UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the

Registrant

x

Filed by a Party

other than the Registrant

¨

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of

the Commission Only (as permitted by Rule 14(a)-6(e)(2))

|

|

|

x

|

Definitive Proxy Statement

|

|

|

¨

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Pursuant to Section 240.14a-11(c) or Section

240.14a-12

|

SEACOAST BANKING

CORPORATION OF FLORIDA

(Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

|

|

Payment of Filing Fee (Check the appropriate

box):

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and

0-11

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined.):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule, or Registration Statement No.:

|

2016

Proxy Statement

|

|

815 Colorado Avenue

Stuart, Florida 34994

|

|

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

|

Tuesday,

May 24, 2016

3:00

p.m. Eastern Time

Seacoast Banking Corporation

of Florida (“Seacoast”) will hold its 2016 Annual Meeting of Shareholders at Vista Room, Hawthorn Suites, 301 Lamberton

Drive, West Palm Beach, Florida, on Tuesday, May 24, 2016 at 3:00 p.m. Local Time.

To vote on the following

proposals:

|

|

1.

|

Election of Directors.

To re-elect five Class II directors (“Proposal 1”);

|

|

|

2.

|

Ratification of Appointment of Independent Auditor.

To ratify the appointment of Crowe Horwath

LLP as independent auditors for Seacoast for the fiscal year ending December 31, 2016 (“Proposal 2”);

|

|

|

3.

|

Advisory (Non-binding) Vote on Compensation of Named Executive Officers.

To allow shareholders

to endorse or not endorse the compensation of the Company’s named executive officers as disclosed in this Proxy Statement

(“Proposal 3”);

|

|

|

4.

|

To transact such other business as may properly come before the Annual Meeting and any adjournment

or postponement thereof.

|

|

Close of business on

March 23, 2016

|

|

|

|

|

|

|

Dennis S. Hudson, III

|

|

|

Chairman & Chief Executive Officer

|

April 7, 2016

Table of Contents

Annual Meeting Information

Date,

Time and Place:

Tuesday, May 24, 2016, at 3:00 P.M. Eastern

Time at Vista Room, Hawthorn Suites, 301 Lamberton Drive, West Palm Beach, Florida

Street

Name Holders:

If your shares are held in a bank, brokerage

or other institutional account, you are a beneficial owner of these shares (which is commonly referred to as “street name”).

However, you are not the record holder. If your shares are held in street name, you are invited to attend the Annual Meeting; however,

to vote your shares in person at meeting, you must request and obtain a power of attorney or other authority from the bank, broker

or other nominee who holds your shares and bring it with you to submit with your ballot at the meeting.

How to View Proxy Materials

Online:

Important Notice Regarding

the Availability of Proxy Materials for the 2016 Shareholder Meeting

Our 2016 Proxy Statement

and the Annual Report on Form 10-K for the year ended December 31, 2015 (referred to collectively herein as the “proxy materials”)

are available online at:

www.proxyvote.com

or at www.seacoastbanking.com/GenPage.aspx?IID=100425&GKP=325642.

We have mailed to certain

shareholders a notice of internet availability of proxy materials on or about April 7, 2016. This notice contains instructions

on how to access and review the proxy materials on the internet. The notice also contains instructions on how to submit your proxy

on the internet or by phone, or, if you prefer, to obtain a paper or email copy of the proxy materials.

You may vote common shares

that you owned as of the close of business on March 23, 2016, which is the record date for the meeting.

Your vote is important. Whether

or not you plan to attend the meeting, we hope you will vote as soon as possible. Please review the instructions on each of your

voting options described in this proxy statement, as well as in the notice you received in the mail. By voting prior to the meeting,

you will help ensure that we have a quorum and that your preferences will be expressed on the matters that are being considered.

If you are able to attend the meeting, you may vote your shares in person, even if you have previously voted by another means by

revoking your proxy vote at any time prior to its exercise.

You may vote by any of the

following methods:

BY TELEPHONE:

You can vote by calling the number

on your proxy card or voting instruction form, or provided on the website listed on your notice.

BY INTERNET:

You can vote online at www.proxyvote.com.

BY MAIL:

You also may vote your shares by

requesting a paper proxy card and completing, signing and returning it by mail in the envelope provided.

IN PERSON:

You can vote in person at the annual

meeting. If you hold your shares in street name, you must obtain a proxy form the record holder to vote in person.

For telephone and internet voting, you will

need the 16-digit control number included in your notice, on your proxy card or in the voting instructions that accompanied your

proxy materials.

For shares held in employee plans, we must

receive your voting instructions no later than 11:59 p.m. Eastern Time on May 17, 2016 (the “cut-off date”) to be counted.

Otherwise, you may vote up until 11:59 P.M. Eastern Time the day before the meeting date.

Readers of previous Seacoast

proxy statements will notice significant enhancements to this year’s proxy statement. Our objectives are to provide our existing

and prospective shareholders, employees, customers, and other constituents with deeper insights into the transformation of our

business, our near-term performance expectations, and how innovative approaches and perspectives on board and executive talent

and the alignment between pay and performance are supporting our efforts to build a truly great company.

Introduction

The Board of Directors and

management view 2015 as an inflection point in the implementation of our strategic vision for Seacoast. We delivered our best performance

since the financial crisis of 2008 while continuing to invest in the future of the franchise, driving significant progress in the

transformation of our company. Our success in executing on our strategy was buoyed by the tailwind of a strong Florida economy

that added to our growth in customer households and across our products and services. These indicators suggest we are well-positioned

for future success.

In this section, we summarize

2015 performance highlights and other information discussed later in this proxy statement. Please carefully review the information

included throughout this proxy statement and as provided in the 2015 Annual Report on Form 10-K before you vote.

2015

Performance Highlights

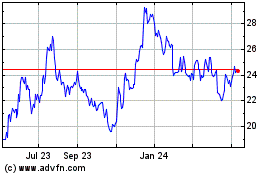

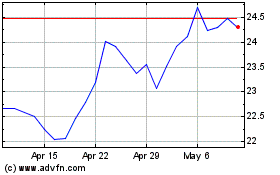

Value Creation for our Shareholders

|

|

·

|

Seacoast continued its momentum in driving

performance upward, through accelerated execution of our strategy. This momentum has delivered outsized results for shareholders.

|

|

|

·

|

Revenue grew a strong 42 percent to $142

million.

|

|

|

·

|

Net income increased 288 percent to $22.1

million from $5.7 million, while fully diluted earnings per share tripled to 66 cents from 21 cents.

|

|

|

·

|

Our team is working hard for our shareholders

with a short-term goal of $1.00 adjusted earnings per share (“EPS”)

1

for 2016, representing approximately

33% growth from our 2015 results, on the way to stronger sustainable performance.

|

Our balanced growth strategy combines outsized

organic growth and select strategic M&A with prudent risk management to deliver consistent results.

|

|

·

|

A strong reputation in our legacy markets

is augmented by our Accelerate commercial banking model, and industry-leading analytics and digital delivery, has helped us deliver:

|

|

|

o

|

An 18% increase in loans, 12% excluding acquired loans.

|

|

|

o

|

21% growth in core deposits, 12% adjusting for acquisitions. Demand deposits represent 56% of our

deposit base.

|

|

|

o

|

Households increased at a solid 8% growth rate, and by 5 percent excluding 2015 acquisitions.

|

|

|

·

|

We further drove results through the successful

acquisition of Grand Bankshares, Inc. in Palm Beach County and accelerated growth in the attractive Orlando market where we acquired

the BANKshares, Inc. in late 2014.

|

|

|

o

|

Through disciplined execution, our acquisitions are providing impressive internal returns for our

franchise, with internal rates of return ranging from near 20% to well above that level.

|

1

Non-GAAP measure; refer to Appendix A – Information Regarding Non-GAAP Financial Measures

|

|

o

|

Both acquisitions grew households-served in the first quarter following their close, significantly

exceeding expectations in both markets. Seven percent household growth in our Orlando franchise beat already-impressive household

growth rates attained in our legacy markets.

|

|

|

o

|

Cross-sell in both Orlando and Palm Beach County outpaced already-strong cross-sell results in

our overall franchise, further building value from our acquisitions.

|

|

|

o

|

Looking ahead, we anticipate

further gains upon the successful integration of Floridian

Financial

Group, Inc. and BMO Harris’ Bank’s Orlando banking operations during the first half of 2016.

|

|

|

·

|

At the same time, we’ve maintained

prudent concentration limits and granularity in our loan portfolio. Our top ten loan relationships represent 31% of total risk-based

capital, down by over 40% since 2011; average commercial loan size decreased 43% since 2011.

|

Our methodical transformation continues

with clear evidence of success and significant implications.

|

|

·

|

Digital connectivity and big data are

disrupting all industries, including community banking, ushering in the age of the consumer. Consumers are better informed and

expect companies to revolve around them, not the other way around. Thus, convenience has been fundamentally redefined, to the benefit

of banks that take advantage of transformational opportunities.

|

|

|

·

|

We recognized the implications early and,

through efforts aimed at providing digital/electronic delivery to customers and through development of industry-leading technology

and analytics, we have begun to drive growth and reduce costs.

|

|

|

o

|

Today more than 70% of everything being done at a Seacoast branch can be accomplished by mobile

phone or ATM. We have invested in our 24/7 call center, ATMs, ATM capabilities and use of mobile, while consolidating our high

fixed-cost branch network.

|

|

|

o

|

Over 26% of consumer accounts are using Seacoast’s mobile app, following its launch only

two years ago.

|

|

|

o

|

More than 30% of all physical checks are deposited outside the branch as of February 2016, up from

22 percent in February 2015, driven by steady adoption of mobile check deposit along with our ATM network.

|

|

|

o

|

Digitally-enabled, data-driven cross-sell has propelled consumer loan growth up nearly 50%, with

approximately one-quarter of all consumer sales now taking place outside of the branch.

|

|

|

o

|

Cross-sell of new deposit accounts to existing customers is up 27%, with over 15% of these sales

taking place outside of the branch.

|

|

|

o

|

Cross-selling of small business loans is up nearly 190 percent year over year, reflecting our focus

on growing our small business portfolio.

|

|

|

o

|

Since 2012, our deposits have increased 62 percent while our branch network has grown by less than

20 percent.

|

|

|

o

|

67% of our customers with online access use their mobile devices to access their Seacoast accounts,

up from 49 percent in the first quarter of 2014. This compares to only 44 percent for peer community banks and 48 percent for big

banks.

|

The Florida Economy continues to provide

tailwinds for our franchise.

|

|

·

|

ADP’s Employment Report indicated

that Florida accounted for 9.4% of job growth nationally in February 2016 with just 6.3% of the nation’s population, outperforming

the rest of the country by 49%.

|

|

|

·

|

Orlando led the nation in job growth in

2015.

|

|

|

·

|

Comerica Bank's Comerica Economic Insights

report dated January 5, 2016 stated, "Our Florida Economic Activity Index increased again in October, for the 19th consecutive

month. Most components of the index were positive in October. … The Florida economy is firmly re-established

as a growth leader for the U.S.”

|

Our engaged employee base is a tremendous

asset.

|

|

·

|

In our most recent engagement survey,

80 percent of employees said they are extremely satisfied to work for Seacoast. This compares to a global average of 72 percent,

according to IBM research.

|

|

|

·

|

We were honored that our employees voted

us a “

2015 Best Places to Work in Central Florida” through the

Orlando Business Journal

survey.

|

|

|

·

|

Numerous studies link employee engagement

to positive outcomes in service, sales, quality, retention, profit and total shareholder returns.

2

|

And our focus on customers is what makes

us special.

|

|

·

|

90 years of experience has firmly established

our brand and allowed us to hone our convenience service model.

|

|

|

·

|

Our customer satisfactions scores remain

high, with 70 percent of our customers rating us a 9 or 10. Further, more than three-fourths of customers say they have recommended

Seacoast to a friend.

|

2

Forbes, September 4, 2012

|

|

·

|

Gallup indicates that “a customer

who is fully engaged represents an average 23%

premium

in terms of share of wallet, profitability, revenue, and relationship

growth compared with the average customer. In stark contrast, an actively disengaged customer represents a 13%

discount

in those same measures.”

3

|

We are equipped with a unique business model

that combines engaged employees and customers, a brand built through years of service to our customers and constituents, and technology

that allows us to understand our customers and meet their wants and needs through the delivery channel

they

choose. We have

begun to grow revenues and bring down costs as a result, while continuing to invest in those areas that will transform our company,

positioning us to meet the needs of not only today’s, but tomorrow’s, customers.

We recognize that we are early in this investment

and transformation, and we have started to see the success this transformation can bring to our top and bottom line results. Shareholder

return figures lead us to believe that you, our shareholders, also recognize our performance trends and the opportunity our strategic

direction can provide. We look forward to continuing to serve our shareholders, customers and communities in 2016 and beyond.

3

Gallup Business Journal, July 22, 2014

Executive

Compensation Program Highlights

The Compensation and Governance

Committee (“CGC”) took a number of actions in 2015 to better align our compensation strategies with the needs of our

evolving business strategy, our commitment to good governance and effective risk management practices, and our efforts to generate

superior returns for our long-term shareholders. These actions enhanced and increased the pay-for-performance emphasis of our executive

compensation programs and, ultimately, the alignment of management with shareholder interests. Significant value only will be realized

if we exceed our long-term performance expectations and deliver meaningful value creation for our shareholders.

Seacoast CEO FY15 Total

Direct Compensation vs. Core Bank Peer Composite CEOs

Our executive compensation strategy strongly

aligns our CEO and other executives with long-term shareholder interests.

|

|

·

|

Base salary is the sole form of fixed

compensation. For our CEO, base salary represents less than one-half (47%) of pay.

|

|

|

·

|

Variable or “at risk” pay

approximates or exceeds greater than one-half of the pay for our named executive officers. For our CEO, short-term incentive cash

represented less than 10% of his total direct compensation for FY15.

|

|

|

·

|

The majority of our variable pay opportunity

is delivered as performance-based stock that only can be earned if we attain or exceed minimal levels of acceptable financial or

market-based goals, as approved by the CGC.

|

|

|

·

|

Performance-based stock is our primary

form of incentive compensation, ensuring that pay outcomes closely align with shareholder returns.

|

|

|

·

|

Seacoast issues two types of performance-based

stock awards:

|

|

|

o

|

Performance Share Units (PSUs) settled in shares and earned for four-year Cumulative Net Operating

Income and four-year average Return on Average Tangible Common Equity, rewarding management for quality earnings growth.

|

|

|

o

|

Performance Stock Options that require the price per share of Seacoast’s common stock to

attain 120% of the exercise price before options begin to vest at a rate of 1/48 per month.

|

|

|

o

|

Each type of award is subject to a risk-based vesting condition and an additional 12-month holding

requirement.

|

Potential Program Changes

for 2016

|

|

·

|

Introduction of individual performance

scorecards for all of our executives, which among other things will include an EPS performance goal of $1.00. Failure to attain

this goal could result in a material reduction in the incentive cash bonus to be paid and the target value of equity to be granted

in early 2017 for FY16 performance.

|

|

|

·

|

Replacement of Cumulative Net Operating

Income in our PSU program with a multi-year EPS goal. The CGC is considering this change given investor preferences and the clarity

EPS provides in evaluating our financial performance and how it is attained.

|

Please refer to the

Compensation

Discussion and Analysis

and

The Executive Compensation Tables

in this proxy statement for additional details.

Summary

of Voting Matters and Board Recommendations

|

Item

|

Proposal

|

Board Voting

Recommendation

|

Vote Required

|

|

1

|

Re-Election of Five Class II Directors

|

FOR ALL

|

Plurality vote*

|

|

2

|

Ratification of Appointment of Crowe Horwath LLP as Independent Auditor for 2016

|

FOR

|

Affirmative vote of a majority of votes cast

|

|

3

|

Advisory (Non-binding) Vote on Executive Compensation (Say on Pay)

|

FOR

|

Affirmative vote of a majority of votes cast

|

* More fully described

in

Proposal 1 - Election of Directors, Manner of Voting Proxies

Our

Director Nominees

You are being asked to, among

other things, re-elect five Class II directors of Seacoast. All of the nominees are presently directors of Seacoast and also serve

as members of the board of directors of Seacoast’s principal banking subsidiary, Seacoast National Bank (the “Bank”).

If elected, each director nominee will serve a three year term expiring at the 2019 Annual Meeting and until their successors have

been elected and qualified. Detailed information about each nominee’s background, skills and expertise can be found in

Proposal

I – Election of Directors.

|

Name

|

Age

|

Director

Since

|

Current Occupation

|

Independent

|

No. of Other

Public Boards

|

|

Dennis J. Arczynski

|

64

|

2013

|

Risk management, corporate governance, regulatory affairs and banking consultant

|

✔

|

0

|

|

Maryann Goebel

|

65

|

2014

|

Independent IT management consultant

|

✔

|

0

|

|

Roger O. Goldman

|

71

|

2012

|

Lead director, American Express Bank FSB;

President & managing partner, Berkshire Opportunity Fund

|

✔

|

0

|

|

Dennis S. Hudson, Jr.

|

88

|

1983

|

Retired Chairman of Company and Bank

|

|

0

|

|

Thomas E. Rossin

|

82

|

2004

|

Practicing attorney and management chairman, St. John, Rossin & Burr, PLLC

|

✔

|

0

|

Board

and Governance Highlights

INFORMATION ABOUT OUR CURRENT

BOARD COMMITTEE MEMBERSHIP AND 2015 COMMITTEE MEETINGS

|

Director Name

|

Audit

|

Compensation &

Governance

|

Enterprise Risk

Management

|

|

Dennis J. Arczynski

(1)

|

X

|

|

|

|

X

|

(2)

|

|

Stephen Bohner

(1)

|

|

|

|

|

X

|

|

|

Jacqueline L. Bradley

(1)

|

|

|

|

|

|

|

|

T. Michael Crook

|

|

|

|

|

X

|

|

|

H. Gilbert Culbreth, Jr.

(1)

|

|

|

X

|

(2)

|

|

|

|

Julie H. Daum

(1)

|

|

|

X

|

|

|

|

|

Christopher E. Fogal

(1)

|

X

|

(2)

|

|

|

|

|

|

Maryann Goebel

(1)

|

X

|

|

X

|

(3)

|

X

|

|

|

Roger O. Goldman

(1) (4)

|

|

|

|

|

|

|

|

Dennis S. Hudson, Jr.

|

|

|

|

|

X

|

|

|

Dennis S. Hudson, III

|

|

|

|

|

|

|

|

Thomas E. Rossin

(1)

|

|

|

|

|

X

|

|

|

TOTAL MEETINGS HELD

|

8

|

|

10

|

|

7

|

|

|

|

(3)

|

Effective March 22, 2016

|

|

|

(4)

|

Independent Lead Director who serves as an ex-officio (non-voting) member of all committees

|

Director Attendance:

All directors attended over 75 percent or more of the meetings of the board and board committees on which they served in 2015.

Board

Composition

|

Over the past three years, we have recruited new talent to our board to increase diversity of thought and experience and better align overall board capability with our strategic focus. Our Chairman/CEO and our Lead Director have focused considerable attention on board development over the past four years, during which time we have added five new directors with skill sets needed to help navigate the changing environment impacting our business. As a result, our overall board composition has been significantly altered across a number of important aspects creating a vibrant board culture and unrelenting focus on creating shareholder value over the long term.

|

In addition, on March 23,

2016, we announced the selection of two new highly qualified individuals who we intend to appoint to our Board in 2016:

|

|

·

|

Herbert Lurie, Senior Advisor, Guggenheim

Securities

|

|

|

·

|

Timothy Huval, Senior Vice President,

Chief Human Resources Officer, Humana

|

We expect to appoint Mr.

Lurie as a director at our April 2016 board meeting, and expect to appoint Mr. Huval as a director at a board meeting to be held

after mid-year.

Below is a graphic illustration

of the changes in our Board over the past three years and additions in 2016:

Currently, our board has

the following characteristics:

|

|

|

Seacoast

Policy:

Ensure a balanced mix of directors with deep knowledge of Seacoast and its markets, as well as new members with

fresh perspectives

|

Seacoast Policy:

Build a diverse board with experience aligned with our strategic mission

|

Since 2013, we have managed

the Board talent pipeline and:

|

|

·

|

added three women to our Board,

|

|

|

·

|

added expertise in the areas of regulatory

matters, risk management, talent acquisition, corporate governance and technology, and

|

|

|

·

|

transitioned three retiring long-tenured

directors.

|

As a result, we have reduced

the average tenure of our non-executive directors from 13.7 years to 10.1 years and decreased the average age by nearly 4 years.

Upon appointment of the two

new Board members in 2016, we will:

|

|

·

|

have additional expertise in the areas

of talent acquisition, credit management, strategic planning and investment banking, and

|

|

|

·

|

further lower the average tenure of our

non-executive directors to 8.5 years.

|

Our Board is committed to

identifying, appointing and developing directors who reflect the diverse profiles of our existing and prospective customers and

who can add significant value to its efforts to oversee Seacoast on behalf of our shareholders. Constructing an effective Board

and positioning it for success are key objectives for Seacoast. Under Mr. Goldman’s guidance, we have made significant progress

in expanding the experience of the Board. These outcomes have increased overall Board effectiveness while increasing its agility

and the velocity of decision making, which are critical inputs in the governance process given the need to outpace our competitors.

Under Mr. Goldman’s leadership, the Board is well-positioned to fulfill its duties to our shareholders and meet the evolving

needs of Seacoast.

|

corporate

governance at seacoast

|

Our

Corporate Governance Framework

|

Board Independence

|

·

9

of our 12 directors are independent.

·

Our

CEO is the only member of management who serves as a director.

|

|

Board Refreshment & Diversity

|

·

We

seek a board that, considered as a group, will possess a diversity of experience, which may, at any one or more times, include

differences with respect to personal, educational or professional experience, gender, ethnicity, national origin, geographic representation,

community involvement and age.

·

We

have a mix of new and longer tenured directors to help ensure fresh perspectives as well as continuity and experience. The average

tenure of our non-management directors is10.1 years.

·

We

added five new directors to our board since 2012, including three women.

|

|

Board Committees

|

·

We

have three standing board committees—Audit; Compensation and Governance (“CGC”); and Enterprise Risk Management.

·

The

Audit Committee and CGC consist entirely of independent, non-management directors.

·

Chairs

of the committees shape the agenda and information presented to their committees.

|

|

Strong Independent Lead Director

|

·

Our

independent directors elect an independent lead director.

·

Our

independent lead director chairs regularly scheduled executive sessions, without management present, at which directors can discuss

management performance, succession planning, board information needs, board effectiveness or any other matter.

·

Our

lead independent director strongly influences our strategy and direction, and facilitates our annual strategic planning sessions.

|

|

Board Oversight of Strategy & Risk

|

·

Our

Board has ultimate oversight responsibility for strategy and risk management.

·

Our

Board directly advises management on development and execution of the company’s strategy through an annual two-day off-site

meeting and provides oversight through regular updates

·

Through

an integrated enterprise risk management process, key risks are reviewed and evaluated by the Enterprise Risk Management Committee

(“ERMC”) before they are reviewed by the Board.

·

The

ERMC oversees the integration of risk management at Seacoast, monitors the risk framework, and makes recommendations to the Board

regarding the Company’s risk appetite.

·

The

Audit Committee oversees the Company’s financial risk management process.

·

The

CGC oversees risks and exposures related to the Company’s corporate governance, director succession planning, and compensation

practices to ensure that they do not encourage imprudent or excessive risk-taking.

·

The

CGC assists the Board with its leadership assessment and succession planning with respect to the position of CEO.

|

|

Accountability

|

·

We

have a plurality vote standard for the election of directors, with a director resignation policy for uncontested elections.

·

Each

common share is entitled to one vote.

·

We

have a process by which all shareholders may communicate with our Board, a Board committee or non-management directors as a group,

or other individual directors.

|

|

Director Stock Ownership

|

·

A personal holding of three times the annual retainer is recommended for each director, to be acquired within five years of joining the Board.

|

|

Succession Planning

|

·

CEO and management succession planning is one of the Board’s highest priorities. Our Board ensures that appropriate attention is given to identifying and developing talented leaders.

|

|

Board Effectiveness

|

·

Our

board strives to continually improve its effectiveness.

·

The

board meets in a director-only session prior to each regular meeting to discuss the company’s business condition. Each regular

meeting is followed by an executive session of non-management directors led by the lead independent director.

·

The

board and its independent committees annually evaluate their performance.

|

|

Open Commun-ication

|

·

Our

board receives regular updates from line of business leaders regarding their area of expertise.

·

Our

directors have access to all management and employees on a confidential basis.

·

Our

board and its committees are authorized to hire outside consultants at their discretion and at the company’s expense.

|

Our goal is to maintain a

corporate governance framework that supports an engaged, independent board with diverse perspectives and judgment that is committed

to representing the long-term interests of our shareholders. We believe our directors should possess the highest personal and professional

standards for ethics, integrity and values, as well as practical wisdom and mature judgment. Therefore, our Board, with the assistance

of management and the CGC, regularly reviews our corporate governance principles and practices.

Corporate

Governance Principles and Practices

Governance Policies

Important elements of our

corporate governance framework are our governance policies, which include:

|

|

·

|

our Corporate Governance Guidelines

|

|

|

·

|

our Code of Conduct (applicable to all

directors, officers and employees)

|

|

|

·

|

our Code of Ethics for Financial Professionals

(applicable to the Company’s chief executive officer and its chief financial officer)

|

|

|

·

|

charters for each of our Board Committees

|

You may view these and other

corporate governance documents at our investor relations website located at

www.seacoastbanking.com

, or request a copy,

without charge, upon written request to Seacoast Banking Corporation of Florida, c/o Corporate Secretary, 815 Colorado Avenue,

P. O. Box 9012, Stuart, Florida 34995.

Board Independence

|

Our governance

principles provide that a substantial majority of our directors will meet the criteria for independence required by Nasdaq. Currently,

75 percent of our board meets our criteria for independence.

|

The Company’s Common

Stock is listed on the Nasdaq Global Select Market (“Nasdaq”). Nasdaq requires that a majority of the Company’s

directors be “independent,” as defined by the Nasdaq’s rules. Generally, a director does not qualify as an independent

director if the director (or, in some cases, a member of the director’s immediate family) has, or in the past three years

had, certain relationships or affiliations with the Company, its external or internal auditors, or other companies that do business

with the Company. The Board of Directors has determined that a majority of the Company’s directors are independent directors

under the Nasdaq rules. The Company’s current independent directors are: Dennis J. Arczynski, Stephen E. Bohner, Jacqueline

L. Bradley, H. Gilbert Culbreth, Jr., Julie H. Daum, Christopher E. Fogal, Maryann Goebel, Roger O. Goldman and Thomas E. Rossin.

Board Leadership Structure

|

Board leadership

is provided through: 1) a combined Chairman and CEO role, 2) a clearly defined and substantial lead independent director role,

3) active committees and committee chairs, and 4) talented directors who are committed and independent-minded. At this time, the

Board believes this governance structure is appropriate and best serves the interests of our shareholders.

|

Chairman and CEO Roles

The Board of Directors periodically

assesses who should serve as Chairman and as Chief Executive Officer, and whether the offices should be combined or separate, with

appropriate consideration of current facts and circumstances.

The Company’s current

Chief Executive Officer, Dennis S. Hudson, III, also serves as the Chairman of the Board of Directors. He has held the post of

Chief Executive Officer for the past 18 years, Chairman for the past 11 years, President for the eight years prior to being named

Chairman, and has also served as Chief Executive Officer of the Bank for the past 23 years. During this time, Mr. Hudson has led

the Company through its growth from a local community bank to an institution with nearly $4 billion in assets and 53 full-service

branches and five commercial banking centers in 15 counties today. In light of Mr. Hudson’s significant leadership tenure

with the organization, his breadth of knowledge of the Company and his relationship with the institutional investor community,

as well as the efficiencies, accountability, unified leadership and cohesive corporate culture that this structure provides, the

Board of Directors believes it is appropriate that he serve as both Chief Executive Officer and Chairman.

Independent Lead Director

To further strengthen our

corporate governance environment, our independent directors select a lead director from the independent directors if the positions

of Chairman and Chief Executive Officer are held by the same person or if the Chairman of the Board is not an independent director.

The role of our Lead Independent Director is described in our Corporate Governance Guidelines and in the table at the end of this

section.

Our current Lead Director is Mr. Roger Goldman.

He has served in this capacity since 2012. Mr. Goldman’s experience includes a number of high profile leadership assignments

at or on behalf of shareholders or other constituent groups at organizations significantly larger than Seacoast. The depth and

breadth of his experience and his willingness and capacity to dedicate a significant portion of his time on behalf of the Board

and our shareholders are key inputs in our transformative efforts. We aspire to be a significantly larger organization. Our ability

to attain our aspirations depends heavily on our success in developing and implementing innovative products and services that are

easily accessible, secure, and that make a meaningful difference to our customers. His vision for our future and his “operator”

level understanding of the required strategies, investments, talent needs, capabilities, infrastructure and the associated risks

provide our Board with an independent and objective perspective on management’s ability to succeed. Mr. Goldman’s services

are in demand by companies or opportunities that are beyond Seacoast’s traditional competitive frame for director talent.

The Board hopes our shareholders share our view that we are fortunate to have him serving in the capacity of our Lead Director.

Mr. Goldman’s affiliation with Seacoast

enhances our reputation within the industry, improves the performance and effectiveness of the Board, and enhances our exposure

with the investment community. He is uniquely suited to lead the Board during the normal course of business and in its day-to-day

interactions with and oversight of management.

In addition to Mr. Goldman’s efforts

to ensure an effective and results-oriented Board, he engages on the Board’s behalf with management and employees across

the Company. Frequent active, independent, and effective engagement provides the credible challenge necessary for the Board of

Directors to make informed decisions on our business and risk strategies. He also is well-positioned to assess our executive and

managerial talent, succession readiness plans, and leadership development efforts, which are key to our success. Finally, his accessibility

and high level of visibility within the Company provides employees with ongoing opportunities to raise issues or concerns free

from management’s direct influence. Mr. Goldman provides a wide array of highly valuable services to Seacoast. We believe

the associated replacement costs if he were to step down from the Lead Director role are significantly greater than what we would

incur to engage the skill levels and experience necessary to replicate the services he provides to the Board and our shareholders.

Mr. Goldman devotes significant time to serving

as our Lead Director. While the structure of his role and scope of responsibilities are significantly greater than most other US

companies, we view his contributions and level of commitment as material to the Company’s success and its ongoing safety

and soundness. In order to induce Mr. Goldman to accept the role of Lead Director and ensure that he is paid appropriately for

his contributions and time and aligned with shareholder interests, the Board of Directors approved a compensation package that

is discussed below in the “Director Compensation” section under “Lead Director Compensation and Agreement”.

BOARD LEADERSHIP STRUCTURE - DEFINITION OF

ROLES

|

Lead Independent Director Role

|

Chair/CEO Role

|

|

Full Board Meetings

|

|

·

Participates

in Board meetings like every other Director

·

Acts

as Chairperson of the Board in situations where the Chairperson/ CEO is unable to serve in that capacity, including chairing meetings

of the Board in the absence of the Chairperson/CEO

|

·

Has

the authority to request meetings of the Board of Directors and drafts the agenda for each meeting

·

Chairs

board meetings and annual meeting of shareholders

|

|

Executive Session Responsibilities

|

|

·

Has

the authority to call meetings of the independent Directors

·

Chairs

executive sessions of the non-management directors

·

Sets

the agenda for executive sessions

·

Meets

separately with the Chair/CEO after executive sessions to review the matters discussed during the executive sessions

|

·

Receives full feedback from Lead Independent Director on the matters discussed in executive sessions and required follow-up

|

|

Board Communications Responsibilities

|

|

·

Facilitates

communication among the non-management Directors on key issues and concerns outside of board meetings

·

Serves

as the principal, but non-exclusive, liaison and intermediary between the CEO and the Independent Directors regarding

views, concerns, and issues of the Independent

Directors

·

Functions

as a resource to the CEO on board issues and other matters affecting the Company

|

·

Communicates

with all Directors on key issues and concerns outside of board meetings

·

Expected

to inform the Lead Independent Director of all significant issues facing the Company

|

|

Board Agenda and Information Responsibilities

|

|

·

Collaborates

with the Chair/CEO to set the board agenda and communicate board information

·

Seeks

agenda input from other Directors

|

·

Drafts the Board agenda and works with Lead Independent Director to ensure that Board agendas and information is provided to the Board so it can fulfill its duties

|

|

External Stakeholder Responsibilities

|

|

·

Reviews

responses to direct shareholder communications with the Board

·

If

requested by major shareholder or the CEO, is available for consultation and direct communication

|

·

Represents the organization and interacts with external stakeholders and employees

|

|

Lead Independent Director Role

|

Chair/CEO Role

|

|

Strategy and Execution Responsibilities

|

|

·

Collaborates with the Board and the CEO to establish and support appropriate short term and long term strategies, objectives, goals, and programs that support sustainable growth and profitability.

|

·

Leads

the management team to establish and support the development of appropriate short term and long term strategies.

·

Leads

the development of overall corporate and business unit objectives and goals.

·

Develops

and implements programs, and drives overall execution to achieve desired objectives and goals.

|

|

Company Operations Responsibilities

|

|

·

Has

no role in managing Company operations

·

Officers

and employees report to the CEO, not to the Lead Independent Director

|

·

Leads

Company operations

·

Officers

and employees report to the CEO

|

Non-Management Executive

Sessions

|

In order to give

a significant voice to our non-management directors, our corporate governance guidelines provide for executive sessions of our

non-management and independent directors. Our board believes this is an important governance practice that enables the board to

discuss matters (such as strategy, CEO and management performance, succession planning and board effectiveness) without management

present.

|

Our non-management directors

generally meet in executive session following each regularly scheduled board meeting. Our independent directors meet separately

from the other directors in regularly scheduled executive sessions at least twice annually, and at such other times as may be deemed

appropriate by the Company’s independent directors. Our Lead Independent Director presides at all executive sessions of the

independent directors and non-management directors, and sets the agenda for such executive sessions. Any independent director may

call an executive session of independent directors at any time. The independent directors met seven times in executive session

in 2015. Interested parties, including the Company’s shareholders, may communicate directly with non-management directors

by sending written communications to Non-Management Directors, c/o Corporate Secretary, Seacoast Banking Corporation of Florida,

815 Colorado Avenue, P. O. Box 9012, Stuart, Florida 34995.

Committee Structure &

Other Matters

Oversight is also provided

through the extensive work of the Board’s committees – Audit; Compensation and Governance (“CGC”); and

Enterprise Risk Management Committee – in key areas such as financial reporting, internal controls, compliance, corporate

governance, succession planning, compensation programs and risk management. The Audit Committee and the CGC consist entirely of

independent, non-management directors.

In addition, at the end of

each year, the Board and each of its committees review a schedule of agenda topics to be considered in the coming year. Each Board

and committee member may raise subjects that are not on the agenda at any meeting and suggest items for inclusion in future agendas.

The Company believes that

the foregoing structure, policies, and practices, when combined with the Company’s other governance policies and procedures,

provide appropriate opportunities for oversight, discussion, evaluation of decisions and direction from the Board of Directors.

Shareholder Engagement

|

We engage with our

shareholders to ensure that the Board and management are aware of and address issues of importance to our investors. We regularly

meet with various institutional shareholders and welcome feedback from other shareholders which is considered by the Board or

appropriate Board committee.

|

The Company’s Corporate

Governance Guidelines provide for a process by which shareholders may communicate with the Board, a Board committee or the non-management

directors as a group, or other individual directors. Shareholders who wish to communicate with the Board of Directors, a Board

committee, the Lead Director or any other directors or an individual director may do so by sending written communications addressed

to the Board of Directors of Seacoast Banking Corporation of Florida, a Board committee or such group of directors or individual

director, c/o Corporate Secretary, Seacoast Banking Corporation of Florida, 815 Colorado Avenue, P.O. Box, 9012, Stuart, Florida

34995. All communications will be compiled by the Company’s Secretary and submitted to the Board of Directors, a committee

of the Board of Directors or the appropriate group of directors or individual director, as appropriate, at the next regular meeting

of the Board.

Shareholder Feedback/Results of Shareholder Advisory Vote on

Executive Compensation

Since 2009 the Company has annually included

in its proxy a separate advisory vote on the compensation paid to its executives, as disclosed in the Compensation Discussion and

Analysis, the compensation tables and related proxy disclosure, commonly known as a “say-on-pay” proposal. Our say-on-pay

proposals have received a high level of support from shareholders every year since 2009. At the 2015 Annual Meeting, 94.8 percent

of shareholder votes cast on the say-on-pay proposal were in favor of our executive compensation program.

The Company and the CGC considered the results

of the say-on-pay vote, feedback from large shareholders, and other factors in assessing Seacoast’s executive compensation

programs. As further discussed in this proxy statement, these other factors include: 1) the alignment of our compensation program

with the long-term interests of our shareholders, 2) the evolution of our business strategy with emerging opportunities and in

fulfilling customer demand for innovative products and services, and 3) the relationship between risk-taking and the incentive

compensation provided to our executives. After considering these factors, the CGC restructured our executive compensation plan

to place greater emphasis on long-term performance and profitability based on emerging opportunities.

The Committee will continue

to monitor best practices, future advisory votes on executive compensation and other shareholder feedback to guide it in evaluating

the alignment of the Company’s executive compensation program with the interests of the Company and its shareholders.

Management Succession Planning and Development

|

Our Board understands

that a strong succession framework reduces risk to the organization and therefore ensures that appropriate attention is given

to identifying and developing talented leaders. Therefore, we have robust management succession and development plan which is

reviewed and updated annually.

|

The Board maintains oversight

responsibility for planning for succession with respect to the position of CEO and monitoring and advising on management’s

succession planning for other executive officers. The Board’s goal is to have a long-term and continuing program for effective

senior leadership development and succession. The Board also has short-term contingency plans in place for emergency and unexpected

occurrences, such as the sudden departure, death, or disability of the CEO or other executive officers.

The CGC, working with the

CEO, annually evaluates succession planning at the senior levels of management and reports the results of such evaluation to the

Board, along with recommendations on management development and succession planning. The updated succession plan is reviewed and

approved by the Board to ensure that competencies are in alignment with the strategic plan. The annual review of the CEO succession

planning process includes a review of specific individuals identified as active CEO succession candidates, and each of those individuals

is reviewed with respect to progress in his or her current job position and progress toward meeting his or her defined leadership

development plan. The Company’s CEO and senior management are similarly responsible for supporting “next generation”

leadership development by: identifying core talent, skills and capabilities of future leaders within the Company; assessing the

individuals against leadership capabilities; identifying talent and skill gaps and development needs; assisting with internal candidate

development; and identifying significant external hire needs.

The Board and individual

Board members may meet with, advise and assist CEO succession candidates and become familiar with other senior and future leaders

in the Company. Directors are encouraged to become sufficiently familiar with the Company’s executive officers to be able

to provide perspective on the experience, capabilities and performance of potential CEO candidates. The Board urges senior management,

as well as other members of management who have future leadership potential within the Company, to attend and present at Board

meetings so that each can be given appropriate exposure to the Board. The Board may contact and meet with any employee of the Company

at any time, and are encouraged to make site visits, to meet with management, and to attend Company, industry and other events.

Executive Officers

Executive officers are appointed

annually at the organizational meeting of the respective Boards of Directors of Seacoast and the Bank following the annual meeting

of Company shareholders, to serve until the next annual meeting and until successors are chosen and qualified.

Management Stock Ownership

As of the Record Date, based

on available information, all directors, director nominees and executive officers of Seacoast as a group (17 persons) beneficially

owned approximately 1,066,731 outstanding shares of Common Stock, constituting 2.8 percent of the total number of shares of Common

Stock outstanding at that date. In addition, as of the Record Date, various subsidiaries of Seacoast, as fiduciaries, custodians,

and agents, had sole or shared voting power over 47,326 outstanding shares, or 0.1 percent of the outstanding shares, of Seacoast

Common Stock, including shares held as trustee or agent of various Seacoast employee benefit and stock purchase plans.

Director Nomination Process

The CGC serves as the nominating

committee of the Company. The Committee annually reviews and makes recommendations to the full Board of Directors regarding the

composition and size of the Board of Directors and its committees, and if determined necessary, recommends potential candidates

to the Board for nomination for election to the Board. The goal is to ensure that the Board of Directors consists of a diverse

group of members with the proper expertise, skills, personal attributes and professional backgrounds who, individually and collectively,

are appropriate to achieve the Company’s strategic vision and business objectives, and best serve the Company’s and

shareholders’ long-term interests.

As part of the assessment

process, the CGC evaluates whether the addition of a director or directors with particular attributes, experience, or skill sets

could enhance the Board’s effectiveness. The Committee identifies director candidates through business, civic and legal contacts,

and may consult with other directors and senior officers. The Committee may also hire a search firm to assist it to identify, evaluate

and conduct due diligence on potential director candidates. Once a candidate has been identified, the Committee confirms that the

candidate meets the minimum qualifications for director nominees, and gathers information about the candidate through interviews,

questionnaires, background checks, or any other means that the Committee deems to be helpful in the evaluation process. Director

candidates are interviewed by the Chairman of the CGC and at least one other member of the committee. Each member of the committee

participates in the review and discussion of director candidates. Where appropriate, directors who are not on the Committee are

encouraged to meet with and evaluate the suitability of potential candidates. The Committee then evaluates the qualities and skills

of each candidate, both on an individual basis and taking into account the overall composition and needs of the Board, and recommends

nominees to the Board. The full Board formally nominates candidates for director to be included in the slate of directors presented

for shareholder vote based upon the recommendations of the CGC following this process.

Given the evolving needs

and business strategy of the Company, the CGC believes that the Board of Directors as a whole should have diversity of thought

and experience, which may, at any one or more times, include differences with respect to personal, educational or professional

experience, gender, ethnicity, national origin, geographic representation, community involvement and age. However, the CGC does

not assign specific weights to any particular criteria. Its goal is to identify nominees that, considered as a group, will possess

the talents and characteristics necessary for the Board of Directors to fulfill its responsibilities. In addition, each director

must have the qualifications, if any, set forth in the Company’s Bylaws, as well as the personal characteristics and core

competencies described below as our Director Eligibility Guidelines:

|

Director Eligibility Guidelines

|

|

Personal Characteristics

|

Core Competencies

|

|

·

the

highest ethical character

·

a

personal and professional reputation consistent with the values of the Company as reflected in its Code of Conduct

·

the

ability to exercise sound business judgment

·

a

willingness to listen to differing points of view and work in a mutually respectful manner

·

the

absence of any real or perceived conflict of interest that would impair the director’s ability to act in the interest of

shareholders

|

·

substantial

business or professional experience and be able to offer meaningful advice and guidance to the Company’s management based

on that experience

·

professional

achievement through service as a principal executive of a major company, partner in a law or accounting firm, successful entrepreneur,

a prominent academic or similar position of significant responsibility

|

The Committee also considers

numerous other qualities, skills and characteristics when evaluating director nominees, such as:

|

|

·

|

an understanding of and experience in the

financial services industry, as well as accounting, finance, legal, real estate, corporate governance and technology expertise;

|

|

|

·

|

leadership experience with public companies

or other major organizations, as well as civic and community relationships;

|

|

|

·

|

availability and commitment to carry out

the responsibilities as a director;

|

|

|

·

|

knowledge, experience and skills that enhance

the mix of the Board’s core competencies and provide a different perspective; and

|

|

|

·

|

qualification as an independent director.

|

In addition to nominations

by the Committee, any Company shareholder entitled to vote generally on the election of directors may recommend a candidate for

nomination as a director by providing advance notice of such proposed nomination to the Corporate Secretary at the Company’s

principal offices. The written submission must comply with the applicable provision in the Company’s Articles of Incorporation.

To be considered, recommendations with respect to an election of directors to be held at an annual meeting must be received not

less than 60 days nor more than 90 days prior to the anniversary of the Company’s last annual meeting of shareholders (or,

if the date of the annual meeting is changed by more than 20 days from such anniversary date, within 10 days after the date that

the Company mails or otherwise gives notice of the date of the annual meeting to shareholders), and recommendations with respect

to an election of directors to be held at a special meeting called for that purpose must be received by the 10th day following

the date on which notice of the special meeting was first mailed to shareholders. Recommendations meeting these requirements will

be brought to the attention of the Company’s CGC. Candidates for director recommended by shareholders in compliance with

these provisions and who satisfy the Director Eligibility Guidelines will be afforded the same consideration as candidates for

director identified by Company directors, executive officers or search firms, if any, employed by the Company. In 2015, there were

no shareholder nominee recommendations received.

Board Evaluation Process

|

Annually, our board

and each committee evaluate their performance, along with processes and structure, to identify areas for enhancement. The process

is described below.

|

|

Element

|

Description

|

|

Corporate Governance Review

|

The Compensation & Governance Committee reviews corporate governance principles with consideration given to generally accepted practices and feedback from investor advocacy groups and make recommendations for board changes. This Committee also oversees the process for annual board evaluations.

|

|

Annual Board & Committee Self-Evaluations

|

The Board and committee evaluations for 2015 were conducted through a questionnaire completed by each director or committee member.

|

|

Summary and Review

|

The Chief Human Resources Officer compiled and summarized the responses, including comments, which are then reviewed by Lead Director Goldman or the committee chairs, as applicable. The Lead Director discussed the individual results of the Board evaluation with each director, and presented summary results to the Board. The committee chairs discussed the results with their respective committees and the full Board.

|

|

Actions

|

As a result of the Board evaluation process, the Board conducted a rigorous search and assessment of potential new director candidates with experience determined during this process as important to achieving our strategic mission, resulting in the selection of Timothy Huval and Herbert Lurie as future new additions to the Company’s Board.

|

Board

Meetings and Board Committees

Board Meeting Attendance

The Board of Directors held

five regular meetings, two special meetings, and one joint strategic planning meeting with the Bank’s board of directors

during 2015. All of the directors attended at least 75 percent of the total number of meetings of the Board of Directors and committees

on which they served.

Annual Meeting Attendance

Nine of the 14 then-incumbent

Directors attended the Company’s 2015 annual shareholders’ meeting. The Company encourages all of its directors to

attend its shareholders’ meetings but understands that situations may arise that prevent such attendance.

Board Committees

The Company’s Board

of Directors has three standing permanent committees: the Audit Committee, the CGC, and the Enterprise Risk Management Committee.

These committees serve the same functions for the Company and the Bank. The current composition of each Company committee is set

forth in the table under

Proxy Summary - Board and Governance Highlights

.

Each committee has a charter

specifying such committee’s responsibilities and duties. The Company hereby certifies that the CGC charter, which also details

the Company’s nomination process, is reviewed annually. The Company also certifies that the Audit Committee charter is reviewed

annually. These charters are available on the Company’s website at www.seacoastbanking.com or upon written request to c/o

Corporate Secretary, Seacoast Banking Corporation of Florida, 815 Colorado Avenue, P. O. Box 9012, Stuart, Florida 34995.

Audit Committee

|

Members:

|

Christopher E. Fogal (Chair), Dennis J. Arczynski and Maryann Goebel

|

|

Responsibilities:

|

As set forth in the Audit Committee charter, as adopted by the full Board of Directors, this committee:

|

|

|

·

Reviews

Seacoast’s and its subsidiaries’ financial statements and internal accounting controls, and reviews reports of regulatory

authorities and determining that all audits and examinations required by law are performed;

·

Appoints

the independent auditors, reviews their audit plan, and reviews with the independent auditors the results of the audit and management’s

response thereto;

·

Reviews

the adequacy of the internal audit budget and personnel, the internal audit plan and schedule, and results of audits performed

by the internal audit staff and those outsourced to a third party;

|

·

Oversees

the audit function and appraises the effectiveness of internal and external audit efforts;

·

Reviews

the procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting

controls or auditing matters, and changes to the Company’s Code of Conduct, and approves related party transactions;

·

Periodically

reports its findings to the Board of Directors; and

·

Is

comprised of members who have not participated in the preparation of the financial statements of the Company or any current subsidiary

at any time during the last three fiscal years.

|

|

# of Meetings:

|

This committee held eight meetings in 2015. Following these meetings, the Audit Committee met three times in private session with our independent auditor, and three times in private session without members of management present, but with a third party accounting firm who co-sources a portion of the Company’s internal audit function.

|

|

Independence:

|

Our Board has determined that each member of the committee is independent under Nasdaq and SEC rules. Our Board has also determined that Mr. Fogal is an “audit committee financial expert” as defined by Item 407 of Regulation S-K.

|

Compensation and Governance Committee

(“CGC”)

|

Members:

|

Currently: H. Gilbert Culbreth,

Jr. (Chair), Julie H. Daum and Maryann Goebel.

In 2015: H. Gilbert Culbreth,

Jr. (Chair), Stephen E. Bohner, Julie H. Daum and Edwin E. Walpole, III, as well as Robert B. Goldstein until his separation from

service in September 2015. Mr. Walpole retired from the Board in January 2016.

|

|

Responsibilities:

|

As set forth in its charter, and approved by the Board of Directors, this committee, among other things:

|

|

|

·

determines

the compensation of the Company’s and the Bank’s key executive officers;

·

oversees

the preparation of a “compensation discussion and analysis” on executive compensation and an annual compensation committee

report which is included herein under “Compensation and Governance Committee Report”;

·

administers

the provisions of the Company’s incentive compensation plans and other employee benefits plans;

·

identifies

qualified individuals to serve as members of the boards of directors of the Company and/or the Bank;

|

·

recommends

to the boards of directors of the Company and the Bank the director nominees for the next annual meeting of shareholders;

·

takes

a leadership role in shaping corporate governance policies and practices, including recommending to the Board of Directors the

corporate governance guidelines applicable to Seacoast and monitoring Seacoast’s compliance with these policies and guidelines;

and

·

makes

recommendations to the Board of Directors concerning management development and succession planning activities at the senior levels

of management, including an appropriate successor in the event of the unexpected death, incapacity or resignation of the CEO.

|

|

|

The CGC has the resources and authority to discharge its responsibilities, including authority to retain and terminate any compensation consulting firms, director search firms, independent legal counsel and other compensation advisers used to assist in carrying out its responsibilities. The CGC may delegate to a subcommittee consisting of two or more members, to the extent permitted by applicable law, such of its duties and responsibilities as it deems appropriate and advisable.

|

|

# of Meetings:

|

This committee held ten meetings in 2015.

|

|

Independence:

|

Our Board of Directors has determined that each member of the committee is independent under Nasdaq and SEC rules.

|

|

CGC Interlocks

and Insider Participation:

|

None of the current or former members of the committee is a former or current officer or employee of the company or any of its subsidiaries. None of them has any relationship with the Company requiring disclosure under this caption under the rules of the SEC.

|

Enterprise Risk Management Committee

(“ERMC”)

|

Members:

|

Dennis J. Arczynski (Chair), Stephen E. Bohner, T. Michael Crook, Maryann Goebel, Dennis S. Hudson, Jr. and Thomas E. Rossin

|

|

Responsibilities:

|

As set forth in its charter, and approved by the Board of Directors, this committee, among other things:

|

|

|

·

monitors

the risk framework to assist the full Board of Directors in identifying, considering, and overseeing critical issues and opportunities;

·

evaluates

strategic opportunities being considered by Seacoast from a risk perspective, highlights key risk considerations embedded in such

strategic opportunities for the full Board, and makes recommendations on courses of action to the Board based on the ERMC’s

evaluation;

·

provides

oversight of the risk management monitoring and reporting functions at Seacoast to help ensure these functions are independent

of business line or risk-taking processes;

|

·

reviews

key management, systems, processes and decisions, and assesses the integrity and adequacy of the risk management function of Seacoast

to help build risk assessment data into critical business systems, and reports any significant issues to the Board;

·

makes

recommendations to the Board regarding the Company’s risk appetite, limits and policies and reviewing the strategic plan

to help ensure it aligns with the Board-approved risk appetite; and

·

recommends

to the Board the capital policy consistent with the Company’s risk appetite and reviewing the adequacy of Seacoast’s

capital and its allocation to each line of business.

|

|

# of Meetings:

|

This committee held seven meetings in 2015.

|

The Board’s Role in Strategy and Risk Oversight

The Board of Directors

actively reviews our long term strategy and the plans and programs that management develops to implement our strategy. While the

Board meets formally at least once every year to consider overall long term strategy, it generally reviews various elements of

strategy, and our progress towards implementation, at every regular meeting. Under the leadership of Lead Director Goldman, our

directors are active in our strategic planning process and exercise robust oversight and challenge to both strategy and implementation.

The Board believes that

strategic risk is an exceptionally important risk element among a number of risks that the Company faces and works to ensure that

this risk is appropriately managed in the context of the rapidly changing environment in which the Company and its customers operate.

The Board does not believe this risk can be delegated and the Board as a whole regularly spends a significant amount of its time

engaged with management and in executive session discussing our long term strategy, the effectiveness of our plans to implement

and our progress against those plans.

The Board’s committees

also work to ensure that we have the right alignment to support our long-term strategic direction including: (i) an active board

recruitment process focused on developing or acquiring the skill, experience and attributes of both individuals and the board as

a whole needed to support our strategy, (ii) ensuring an appropriate link is established between our compensation design and our

long-term strategy to encourage and reward the achievement of our long-term goals and protect shareholder value by discouraging

excessive risk, and (iii) ensuring that our risk management structure can effectively manage the inherent risks that underlie our

strategy.

Moreover, the Board has

decided that an integral part of managing strategic risk is the appointment of a strong lead director to: i) regularly engage with

the CEO on an ongoing basis, ii) interact from time to time with other key members of the management and other leaders throughout

the Company to examine alignment around our chosen long-term strategy, and iii) ensure that the Board’s views are considered

as our strategy is further evolved through time. The Board strongly believes having an active and engaged lead director better

ensures that the Board as a whole can serve as a credible challenge to management’s plans and programs and increases transparency

into the fast-paced changes management is implementing.

Other types of risks

that the Company faces include:

|

|

·

|

macro-economic risks, such as inflation,

reductions in economic growth, or recession;

|

|

|

·

|

political or regulatory risks, such as restriction

on access to markets;

|

|

|

·

|

event risks, such as natural disasters; and

|

|

|

·

|

business specific risks related to financial