Starbucks Adjusts Sales Targets After Third Straight Miss

July 21 2016 - 5:30PM

Dow Jones News

Starbucks Corp. on Thursday revised its projections for the year

as sales in the June quarter again fell short of expectations,

dragged down by its European operations.

Shares, down 4% this year, fell 3% to $55.80 in after-hours

trading.

The Seattle-based coffeehouse chain, which has missed analysts'

sales targets for three consecutive quarters, now expects sales to

increase about 10%, with sales at stores open at least 13 months

increasing in the mid-single digits. That's a downward revision

from its previous guidance of revenue increasing by at least 10%

with comparable sales increasing "somewhat above the mid-single

digits."

Meanwhile, the company raised its profit forecast, saying it now

expects to make $1.88 to $1.89 a share, up from $1.85 to $1.86 a

share.

Domestic sales, which account for the bulk of business, drove an

overall revenue increase, easing concerns that customers would

spurn changes to the company's loyalty program that went into

effect in April.

Sales rose 8% in the U.S. while comparable sales, a closely

watched metric, rose 4% in the third quarter. The results, however,

suggest a slowdown from the year-ago period when Starbucks reported

increases of 13% and 8%, respectively.

Company officials have defended the changes, which link rewards

to spending rather than just number of visits, by saying they would

improve service by eliminating the incentive to split orders.

On Thursday, executives said that, at the end of the quarter,

the program had expanded to 12.3 million active members in the

U.S., an 18% increase from the year earlier.

Meanwhile, comparable sales in Europe, Middle East and Africa

fell 1%, against analysts' projected 2.8% increase, while China and

the Asia Pacific region saw a weaker-than-projected 3%

increase.

China, a key pillar in its international expansion with a target

of more than 3,400 stores by 2019, saw a 7% increase in comparable

sales.

Over all, Starbucks reported profit of $754 million, or 51 cents

a share, compared with $626.7 million, or 41 cents a share, a year

earlier. Excluding certain items, profit was 49 cents, compared

with 42 cents a year earlier and at the high-end of the company's

guidance.

Revenue rose 7% to $5.24 billion, below analysts' projected

$5.33 billion, according to Thomson Reuters.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

July 21, 2016 17:15 ET (21:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

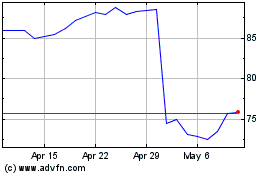

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

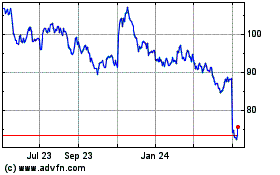

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024