UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 23, 2015

Starbucks Corporation

(Exact name of registrant as specified in its charter)

|

| | |

Washington | 0-20322 | 91-1325671 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

|

2401 Utah Avenue South, Seattle, Washington 98134 |

(Address of principal executive offices) (Zip Code) |

|

(206) 447-1575 |

(Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Item 2.02 | Results of Operations and Financial Condition. |

On July 23, 2015, Starbucks Corporation (the "Company") issued a press release announcing its financial results for the quarter ended June 28, 2015. A copy of the press release is attached as Exhibit 99.1.

On July 23, 2015, the Company issued a press release announcing that its Board of Directors has authorized the repurchase by the Company of an additional 50 million shares of the Company’s common stock under its ongoing share repurchase program. This authorization has no expiration date and is in addition to the 11.0 million shares that remained available for repurchase as of June 28, 2015 under an existing authorization.

A copy of the press release announcing the share repurchase authorization is attached as Exhibit 99.2.

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

|

| | |

Exhibit No. | | Description |

99.1 | | Earnings release of Starbucks Corporation dated July 23, 2015 |

99.2 | | Press release dated July 23, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | |

| STARBUCKS CORPORATION |

| | |

Dated: July 23, 2015 | | | |

| By: | /s/ Scott Maw |

| | Scott Maw |

| | executive vice president, chief financial officer |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

99.1 | | Earnings release of Starbucks Corporation dated July 23, 2015 |

99.2 | | Press release dated July 23, 2015 |

Exhibit 99.1

Starbucks Delivers Record Quarterly Revenue of $4.9 Billion and Record Q3 EPS

Comp Store Sales Rise 7% Globally, 8% in the Americas, and 11% in China/Asia Pacific; Global Traffic Up 4%

Global Revenues Rise 18%; GAAP Operating Income Up 22% to a Q3 Record $939 Million

GAAP EPS Jumps 21% to a Q3 Record $0.41; Non-GAAP EPS Jumps 24% to a Q3 Record $0.42

Company Increases Outlook for Fiscal 2015

SEATTLE; July 23, 2015 – Starbucks Corporation (NASDAQ: SBUX) today reported financial results for its 13-week fiscal third quarter and 39-week fiscal year to date ended June 28, 2015. Q3 FY15 GAAP results include Starbucks Japan acquisition-related items, which are excluded from the non-GAAP results. Please refer to the reconciliation of GAAP measures to non-GAAP measures at the end of this release.

Q3 Fiscal 2015 Highlights:

| |

• | Global comparable store sales increased 7%, driven by a 4% increase in traffic |

| |

◦ | Americas comp sales increased 8%, driven by a 4% increase in traffic |

| |

◦ | China/Asia Pacific comp sales increased 11%, driven by a 10% increase in traffic |

| |

◦ | EMEA comp sales increased 3%, driven by a 2% increase in traffic |

| |

• | Consolidated net revenues increased 18% over Q3 FY14 to a quarterly record $4.9 billion |

| |

• | Consolidated operating income up 22% to $938.6 million |

| |

◦ | Non-GAAP operating income up 24% to $950.1 million |

| |

• | Consolidated operating margin expanded 70 basis points to 19.2% |

| |

◦ | Non-GAAP operating margin increased 100 basis points to 19.5% |

| |

• | GAAP earnings increased 21% over Q3 FY14 to $0.41 per share |

| |

◦ | Non-GAAP earnings increased 24% over Q3 FY14 to $0.42 per share |

| |

• | Starbucks Mobile Order & Pay expanded to over 4,000 U.S. company-operated stores in Q3; full deployment to all U.S. company-operated stores by holiday |

| |

• | 431 net new stores opened in the quarter; total store count reaches 22,519 |

| |

• | Year over year comparable store customer transactions increased nearly 18 million in the U.S. and over 23 million globally |

“Starbucks Q3 fiscal 2015 stands as among the strongest and most remarkable quarters in our over 23 years as a public company,” said Howard Schultz, chairman and ceo. “The 4% increase in global transactions we reported equates to our having served an additional 23 million customer occasions in Q3 of this year over last year, clearly evidencing a continuation of the strong momentum we have seen across our business and around the world this fiscal year,” Schultz added.

“Starbucks very strong year over year financial performance in Q3 demonstrates our commitment to delivering best in class financial and operating results while at the same time investing in our future growth - building new stores, renovating existing stores, deploying new technology - investing in our partners and delivering an elevated Starbucks Experience to our customers,” said Scott Maw, Starbucks cfo. “We believe that by getting this balance right, we will be able to continue delivering exceptional growth, profitability and increased returns to our shareholders,” Maw added.

Third Quarter Fiscal 2015 Summary

|

| | | | | |

| Quarter Ended Jun 28, 2015 |

Comparable Store Sales(1) | Sales Growth | | Change in Transactions | | Change in Ticket |

Consolidated | 7% | | 4% | | 3% |

Americas | 8% | | 4% | | 4% |

EMEA | 3% | | 2% | | 1% |

CAP | 11% | | 10% | | 1% |

(1) Includes only Starbucks company-operated stores open 13 months or longer. |

|

| | | | | |

Operating Results | Quarter Ended | | |

($ in millions, except per share amounts) | Jun 28, 2015 | | Jun 29, 2014 | | Change |

Net New Stores | 431 | | 344 | | 87 |

Revenues | $4,881.2 | | $4,153.7 | | 18% |

Operating Income | $938.6 | | $768.5 | | 22% |

Operating Margin | 19.2% | | 18.5% | | 70 bps |

EPS | $0.41 | | $0.34 | | 21% |

Consolidated net revenues were $4.9 billion in Q3 FY15, an increase of 18% over Q3 FY14. The increase was primarily driven by incremental revenues from the acquisition of Starbucks Japan, a 7% increase in global comparable store sales and the opening of 1,592 net new stores over the past 12 months.

Consolidated operating income grew 22% to $938.6 million in Q3 FY15, up from $768.5 million in Q3 FY14. Consolidated operating margin expanded 70 basis points to 19.2% primarily driven by sales leverage. This was partially offset by the impact of our ownership change in Starbucks Japan, which drove 90 basis points of margin decline, and by investments in our store partners (employees) in the Americas segment.

Q3 Americas Segment Results

|

| | | | | |

| | | | | |

| Quarter Ended | | |

($ in millions) | Jun 28, 2015 | | Jun 29, 2014 | | Change |

Net New Stores | 171 | | 149 | | 22 |

Revenues | $3,414.6 | | $3,057.7 | | 12% |

Operating Income | $855.3 | | $728.5 | | 17% |

Operating Margin | 25.0% | | 23.8% | | 120 bps |

Net revenues for the Americas segment were $3.4 billion in Q3 FY15, an increase of 12% over Q3 FY14. The increase was driven by 8% growth in comparable store sales and incremental revenues from 658 net new store openings over the past 12 months.

Operating income of $855.3 million in Q3 FY15 increased 17% from $728.5 million in Q3 FY14. Operating margin expanded 120 basis points to 25.0% primarily due to sales leverage and lower commodity costs, primarily dairy, and was partially offset by investments in our store partners (employees).

Q3 EMEA Segment Results

|

| | | | | |

| | | | | |

| Quarter Ended | | |

($ in millions) | Jun 28, 2015 | | Jun 29, 2014 | | Change |

Net New Stores | 58 | | 37 | | 21 |

Revenues | $294.7 | | $323.5 | | (9)% |

Operating Income | $36.0 | | $29.2 | | 23% |

Operating Margin | 12.2% | | 9.0% | | 320 bps |

Net revenues for the EMEA segment were $294.7 million in Q3 FY15, a 9% decrease versus Q3 FY14. The decrease was primarily driven by unfavorable foreign currency translation and the shift in the portfolio towards more licensed stores. Partially offsetting the decrease was a 3% increase in comparable store sales.

Operating income increased 23% to $36.0 million in Q3 FY15, up from $29.2 million in Q3 FY14. Operating margin expanded 320 basis points to 12.2%, primarily due to sales leverage driven by the ongoing shift in the portfolio towards more licensed stores.

Q3 China/Asia Pacific Segment Results

|

| | | | | |

| | | | | |

| Quarter Ended | | |

($ in millions) | Jun 28, 2015 | | Jun 29, 2014 | | Change |

Net New Stores | 205 | | 160 | | 45 |

Revenues | $652.7 | | $287.6 | | 127% |

Operating Income | $150.0 | | $100.8 | | 49% |

Operating Margin | 23.0% | | 35.0% | | (1,200) bps |

Net revenues for the China/Asia Pacific segment grew 127% to $652.7 million in Q3 FY15. The increase was primarily driven by incremental revenues from the acquisition of Starbucks Japan. Also contributing were incremental revenues from 750 net new store openings over the past 12 months and an 11% increase in comparable store sales.

Operating income grew 49% to $150.0 million in Q3 FY15. Operating margin declined 1,200 basis points to 23.0% due to the impact of our ownership change in Starbucks Japan, which drove a 1,570 basis point decline. The remaining 370 basis point expansion was primarily driven by sales leverage as well as improved profitability in our company-operated stores in the region.

Q3 Channel Development Segment Results

|

| | | | | |

| | | | | |

| Quarter Ended | | |

($ in millions) | Jun 28, 2015 | | Jun 29, 2014 | | Change |

Revenues | $403.6 | | $375.3 | | 8% |

Operating Income | $143.4 | | $139.3 | | 3% |

Operating Margin | 35.5% | | 37.1% | | (160) bps |

Net revenues for the Channel Development segment grew 8% to $403.6 million in Q3 FY15, primarily driven by increased sales of premium single-serve products and higher foodservice sales.

Operating income of $143.4 million in Q3 FY15 grew 3% compared to Q3 FY14. Operating margin decreased 160 basis points to 35.5%, primarily driven by increased marketing spend and increased coffee costs. The decrease was partially offset by leverage on cost of sales and increased income from our North American Coffee Partnership.

Q3 All Other Segments Results

|

| | | | | |

| | | | | |

| Quarter Ended | | |

($ in millions) | Jun 28, 2015 | | Jun 29, 2014 | | Change |

Net New Stores | (3) | | (2) | | (1) |

Revenues | $115.6 | | $109.6 | | 5% |

Operating Loss | $(13.1) | | $(18.9) | | (31)% |

Year to Date Financial Results

|

| | | | | |

| | | | | |

| Three Quarters Ended Jun 28, 2015 |

Comparable Store Sales(1) | Sales Growth | | Change in Transactions | | Change in Ticket |

Consolidated | 7% | | 3% | | 4% |

Americas | 7% | | 3% | | 4% |

EMEA | 3% | | 2% | | 1% |

CAP | 10% | | 9% | | 1% |

(1) Includes only Starbucks company-operated stores open 13 months or longer. |

|

| | | | | |

| | | | | |

Operating Results | Three Quarters Ended | | |

($ in millions, except per share amounts) | Jun 28, 2015 | | Jun 29, 2014 | | Change |

Net New Stores (1) | 1,153 | | 1,096 | | 57 |

Revenues | $14,247.9 | | $12,267.1 | | 16% |

Operating Income | $2,631.6 | | $2,226.3 | | 18% |

Operating Margin | 18.5% | | 18.1% | | 40 bps |

EPS | $1.39 | | $0.97 | | 43% |

(1) Net new stores include the closure of 132 Target Canada licensed stores in the second quarter of fiscal 2015.

Fiscal 2015 Targets

Starbucks is providing the following fiscal 2015 targets. Projected Q4 FY15 non-GAAP adjustments relate to the acquisition of Starbucks Japan and the redemption of debt; please refer to the reconciliation of GAAP measures to non-GAAP measures at the end of this release.

The Company Provides the Following Targets:

| |

• | Total net new store openings for the fiscal year remain at 1,650: |

| |

◦ | Americas: remain at approximately 600, half licensed |

| |

◦ | EMEA: remain at approximately 200, primarily licensed |

| |

◦ | China/Asia Pacific: remain at approximately 850, two-thirds licensed |

| |

• | Continue to expect full year revenue growth of 16% to 18% |

| |

• | Global comparable store sales growth remains in the mid-single digits |

| |

• | Full year GAAP operating margin is still expected to be flat to FY14 due to the impact of the acquisition of Starbucks Japan; full year non-GAAP operating margin is still expected to modestly improve over prior year non-GAAP operating margin. Operating margin by segment: |

| |

◦ | Americas: continue to expect modest margin improvement over FY14 |

| |

◦ | EMEA: now expecting margin to be at or slightly above the upper end of the 10% to 12% range |

| |

◦ | China/Asia Pacific: now expecting margin to be slightly over 20% |

| |

◦ | Channel Development: continue to expect margin improvement of approximately 150 basis points over FY14 |

| |

• | Continue to expect a consolidated tax rate of approximately 31% on a GAAP basis |

| |

• | GAAP Earnings per Share: |

| |

◦ | Now expect full year EPS in the range of $1.77 to $1.78 |

| |

◦ | Now expect Q4 EPS in the range of $0.38 to $0.39 |

| |

• | Non-GAAP Earnings per Share: |

| |

◦ | Now expect full year EPS in the range of $1.57 to $1.58 |

| |

◦ | Continue to expect Q4 EPS in the range of $0.42 to $0.43 |

| |

• | The Company now expects capital expenditures of approximately $1.3 billion |

Company Updates

| |

• | Starbucks and PepsiCo, Inc. today announced they have entered into an agreement for the marketing, sales and distribution of a locally-relevant portfolio of Starbucks ready-to-drink (RTD) coffee and energy products in Latin America. |

| |

• | Enhancing the digital experience for My Starbucks Rewards® members, the company has recently made three strategic relationship announcements, starting with Spotify in May, The New York Times on July 21 and Lyft on July 22. Each of the announcements supports a new opportunity for Starbucks loyalty program members to earn stars through purchases made with other companies and then have the ability to redeem those earned stars for food and beverages at participating Starbucks® stores. These relationships, collectively, lend to a broader strategy to build a robust digital ecosystem with businesses that complement our customer experience. |

| |

• | The Company recently announced two new strategic business partnerships; the first is a licensed agreement with Casino Restauration (a subsidiary of Groupe Casino) that will open Starbucks stores within Géant Casino Hypermarkets and Casino Supermarkets across France. The second is a licensed partnership with Taste Holdings to open Starbucks stores across South Africa, starting with Johannesburg which is expected to open in 2016. This will be Starbucks first store in sub-Saharan Africa. |

| |

• | In May, Starbucks opened a store in Japan’s Tottori Prefecture, the last district in Japan without a Starbucks store. The company operates more than 1,000 stores across the country. |

| |

• | Starbucks, along with more than a dozen leading, U.S.-based companies, announced on July 13 the formation of the 100,000 Opportunities Initiative, an employer-led coalition with a collective goal of engaging 100,000 Opportunity Youth - 16 to 24 year olds who face systemic barriers to jobs and education - through apprenticeships, internships, training programs, and both part-time and full-time jobs. |

| |

• | In June, Starbucks raised $850 million in proceeds from a public offering of $500 million of 2.700% Senior Notes due 2022 and $350 million of 4.300% Senior Notes due 2045. As previously announced, a portion of the proceeds from the offering were used to redeem the Company’s $550 million of 6.250% Senior Notes due 2017. The redemption was settled July 1, 2015. |

| |

• | The Company repurchased 12.1 million shares of common stock in Q3 FY15; 61 million shares remain available for purchase under current authorizations, comprised of 11 million shares that remained available for repurchase as of June 28, 2015 under an existing authorization and an additional 50 million shares which the Company announced today has been authorized for repurchase by its Board of Directors under its ongoing share repurchase program. |

| |

• | The Board of Directors declared a cash dividend of $0.16 per share, payable on August 21, 2015 to shareholders of record as of August 6, 2015. |

Conference Call

Starbucks will be holding a conference call today at 2:00 p.m. Pacific Time, which will be hosted by Howard Schultz, chairman and ceo; Kevin Johnson, president and coo; and Scott Maw, cfo. The call will be webcast and can be accessed at http://investor.starbucks.com. A replay of the webcast will be available through approximately 9:00 p.m. Pacific Time on Thursday, August 20, 2015.

About Starbucks

Since 1971, Starbucks Coffee Company has been committed to ethically sourcing and roasting high-quality arabica coffee. Today, with stores around the globe, the company is the premier roaster and retailer of specialty coffee in the world. Through our unwavering commitment to excellence and our guiding principles, we bring the unique Starbucks Experience to life for every customer through every cup. To share in the experience, please visit us in our stores or online at news.starbucks.com or www.starbucks.com.

Forward-Looking Statements

This release contains forward-looking statements relating to certain company initiatives, strategies and plans, as well as trends in or expectations regarding our diversified business model, the strength, momentum, health and potential of our business, operations and brand, our innovation, growth and growth opportunities and related investments, earnings per share, revenues, operating margins, profitability, capital expenditures, tax rate, financial discipline, anticipated gains and costs related to the acquisition of Starbucks Japan, comparable store sales and net new stores. These forward-looking statements are based on currently available operating, financial and competitive information and are subject to a number of significant risks and uncertainties. Actual future results may differ materially depending on a variety of factors including, but not limited to, fluctuations in U.S. and international economies and currencies, our ability to preserve, grow and leverage our brands, potential negative effects of material breaches of our information technology systems if any were to occur, costs associated with, and the successful execution of, the company’s initiatives and plans, including the acquisition of Starbucks Japan, the acceptance of the company’s products by our customers, the impact of competition, coffee, dairy and other raw material prices and availability, the effect of legal proceedings, and other risks detailed in the company filings with the Securities and Exchange Commission, including the “Risk Factors” section of Starbucks Annual Report on Form 10-K for the fiscal year ended September 28, 2014. The company assumes no obligation to update any of these forward-looking statements.

Contacts:

|

| | |

Starbucks Contact, Investor Relations: | | Starbucks Contact, Media: |

JoAnn DeGrande | | Alisha Damodaran |

206-318-7118 | | 206-318-7100 |

investorrelations@starbucks.com | | press@starbucks.com |

STARBUCKS CORPORATION

CONSOLIDATED STATEMENTS OF EARNINGS

(unaudited, in millions, except per share data)

|

| | | | | | | | | | | | | | | | | |

| | | Quarter Ended | | Quarter Ended |

| | | Jun 28,

2015 | | Jun 29,

2014 | | % Change | | Jun 28,

2015 | | Jun 29,

2014 |

| |

| | | | | | | | | As a % of total net revenues |

| | Net revenues: | | | | | | | | | |

| | Company-operated stores | $ | 3,915.0 |

| | $ | 3,290.5 |

| | 19.0 | % | | 80.2 | % | | 79.2 | % |

| | Licensed stores | 475.2 |

| | 408.1 |

| | 16.4 |

| | 9.7 |

| | 9.8 |

|

| | CPG, foodservice and other | 491.0 |

| | 455.1 |

| | 7.9 |

| | 10.1 |

| | 11.0 |

|

| | Total net revenues | 4,881.2 |

| | 4,153.7 |

| | 17.5 |

| | 100.0 |

| | 100.0 |

|

| | Cost of sales including occupancy costs | 1,953.9 |

| | 1,711.5 |

| | 14.2 |

| | 40.0 |

| | 41.2 |

|

| | Store operating expenses | 1,392.4 |

| | 1,176.5 |

| | 18.4 |

| | 28.5 |

| | 28.3 |

|

| | Other operating expenses | 131.6 |

| | 120.6 |

| | 9.1 |

| | 2.7 |

| | 2.9 |

|

| | Depreciation and amortization expenses | 236.5 |

| | 180.1 |

| | 31.3 |

| | 4.8 |

| | 4.3 |

|

| | General and administrative expenses | 288.5 |

| | 269.4 |

| | 7.1 |

| | 5.9 |

| | 6.5 |

|

| | Total operating expenses | 4,002.9 |

| | 3,458.1 |

| | 15.8 |

| | 82.0 |

| | 83.3 |

|

| | Income from equity investees | 60.3 |

| | 72.9 |

| | (17.3 | ) | | 1.2 |

| | 1.8 |

|

| | Operating income | 938.6 |

| | 768.5 |

| | 22.1 |

| | 19.2 |

| | 18.5 |

|

| | Interest income and other, net | 25.5 |

| | 19.4 |

| | 31.4 |

| | 0.5 |

| | 0.5 |

|

| | Interest expense | (19.1 | ) | | (16.4 | ) | | 16.5 |

| | (0.4 | ) | | (0.4 | ) |

| | Earnings before income taxes | 945.0 |

| | 771.5 |

| | 22.5 |

| | 19.4 |

| | 18.6 |

|

| | Income taxes | 318.5 |

| | 259.0 |

| | 23.0 |

| | 6.5 |

| | 6.2 |

|

| | Net earnings including noncontrolling interests | 626.5 |

| | 512.5 |

| | 22.2 |

| | 12.8 |

| | 12.3 |

|

| | Net earnings/(loss) attributable to noncontrolling interests | (0.2 | ) | | (0.1 | ) | | 100.0 |

| | — |

| | — |

|

| | Net earnings attributable to Starbucks | $ | 626.7 |

| | $ | 512.6 |

| | 22.3 |

| | 12.8 | % | | 12.3 | % |

| | | | | | | | | | | |

| | Net earnings per common share - diluted | $ | 0.41 |

| | $ | 0.34 |

| | 20.6 | % | | | | |

| | Weighted avg. shares outstanding - diluted | 1,515.7 |

| | 1,522.0 |

| | | | | | |

| | | | | | | | | | | |

| | Cash dividends declared per share | $ | 0.16 |

| | $ | 0.13 |

| | | | | | |

| | | | | | | | | | | |

| | Supplemental Ratios: | | | | | | | | | |

| | Store operating expenses as a percentage of company-operated store revenues | | | | | | | 35.6 | % | | 35.8 | % |

| | Effective tax rate including noncontrolling interests | | | | | | | 33.7 | % | | 33.6 | % |

|

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | Three Quarters Ended | | Three Quarters Ended |

| | | Jun 28,

2015 | | Jun 29,

2014 | | % Change | | Jun 28,

2015 | | Jun 29,

2014 |

| |

| | | | | | | | | As a % of total

net revenues |

| | Net revenues: | | | | | | | | | |

| | Company-operated stores | $ | 11,310.7 |

| | $ | 9,702.3 |

| | 16.6 | % | | 79.4 | % | | 79.1 | % |

| | Licensed stores | 1,380.5 |

| | 1,166.1 |

| | 18.4 |

| | 9.7 |

| | 9.5 |

|

| | CPG, foodservice and other | 1,556.7 |

| | 1,398.7 |

| | 11.3 |

| | 10.9 |

| | 11.4 |

|

| | Total net revenues | 14,247.9 |

| | 12,267.1 |

| | 16.1 |

| | 100.0 |

| | 100.0 |

|

| | Cost of sales including occupancy costs | 5,804.9 |

| | 5,135.7 |

| | 13.0 |

| | 40.7 |

| | 41.9 |

|

| | Store operating expenses | 4,032.5 |

| | 3,486.1 |

| | 15.7 |

| | 28.3 |

| | 28.4 |

|

| | Other operating expenses | 394.5 |

| | 346.3 |

| | 13.9 |

| | 2.8 |

| | 2.8 |

|

| | Depreciation and amortization expenses | 659.6 |

| | 524.2 |

| | 25.8 |

| | 4.6 |

| | 4.3 |

|

| | General and administrative expenses | 892.8 |

| | 752.6 |

| | 18.6 |

| | 6.3 |

| | 6.1 |

|

| | Litigation credit | — |

| | (20.2 | ) | | (100.0 | ) | | — |

| | (0.2 | ) |

| | Total operating expenses | 11,784.3 |

| | 10,224.7 |

| | 15.3 |

| | 82.7 |

| | 83.4 |

|

| | Income from equity investees | 168.0 |

| | 183.9 |

| | (8.6 | ) | | 1.2 |

| | 1.5 |

|

| | Operating income | 2,631.6 |

| | 2,226.3 |

| | 18.2 |

| | 18.5 |

| | 18.1 |

|

| | Gain resulting from acquisition of joint venture | 390.6 |

| | — |

| | nm |

| | 2.7 |

| | — |

|

| | Interest income and other, net | 36.6 |

| | 57.0 |

| | (35.8 | ) | | 0.3 |

| | 0.5 |

|

| | Interest expense | (52.3 | ) | | (47.7 | ) | | 9.6 |

| | (0.4 | ) | | (0.4 | ) |

| | Earnings before income taxes | 3,006.5 |

| | 2,235.6 |

| | 34.5 |

| | 21.1 |

| | 18.2 |

|

| | Income taxes | 899.7 |

| | 755.4 |

| | 19.1 |

| | 6.3 |

| | 6.2 |

|

| | Net earnings including noncontrolling interests | 2,106.8 |

| | 1,480.2 |

| | 42.3 |

| | 14.8 |

| | 12.1 |

|

| | Net earnings/(loss) attributable to noncontrolling interests | 1.9 |

| | (0.1 | ) | | nm |

| | — |

| | — |

|

| | Net earnings attributable to Starbucks | $ | 2,104.9 |

| | $ | 1,480.3 |

| | 42.2 | % | | 14.8 | % | | 12.1 | % |

| | | | | | | | | | | |

| | Net earnings per common share - diluted | $ | 1.39 |

| | $ | 0.97 |

| | 43.3 | % | | | | |

| | Weighted avg. shares outstanding - diluted | 1,516.3 |

| | 1,527.8 |

| | | | | | |

| | | | | | | | | | | |

| | Cash dividends declared per share | $ | 0.48 |

| | $ | 0.39 |

| | | | | | |

| | | | | | | | | | | |

| | Supplemental Ratios: | | | | | | | | | |

| | Store operating expenses as a percentage of company-operated store revenues | | | | | | | 35.7 | % | | 35.9 | % |

| | Effective tax rate including noncontrolling interests | | | | | | | 29.9 | % | | 33.8 | % |

Segment Results (in millions)

Americas

|

| | | | | | | | | | | | | | | | | |

| | | Jun 28,

2015 | | Jun 29,

2014 | | % Change | | Jun 28,

2015 | | Jun 29,

2014 |

| |

| | Quarter Ended | | | | | | | As a % of Americas total net revenues |

| | Net revenues: | | | | | | | | | |

| | Company-operated stores | $ | 3,061.3 |

| | $ | 2,772.3 |

| | 10.4 | % | | 89.7 | % | | 90.7 | % |

| | Licensed stores | 344.9 |

| | 275.6 |

| | 25.1 |

| | 10.1 |

| | 9.0 |

|

| | Foodservice and other | 8.4 |

| | 9.8 |

| | (14.3 | ) | | 0.2 |

| | 0.3 |

|

| | Total net revenues | 3,414.6 |

| | 3,057.7 |

| | 11.7 |

| | 100.0 |

| | 100.0 |

|

| | Cost of sales including occupancy costs | 1,227.7 |

| | 1,130.0 |

| | 8.6 |

| | 36.0 |

| | 37.0 |

|

| | Store operating expenses | 1,126.7 |

| | 1,002.4 |

| | 12.4 |

| | 33.0 |

| | 32.8 |

|

| | Other operating expenses | 26.9 |

| | 26.2 |

| | 2.7 |

| | 0.8 |

| | 0.9 |

|

| | Depreciation and amortization expenses | 130.8 |

| | 119.5 |

| | 9.5 |

| | 3.8 |

| | 3.9 |

|

| | General and administrative expenses | 47.2 |

| | 51.1 |

| | (7.6 | ) | | 1.4 |

| | 1.7 |

|

| | Total operating expenses | 2,559.3 |

| | 2,329.2 |

| | 9.9 |

| | 75.0 |

| | 76.2 |

|

| | Operating income | $ | 855.3 |

| | $ | 728.5 |

| | 17.4 | % | | 25.0 | % | | 23.8 | % |

| | Supplemental Ratios: | | | | | | | | | |

| | Store operating expenses as a percentage of company-operated store revenues | | | | | | | 36.8 | % | | 36.2 | % |

| | | | | | | | | | | |

| | Three Quarters Ended | | | | | | | | | |

| | Net revenues: | | | | | | | | | |

| | Company-operated stores | $ | 8,890.5 |

| | $ | 8,120.6 |

| | 9.5 | % | | 89.7 | % | | 90.8 | % |

| | Licensed stores | 993.0 |

| | 787.6 |

| | 26.1 |

| | 10.0 |

| | 8.8 |

|

| | Foodservice and other | 26.0 |

| | 31.2 |

| | (16.7 | ) | | 0.3 |

| | 0.3 |

|

| | Total net revenues | 9,909.5 |

| | 8,939.4 |

| | 10.9 |

| | 100.0 |

| | 100.0 |

|

| | Cost of sales including occupancy costs | 3,624.4 |

| | 3,353.8 |

| | 8.1 |

| | 36.6 |

| | 37.5 |

|

| | Store operating expenses | 3,276.1 |

| | 2,965.9 |

| | 10.5 |

| | 33.1 |

| | 33.2 |

|

| | Other operating expenses | 93.4 |

| | 75.2 |

| | 24.2 |

| | 0.9 |

| | 0.8 |

|

| | Depreciation and amortization expenses | 386.5 |

| | 346.6 |

| | 11.5 |

| | 3.9 |

| | 3.9 |

|

| | General and administrative expenses | 146.6 |

| | 131.9 |

| | 11.1 |

| | 1.5 |

| | 1.5 |

|

| | Total operating expenses | 7,527.0 |

| | 6,873.4 |

| | 9.5 |

| | 76.0 |

| | 76.9 |

|

| | Operating income | $ | 2,382.5 |

| | $ | 2,066.0 |

| | 15.3 | % | | 24.0 | % | | 23.1 | % |

| | Supplemental Ratios: | | | | | | | | | |

| | Store operating expenses as a percentage of company-operated store revenues | | | | | | | 36.8 | % | | 36.5 | % |

EMEA

|

| | | | | | | | | | | | | | | | | |

| | | Jun 28,

2015 | | Jun 29,

2014 | | % Change | | Jun 28,

2015 | | Jun 29,

2014 |

| |

| | Quarter Ended | | | | | | | As a % of EMEA total net revenues |

| | Net revenues: | | | | | | | | | |

| | Company-operated stores | $ | 217.8 |

| | $ | 251.8 |

| | (13.5 | )% | | 73.9 | % | | 77.8 | % |

| | Licensed stores | 65.5 |

| | 60.8 |

| | 7.7 |

| | 22.2 |

| | 18.8 |

|

| | Foodservice | 11.4 |

| | 10.9 |

| | 4.6 |

| | 3.9 |

| | 3.4 |

|

| | Total net revenues | 294.7 |

| | 323.5 |

| | (8.9 | ) | | 100.0 |

| | 100.0 |

|

| | Cost of sales including occupancy costs | 143.1 |

| | 161.4 |

| | (11.3 | ) | | 48.6 |

| | 49.9 |

|

| | Store operating expenses | 78.4 |

| | 91.4 |

| | (14.2 | ) | | 26.6 |

| | 28.3 |

|

| | Other operating expenses | 12.9 |

| | 12.5 |

| | 3.2 |

| | 4.4 |

| | 3.9 |

|

| | Depreciation and amortization expenses | 12.4 |

| | 15.1 |

| | (17.9 | ) | | 4.2 |

| | 4.7 |

|

| | General and administrative expenses | 12.8 |

| | 15.0 |

| | (14.7 | ) | | 4.3 |

| | 4.6 |

|

| | Total operating expenses | 259.6 |

| | 295.4 |

| | (12.1 | ) | | 88.1 |

| | 91.3 |

|

| | Income from equity investees | 0.9 |

| | 1.1 |

| | (18.2 | ) | | 0.3 |

| | 0.3 |

|

| | Operating income | $ | 36.0 |

| | $ | 29.2 |

| | 23.3 | % | | 12.2 | % | | 9.0 | % |

| | Supplemental Ratios: | | | | | | | | | |

| | Store operating expenses as a percentage of company-operated store revenues | | | | | | | 36.0 | % | | 36.3 | % |

| | | | | | | | | | | |

| | Three Quarters Ended | | | | | | | | | |

| | Net revenues: | | | | | | | | | |

| | Company-operated stores | $ | 688.0 |

| | $ | 766.3 |

| | (10.2 | )% | | 75.7 | % | | 78.8 | % |

| | Licensed stores | 185.4 |

| | 175.8 |

| | 5.5 |

| | 20.4 |

| | 18.1 |

|

| | Foodservice | 35.0 |

| | 30.9 |

| | 13.3 |

| | 3.9 |

| | 3.2 |

|

| | Total net revenues | 908.4 |

| | 973.0 |

| | (6.6 | ) | | 100.0 |

| | 100.0 |

|

| | Cost of sales including occupancy costs | 434.4 |

| | 487.9 |

| | (11.0 | ) | | 47.8 |

| | 50.1 |

|

| | Store operating expenses | 240.4 |

| | 280.1 |

| | (14.2 | ) | | 26.5 |

| | 28.8 |

|

| | Other operating expenses | 40.0 |

| | 35.9 |

| | 11.4 |

| | 4.4 |

| | 3.7 |

|

| | Depreciation and amortization expenses | 38.9 |

| | 44.5 |

| | (12.6 | ) | | 4.3 |

| | 4.6 |

|

| | General and administrative expenses | 41.6 |

| | 47.1 |

| | (11.7 | ) | | 4.6 |

| | 4.8 |

|

| | Total operating expenses | 795.3 |

| | 895.5 |

| | (11.2 | ) | | 87.5 |

| | 92.0 |

|

| | Income from equity investees | 2.1 |

| | 3.0 |

| | (30.0 | ) | | 0.2 |

| | 0.3 |

|

| | Operating income | $ | 115.2 |

| | $ | 80.5 |

| | 43.1 | % | | 12.7 | % | | 8.3 | % |

| | Supplemental Ratios: | | | | | | | | | |

| | Store operating expenses as a percentage of company-operated store revenues | | | | | | | 34.9 | % | | 36.6 | % |

China/Asia Pacific (CAP)

|

| | | | | | | | | | | | | | | | | |

| | | Jun 28,

2015 | | Jun 29,

2014 | | % Change | | Jun 28,

2015 | | Jun 29,

2014 |

| |

| | Quarter Ended | | | | | | | As a % of CAP total net revenues |

| | Net revenues: | | | | | | | | | |

| | Company-operated stores | $ | 588.4 |

| | $ | 217.0 |

| | 171.2 | % | | 90.1 | % | | 75.5 | % |

| | Licensed stores | 63.1 |

| | 70.6 |

| | (10.6 | ) | | 9.7 |

| | 24.5 |

|

| | Foodservice and other | 1.2 |

| | — |

| | nm |

| | 0.2 |

| | — |

|

| | Total net revenues | 652.7 |

| | 287.6 |

| | 126.9 |

| | 100.0 |

| | 100.0 |

|

| | Cost of sales including occupancy costs | 281.8 |

| | 137.8 |

| | 104.5 |

| | 43.2 |

| | 47.9 |

|

| | Store operating expenses | 161.2 |

| | 54.8 |

| | 194.2 |

| | 24.7 |

| | 19.1 |

|

| | Other operating expenses | 15.8 |

| | 13.2 |

| | 19.7 |

| | 2.4 |

| | 4.6 |

|

| | Depreciation and amortization expenses | 41.2 |

| | 11.3 |

| | 264.6 |

| | 6.3 |

| | 3.9 |

|

| | General and administrative expenses | 30.3 |

| | 16.0 |

| | 89.4 |

| | 4.6 |

| | 5.6 |

|

| | Total operating expenses | 530.3 |

| | 233.1 |

| | 127.5 |

| | 81.2 |

| | 81.1 |

|

| | Income from equity investees | 27.6 |

| | 46.3 |

| | (40.4 | ) | | 4.2 |

| | 16.1 |

|

| | Operating income | $ | 150.0 |

| | $ | 100.8 |

| | 48.8 | % | | 23.0 | % | | 35.0 | % |

| | Supplemental Ratios: | | | | | | | | | |

| | Store operating expenses as a percentage of company-operated store revenues | | | | | | | 27.4 | % | | 25.3 | % |

| | | | | | | | | | | |

| | Three Quarters Ended | | | | | | | | | |

| | Net revenues: | | | | | | | | | |

| | Company-operated stores | $ | 1,542.5 |

| | $ | 621.1 |

| | 148.3 | % | | 88.5 | % | | 75.8 | % |

| | Licensed stores | 197.6 |

| | 198.7 |

| | (0.6 | )% | | 11.3 |

| | 24.2 |

|

| | Foodservice and other | 3.5 |

| | — |

| | nm |

| | 0.2 |

| | — |

|

| | Total net revenues | 1,743.6 |

| | 819.8 |

| | 112.7 |

| | 100.0 |

| | 100.0 |

|

| | Cost of sales including occupancy costs | 784.8 |

| | 398.0 |

| | 97.2 |

| | 45.0 |

| | 48.5 |

|

| | Store operating expenses | 436.0 |

| | 158.5 |

| | 175.1 |

| | 25.0 |

| | 19.3 |

|

| | Other operating expenses | 43.4 |

| | 34.8 |

| | 24.7 |

| | 2.5 |

| | 4.2 |

|

| | Depreciation and amortization expenses | 106.3 |

| | 33.4 |

| | 218.3 |

| | 6.1 |

| | 4.1 |

|

| | General and administrative expenses | 88.4 |

| | 43.1 |

| | 105.1 |

| | 5.1 |

| | 5.3 |

|

| | Total operating expenses | 1,458.9 |

| | 667.8 |

| | 118.5 |

| | 83.7 |

| | 81.5 |

|

| | Income from equity investees | 85.8 |

| | 116.8 |

| | (26.5 | ) | | 4.9 |

| | 14.2 |

|

| | Operating income | $ | 370.5 |

| | $ | 268.8 |

| | 37.8 | % | | 21.2 | % | | 32.8 | % |

| | Supplemental Ratios: | | | | | | | | | |

| | Store operating expenses as a percentage of company-operated store revenues | | | | | | | 28.3 | % | | 25.5 | % |

Channel Development

|

| | | | | | | | | | | | | | | | | |

| | | Jun 28,

2015 | | Jun 29,

2014 | | % Change | | Jun 28,

2015 | | Jun 29,

2014 |

| |

| | Quarter Ended | | | | | | | As a % of Channel Development total net revenues |

| | Net revenues: | | | | | | | | | |

| | CPG | $ | 302.2 |

| | $ | 286.6 |

| | 5.4 | % | | 74.9 | % | | 76.4 | % |

| | Foodservice | 101.4 |

| | 88.7 |

| | 14.3 |

| | 25.1 |

| | 23.6 |

|

| | Total net revenues | 403.6 |

| | 375.3 |

| | 7.5 |

| | 100.0 |

| | 100.0 |

|

| | Cost of sales | 228.3 |

| | 208.3 |

| | 9.6 |

| | 56.6 |

| | 55.5 |

|

| | Other operating expenses | 58.9 |

| | 48.3 |

| | 21.9 |

| | 14.6 |

| | 12.9 |

|

| | Depreciation and amortization expenses | 0.7 |

| | 0.4 |

| | 75.0 |

| | 0.2 |

| | 0.1 |

|

| | General and administrative expenses | 4.1 |

| | 4.5 |

| | (8.9 | ) | | 1.0 |

| | 1.2 |

|

| | Total operating expenses | 292.0 |

| | 261.5 |

| | 11.7 |

| | 72.3 |

| | 69.7 |

|

| | Income from equity investees | 31.8 |

| | 25.5 |

| | 24.7 |

| | 7.9 |

| | 6.8 |

|

| | Operating income | $ | 143.4 |

| | $ | 139.3 |

| | 2.9 | % | | 35.5 | % | | 37.1 | % |

| | | | | | | | | | | |

| | Three Quarters Ended | | | | | | | | | |

| | Net revenues: | | | | | | | | | |

| | CPG | $ | 975.8 |

| | $ | 875.1 |

| | 11.5 | % | | 76.6 | % | | 76.3 | % |

| | Foodservice | 298.4 |

| | 271.7 |

| | 9.8 |

| | 23.4 |

| | 23.7 |

|

| | Total net revenues | 1,274.2 |

| | 1,146.8 |

| | 11.1 |

| | 100.0 |

| | 100.0 |

|

| | Cost of sales | 722.2 |

| | 667.5 |

| | 8.2 |

| | 56.7 |

| | 58.2 |

|

| | Other operating expenses | 160.9 |

| | 142.9 |

| | 12.6 |

| | 12.6 |

| | 12.5 |

|

| | Depreciation and amortization expenses | 2.0 |

| | 1.2 |

| | 66.7 |

| | 0.2 |

| | 0.1 |

|

| | General and administrative expenses | 12.5 |

| | 13.8 |

| | (9.4 | ) | | 1.0 |

| | 1.2 |

|

| | Total operating expenses | 897.6 |

| | 825.4 |

| | 8.7 |

| | 70.4 |

| | 72.0 |

|

| | Income from equity investees | 80.1 |

| | 64.1 |

| | 25.0 |

| | 6.3 |

| | 5.6 |

|

| | Operating income | $ | 456.7 |

| | $ | 385.5 |

| | 18.5 | % | | 35.8 | % | | 33.6 | % |

All Other Segments

|

| | | | | | | | | | |

| Jun 28,

2015 | | Jun 29,

2014 | | % Change |

|

Quarter Ended | | | | | |

Net revenues: | | | | | |

Company-operated stores | $ | 47.5 |

| | $ | 49.4 |

| | (3.8 | )% |

Licensed stores | 1.7 |

| | 1.1 |

| | 54.5 |

|

CPG, foodservice and other | 66.4 |

| | 59.1 |

| | 12.4 |

|

Total net revenues | 115.6 |

| | 109.6 |

| | 5.5 |

|

Cost of sales including occupancy costs | 72.7 |

| | 65.9 |

| | 10.3 |

|

Store operating expenses | 26.1 |

| | 27.9 |

| | (6.5 | ) |

Other operating expenses | 17.3 |

| | 20.5 |

| | (15.6 | ) |

Depreciation and amortization expenses | 4.3 |

| | 3.9 |

| | 10.3 |

|

General and administrative expenses | 8.3 |

| | 10.3 |

| | (19.4 | ) |

Total operating expenses | 128.7 |

| | 128.5 |

| | 0.2 |

|

Operating loss | $ | (13.1 | ) | | $ | (18.9 | ) | | (30.7 | )% |

| | | | | |

Three Quarters Ended | | | | | |

Net revenues: | | | | | |

Company-operated stores | $ | 189.7 |

| | $ | 194.3 |

| | (2.4 | )% |

Licensed stores | 4.5 |

| | 4.0 |

| | 12.5 |

|

CPG, foodservice and other | 218.0 |

| | 189.8 |

| | 14.9 |

|

Total net revenues | 412.2 |

| | 388.1 |

| | 6.2 |

|

Cost of sales including occupancy costs | 242.5 |

| | 217.2 |

| | 11.6 |

|

Store operating expenses | 80.0 |

| | 81.6 |

| | (2.0 | ) |

Other operating expenses | 57.1 |

| | 58.1 |

| | (1.7 | ) |

Depreciation and amortization expenses | 12.2 |

| | 11.3 |

| | 8.0 |

|

General and administrative expenses | 27.2 |

| | 32.9 |

| | (17.3 | ) |

Total operating expenses | 419.0 |

| | 401.1 |

| | 4.5 |

|

Operating loss | $ | (6.8 | ) | | $ | (13.0 | ) | | (47.7 | )% |

Supplemental Information

The following supplemental information is provided for historical and comparative purposes.

U.S. Supplemental Data

|

| | | | | |

| Quarter Ended | | |

($ in millions) | Jun 28, 2015 | | Jun 29, 2014 | | Change |

Revenues | $3,091.0 | | $2,731.2 | | 13% |

Comparable Store Sales Growth(1) | 8% | | 7% | |

|

Change in Transactions | 4% | | 2% | | |

Change in Ticket | 4% | | 5% | |

|

(1) Includes only Starbucks company-operated stores open 13 months or longer |

Store Data:

|

| | | | | | | | | | | | | | | | | |

| Net stores opened (closed) and transferred during the period | | | | |

| Quarter Ended | | Three Quarters Ended | | Stores open as of |

| Jun 28,

2015 | | Jun 29,

2014 | | Jun 28,

2015 | | Jun 29,

2014 | | Jun 28,

2015 | | Jun 29,

2014 |

Americas(1) | | | | | | | | | | | |

Company-operated stores | 68 |

| | 69 |

| | 187 |

| | 155 |

| | 8,582 |

| | 8,233 |

|

Licensed stores | 103 |

| | 80 |

| | 192 |

| | 264 |

| | 5,988 |

| | 5,679 |

|

Total Americas | 171 |

| | 149 |

| | 379 |

| | 419 |

| | 14,570 |

| | 13,912 |

|

EMEA(2) | | | | | | | | | | | |

Company-operated stores | (9 | ) | | (3 | ) | | (33 | ) | | 1 |

| | 784 |

| | 827 |

|

Licensed stores | 67 |

| | 40 |

| | 184 |

| | 132 |

| | 1,507 |

| | 1,275 |

|

Total EMEA | 58 |

| | 37 |

| | 151 |

| | 133 |

| | 2,291 |

| | 2,102 |

|

China/Asia Pacific (3,4) | | | | | | | | | | | |

Company-operated stores | 82 |

| | 45 |

| | 1,219 |

| | 159 |

| | 2,351 |

| | 1,041 |

|

Licensed stores | 123 |

| | 115 |

| | (604 | ) | | 384 |

| | 2,888 |

| | 3,384 |

|

Total China/Asia Pacific | 205 |

| | 160 |

| | 615 |

| | 543 |

| | 5,239 |

| | 4,425 |

|

All Other Segments | | | | | | | | | | | |

Company-operated stores | (1 | ) | | 10 |

| | 9 |

| | 21 |

| | 378 |

| | 378 |

|

Licensed stores | (2 | ) | | (12 | ) | | (1 | ) | | (20 | ) | | 41 |

| | 46 |

|

Total All Other Segments | (3 | ) | | (2 | ) | | 8 |

| | 1 |

| | 419 |

| | 424 |

|

| | | | | | | | | | | |

Total Company | 431 |

| | 344 |

| | 1,153 |

| | 1,096 |

| | 22,519 |

| | 20,863 |

|

(1) Americas store data includes the closure of 132 Target Canada licensed stores in the second quarter of fiscal 2015.

(2) EMEA store data has been adjusted for the transfer of certain company-operated stores to licensed stores in the second and fourth quarters of fiscal 2014.

(3) China/Asia Pacific store data includes the transfer of 1,009 Japan stores from licensed stores to company-operated as a result of the acquisition of Starbucks Japan in the first quarter of fiscal 2015.

(4) China/Asia Pacific store data has been adjusted for the transfer of certain company-operated stores to licensed stores in the fourth quarter of fiscal 2014.

Non-GAAP Disclosure

In addition to the GAAP results provided in this release, the company provides consolidated non-GAAP earnings per share ("non-GAAP EPS") for Q4 and full year fiscal 2014, consolidated non-GAAP operating income, non-GAAP operating margin and non-GAAP EPS for Q3 fiscal 2015, China/Asia Pacific (“CAP”) segment non-GAAP operating income and non-GAAP operating margin for Q3 fiscal 2015, and projected consolidated non-GAAP EPS for Q4 and full year fiscal 2015. These non-GAAP financial measures are not in accordance with, or alternatives for, generally accepted accounting principles in the United States. The GAAP measures most directly comparable to non-GAAP operating income, non-GAAP operating margin, and non-GAAP EPS are operating income, operating margin, and diluted net earnings per share, respectively. The company’s management believes that providing these non-GAAP financial measures better enables investors to understand and evaluate the company’s historical and prospective operating performance.

The consolidated Q4 and full year fiscal 2014 non-GAAP EPS excludes the net benefit from transactions in Q4 fiscal 2014. The consolidated full year fiscal 2014 non-GAAP EPS also excludes the benefit recognized from a Kraft related litigation credit in Q1 fiscal 2014. The net benefit from transactions in Q4 fiscal 2014 includes a gain on the sale of our Malaysia equity method investment, partially offset by a loss on the sale of our Australia retail operations and transaction costs incurred related to the acquisition of Starbucks Japan. Management excludes these items because they believe the impacts do not reflect expected future gains or expenses and do not contribute to a meaningful evaluation of the company’s future operating performance or comparisons to the company’s past operating performance.

The consolidated Q3 fiscal 2015 non-GAAP financial measures exclude certain Starbucks Japan acquisition-related items, specifically amortization expense from acquired intangible assets and transaction and integration costs. The Q3 fiscal 2015 CAP segment non-GAAP financial measures exclude the amortization expense from acquired intangible assets related to the acquisition of Starbucks Japan. Management excludes the acquisition-related transaction costs described above because they believe these items do not reflect expected future expenses and do not contribute to a meaningful evaluation of the company’s future operating performance or comparisons to the company’s past operating performance. In addition, management believes it is useful to exclude the integration costs and the amortization of the acquired intangible assets when evaluating performance because they are not representative of our core business operations. Although these items will affect earnings per share beyond fiscal 2015, the majority of these costs will be recognized over a finite period of time. More specifically, the amounts of the acquired intangible assets are specific to the transaction and the related amortization was fixed at the time of acquisition and generally cannot subsequently be changed or influenced by management in a future period. Therefore, these items do not contribute to a meaningful evaluation of the company’s fiscal 2015 operating performance or comparisons of the company’s fiscal 2015 operating performance to the company’s past operating performance or, with respect to the CAP segment, to a meaningful evaluation of the CAP segment’s operating performance or comparisons to the CAP segment’s past operating performance.

The projected consolidated non-GAAP EPS for Q4 and full year fiscal 2015 exclude certain Starbucks Japan acquisition-related items comprised of projected amortization expense from acquired intangible assets and transaction and integration costs, as well as certain losses and costs related to the redemption of the company's $550 million of 6.250% 2017 Senior Notes in Q4 fiscal 2015. Losses and costs related to the redemption are included as debt extinguishment-related items. The projected consolidated non-GAAP EPS for full year fiscal 2015 also excludes the gain in Q1 related to the fair value adjustment of Starbucks 39.5% ownership in Starbucks Japan prior to the acquisition. Management is excluding the Starbucks Japan acquisition-related items from our projected non-GAAP measures for the same reasons described above. Additionally, management is excluding the fair value gain and debt extinguishment-related items because they believe these items do not reflect future gains, losses or expenses and do not contribute to a meaningful evaluation of the company's future operating performance or comparisons to the company's past operating performance.

These non-GAAP financial measures may have limitations as analytical tools, and these measures should not be considered in isolation or as a substitute for analysis of the company’s results as reported under GAAP. Other companies may calculate these non-GAAP financial measures differently than the company does, limiting the usefulness of those measures for comparative purposes.

STARBUCKS CORPORATION

RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES

(unaudited)

|

| | | | | | | | | | |

| Quarter Ended | | |

| Jun 28,

2015 | | Jun 29,

2014 | | Change |

Consolidated | | | | | |

Operating income, as reported (GAAP) | $ | 938.6 |

| | $ | 768.5 |

| | 22.1 | % |

Starbucks Japan acquisition-related items - other(1) | 11.5 |

| | — |

| | |

Non-GAAP operating income | $ | 950.1 |

| | $ | 768.5 |

| | 23.6 | % |

| | | | | |

Operating margin, as reported (GAAP) | 19.2 | % | | 18.5 | % | | 70 bps |

|

Starbucks Japan acquisition-related items - other(1) | 0.2 |

| | — |

| | |

Non-GAAP operating margin | 19.5 | % | | 18.5 | % | | 100 bps |

|

| | | | | |

Diluted net earnings per share, as reported (GAAP) | $ | 0.41 |

| | $ | 0.34 |

| | 20.6 | % |

Starbucks Japan acquisition-related items - other(1) | 0.01 |

| | — |

| | |

Non-GAAP net earnings per share | $ | 0.42 |

| | $ | 0.34 |

| | 23.5 | % |

| | | | | |

China/Asia Pacific (CAP) | | | | | |

Operating income, as reported (GAAP) | $ | 150.0 |

| | $ | 100.8 |

| | 48.8 | % |

Starbucks Japan amortization expense of acquired intangibles

| 11.0 |

| | — |

| | |

Non-GAAP operating income | $ | 161.0 |

| | $ | 100.8 |

| | 59.7 | % |

| | | | | |

Operating margin, as reported (GAAP) | 23.0 | % | | 35.0 | % | | (1,200) bps |

|

Starbucks Japan amortization expense of acquired intangibles

| 1.7 |

| | — |

| | |

Non-GAAP operating margin | 24.7 | % | | 35.0 | % | | (1,030) bps |

|

(1) Includes ongoing amortization expense of acquired intangible assets and transaction and integration costs.

|

| | | | | | | | |

| Quarter Ended | | |

| Sep 27,

2015 | | Sep 28,

2014 | | |

Consolidated | (Projected) | | (As Reported) | | Change |

Diluted net earnings per share (GAAP) | $0.38 - $0.39 |

| | $ | 0.39 |

| | (3%) - 0% |

Net benefit from transactions in Q4 2014(1) | — |

| | (0.02 | ) | | |

Starbucks Japan acquisition-related items - other(2) | 0.01 |

| | — |

| | |

Debt extinguishment-related items(3) | 0.03 |

| | — |

| | |

Non-GAAP net earnings per share | $0.42 - $0.43 |

| | $ | 0.37 |

| | 14% - 16% |

| | | | | |

| Year Ended | | |

| Sep 27,

2015 | | Sep 28,

2014 | | |

Consolidated | (Projected) | | (As Reported) | | Change |

Diluted net earnings per share (GAAP) | $1.77 - $1.78 |

| | $ | 1.35 |

| | 31% - 32% |

Litigation credit | — |

| | (0.01 | ) | | |

Net benefit from transactions in Q4 2014(1) | — |

| | (0.02 | ) | | |

Starbucks Japan acquisition-related items - gain(4) | (0.26 | ) | | — |

| | |

Starbucks Japan acquisition-related items - other(2) | 0.03 |

| | — |

| | |

Debt extinguishment-related items(3) | 0.03 |

| | — |

| | |

Non-GAAP net earnings per share | $1.57 - $1.58 |

| | $ | 1.33 |

| | 18% - 19% |

(1) The net benefit from transactions in Q4 2014 relates primarily to a $0.02 gain on the sale of our Malaysia equity method investment, partially offset by a loss on the sale of our Australia retail operations and transaction costs incurred in Q4 2014 related to the acquisition of Starbucks Japan.

(2) Includes ongoing amortization expense of acquired intangible assets and transaction and integration costs.

(3) Represents the loss on extinguishment of debt ($61.1M), which is comprised of the cost of the optional redemption provision, unamortized debt issuance costs, and unamortized discount associated with the $550 million of 6.250% 2017 Senior Notes redeemed in Q4 2015, as well as the related unamortized interest rate hedge loss ($2.0M), which will be recorded in interest expense.

(4) Gain represents the fair value adjustment of Starbucks preexisting 39.5% ownership interest in Starbucks Japan upon acquisition.

#

Exhibit 99.2

Starbucks Announces Additional Share Repurchase Authorization

SEATTLE, July 23, 2015 - Starbucks Corporation (NASDAQ: SBUX) today announced that its Board of Directors has authorized the repurchase of an additional 50 million shares of the Company's common stock under its ongoing share repurchase program. This authorization has no expiration date and is in addition to the 11 million shares that remained available for repurchase as of June 28, 2015 under an existing authorization.

“Since the Company's share repurchase program was authorized in September of 2001, Starbucks has repurchased more than 430 million shares at a cost of $7.4 billion under authorizations through June 28, 2015,” said Scott Maw, Starbucks chief financial officer. “This additional authorization reflects the ongoing strength of Starbucks balance sheet and operating cash flow, which allows us to support our global growth and return value to our shareholders through the payment of quarterly dividends and share repurchases."

Shares will continue to be repurchased in the open market at times and amounts considered appropriate by the Company based on several factors including price and market conditions. The Company may also repurchase shares through trading plans entered into pursuant to Rule 10b5-1 of the Securities Exchange Act of 1934.

About Starbucks

Since 1971, Starbucks Coffee Company has been committed to ethically sourcing and roasting high-quality arabica coffee. Today, with stores around the globe, the company is the premier roaster and retailer of specialty coffee in the world. Through our unwavering commitment to excellence and our guiding principles, we bring the unique Starbucks Experience to life for every customer through every cup. To share in the experience, please visit us in our stores or online at https://news.starbucks.com/.

|

| |

Starbucks Contact, Investor Relations: JoAnn DeGrande, 206-318-7118 investorrelations@starbucks.com | Starbucks Contact, Media: Linda Mills, 206-318-7100 press@starbucks.com |

###

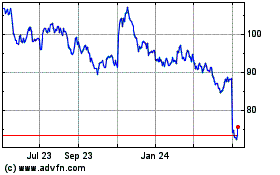

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

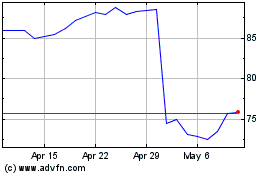

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024