As filed with the U.S. Securities and Exchange

Commission on August 26, 2015

Registration No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

SEACOAST BANKING CORPORATION OF FLORIDA

(Exact name of registrant

as specified in its charter)

| Florida |

|

59-2260678 |

| |

|

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

815 Colorado Avenue

Stuart, Florida 34994

(772) 287-4000

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Dennis S. Hudson, III

Chief Executive Officer

Seacoast Banking Corporation of Florida

815 Colorado Avenue

Stuart, Florida 34994

(772) 287-4000

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Randolph A. Moore III

Alston & Bird LLP

One Atlantic Center

1201 W. Peachtree Street

Atlanta, Georgia 30309

Telephone: (404) 881-7794

Approximate date of commencement of proposed

sale to the public: From time to time after the registration statement becomes effective.

If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other

than securities offered only in connection with dividend or interest reinvestment plans, check the following box. þ

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement

pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer x |

Non-accelerated filer ¨ |

Smaller reporting company ¨ |

| (Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be

Registered |

|

Amount to be

Registered |

|

Proposed

Maximum

Offering Price Per

Unit (1) |

|

Proposed

Maximum

Aggregate Offering

Price(1) |

|

Amount

of

Registration

Fee (2) |

| Common Stock |

|

7,963,141 shares |

$ |

14.465 |

$ |

115,186,834 |

$ |

13,384.71 |

| (1) | Estimated solely for the purpose of calculating the registration fee computed pursuant to Rule 457(c) of the Securities Act

of 1933, as amended, on the basis of the average of the high and low sales price of a share of the common stock of Seacoast Banking

Corporation of Florida, as reported on the NASDAQ Global Select Market on August 24, 2015. |

| (2) | Calculated pursuant to Rule 457(c). |

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective

on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission

is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in

any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

AUGUST 26, 2015

PROSPECTUS

7,963,141 Shares of Common Stock

This prospectus relates solely to the resale

of up to an aggregate of 7,963,141 shares of common stock previously issued by Seacoast Banking Corporation of Florida to CapGen

Capital Group III LP (“CapGen”). We are registering the offer and sale of the shares on behalf of CapGen, the selling

stockholder.

The selling stockholder may offer the shares

from time to time as they may determine through public or private transactions or through other means described in the section

entitled “Plan of Distribution” of this prospectus at fixed or privately negotiated prices. The prices at which the

selling stockholder may sell the shares may be determined by the prevailing market price for the shares at the time of sale, may

be different than such prevailing market prices or may be determined through negotiated transactions with third parties.

We will not receive any of the proceeds

from the sale of these shares by the selling stockholder. We have agreed to pay all expenses relating to registering the securities.

The selling stockholder will pay any underwriting discounts, selling commissions and/or similar charges incurred for the sale of

any shares.

Because all of the shares offered under

this prospectus are being offered by the selling stockholder, we cannot currently determine the price or prices at which our shares

may be sold under this prospectus.

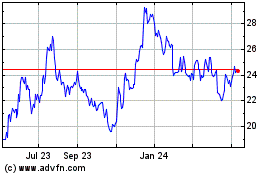

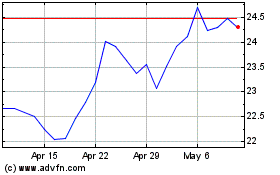

Our common stock is listed on the NASDAQ

Global Select Market and trades on the exchange under the symbol “SBCF.” On August 24, 2015, the closing sale

price of our common stock on the NASDAQ Global Select Market was $14.49 per share. You are urged to obtain current market quotations

for the common stock.

Investing in our common stock involves

risks. You should carefully consider the risk factors referred to on page 5 of this prospectus and set forth in the documents incorporated

by reference herein before making any decision to invest in our common stock.

None of the Securities and Exchange Commission

(the “SEC”), the Federal Deposit Insurance Corporation (the “FDIC”), the Board of Governors of the Federal

Reserve System (the “Federal Reserve Board”) or any state securities commission or any other federal regulatory agency

has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation

to the contrary is a criminal offense.

These securities are not savings accounts

or deposits or obligations of any bank and are not insured by the FDIC, the Bank Insurance Fund, or any other government agency

or instrumentality.

This prospectus is dated

, 2015.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is a part of a resale registration

statement that we filed with the Securities and Exchange Commission (“SEC”) using a “shelf” registration

process. Under this shelf registration process, the selling stockholder may sell, from time to time, an aggregate of up to 7,963,141

shares of Seacoast’s common stock, in any manner described in this prospectus in one or more offerings, subject to the limitations

contained in the Registration Rights Agreement (as defined herein). In some cases, the selling stockholders will also be required

to provide a prospectus supplement containing specific information about the terms on which they are offering and selling shares

of our common stock. We may also add, update or change in a prospectus supplement any information contained in this prospectus.

You should carefully read this prospectus and any accompanying prospectus supplement, as well as any post-effective amendments

to the registration statement, and all documents incorporated by reference herein, together with the additional information described

below under the heading “Where You Can Find More Information; Incorporation of Certain Information By Reference” before

you make any investment decision.

The registration statement containing this

prospectus, including exhibits to the registration statement, provides additional information about us and the securities offered

under this prospectus. The registration statement, including the exhibits and the documents incorporated herein by reference, can

be read at the SEC’s Internet site at www.sec.gov or at the SEC office mentioned under the heading “Where You Can Find

More Information” below.

You should rely only on the information

contained in or incorporated by reference into this prospectus. Neither we, nor the selling stockholder, have authorized and other

person to provide you with different information. If anyone provides you with different or inconsistent information, you should

not rely on it. This prospectus does not constitute an offer to sell, nor is it soliciting an offer to buy, these securities in

any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus

or in any documents incorporated by reference herein is only accurate as of the date of the applicable document. Our business,

financial condition, results of operations and prospects may have changed since that date.

Unless the context requires otherwise, references

to “Seacoast Banking Corporation of Florida”, “Seacoast Banking”, “Seacoast”, the “Company”,

“we”, “our”, “ours” and “us” are to Seacoast Banking Corporation of Florida and

its subsidiaries.

Unless otherwise indicated, currency amounts

in this prospectus and in any applicable prospectus supplement are stated in U.S. dollars.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. You may read and copy any document that we file with the SEC at the SEC’s

Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at (800) SEC-0330 for further information

about the Public Reference Room. Our filings with the SEC are also available to the public through the SEC’s Internet site

at www.sec.gov. In addition, since some of our securities are listed on the NASDAQ Global Select Market, you can read our SEC filings

at the NASDAQ Stock Market, Inc., Reports Section, 1735 K Street N.W., Washington, D.C. 20006. We also maintain an Internet site

at www.seacoastbanking.net at which there is additional information about our business, but the contents of that site are

not incorporated by reference into, and are not otherwise a part of, this prospectus.

Incorporation

of Certain Documents by Reference

The SEC’s rules allow us to incorporate

by reference information into this prospectus. This means that we can disclose important information to you by referring you to

another document. Any information referred to in this way is considered part of this prospectus from the date we file that document.

Any reports filed by us with the SEC after the date of this prospectus will automatically update and, where applicable, supersede

any information contained in this prospectus or incorporated by reference in this prospectus. We incorporate by reference the following

documents (other than information “furnished” and not “filed”):

| · | Our Annual Report on Form 10-K for the year ended December 31, 2014, filed on March 16, 2015, including the portions of our

Definitive Proxy Statement on Schedule 14A filed on April 7, 2015, and incorporated by reference into Part III of our Annual Report

on Form 10-K; |

| · | Our Quarterly Reports on Form 10-Q for quarter ended March 31, 2015, filed on May 11, 2015 and quarter ended June 30, 2015,

filed on August 10, 2015; |

| · | Our Current Reports on Form 8-K and Form 8-K/A, as applicable, filed on February 24, 2015, March 2, 2015, March 31, 2015, May

18, 2015, May 27, 2015, July 20, 2015 and August 7, 2015; |

| · | The description of our common stock contained in our Registration Statement filed with the SEC pursuant to Section 12 of the

Securities Exchange Act of 1934 (the “Exchange Act”), including any amendment or report filed for purposes of updating

such description; |

| · | Any documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date

of this prospectus and before the termination of the offering of the securities offered hereby (except for information furnished

to the SEC that is not deemed to be “filed” for purposes of the Exchange Act); and |

| · | Any documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of the

initial filing of the registration statement of which this prospectus is a part and prior to the effectiveness of such registration

statement. |

We will provide without charge to each person,

including any beneficial owner, to whom this prospectus is delivered, upon his or her written or oral request, a copy of any or

all documents referred to above which have been or may be incorporated by reference into this prospectus, excluding exhibits to

those documents unless they are specifically incorporated by reference into those documents. You may request a copy of these filings,

at no cost, by writing or telephoning us at:

Seacoast Banking Corporation of Florida

P. O. Box 9012

815 Colorado Avenue

Stuart, Florida 34995

Telephone: (772) 287-4000

Facsimile: (772) 288-6012

Attention: Investor Relations

You should rely only on the information

contained or incorporated by reference in this prospectus and the applicable prospectus supplement. Neither we, nor the selling

stockholder, have authorized anyone else to provide you with additional or different information. This prospectus does not constitute

an offer to sell, nor is it soliciting an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted.

You should not assume that the information in this prospectus or the applicable prospectus supplement or any document incorporated

by reference is accurate as of any date other than the dates of the applicable documents.

SPECIAL CAUTIONARY NOTICE

REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained or incorporated

by reference in this prospectus, including but not limited to, statements concerning future results of operations or financial

position, borrowing capacity and future liquidity, future investment results, future credit exposure, future loan losses and plans

and objectives for future operations, the economic environment, asset quality and future levels of nonaccrual loans, charge-offs,

and/or provisions for loan losses, the Company’s position for future growth and ability to benefit from an economic recovery,

and other statements regarding matters that are not historical facts, are “forward-looking statements” as defined in

the Securities Exchange Act of 1934. These statements are not historical facts but instead are subject to numerous assumptions,

risks and uncertainties, and represent only our belief regarding future events, many of which, by their nature, are inherently

uncertain and outside our control. Any forward-looking statements we may make speak only as of the date on which such statements

are made. Our actual results and financial position may differ materially from the anticipated results and financial condition

indicated in or implied by these forward-looking statements and we make no commitment to update or revise forward-looking statements

in order to reflect new information, subsequent events or changes in expectations after this date.

Factors that could cause our actual results

to differ materially from those in the forward-looking statements include, but are not limited to, the following: inflation, interest

rates, market and monetary fluctuations; geopolitical developments including acts of war and terrorism and their impact on economic

conditions; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the

Federal Reserve Board and laws and regulations concerning taxes, banking and securities with which the Company and Seacoast National

Bank must comply; changes, particularly declines, in general economic conditions and in the local economies in which the Company

operates; the financial condition of the Company’s borrowers; competitive pressures on loan and deposit pricing and demand;

changes in technology and their impact on the marketing of new products and services and the acceptance of these products and services

by new and existing customers; the willingness of customers to substitute competitors’ products and services for the Company’s

products and services; the impact of changes in financial services laws and regulations (including laws concerning taxes, banking,

securities and insurance); changes in accounting principles, policies and guidelines; the risks and uncertainties described in

“Risk Factors” below; other risks and uncertainties described from time to time in press releases and other public

filings; and the Company’s performance in managing the risks involved in any of the foregoing. The foregoing list of important

factors is not exclusive, and we will not update any forward-looking statement, whether written or oral, that may be made from

time to time. You should not put undue reliance on any forward-looking statements.

SEACOAST BANKING CORPORATION OF FLORIDA

The following is a brief summary of our

business. It does not contain all of the information that may be important to you. Before you decide to purchase any of our securities,

you should read carefully this entire prospectus and the accompanying prospectus supplement, along with any other information we

refer to in, or incorporate by reference into, this prospectus and accompanying prospectus supplement.

We are a Florida corporation that is a bank

holding company for our principal subsidiary, Seacoast National Bank (“Seacoast National”). Seacoast National commenced

its operations in 1933. We are one of the largest community banks headquartered in Florida.

We and our subsidiaries provide integrated

financial services including commercial and retail banking, wealth management, and mortgage services to customers through advanced

banking solutions, traditional branches of Seacoast National and its Accelerate business banking offices. Offices stretch

from Ft. Lauderdale, Boca Raton and West Palm Beach north through the Space Coast of Florida, into Orlando and Central Florida,

and west to Okeechobee and surrounding counties

Our principal executive offices are located

at 815 Colorado Avenue, Stuart, Florida 34994, and the telephone number at that address is (772) 287-4000. Our website is located

at www.seacoastbanking.net. We are not incorporating any information from our website into this prospectus, and none of

the information on our website is included or made a part of this prospectus.

RISK FACTORS

An investment in our securities involves

significant risks. You should carefully consider the risks and uncertainties and the risk factors set forth in the documents and

reports filed with the SEC that are incorporated by reference into this prospectus, as well as any risks described in any applicable

prospectus supplement, before you make an investment decision regarding the securities. Additional risks and uncertainties not

presently known to us or that we currently deem immaterial may also affect our business operations and financial condition.

USE OF PROCEEDS

We

will not receive any of the proceeds from the sale of our common stock by CapGen, the selling stockholder. All proceeds from the

sale of our common stock pursuant to this prospectus will be for the account of CapGen.

SELLING

STOCKHOLDER

The

selling stockholder may from time to time offer and sell any or all shares of our common stock set forth below pursuant to this

prospectus. When we refer to “selling stockholder” in this prospectus, we mean CapGen Capital Group III LP,

or CapGen, and its permitted transferees under the applicable registration rights agreement.

Over the years, CapGen has made various investments in our common stock and received registration rights for such common stock.

The purpose of this registration statement and prospectus is to register for resale all of CapGen’s shares of our common

stock on a single registration statement and prospectus and replaces the prior registration statements previously filed for this

purpose.

On December 17, 2009, we issued 6,000,000

shares of common stock to CapGen in a private placement. On April 9, 2010, we issued 9,715,862 shares of our common stock to CapGen

upon the conversion of shares of our Series B Mandatorily Convertible Noncumulative Nonvoting Preferred Stock in a private placement.

Seacoast has previously registered these shares on prior registration statements. More recently, on January 13, 2014, we completed

the sale of 11,627,907 shares of common stock to CapGen pursuant a Stock Purchase Agreement,

dated as of November 6, 2013, for an aggregate purchase price equal to $25.0 million in cash. Pursuant to the registration

statement of which this prospectus is a part, we are registering all of the CapGen shares. The total number of registered shares

for CapGen have been adjusted to account for the 1-for-5 reverse stock split, which was effective on December 13, 2013. In connection

with the merger of The BANKshares, Inc. with and into the Company on October 1, 2014, pursuant to the Agreement and Plan of Merger,

dated April 24, 2014, by and among the Company, Seacoast National, The BANKshares, Inc., and BankFIRST, CapGen received 2,488,292

shares of Seacoast common stock, in exchange for the aggregate number of shares of The BANKshares, Inc. common stock held by CapGen

as of the consummation of the merger.

We are registering the shares to permit

the selling stockholder and its pledgees, donees, transferees and other successors-in-interest that receive their shares from the

selling stockholder as a gift, partnership distribution or other non-sale related transfer after the date of this prospectus to

resell the shares when and as they deem appropriate in the manner described in the “Plan of Distribution.”

Assuming

that the selling stockholder sells all the shares of our common stock beneficially owned by them that have been registered by us

and do not acquire any additional shares during the offering, the selling stockholder will not own any shares following the offering.

We cannot advise as to whether the selling stockholder will in fact sell any or all of such shares. In addition, the selling stockholder

may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to

time, the shares in transactions exempt from the registration requirements of the Securities Act after the date on which they provided

the information set forth on the table below. The percentages of shares owned set forth below are based on 34,345,139 shares of

our common stock issued and outstanding as of August 25, 2015.

The

following table sets forth, as of the date of this prospectus, certain information about the selling stockholder.

| Selling Stockholder | |

Shares of Common Stock

Owned Prior to the Offering | | |

Maximum

Number of Shares

of Common Stock

that may be Sold

in the Offering | | |

Shares of Common

Stock Owned

Following the

Offering(1) | |

| | |

Number | | |

% | | |

| | |

Number | | |

% | |

| CapGen Capital Group III LP | |

| 7,963,141 | | |

| 23.2 | % | |

| 7,963,141 | | |

| 0 | | |

| 0 | % |

| (1) | Assuming that all

shares of common stock that may be sold in the offering are sold. |

DESCRIPTION OF CAPITAL STOCK

The following description of shares of our

capital stock is a summary only and is subject to applicable provisions of the Florida Business Corporation Act, as amended (the

“Florida Act”) and to our amended and restated articles of incorporation and our amended and restated bylaws.

Common Stock

General

Our articles of incorporation provide that

we may issue up to 60 million shares of common stock, par value $0.10 per share, or “common stock.” Our common stock

is listed on the NASDAQ Global Select Market under the symbol “SBCF.”

Voting Rights

Each outstanding share of our common stock

entitles the holder to one vote on all matters submitted to a vote of shareholders, including the election of directors. The holders

of our common stock possess exclusive voting power, except as otherwise provided by law or by articles of amendment establishing

any series of our preferred stock.

There is no cumulative voting in the election

of directors, which means that the holders of a plurality of our outstanding shares of common stock can elect all of the directors

then standing for election. Since the closing of the CapGen offering on December 17, 2009 (the “CapGen Offering”),

CapGen has been entitled to appoint one director to our board of directors, so long as CapGen retains ownership of all of the shares

of common stock purchased in that offering, adjusted as applicable.

When a quorum is present at any meeting,

questions brought before the meeting will be decided by the vote of the holders of a majority of the shares present and voting

on such matter, whether in person or by proxy, except when the meeting concerns matters requiring the vote of the holders of a

majority of all outstanding shares under applicable Florida law. Our articles of incorporation provide certain anti-takeover provisions

that require super-majority votes, which may limit shareholders’ rights to effect a change in control as described under

the section below entitled “Anti-Takeover Effects of Certain Articles of Incorporation Provisions.”

Dividends, Liquidation and Other Rights

Holders of shares of common stock are entitled

to receive dividends only when, as and if approved by our board of directors from funds legally available for the payment of dividends.

Our shareholders are entitled to share ratably in our assets legally available for distribution to our shareholders in the event

of our liquidation, dissolution or winding up, voluntarily or involuntarily, after payment of, or adequate provision for, all of

our known debts and liabilities and of any preferences of any series of our preferred stock that may be outstanding in the future.

These rights are subject to the preferential rights of any series of our preferred stock that may then be outstanding.

Holders of shares of our common stock have

no preference, conversion, exchange, sinking fund or redemption rights and have no preemptive rights to subscribe for any of our

securities. Our board of directors, under our articles of incorporation, may issue additional shares of our common stock or rights

to purchase shares of our common stock without the approval of our shareholders.

Restrictions on Ownership

The Bank Holding Company Act requires any

“bank holding company,” as defined in the Bank Holding Company Act, to obtain the approval of the Federal Reserve Board

prior to the acquisition of 5% or more of our common shares. Any person, other than a bank holding company, is required to obtain

prior approval of the Federal Reserve Board to acquire 10% or more of our common shares under the Change in Bank Control Act. Any

holder of 25% or more of our common shares, or a holder of 5% or more if such holder otherwise exercises a “controlling influence”

over us, is subject to regulation as a bank holding company under the Bank Holding Company Act. CapGen is currently regulated by

the Federal Reserve as a bank holding company.

Certain provisions included in our amended

and restated articles of incorporation and bylaws, as described further below, as well as certain provisions of the Florida Business

Corporation Act and federal law, may discourage, delay or prevent potential acquisitions of control of us, particularly when attempted

in a transaction that is not negotiated directly with, and approved by, our board of directors, despite possible benefits to our

shareholders. These provisions are more fully described in the documents and reports filed with the SEC pursuant to Sections 13(a),

13(c), 14 or 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference into this prospectus.

Transfer Agent and Registrar

Subject to compliance with applicable federal

and state securities laws, our common stock may be transferred without any restrictions or limitations. The transfer agent and

registrar for shares of our common stock is Continental Stock Transfer and Trust Company.

Preferred Stock

We are authorized to issue 4 million shares

of preferred stock, 2,000 shares of which have been designated as Series A Preferred Stock, and 50,000 of which have been designated

as Series B Preferred Stock. On December 31, 2013, we redeemed in full all 2,000 shares of Series A Preferred Stock then issued

and outstanding. Such Series A Preferred Stock was originally issued to the U.S. Treasury Department under the Capital Purchase

Program and subsequently auctioned to private investors. No shares of Series B Preferred Stock are issued and outstanding as of

the date of this prospectus.

The following outlines the general provisions

of the shares of preferred stock, par value $0.10 per share, or “preferred stock,” that we may offer from time to time.

The specific terms of a series of preferred stock will be described in the applicable prospectus supplement relating to that series

of preferred stock. The following description of the preferred stock and any description of preferred stock in a prospectus supplement

is only a summary and is subject to and qualified in its entirety by reference to the articles of amendment to our amended and

restated articles of incorporation relating to the particular series of preferred stock, a copy of which we will file with the

SEC in connection with the sale of any series of preferred stock.

General

Under our amended and restated articles

of incorporation, our board of directors is authorized, without shareholder approval, to adopt resolutions providing for the issuance

of up to 4 million shares of preferred stock, par value $0.10 per share, in one or more series. Our board of directors may fix

the voting powers, designations, preferences, rights, qualifications, limitations and restrictions of each series of preferred

stock.

In addition, as described under “Description

of Depositary Shares,” we may, instead of offering full shares of any series of preferred stock, offer depositary shares

evidenced by depositary receipts, each representing a fraction of a share of the particular series of preferred stock issued and

deposited with a depositary. The fraction of a share of preferred stock which each depositary share represents will be set forth

in the prospectus supplement relating to such depositary shares.

The prospectus supplement relating to a

particular series of preferred stock will contain a description of the specific terms of that series, including, as applicable:

| · | the title, designation, number of shares and stated or liquidation value of the preferred stock; |

| · | the dividend amount or rate or method of calculation, the payment dates for dividends and the place or places where the dividends

will be paid, whether dividends will be cumulative or noncumulative, and, if cumulative, the dates from which dividends will begin

to accrue; |

| · | any conversion or exchange rights; |

| · | whether the preferred stock will be subject to redemption and the redemption price and other terms and conditions relative

to the redemption rights; |

| · | any sinking fund provisions; |

| · | the exchange or market, if any, where the preferred stock will be listed or traded; and |

| · | any other rights, preferences, privileges, limitations and restrictions that are not inconsistent with the terms of our amended

and restated articles of incorporation. |

Upon the issuance and payment for shares

of preferred stock, the shares will be fully paid and nonassessable. Except as otherwise may be specified in the prospectus supplement

relating to a particular series of preferred stock, holders of preferred stock will not have any preemptive or subscription rights

to acquire any class or series of our capital stock and each series of preferred stock will rank prior to our common stock as to

dividends and any distribution of our assets.

The rights of holders of our preferred stock

may be adversely affected in the future by the rights of holders of any new shares of preferred stock that may be issued by us

in the future. Our board of directors may cause shares of preferred stock to be issued in public or private transactions for any

proper corporate purposes, including issuance in connection with a shareholders’ rights plan or with terms that may discourage

a change in control of us. The ability of our board of directors to a designate series and issue shares of preferred stock without

further shareholder approval may discourage or make more difficult attempts by others to acquire control of us. See “Anti-Takeover

Effects of Certain Articles of Incorporation Provisions.”

Redemption

If so specified in the applicable prospectus

supplement, a series of preferred stock may be redeemable at any time, in whole or in part, at our option, and may be mandatorily

redeemable or convertible. Restrictions, if any, on the repurchase or redemption by us of any series of our preferred stock will

be described in the applicable prospectus supplement relating to that series. Generally, any redemption of our preferred stock

will be subject to prior Federal Reserve Board approval. Any partial redemptions of preferred stock will be made in a way that

our board of directors decides is equitable.

Upon the redemption date of shares of preferred

stock called for redemption or upon our earlier call and deposit of the redemption price, all rights of holders of the preferred

stock called for redemption will terminate, except for the right to receive the redemption price.

Dividends

Holders of each series of preferred stock

will be entitled to receive cash dividends only when, as and if declared by our board of directors out of funds legally available

for dividends. The rates or amounts and dates of payment of dividends will be described in the applicable prospectus supplement

relating to each series of preferred stock. Dividends will be payable to holders of record of preferred stock on the record dates

fixed by our board of directors. Dividends on any series of preferred stock may be cumulative or noncumulative, as described in

the applicable prospectus supplement.

Our board of directors may not declare,

pay or set apart funds for payment of dividends on a particular series of preferred stock unless full dividends on any other series

of preferred stock that ranks equally with or senior to such series of preferred stock have been paid or sufficient funds have

been set apart for payment for either of the following:

| · | all prior dividend periods of each series of preferred stock that pay dividends on a cumulative basis; or |

| · | the immediately preceding dividend period of each series of preferred stock that pays dividends on a noncumulative basis. |

Partial dividends declared on shares of

any series of preferred stock and other series of preferred stock ranking on an equal basis as to dividends will be declared pro

rata. A pro rata declaration means that the ratio of dividends declared per share to accrued dividends per share will be the same

for all series of preferred stock of equal priority.

Liquidation Preference

In the event of the liquidation, dissolution

or winding-up of us, holders of each series of preferred stock will have the right to receive distributions upon liquidation in

the amount described in the applicable prospectus supplement relating to each series of preferred stock, plus an amount equal to

any accrued but unpaid dividends. These distributions will be made before any distribution is made on our common stock or on any

other securities ranking junior to such preferred stock upon liquidation, dissolution or winding-up.

If the liquidation amounts payable to holders

of preferred stock of all series ranking on a parity regarding liquidation are not paid in full, the holders of the preferred stock

of these series will have the right to a ratable portion of our available assets up to the full liquidation preference. Holders

of these series of preferred stock or such other securities will not be entitled to any other amounts from us after they have received

their full liquidation preference.

Voting Rights

The holders of shares of preferred stock

will have no voting rights, except:

| · | as otherwise stated in the applicable prospectus supplement; |

| · | as otherwise stated in the articles of amendment to our amended and restated articles of incorporation establishing the series

of such preferred stock; and |

| · | as otherwise required by applicable law. |

Transfer Agent and Registrar

The transfer agent, registrar, dividend

paying agent and depositary, if any, for any preferred stock offering will be stated in the applicable prospectus supplement.

ANTI-TAKEOVER EFFECTS OF CERTAIN ARTICLES

OF INCORPORATION PROVISIONS

Our Articles of Incorporation contain certain

provisions that make it more difficult to acquire control of us by means of a tender offer, open market purchase, a proxy fight

or otherwise. These provisions are designed to encourage persons seeking to acquire control of us to negotiate with our directors.

We believe that, as a general rule, the interests of our shareholders would be best served if any change in control results from

negotiations with our directors.

Our Articles of Incorporation provide for

a classified board to which approximately one-third of our board of directors is elected each year at our annual meeting of shareholders.

Accordingly, our directors serve three-year terms rather than one-year terms. The classification of our board of directors has

the effect of making it more difficult for shareholders to change the composition of our board of directors. At least two annual

meetings of shareholders, instead of one, will generally be required to effect a change in a majority of our board of directors.

Such a delay may help ensure that our directors, if confronted by a shareholder attempting to force a proxy contest, a tender or

exchange offer, or an extraordinary corporate transaction, would have sufficient time to review the proposal as well as any available

alternatives to the proposal and to act in what they believe to be the best interests of our shareholders. The classification provisions

apply to every election of directors, however, regardless of whether a change in the composition of our board of directors would

be beneficial to us and our shareholders and whether or not a majority of our shareholders believe that such a change would be

desirable.

The classification of our board of directors

could also have the effect of discouraging a third party from initiating a proxy contest, making a tender offer or otherwise attempting

to obtain control of us, even though such an attempt might be beneficial to us and our shareholders. The classification of our

board of directors could thus increase the likelihood that incumbent directors will retain their positions. In addition, because

the classification of our board of directors may discourage accumulations of large blocks of our stock by purchasers whose objective

is to take control of us and remove a majority of our board of directors, the classification of our board of directors could tend

to reduce the likelihood of fluctuations in the market price of our common stock that might result from accumulations of large

blocks of our common stock for such a purpose. Accordingly, our shareholders could be deprived of certain opportunities to sell

their shares at a higher market price than might otherwise be the case.

Our Articles of Incorporation require the

affirmative vote of the holders of not less than two-thirds of all the shares of our stock outstanding and entitled to vote generally

in the election of directors in addition to the votes required by law or elsewhere in the Articles of Incorporation, the bylaws

or otherwise, to approve: (a) any sale, lease, transfer, purchase and assumption of all or substantially all of our consolidated

assets and/or liabilities, (b) any merger, consolidation, share exchange or similar transaction of the Company, or any merger

of any significant subsidiary, into or with another person, or (c) any reclassification of securities, recapitalization or

similar transaction that has the effect of increasing other than pro rata with the other shareholders, the proportionate amount

of shares that is beneficially owned by an Affiliate (as defined in our Articles of Incorporation). Any business combination described

above may instead be approved by the affirmative vote of a majority of all the votes entitled to be cast on the plan of merger

if such business combination is approved and recommended to the shareholders by (x) the affirmative vote of two-thirds of

our board of directors, and (y) a majority of the Continuing Directors (as defined in our Articles of Incorporation).

Our Articles of Incorporation also contain

additional provisions that may make takeover attempts and other acquisitions of interests in us more difficult where the takeover

attempt or other acquisition has not been approved by our board of directors. These provisions include:

| · | A requirement that any change to our Articles of Incorporation relating to the structure of our board of directors, certain

anti-takeover provisions and shareholder proposals must be approved by the affirmative vote of holders of two-thirds of the shares

outstanding and entitled to vote; |

| · | A requirement that any change to our Bylaws, including any change relating to the number of directors, must be approved by

the affirmative vote of either (a) (i) two-thirds of our board of directors, and (ii) a majority of the Continuing

Directors (as defined in our Articles of Incorporation) or (b) two-thirds of the shares entitled to vote generally in the

election of directors; |

| · | A requirement that shareholders may call a meeting of shareholders on a proposed issue or issues only upon the receipt by us

from the holders of 50% of all shares entitled to vote on the proposed issue or issues of signed and dated written demands for

the meeting describing the purpose for which it is to be held; and |

| · | A requirement that a shareholder wishing to submit proposals for a shareholder vote or nominate directors for election comply

with certain procedures, including advanced notice requirements. |

Our Articles of Incorporation provide that,

subject to the rights of any holders of our preferred stock to act by written consent instead of a meeting, shareholder action

may be taken only at an annual meeting or special meeting of the shareholders and may not be taken by written consent. The Articles

of Incorporation also include provisions that make it difficult to replace directors. Specifically, directors may be removed only

for cause and only upon the affirmative vote at a meeting duly called and held for that purpose upon not less than 30 days’

prior written notice of two-thirds of the shares entitled to vote generally in the election of directors. In addition, any vacancies

on the board of directors for any reason, and any newly created directorships resulting from any increase in the number of directors,

may be filled only by the board of directors (except if no directors remain on the board, in which case the shareholders may act

to fill the vacant board).

We believe that the power of our board of

directors to issue additional authorized but unissued shares of our common stock or preferred stock without further action by our

shareholders, unless required by applicable law or the rules of any stock exchange or automated quotation system on which our securities

may be listed or traded, will provide us with increased flexibility in structuring possible future financings and acquisitions

and in meeting other needs that might arise. Our board of directors could authorize and issue a class or series of stock that could,

depending upon the terms of such class or series, delay, defer or prevent a transaction or a change in control of us that might

involve a premium price for holders of our common stock or that our shareholders otherwise consider to be in their best interest.

PLAN OF DISTRIBUTION

We are registering the shares covered by

this prospectus to permit the selling stockholder to sell shares of our common stock directly to purchasers or through underwriters,

broker-dealers or agents from time to time after the date of this prospectus. We will not receive any of the proceeds of the sale

of the shares offered by this prospectus. The aggregate proceeds to the selling stockholder from the sale of the shares will be

the purchase price of the shares less any discounts and commissions. The selling stockholder reserves the right to accept and,

together with its agents, to reject, any proposed purchases of shares to be made directly or through agents.

The

selling stockholder and any underwriters, broker-dealers or agents that participate in the sale of the shares of common stock or

interests therein may be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions,

concessions or profit they earn on any resale of those shares may be underwriting discounts and commissions under the Securities

Act.

The selling stockholder and any of their

permitted transferees under the registration rights agreement may, from time to time, sell any or all of their shares of common

stock offered by this prospectus on any stock exchange, market or trading facility on which the shares are traded or in private

transactions. These sales may be at fixed, varying or privately negotiated prices. Subject to the limitations set forth in the

registration rights agreement, the selling stockholder may use any one or more of the following methods when selling the shares

offered by this prospectus:

| · | to or through underwriters or broker-dealers; |

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the

block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| · | an exchange distribution in accordance with the rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | underwriters or broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated

price per share; |

| · | a combination of any such methods of sale; and |

| · | any other method permitted pursuant to applicable law. |

In connection with these sales, subject

to certain limitations set forth in the registration rights agreement, the selling stockholder may enter into hedging transactions

with underwriters, broker-dealers or other financial institutions that in turn may engage in short sales of shares of our common

stock in the course of hedging the positions they assume.

With respect to a particular offering of

the shares of common stock held by the selling stockholder, to the extent required, an accompanying prospectus supplement or, if

appropriate, a post-effective amendment to the registration statement of which this prospectus is part, will be prepared and will

set forth the following information:

| · | the specific shares of common stock to be offered and sold; |

| · | the respective purchase prices and public offering prices and other material terms of the offering; |

| · | the names of any participating agents, broker-dealers or underwriters; and |

| · | any applicable commissions, discounts, concessions and other items constituting compensation from the selling stockholder. |

Broker-dealers engaged by the selling stockholder

may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling

stockholder (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated.

The selling stockholder does not expect these commissions and discounts to exceed what is customary in the types of transactions

involved.

To our knowledge, there are currently no

plans, arrangements or understandings between the selling stockholder and any underwriter, broker-dealer or agent regarding the

sale of the shares by the selling stockholder.

Our common stock is listed on the NASDAQ

Global Select Market under the symbol “SBCF.”

We

have advised the selling stockholder that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales

of our common stock in the market and to the activities of the selling stockholder and its affiliates. In addition, to the extent

applicable, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling

stockholder for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholder may

indemnify any broker-dealer that participates in transactions involving the sale of our common stock against certain liabilities,

including liabilities arising under the Securities Act.

There

can be no assurance that the selling stockholder will sell all or any of the common stock offered by this prospectus. Moreover,

some of the common stock offered by this prospectus may be sold by the selling stockholder in private transactions or under Rule

144 under the Securities Act rather than pursuant to this prospectus.

Agents,

broker-dealers and underwriters may be entitled to indemnification by us and the selling stockholder against certain civil liabilities,

including liabilities under the Securities Act, or to contribution with respect to payments which the agents, broker-dealers or

underwriters may be required to make in respect thereof.

The

specific terms of the lock-up provisions in respect of any given offering will be described in the applicable prospectus supplement.

Any purchaser in the offering will be subject

to the restrictions on ownership and prior approval requirements described under the section entitled “Description of Capital

Stock” under the heading “Restrictions on Ownership”.

Registration Rights

Agreement

On

January 13, 2014, we entered into a registration rights agreement (the “Registration Rights Agreement”) with CapGen,

pursuant to which CapGen became entitled to certain customary registration rights. Under the Registration Rights Agreement, we

have agreed to file with the SEC the registration statement of which this prospectus forms a part for an offering to be

made on a delayed or continuous basis covering resales of the shares of our common stock purchased by CapGen and registered for

sale hereby.

We will not receive any of the proceeds

from the sale of these shares by the selling stockholder. We have agreed to pay all expenses relating to registering the shares.

The selling stockholder will pay any underwriting discounts, selling commissions or similar charges incurred for the sale of any

shares.

The

selling stockholder is entitled to demand two offerings or sales of our common stock pursuant to the Registration Rights Agreement

and this prospectus, including underwritten takedowns (each a “Shelf Take-Down”); provided, however,

that (a) the shares of common stock requested to be included in such underwritten Shelf Take-Down constitute at least 25% of the

then outstanding shares of common stock registrable under the Registration Rights Agreement or (b) the anticipated aggregate offering

price based on the then-current markets prices, net of underwriting discounts and commissions, would exceed $6,250,000. We are

obligated to use our reasonable best efforts to maintain the effectiveness of this registration statement until such date that

is the earlier of (a) the date on which all of the shares of common stock included in this registration statement have been sold

or otherwise cease to be registrable securities and (b) the date on which the shares of common stock included in this registration

statement may be sold during any 90 day period without any volume restrictions pursuant to Rule144 promulgated under the Securities

Act, after taking into account CapGen’s status as an affiliate of the Company.

The selling stockholders have the right

to transfer their rights, remedies, obligations and liabilities arising under the Registration Rights Agreement.

We have agreed to indemnify the selling

stockholder against certain liabilities, including certain liabilities under the Securities Act, or to contribute proportionately

to payments the selling stockholder may be required to make because of any of those liabilities.

The

foregoing summary is a general description only, does not purport to be complete and is qualified in its entirety by reference

to the Registration Rights Agreement, which is filed as Exhibit 10.1 to our Current Report on Form 8-K filed with the SEC on January

14, 2014, and incorporated herein by reference.

EXPERTS

The consolidated financial

statements of Seacoast Banking Corporation of Florida and subsidiaries as of and for the year ended December 31, 2014 and Seacoast’s

effectiveness of internal control over financial reporting as of December 31, 2014 have been audited by Crowe Horwath LLP, independent

registered public accounting firm, as set forth in their report appearing in our Annual Report on Form 10-K for the year ended

December 31, 2014 and incorporated in this registration statement by reference. Such consolidated financial statements have been

so incorporated in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

The consolidated financial

statements of Seacoast Banking Corporation of Florida and subsidiaries as of December 31, 2013, and for each of the years in the

two-year period ended December 31, 2013, have been incorporated by reference herein in reliance upon the report of KPMG LLP, independent

registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting

and auditing.

LEGAL MATTERS

Unless otherwise indicated in the applicable

prospectus supplement, the validity of the securities offered hereby will be passed upon for us by Alston & Bird LLP, Atlanta,

Georgia.

Alston & Bird LLP has represented and

continues to represent Seacoast on a regular basis and in a variety of matters.

PART II. INFORMATION NOT REQUIRED IN

PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following is an itemized statement of

the estimated fees and expenses in connection with the issuance and distribution of the securities registered hereby:

| SEC registration fee |

$ |

13,384.71 |

| Listing fees and expenses |

|

** |

| Blue Sky fees and expenses |

|

** |

| Printing and engraving expenses |

|

** |

| Trustee, registrar and transfer agent, and depositary fees and expenses |

|

** |

| Attorneys’ fees and expenses |

|

** |

| Accounting fees and expenses |

|

** |

| Miscellaneous |

|

** |

| |

|

|

| Total |

$ |

** |

** Estimated expenses are not presently known.

Item 15. Indemnification of Directors and Officers

The Florida Business Corporation Act, as

amended, or the “FBCA,” permits, under certain circumstances, the indemnification of officers, directors, employees

and agents of a corporation with respect to any threatened, pending or completed action, suit or proceeding, whether civil, criminal,

administrative or investigative, to which such person was or is a party or is threatened to be made a party, by reason of his or

her being an officer, director, employee or agent of the corporation, or is or was serving at the request of, such corporation

as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against

liability incurred in connection with such proceeding, including appeals thereof; provided, however, that the officer, director,

employee or agent acted in good faith and in a manner that he or she reasonably believed to be in, or not opposed to, the best

interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or

her conduct was unlawful. The termination of any such third-party action by judgment, order, settlement, or conviction or upon

a plea of nolo contendere or its equivalent does not, of itself, create a presumption that the person (i) did not act

in good faith and in a manner which he or she reasonably believed to be in, or not opposed to, the best interests of the corporation

or (ii) with respect to any criminal action or proceeding, had reasonable cause to believe that his or her conduct was unlawful.

In the case of proceedings by or in the

right of the corporation, the FBCA permits for indemnification of any person by reason of the fact that such person is or was a

director, officer, employee or agent of the corporation, or is or was serving at the request of, such corporation as a director,

officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against liability incurred

in connection with such proceeding, including appeals thereof; provided, however, that the officer, director, employee or

agent acted in good faith and in a manner that he or she reasonably believed to be in, or not opposed to, the best interests of

the corporation, except that no indemnification is made where such person is adjudged liable, unless a court of competent jurisdiction

determines that, despite the adjudication of liability but in view of all circumstances of the case, such person is fairly and

reasonably entitled to indemnity for such expenses which such court shall deem proper.

To the extent that such person is successful

on the merits or otherwise in defending against any such proceeding, Florida law provides that he or she shall be indemnified against

expenses actually and reasonably incurred by him or her in connection therewith.

Our Bylaws contain indemnification provisions

similar to the FBCA, and further provide that we may purchase and maintain insurance on behalf of directors, officers, employees

and agents in their capacities as such, or serving at the request of the corporation, against any liabilities asserted against

such persons whether or not we would have the power to indemnify such persons against such liability under our Bylaws.

Insofar as indemnification for liabilities

arising under the Securities Act of 1933, as amended, may be permitted to our directors, officers and controlling persons pursuant

to the foregoing provisions, or otherwise, we have been advised that, in the opinion of the Securities and Exchange Commission

such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Item 16. Exhibits

| Exhibit No. |

|

Exhibit |

| |

|

|

| 1.1 |

|

Form of Underwriting Agreement.* |

| |

|

|

| 4.1.1 |

|

Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Quarterly Report on Form 10 Q, filed May 10, 2006. |

| |

|

|

| 4.1.2 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8 K, filed December 23, 2008. |

| |

|

|

| 4.1.3 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.4 to the Company’s Form S-1, filed June 22, 2009. |

| |

|

|

| 4.1.4 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8 K, filed July 20, 2009. |

| |

|

|

| 4.1.5 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8 K, filed December 3, 2009. |

| |

|

|

| 4.1.6 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8-K/A, filed July 14, 2010. |

| |

|

|

| 4.1.7 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8-K, filed June 25, 2010. |

| |

|

|

| 4.1.8 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8-K, filed June 1, 2011. |

| |

|

|

| 4.1.9 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8-K, filed December 13, 2013. |

| |

|

|

| 4.2 |

|

Amended and Restated By-laws of the Corporation, incorporated herein by reference from Exhibit 3.2 to the Company’s Form 8 K, filed December 21, 2007. |

| |

|

|

| 4.3 |

|

Specimen Common Stock Certificate, incorporated herein by reference from Exhibit 4.1 to the Company’s Form 10-K, filed March 17, 2014. |

| |

|

|

| 4.4 |

|

Registration Rights Agreement, dated as of January 13, 2014, by and between Seacoast Banking Corporation of Florida and CapGen Capital Group III LP, incorporated herein by reference from Exhibit 10.1 to the Company’s Form 8-K, filed January 14, 2014. |

| |

|

|

| 5.1 |

|

Opinion of Alston & Bird LLP as to the legality of the securities registered hereby. |

| |

|

|

| 23.1 |

|

Consent of KPMG LLP. |

| 23.2 |

|

Consent of Crowe Horwath LLP. |

| |

|

|

| 23.3 |

|

Consent of Alston & Bird LLP (included in Exhibit 5.1) |

| |

|

|

| 24.1 |

|

Power of Attorney (included on the signature pages hereto). |

* If any underwriting agreement

is utilized, it will be filed by amendment or as an exhibit to a document to be incorporated

by reference herein.

Item 17. Undertakings

| (a) | The undersigned registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| (i) | To include any prospectus required by Section 10(a)(3)

of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most

recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information

set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered

(if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or

high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant

to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum

aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement; |

provided, however, that paragraphs (1)(i),

(1)(ii) and (1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those

paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section

15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained

in a form of prospectus filed pursuant to Rule 424(b) (§ 230.424(b) of this chapter) that is part of the registration statement.

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold

at the termination of the offering. |

| (4) | That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| (i) | Each prospectus filed by the registrant pursuant to Rule 424(b)(3) (§ 230.424(b)(3) of this chapter) shall be deemed

to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration

statement; and |

| (ii) | Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) (§ 230.424(b)(2), (b)(5), or (b)(7)

of this chapter) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i),

(vii), or (x) (§ 230.415(a)(1)(i), (vii), or (x) of this chapter) for the purpose of providing the information required

by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the

earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities

in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person

that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating

to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in

a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed

incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to

a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the

registration statement or prospectus that was part of the registration statement or made in any such document immediately prior

to such effective date. |

| (5) | That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial

distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned

registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser,

if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant

will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser: |

| (i) | Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant

to Rule 424 (§ 230.424 of this chapter); |

| (ii) | Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred

to by the undersigned registrant; |

| (iii) | The portion of any other free writing prospectus relating to the offering containing material information about the undersigned

registrant or its securities provided by or on behalf of the undersigned registrant; and |

| (iv) | Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| (b) | The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933,

each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of

1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities

Exchange Act of 1934, as amended) that is incorporated by reference in the registration statement shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the

initial bona fide offering thereof. |

| (c) | Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers

and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that

in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act

and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment

by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful

defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities

being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed

in the Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing

on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in the City of Stuart, State of Florida, on August 26, 2015.

| |

SEACOAST BANKING CORPORATION OF FLORIDA |

| |

|

|

| |

By: |

/s/ Dennis S. Hudson, III |

| |

|

Name: Dennis S. Hudson, III |

| |

|

Title: Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each

person whose signature appears below constitutes and appoints Dennis S. Hudson, III his true and lawful attorney-in-fact and agent,

with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign

any and all amendments (including pre-effective and post-effective amendments) to this Registration Statement and to sign any registration

statement (and any post-effective amendments thereto) effective upon filing pursuant to Rule 462(b) under the Securities Act of

1933, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange

Commission, granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing

requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person,

hereby ratifying and confirming that said attorney-in-fact, agent or his substitutes may lawfully do or cause to be done by virtue

hereof.

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Dennis S. Hudson, III |

|

Chairman of the Board of Directors, |

|

August 26, 2015 |

| Dennis S. Hudson, III |

|

Chief Executive Officer and Director |

|

|

| |

|

(principal executive officer) |

|

|

| |

|

|

|

|

| /s/ Stephen A. Fowle |

|

Executive Vice President and |

|

August 26, 2015 |

| Stephen A. Fowle |

|

Chief Financial Officer (principal financial |

|

|

| |

|

and accounting officer) |

|

|

| |

|

|

|

|

| /s/ Dennis J. Arczynski |

|

Director |

|

August 26, 2015 |

| Dennis J. Arczynski |

|

|

|

|

| |

|

|

|

|

| /s/ Stephen E. Bohner |

|

Director |

|

August 26, 2015 |

| Stephen E. Bohner |

|

|

|

|

| /s/ Jacqueline L. Bradley |

|

Director |

|

August 26, 2015 |

| Jacqueline L. Bradley |

|

|

|

|

| |

|

|

|

|

| /s/ T. Michael Crook |

|

Director |

|

August 26, 2015 |

| T. Michael Crook |

|

|

|

|

| |

|

|

|

|

| /s/ H. Gilbert Culbreth, Jr. |

|

Director |

|

August 26, 2015 |

| H. Gilbert Culbreth, Jr. |

|

|

|