Share-based payment expense | |

| 19,417 | | |

| 18,240 | |

| Deferred income taxes | |

| 136,294 | | |

| 74,565 | |

| Other non-cash purchase price adjustments | |

| (836 | ) | |

| (945 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Receivables | |

| (9,727 | ) | |

| (11,080 | ) |

| Inventory | |

| (3,540 | ) | |

| (5,124 | ) |

| Related party assets | |

| 192 | | |

| 654 | |

| Prepaid expenses and other current assets | |

| (19,102 | ) | |

| (15,682 | ) |

| Other long-term assets | |

| 215 | | |

| 718 | |

| Accounts payable and accrued expenses | |

| (27,918 | ) | |

| (68,168 | ) |

| Accrued interest | |

| (12,690 | ) | |

| 15,291 | |

| Deferred revenue | |

| 40,304 | | |

| 34,861 | |

| Related party liabilities | |

| 503 | | |

| 177 | |

| Other long-term liabilities | |

| 377 | | |

| 3,538 | |

| Net cash provided by operating activities | |

| 310,029 | | |

| 251,390 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Additions to property and equipment | |

| (29,831 | ) | |

| (28,601 | ) |

| Purchases of restricted and other investments | |

| (3,966 | ) | |

| - | |

| Acquisition of business, net of cash acquired | |

| - | | |

| 1,144 | |

| Net cash used in investing activities | |

| (33,797 | ) | |

| (27,457 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from exercise of stock options | |

| - | | |

| 259 | |

| Taxes paid in lieu of shares issued for stock-based compensation | |

| (12,711 | ) | |

| (4,229 | ) |

| Proceeds from long-term borrowings and revolving credit facility, net of costs | |

| 1,263,745 | | |

| - | |

| Repayment of long-term borrowings and revolving credit facility | |

| (657,731 | ) | |

| (152,528 | ) |

| Common stock repurchased and retired | |

| (535,216 | ) | |

| (81,069 | ) |

| Net cash provided by (used in) financing activities | |

| 58,087 | | |

| (237,567 | ) |

| Net increase (decrease) in cash and cash equivalents | |

| 334,319 | | |

| (13,634 | ) |

| Cash and cash equivalents at beginning of period | |

| 147,724 | | |

| 134,805 | |

| Cash and cash equivalents at end of period | |

$ | 482,043 | | |

$ | 121,171 | |

Key

Operating Metrics

The following

table contains our key operating metrics based on our adjusted results of operations for the three months ended March 31, 2015

and 2014, respectively. Subscribers and subscription related revenues and expenses associated with our connected vehicle services

are not included in our subscriber count or subscriber-based operating metrics:

| | |

Unaudited |

| | |

For the Three Months Ended March 31, |

| (in thousands, except per subscriber and per installation amounts) |

|

2015 | |

2014 |

| Self-pay subscribers | |

| 22,917 | | |

| 21,255 | |

| Paid promotional subscribers | |

| 4,826 | | |

| 4,571 | |

| Ending subscribers (a) | |

| 27,742 | | |

| 25,826 | |

| | |

| | | |

| | |

| Self-pay subscribers | |

| 394 | | |

| 173 | |

| Paid promotional subscribers | |

| 37 | | |

| 93 | |

| Net additions (a) | |

| 431 | | |

| 267 | |

| | |

| | | |

| | |

| Daily weighted average number of subscribers | |

| 27,406 | | |

| 25,602 | |

| | |

| | | |

| | |

| Average self-pay monthly churn | |

| 1.8 | % | |

| 1.9 | % |

| | |

| | | |

| | |

| New vehicle consumer conversion rate | |

| 40 | % | |

| 42 | % |

| | |

| | | |

| | |

| ARPU | |

$ | 12.26 | | |

$ | 12.18 | |

| SAC, per installation | |

$ | 33 | | |

$ | 35 | |

| Customer service and billing expenses, per average subscriber | |

$ | 1.01 | | |

$ | 1.09 | |

| Free cash flow | |

$ | 276,232 | | |

$ | 222,789 | |

| Adjusted EBITDA | |

$ | 399,227 | | |

$ | 334,782 | |

(a) Note: Amounts may

not sum as a result of rounding.

Glossary

Adjusted EBITDA - EBITDA is defined as net income before

interest and investment income (loss); interest expense, net of amounts capitalized; income tax expense and depreciation and amortization.

We adjust EBITDA to exclude the impact of other income and expense, loss on extinguishment of debt, loss on change in value of

derivatives as well as certain other charges discussed below. This measure is one of the primary Non-GAAP financial measures on

which we (i) evaluate the performance of our businesses, (ii) base our internal budgets and (iii) compensate management. Adjusted

EBITDA is a Non-GAAP financial performance measure that excludes (if applicable): (i) certain adjustments as a result of the purchase

price accounting for the merger of Sirius and XM, (ii) depreciation and amortization and (iii) share-based payment expense. The

purchase price accounting adjustments include: (i) the elimination of deferred revenue associated with the investment in XM Canada,

(ii) recognition of deferred subscriber revenues not recognized in purchase price accounting, and (iii) elimination of the benefit

of deferred credits on executory contracts, which are primarily attributable to third party arrangements with an OEM and programming

providers. We believe adjusted EBITDA is a useful measure of the underlying trend of our operating performance, which provides

useful information about our business apart from the costs associated with our physical plant, capital structure and purchase price

accounting. We believe investors find this Non-GAAP financial measure useful when analyzing our results and comparing our operating

performance to the performance of other communications, entertainment and media companies. We believe investors use current and

projected adjusted EBITDA to estimate our current and prospective enterprise value and to make investment decisions. Because we

fund and build-out our satellite radio system through the periodic raising and expenditure of large amounts of capital, our results

of operations reflect significant charges for depreciation expense. The exclusion of depreciation and amortization expense is useful

given significant variation in depreciation and amortization expense that can result from the potential variations in estimated

useful lives, all of which can vary widely across different industries or among companies within the same industry. We also believe

the exclusion of share-based payment expense is useful given share-based payment expense is not directly related to the operational

conditions of our business.

Adjusted EBITDA has certain limitations in that it does not take

into account the impact to our statements of comprehensive income of certain expenses, including share-based payment expense and

certain purchase price accounting for the merger of Sirius and XM. We endeavor to

compensate for the limitations of the Non-GAAP measure presented

by also providing the comparable GAAP measure with equal or greater prominence and descriptions of the reconciling items, including

quantifying such items, to derive the Non-GAAP measure. Investors that wish to compare and evaluate our operating results after

giving effect for these costs, should refer to net income as disclosed in our unaudited consolidated statements of comprehensive

income. Since adjusted EBITDA is a Non-GAAP financial performance measure, our calculation of adjusted EBITDA may be susceptible

to varying calculations; may not be comparable to other similarly titled measures of other companies; and should not be considered

in isolation, as a substitute for, or superior to measures of financial performance prepared in accordance with GAAP. The reconciliation

of net income to the adjusted EBITDA is calculated as follows (in thousands):

| | |

Unaudited |

| | |

For the Three Months Ended

March 31, |

| | |

2015 | |

2014 |

| Net income (GAAP): | |

$ | 105,692 | | |

$ | 93,988 | |

| Add back items excluded from Adjusted EBITDA: | |

| | | |

| | |

| Purchase price accounting adjustments: | |

| | | |

| | |

| Revenues | |

| 1,813 | | |

| 1,813 | |

| Operating expenses | |

| (836 | ) | |

| (945 | ) |

| Share-based payment expense (GAAP) | |

| 19,417 | | |

| 18,240 | |

| Depreciation and amortization (GAAP) | |

| 65,027 | | |

| 68,267 | |

| Interest expense, net of amounts capitalized (GAAP) | |

| 69,908 | | |

| 54,092 | |

| Interest and investment income (GAAP) | |

| (981 | ) | |

| (4,349 | ) |

| Loss on change in value of derivatives (GAAP) | |

| - | | |

| 27,023 | |

| Other loss (income) (GAAP) | |

| 258 | | |

| (95 | ) |

| Income tax expense (GAAP) | |

| 138,929 | | |

| 76,748 | |

| Adjusted EBITDA | |

$ | 399,227 | | |

$ | 334,782 | |

Adjusted Revenues and Operating Expenses - We define

this Non-GAAP financial measure as our actual revenues and operating expenses adjusted to exclude the impact of certain purchase

price accounting adjustments from the merger of Sirius and XM and share-based payment expense. We use this Non-GAAP financial measure

to manage our business, to set operational goals and as a basis for determining performance-based compensation for our employees.

The following tables reconcile our actual revenues and operating expenses to our adjusted revenues and operating expenses for the

three months ended March 31, 2015 and 2014:

| | |

Unaudited For the Three Months Ended March 31, 2015 |

| (in thousands) | |

As Reported | |

Purchase Price

Accounting

Adjustments | |

Allocation of

Share-based

Payment Expense | |

Adjusted |

| | |

| | |

| | |

| | |

| |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Subscriber revenue | |

$ | 911,470 | | |

$ | - | | |

$ | - | | |

$ | 911,470 | |

| Advertising revenue | |

| 26,873 | | |

| - | | |

| - | | |

| 26,873 | |

| Equipment revenue | |

| 24,841 | | |

| - | | |

| - | | |

| 24,841 | |

| Other revenue | |

| 117,806 | | |

| 1,813 | | |

| - | | |

| 119,619 | |

| Total revenue | |

$ | 1,080,990 | | |

$ | 1,813 | | |

$ | - | | |

$ | 1,082,803 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of services: | |

| | | |

| | | |

| | | |

| | |

| Revenue share and royalties | |

$ | 212,978 | | |

$ | - | | |

$ | - | | |

$ | 212,978 | |

| Programming and content | |

| 71,146 | | |

| 836 | | |

| (2,227 | ) | |

| 69,755 | |

| Customer service and billing | |

| 92,097 | | |

| - | | |

| (695 | ) | |

| 91,402 | |

| Satellite and transmission | |

| 21,304 | | |

| - | | |

| (937 | ) | |

| 20,367 | |

| Cost of equipment | |

| 8,845 | | |

| - | | |

| - | | |

| 8,845 | |

| Subscriber acquisition costs | |

| 122,260 | | |

| - | | |

| - | | |

| 122,260 | |

| Sales and marketing | |

| 78,744 | | |

| - | | |

| (3,744 | ) | |

| 75,000 | |

| Engineering, design and development | |

| 14,960 | | |

| - | | |

| (2,134 | ) | |

| 12,826 | |

| General and administrative | |

| 79,823 | | |

| - | | |

| (9,680 | ) | |

| 70,143 | |

| Depreciation and amortization (a) | |

| 65,027 | | |

| - | | |

| - | | |

| 65,027 | |

| Share-based payment expense | |

| - | | |

| - | | |

| 19,417 | | |

| 19,417 | |

| Total operating expenses | |

$ | 767,184 | | |

$ | 836 | | |

$ | - | | |

$ | 768,020 | |

(a) Purchase price accounting adjustments included above exclude

the incremental depreciation and amortization associated with the $785,000 stepped up basis in property, equipment and intangible

assets as a result of the merger of Sirius and XM. The increased depreciation and amortization for the three months ended March

31, 2015 was $9,000.

| | |

Unaudited For the Three Months Ended March 31, 2014 |

| (in thousands) | |

As Reported | |

Purchase Price

Accounting

Adjustments | |

Allocation of

Share-based

Payment Expense | |

Adjusted |

| | |

| | |

| | |

| | |

| |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Subscriber revenue | |

$ | 851,436 | | |

$ | - | | |

$ | - | | |

$ | 851,436 | |

| Advertising revenue | |

| 22,214 | | |

| - | | |

| - | | |

| 22,214 | |

| Equipment revenue | |

| 23,978 | | |

| - | | |

| - | | |

| 23,978 | |

| Other revenue | |

| 100,083 | | |

| 1,813 | | |

| - | | |

| 101,896 | |

| Total revenue | |

$ | 997,711 | | |

$ | 1,813 | | |

$ | - | | |

$ | 999,524 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of services: | |

| | | |

| | | |

| | | |

| | |

| Revenue share and royalties | |

$ | 195,411 | | |

$ | - | | |

$ | - | | |

$ | 195,411 | |

| Programming and content | |

| 74,870 | | |

| 945 | | |

| (2,215 | ) | |

| 73,600 | |

| Customer service and billing | |

| 91,069 | | |

| - | | |

| (577 | ) | |

| 90,492 | |

| Satellite and transmission | |

| 21,380 | | |

| - | | |

| (946 | ) | |

| 20,434 | |

| Cost of equipment | |

| 7,804 | | |

| - | | |

| - | | |

| 7,804 | |

| Subscriber acquisition costs | |

| 123,022 | | |

| - | | |

| - | | |

| 123,022 | |

| Sales and marketing | |

| 76,327 | | |

| - | | |

| (3,566 | ) | |

| 72,761 | |

| Engineering, design and development | |

| 15,911 | | |

| - | | |

| (1,926 | ) | |

| 13,985 | |

| General and administrative | |

| 76,243 | | |

| - | | |

| (9,010 | ) | |

| 67,233 | |

| Depreciation and amortization (a) | |

| 68,267 | | |

| - | | |

| - | | |

| 68,267 | |

| Share-based payment expense | |

| - | | |

| - | | |

| 18,240 | | |

| 18,240 | |

| Total operating expenses | |

$ | 750,304 | | |

$ | 945 | | |

$ | - | | |

$ | 751,249 | |

(a) Purchase price accounting adjustments included above exclude

the incremental depreciation and amortization associated with the $785,000 stepped up basis in property, equipment and intangible

assets as a result of the merger of Sirius and XM. The increased depreciation and amortization for the three months ended March

31, 2014 was $10,000.

Adjusted Cash Operating Expenses - We define this

Non-GAAP financial measure as our actual operating expenses adjusted to exclude the impact of certain purchase price accounting

adjustments from the merger of Sirius and XM, depreciation and amortization expense, and share-based payment expense. The following

table reconciles our actual operating expenses to our adjusted cash operating expenses for the three months ended March 31, 2015

and 2014:

| | |

Unaudited |

| | |

For the Three Months Ended

March 31, |

| | |

2015 | |

2014 |

| Operating expenses (GAAP): | |

$ | 767,184 | | |

$ | 750,304 | |

| Items excluded from adjusted cash operating expenses: | |

| | | |

| | |

| Purchase price accounting adjustments | |

| 836 | | |

| 945 | |

| Share-based payment expense (GAAP) | |

| (19,417 | ) | |

| (18,240 | ) |

| Depreciation and amortization (GAAP) | |

| (65,027 | ) | |

| (68,267 | ) |

| Adjusted cash operating expenses | |

$ | 683,576 | | |

$ | 664,742 | |

ARPU - is derived from total earned subscriber

revenue, advertising revenue and other subscription-related revenue, excluding revenue associated with our connected vehicle business,

divided by the number of months in the period, divided by the daily weighted average number of subscribers for the period. Other

subscription-related revenue includes the U.S. Music Royalty Fee. ARPU is calculated as follows (in thousands, except per subscriber

amounts):

| | |

Unaudited |

| | |

For the Three Months Ended

March 31, |

| | |

2015 | |

2014 |

| Subscriber revenue, excluding connected vehicle (GAAP) | |

$ | 888,381 | | |

$ | 832,804 | |

| Add: advertising revenue (GAAP) | |

| 26,873 | | |

| 22,214 | |

| Add: other subscription-related revenue (GAAP) | |

| 92,654 | | |

| 80,768 | |

| | |

$ | 1,007,908 | | |

$ | 935,786 | |

| Daily weighted average number of subscribers | |

| 27,406 | | |

| 25,602 | |

| ARPU | |

$ | 12.26 | | |

$ | 12.18 | |

Average self-pay monthly churn - is defined as

the monthly average of self-pay deactivations for the period divided by the average number of self-pay subscribers for the period.

Customer

service and billing expenses, per average subscriber - is derived from total customer service and billing expenses, excluding

connected vehicle customer service and billing expenses and share-based payment expense, divided by the number of months in the

period, divided by the daily weighted average number of subscribers for the period. We believe the exclusion of share-based payment

expense in our calculation of customer service and billing expenses, per average subscriber, is useful as share-based payment expense

is not directly related to the operational conditions that give rise to variations in the components of our customer service and

billing expenses. Customer service and billing expenses, per average subscriber, is calculated as follows (in thousands, except

per subscriber amounts):

| | |

Unaudited

|

| | |

For the Three Months Ended

March 31, |

| | |

2015 | |

2014 |

| Customer service and billing expenses, excluding connected vehicle (GAAP) | |

$ | 84,061 | | |

$ | 84,103 | |

| Less: share-based payment expense (GAAP) | |

| (695 | ) | |

| (577 | ) |

| | |

$ | 83,366 | | |

$ | 83,526 | |

| Daily weighted average number of subscribers | |

| 27,406 | | |

| 25,602 | |

| Customer service and billing expenses, per average subscriber | |

$ | 1.01 | | |

$ | 1.09 | |

Free cash flow and free cash flow per diluted share

- are derived from cash flow provided by operating activities, capital expenditures and restricted and other investment activity.

The calculation for free cash flow and free cash flow per diluted share are as follows (in thousands, except per share data):

| | |

Unaudited |

| | |

For the Three Months Ended

March 31, |

| | |

2015 | |

2014 |

| Cash Flow information | |

| | | |

| | |

| Net cash provided by operating activities | |

$ | 310,029 | | |

$ | 251,390 | |

| Net cash used in investing activities | |

$ | (33,797 | ) | |

$ | (27,457 | ) |

| Net cash provided by (used in) financing activities | |

$ | 58,087 | | |

$ | (237,567 | ) |

| Free Cash Flow | |

| | | |

| | |

| Net cash provided by operating activities | |

$ | 310,029 | | |

$ | 251,390 | |

| Additions to property and equipment | |

| (29,831 | ) | |

| (28,601 | ) |

| Purchases of restricted and other investments | |

| (3,966 | ) | |

| - | |

| Free cash flow | |

$ | 276,232 | | |

$ | 222,789 | |

| Diluted weighted average common shares outstanding | |

| 5,639,838 | | |

| 6,173,848 | |

| Free cash flow per diluted share | |

$ | 0.049 | | |

$ | 0.036 | |

New vehicle consumer conversion rate - is defined

as the percentage of owners and lessees of new vehicles that receive our satellite radio service and convert to become self-paying

subscribers after the initial promotion period. At the time satellite radio enabled vehicles are sold or leased, the owners or

lessees generally receive trial subscriptions ranging from three to twelve months. We measure conversion rate three months after

the period in which the trial service ends. The metric excludes rental and fleet vehicles.

Subscriber acquisition cost, per installation -

or SAC, per installation, is derived from subscriber acquisition costs and margins from the sale of radios and accessories, excluding

purchase price accounting adjustments, divided by the number of satellite radio installations in new vehicles and shipments of

aftermarket radios for the period. Purchase price accounting adjustments associated with the merger of Sirius and XM include the

elimination of the benefit of amortization of deferred credits on executory contracts recognized at the merger date attributable

to an OEM. SAC, per installation, is calculated as follows (in thousands, except per installation amounts):

| | |

Unaudited |

| | |

For the Three Months Ended

March 31, |

| | |

2015 | |

2014 |

| Subscriber acquisition costs (GAAP) | |

$ | 122,260 | | |

$ | 123,022 | |

| Less: margin from direct sales of radios and accessories (GAAP) | |

| (15,996 | ) | |

| (16,174 | ) |

| | |

$ | 106,264 | | |

$ | 106,848 | |

| Installations | |

| 3,221 | | |

| 3,079 | |

| SAC, per installation | |

$ | 33 | | |

$ | 35 | |

###

About SiriusXM

Sirius XM Holdings Inc. (NASDAQ: SIRI) is the world’s

largest radio broadcaster measured by revenue and has 27.7 million subscribers. SiriusXM creates and broadcasts commercial-free

music; premier sports talk and live events; comedy; news; exclusive talk and entertainment; and the most comprehensive Latin music,

sports and talk programming in radio. SiriusXM is available in vehicles from every major car company in the U.S. and on smartphones

and other connected devices as well as online at siriusxm.com. SiriusXM radios and accessories are available from retailers

nationwide and at shop.siriusxm.com. SiriusXM also provides premium traffic, weather, data and information services for

subscribers in cars, trucks, RVs, boats and aircraft through SiriusXM Traffic™, SiriusXM Travel Link, NavTraffic®, NavWeather™,

SiriusXM Aviation, SiriusXM Marine™, Sirius Marine Weather, XMWX Aviation™, and XMWX Marine™. SiriusXM holds

a minority interest in SiriusXM Canada which has more than 2 million subscribers. SiriusXM is also a leading provider of

connected vehicles services to major automakers, giving customers access to a suite of safety, security, and convenience services

including automatic crash notification, stolen vehicle recovery assistance, enhanced roadside assistance and turn-by-turn navigation.

On social media, join the SiriusXM community on Facebook,

Twitter, Instagram, and YouTube.

This communication contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited

to, statements about future financial and operating results, our plans, objectives, expectations and intentions with respect to

future operations, products and services; and other statements identified by words such as “will likely result,” “are

expected to,” “will continue,” “is anticipated,” “estimated,” “believe,”

“intend,” “plan,” “projection,” “outlook” or words of similar meaning. Such

forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to

significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally

beyond our control. Actual results may differ materially from the results anticipated in these forward-looking statements.

The following factors, among others, could cause actual results

to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: our

competitive position versus other radio and audio service providers; our ability to attract and retain subscribers, which is uncertain;

our dependence upon the auto industry; general economic conditions; changes in consumer protection laws and their enforcement;

the security of the personal information about our customers; other existing or future government laws and regulations could harm

our business; failure of our satellites would significantly damage our business; the interruption or failure of our information

technology and communications systems; royalties we pay for music rights, which increase over time; the unfavorable outcome of

pending or future litigation; our failure to realize benefits of acquisitions or other strategic initiatives; rapid technological

and industry changes; failure of third parties to perform; failure to comply with FCC requirements; modifications to our business

plans; our indebtedness; and our principal stockholder has significant influence over our management and over actions requiring

stockholder approval and its interests may differ from interests of other holders of our common stock. Additional factors

that could cause our results to differ materially from those described in the forward-looking statements can be found in our Annual

Report on Form 10-K for the year ended December 31, 2014, which is filed with the Securities and Exchange Commission (the "SEC")

and available at the SEC’s Internet site (http://www.sec.gov). The information set forth herein speaks only

as of the date hereof, and we disclaim any intention or obligation to update any forward looking statements as a result of developments

occurring after the date of this communication.

E - SIRI

Contact Information for Investors and Financial Media:

Investors:

Hooper Stevens

212 901 6718

hooper.stevens@siriusxm.com

Media:

Patrick Reilly

212 901 6646

patrick.reilly@siriusxm.com

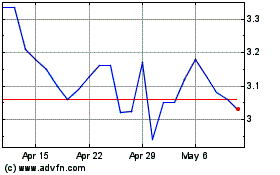

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

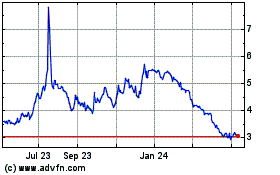

Sirius XM (NASDAQ:SIRI)

Historical Stock Chart

From Apr 2023 to Apr 2024