UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 17, 2015

Starbucks Corporation

(Exact Name of Registrant as Specified in its Charter)

|

| | | | |

Washington | | 0-20322 | | 91-1325671 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

|

2401 Utah Avenue South, Seattle, Washington 98134 |

(Address of principal executive offices) (Zip Code) |

|

(206) 447-1575 |

(Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Item 5.03 | Amendments to Articles of Incorporation or Bylaws. |

On March 17, 2015, the Board of Directors (the "Board") of Starbucks Corporation (the "Company") approved an increase in the authorized number of shares of common stock of the Company from 1,200,000,000 to 2,400,000,000 in connection with a two-for-one forward stock split of the outstanding shares of the Company’s common stock. The forward stock split is to be effected by a stock dividend that will be paid on April 8, 2015 to all shareholders of record as of March 30, 2015. The Company filed Articles of Amendment to its Restated Articles of Incorporation with the Secretary of State of the State of Washington effective March 18, 2015. The only change reflected in the Articles of Amendment is the increase in the authorized number of shares of common stock described above. A copy of the Articles of Amendment is attached hereto as Exhibit 3.1 and is incorporated by reference herein.

On March 18, 2015, the Company issued a press release announcing that the Board had declared a two-for-one forward stock split to be effected by a stock dividend that will be paid on April 8, 2015 to all shareholders of record as of March 30, 2015. A copy of the press release announcing the stock split is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

|

| | |

Exhibit No. | | Description |

3.1 | | Articles of Amendment of the Restated Articles of Incorporation of Starbucks Corporation effective March 18, 2015. |

99.1 | | Press release, dated March 18, 2015, announcing a two-for-one forward stock split |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | |

| STARBUCKS CORPORATION |

| | |

Dated: March 19, 2015 | | |

| By: | /s/ Scott Maw |

| | Scott Maw |

| | executive vice president, chief financial officer |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

3.1 | | Articles of Amendment of the Restated Articles of Incorporation of Starbucks Corporation effective March 18, 2015. |

99.1 | | Press release, dated March 18, 2015, announcing a two-for-one forward stock split |

Exhibit 3.1

ARTICLES OF AMENDMENT OF THE

AMENDED AND RESTATED ARTICLES OF INCORPORATION

OF

STARBUCKS CORPORATION

Pursuant to RCW 23B.10.060 of the Washington Business Corporation Act, the undersigned corporation hereby submits the following amendment to the corporation’s Amended and Restated Articles of Incorporation:

| |

1. | The name of the corporation is Starbucks Corporation. |

| |

2. | Article 4 is hereby amended and restated in its entirety to read as follows: |

“ARTICLE 4. SHARES

The corporation shall have authority to issue 2,407,500,000 shares of capital stock, of which 2,400,000,000 shares will be common stock, and, 7,500,000 shares will be preferred stock.

4.1 Common Stock. The corporation shall have authority to issue up to 2,400,000,000 shares of common stock, $0.001 par value per share.

4.2 Preferred Stock. The corporation shall have authority to issue up to 7,500,000 shares of preferred stock, $0.001 par value per share. The Board of Directors shall have all rights afforded by applicable law to establish series of said preferred shares, the rights and preferences of each such series to be set forth in appropriate resolutions of the Board of Directors.”

| |

3. | The date of adoption of such amendment was March 17, 2015. |

| |

4. | The amendment was duly approved by the Board of Directors pursuant to RCW 23B.10.020; shareholder action was not required. |

DATED: March 17, 2015.

|

| | | |

| STARBUCKS CORPORATION |

| | |

| By: | | /s/ Lucy Lee Helm |

| | | Lucy Lee Helm |

| | | executive vice president, general counsel, and secretary

|

Exhibit 99.1

Starbucks Announces 2-for-1 Stock Split,

Its Sixth Split Since Initial Public Offering

SEATTLE; March 18, 2015 - Starbucks Corporation (Nasdaq: SBUX) today announced that its Board of Directors has declared a two-for-one stock split.

Shareholders of record as of March 30, 2015 will receive one additional share for each share held on the record date. The new shares will be payable on April 8, 2015. Starbucks common stock will begin trading on a split-adjusted basis on April 9, 2015. This is the sixth two-for-one split of the company’s common stock since its initial public offering in 1992; the previous stock split occurred in October 2005.

“On behalf of our board of directors, the Starbucks leadership team and the 300,000 partners who wear the Green Apron globally, I am proud to announce this two-for-one stock split, the sixth in our 23-year history as a public company,” said Howard Schultz, chairman and ceo of Starbucks Corporation. “This split is a direct reflection of the past seven years of increasing shareholder value, enhancing the liquidity of our shares, and building an attractive share price. It also takes place at a time when Starbucks shareholders are experiencing an all-time high in value as we continue to deliver world-class customer service and, in turn, record profits and revenue.”

“Adjusting for the stock split effectively has the impact of modestly increasing our earnings guidance for the second quarter and for fiscal 2015,” noted Scott Maw, chief financial officer of Starbucks Corporation.

On a split adjusted basis, the company’s previously communicated GAAP and non-GAAP earnings per share targets equate to GAAP EPS of $0.32 and a non-GAAP range of $0.32 to $0.33 for the second quarter of fiscal 2015, and a GAAP range of $1.77 to $1.79 and a non-GAAP range of $1.55 to $1.57 for the full fiscal year 2015. Due to this adjustment, the company is updating its GAAP and non-GAAP Q2 FY15 and full year FY15 EPS targets; it is neither updating nor reaffirming any other FY15 targets at this time. A reconciliation of GAAP to non-GAAP measures can be found at the end of this release.

Answers to frequently asked questions about the stock split can be found on the Investor Relations section of the company’s website at http://investor.starbucks.com.

Starbucks plans to report its fiscal second quarter 2015 financial results on April 23, 2015.

About Starbucks

Since 1971, Starbucks Coffee Company has been committed to ethically sourcing and roasting high-quality arabica coffee. Today, with stores around the globe, the company is the premier roaster and retailer of specialty coffee in the world. Through our unwavering commitment to excellence and our guiding principles, we bring the unique Starbucks Experience to life for every customer through every cup. To share in the experience, please visit us in our stores or online at www.starbucks.com.

- more -

Forward Looking Statement

This release includes forward-looking statements regarding the liquidity of our shares, our share price, profits, revenues and projected earnings per share results. These forward-looking statements are based on currently available operating, financial, and competitive information and are subject to various risks and uncertainties. These statements are based upon information available to Starbucks as of the date hereof, and Starbucks actual results or performance, the liquidity of its shares or its share price could differ materially from those stated or implied due to risks and uncertainties associated with its business. These risks and uncertainties include, but are not limited to, fluctuations in U.S. and international economies and currencies, our ability to preserve, grow and leverage our brands, potential negative effects of material breaches of our information technology systems if any were to occur, costs associated with, and the successful execution of, the company’s initiatives and plans, the acceptance of the company’s products by our customers, the impact of competition, coffee, dairy and other raw material prices and availability, the effect of legal proceedings, and other risks detailed in the company filings with the Securities and Exchange Commission, including the “Risk Factors” section of the Starbucks Annual Report on Form 10-K for the fiscal year ended September 28, 2014. The company assumes no obligation to update any of these forward-looking statements.

Starbucks Corporation - Contacts

|

| |

Investor Relations: JoAnn DeGrande, 206-318-7118 investorrelations@starbucks.com | Media: Linda Mills, 206-318-7100 press@starbucks.com |

GAAP to Non-GAAP Reconciliation Table - Fiscal 2015 EPS Targets on a Split-Adjusted Basis

|

| |

Diluted Net Earnings per Share | Full Year FY15 |

GAAP | $1.77 to $1.79 |

Starbucks Japan acquisition-related items - gain(1) | ($0.26) |

Starbucks Japan acquisition-related items - other(2) | $0.03 |

Non-GAAP | $1.55 to $1.57 |

|

| |

Diluted Net Earnings per Share | Q2 FY15 |

GAAP | $0.32 |

Starbucks Japan acquisition-related items - other(2) | $0.01 |

Non-GAAP | $0.32 to $0.33 |

(1) Gain represents the fair value adjustment of Starbucks preexisting 39.5% ownership interest in Starbucks Japan upon acquisition.

(2) Includes ongoing amortization expense of acquired intangible assets and transaction and integration costs.

© 2015 Starbucks Coffee Company. All rights reserved.

###

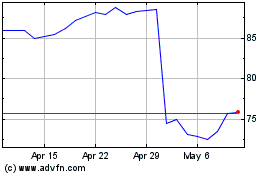

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

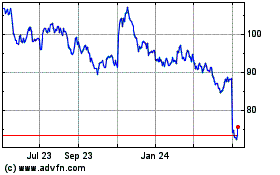

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024