Notice of Exempt Solicitation. Definitive Material. (px14a6g)

May 11 2016 - 5:02PM

Edgar (US Regulatory)

United States Securities and Exchange Commission

Washington, DC 20549

NOTICE OF EXEMPT SOLICITATION

|

|

1.

|

Name of Registrant:

SEACOAST BANKING CORPORATION OF FLORIDA

|

|

|

2.

|

Name of person relying on exemption:

CapGen Capital Group III LP

CapGen Capital Group III LLC

Eugene A. Ludwig

Robert Goldstein

John P. Sullivan

John W. Rose

|

|

|

3.

|

Address of person relying on exemption:

120 West 45th Street

Suite 1010

New York, New York 10036

|

|

|

4.

|

Written materials:

The attached written materials are submitted pursuant to a voluntary application of Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934.

|

May 10, 2016

VIA E-MAIL AND CERTIFIED MAIL

The Board of Directors of

Seacoast Banking Corporation of Florida

c/o Corporate Secretary

815 Colorado Avenue

Stuart, FL 34994

Dear Directors:

CapGen Capital Group III LP currently holds 7,463,141 shares of common stock of Seacoast Banking Corporation of Florida, representing 19.7% of Seacoast’s outstanding shares and making us Seacoast’s largest investor and its top-tier bank holding company. We first purchased Seacoast shares nearly seven years ago in 2009 when we led a successful recapitalization of Seacoast that enabled it to survive despite crippling losses. We have invested approximately $52 million of cash in Seacoast, and over $90 million in total as a result of Seacoast’s stock acquisition of The BANKshares, Inc., which we controlled. Our investment in the company is almost

seven times

the combined ownership of all members of the board and management.

Our investment in Seacoast was a critical factor in saving the company from liquidation in the midst of the financial crisis. We care about the prudent management of the company and its meeting, indeed exceeding, where possible, all regulatory norms, and delivering to shareholders the level of financial returns that are appropriate for a well-run bank with an attractive footprint and customer base. We are long-term shareholders, and have waited patiently for several years for Seacoast to realize its full potential.

Financial results over the period of our investment have been anemic. Over the nearly seven years since our initial investment in the Company, its tangible book value per share has increased less than 5%. Seacoast’s return on equity, return on tangible equity and efficiency ratio have significantly lagged, and continue to lag, comparable metrics for well-run banks. Unfortunately, despite a series of acquisitions that should have driven substantial improvements in financial performance, Seacoast’s metrics remain disappointing. For the first quarter of this year, Seacoast’s ROE was 3.4%, its ROTE was 4.3%, and its efficiency ratio was 69.8%. Moreover, Seacoast continues to emphasize “adjusted” earnings in its reported financial results, while GAAP earnings present a far more somber picture of the company’s performance. Furthermore, we believe management’s earnings guidance using non-GAAP measures is unrealistic, and inconsistent with Seacoast’s earnings history.

In short, we believe that major improvements in operational execution are critical, and that Seacoast must clearly articulate to investors, and deliver upon, a comprehensive plan to achieve financial metrics consistent with the levels of well-run industry peers, which have ROEs in the 12-15% range and efficiency ratios below 60%. Even assuming Seacoast hits its current $1.00 “adjusted” EPS target, its performance will still lag well-run industry peers.

A commitment to shareholder value creation also requires adherence to high standards of corporate governance. We are troubled by the founder mentality exhibited by the current Board, which includes five directors with tenure ranging from 13 to 33 years – directors who presided over a massive loss of shareholder value; excessive compensation paid to Board members; and corporate governance mechanisms, including a staggered board and plurality voting, that serve to entrench the incumbent Board. A thorough overhaul of the company’s existing governance and board structure is essential in order to ensure accountability of the Board and management for Seacoast’s performance and shareholder value creation. Even though the company, contrary to accepted good corporate governance practices has retained plurality voting, we submit that, unless he or she receives a majority of votes, a director should not be seated, or should resign from the Board.

We also believe that Seacoast’s geographic footprint and customer base make it an attractive acquisition target for larger banks, and that there would be strong interest in the company, and an opportunity to realize a substantial premium, were Seacoast to explore strategic alternatives. Unless Seacoast is able to achieve meaningful improvement in its operational execution and achieve similar operating metrics to well-run industry peers, we believe it will become imperative for the company to explore all alternatives to unlock value for shareholders.

As you know, we are a long-term shareholder. We have been supportive of the Board and management and patiently waited for Seacoast to deliver on its full potential. In light of our concerns regarding the direction of the company and the lack of urgency of the Board and management in addressing issues of underperformance and lack of accountability, however, we will be withholding our vote in respect of the current slate of directors at your upcoming shareholders’ meeting. We believe our fellow shareholders should do the same.

Your public filings seek shareholder feedback. We have amended our public filings to include this letter. We encourage our fellow shareholders with similar views to contact you at the following address: c/o Corporate Secretary, Seacoast Banking Corporation of Florida, 815 Colorado Avenue, P.O. Box, 9012, Stuart, Florida 34995.

This letter is being delivered to the Corporate Secretary of Seacoast. Please furnish a copy of this letter promptly to each of the members of the Board.

|

|

Very truly yours,

|

|

|

|

|

|

|

|

|

|

|

|

John P. Sullivan

|

|

|

Managing Director

|

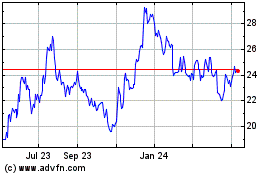

Seacoast Banking Corpora... (NASDAQ:SBCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

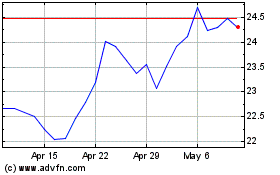

Seacoast Banking Corpora... (NASDAQ:SBCF)

Historical Stock Chart

From Apr 2023 to Apr 2024