Ryanair Profit Rises Despite Turbulent Times

November 07 2016 - 2:30AM

Dow Jones News

LONDON—Ryanair Holdings PLC on Monday reported second-quarter

profit rose 8% and initiated another share buyback to help bolster

investor sentiment after the pound's slump following the Brexit

vote caused Europe's largest discount carrier to issue a profit

warning last month.

Net profit for the July-to-September period, traditionally the

busiest for Ryanair, rose to 912 million euros ($1 billion) from

€843.1 million a year ago. Sales advanced 2% to €2.4 billion.

The Irish carrier said its board had approved a €550 million

share-repurchase program, the airline's eighth, to be carried out

through February 2017. It also signaled its confidence in growth by

boosting its long-term passenger forecast.

Ryanair last month warned that the British currency's fall in

the wake of the country's vote to leave the European Union would

slow profit growth this year. More than a quarter of the Irish

budget carrier's sales are in the U.K.

Net profit is now expected in the range of €1.3 billion to €1.35

billion in the year to end-March, adjusted down from €1.375 billion

to €1.425 billion. Profit last year was €1.2 billion.

"Weaker airfares and Brexit uncertainty will be the dominant

features of [the second half]," Ryanair said.

Europe's largest airline by passenger numbers, which lobbied

against Britain leaving the EU, said "uncertainty over Brexit, and

the final outcome of the U.K.'s departure negotiations with the

European Union, will continue to overhang our business" into next

year.

The British currency will be weaker and growth in the U.K. and

Europe will slow, it said. Ryanair cut its U.K. growth forecast to

5% from 12% this year.

Chief executive Michael O'Leary said the capacity would instead

go to Italy, Germany and Belgium, in part to take advantage of cuts

made by other carriers.

Ryanair also moved to hedge its British currency exposure after

Brexit to give it certainty over costs, said Chief Financial

Officer Neil Sorahan. Ryanair has about 26% of sales in the British

currency, with 18% of costs in pounds.

European airlines have been battling myriad headwinds beyond the

fall of the British currency. Terrorist attacks earlier this year

slowed bookings, air-traffic control strikes forced flight

cancellations, and oversupply has driven down prices even as planes

are full.

Ryanair said average ticket prices fell 10% even as load factor,

a measure of seats sold, rose 95%. The airline carried 64.8 million

passengers in the first six months of its financial year that ends

March 31.

Mr. O'Leary also said the airline had raised its target for

ancillary revenue for items such as early boarding or assigned

seating. The airline now expects 30% of revenue by March 2020 to

come from such sales, up from 20%.

The airline hasn't slowed overall expansion plans, though. Last

week, it said it would open a base at Frankfurt Airport,

intensifying pressure on rival Deutsche Lufthansa AG. Ryanair has

targeted growth in Europe's biggest economy.

Ryanair said it now expects to carry 200 million passengers a

year by March 2024, or 20 million more than previously expected by

that time. The airline expects more than 119 million passengers

will take its flights this year.

The airline will delay some disposal of Boeing Co. 737 planes

and potentially extend some rentals, Mr. Sorahan said. No

additional plane purchases are needed to reach the higher target,

he said.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

November 07, 2016 02:15 ET (07:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

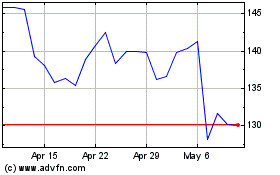

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

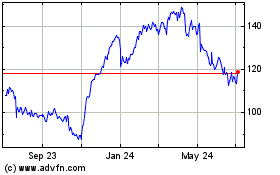

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024