Lufthansa Earnings Hit by Strikes, Overcapacity

November 02 2016 - 4:20AM

Dow Jones News

German carrier Deutsche Lufthansa AG on Wednesday said

third-quarter sales and adjusted earnings fell at a time when

European airlines are grappling with multiple headwinds.

Lufthansa's closely watched adjusted earnings before interest

and taxes fell 6.5% to €1.15 billion ($1.27 billion) as sales

retreated about €111 million to €8.8 billion.

Net profit for the July-through-September period rose 79% to

€1.4 billion, Germany's largest airline said. The net result was

principally padded by a one-time settlement with some employee

groups on pension plans.

Lufthansa, which like other European airlines this year has been

facing repeated air-traffic control strikes, overcapacity and

softened demand from terrorism, also has had to contend with

considerable labor turmoil as unions resist the carrier's efforts

to become more cost competitive.

Cabin crew at discount units Eurowings and Germanwings grounded

nearly 400 flights last Thursday in a protracted contract dispute.

The two sides have resumed talks to avoid further disruptions.

Lufthansa also is in talks with pilots union Vereinigung

Cockpit.

Pressure on Lufthansa and the group's intra-European flights is

mounting. Ryanair Holdings PLC, Europe's largest budget carrier, is

rapidly expanding in Germany to steal customers from the incumbent

carrier.

"We are responding to the pricing pressures in the air transport

sector with consistent capacity and cost discipline," Lufthansa

Chief Executive Carsten Spohr said.

Lufthansa is cutting more capacity in the fourth quarter, with

8.7% growth planned now compared with 9.7% growth planned a year

ago. Full-year capacity will rise 5.2% compared with an earlier

plan for 5.4%.

The situation isn't quite as bad, though, as Lufthansa feared

midyear after terrorist attacks in Europe spooked passengers and

hurt bookings. The carrier last month issued preliminary

third-quarter earnings and raised its full-year forecast. It

partially backtracked on a profit warning issued only three months

earlier though remaining behind expectations for profit growth at

the start of the year. Full-year adjusted earnings before interest

and taxes this year are expected to be roughly on par with last

year's €1.8 billion.

Lufthansa benefited from better-than-expected short-term

business travel bookings in September. The airline warned about

continued volatility.

"Despite the volatility of our business and despite the

difficult market environment, we are looking ahead with confidence

to 2017," Mr. Spohr said.

Capital expenditure this year will be slightly lower than

expected because of delays in some planes deliveries this year.

Canada's Bombardier Inc. has had to postpone shipment of its

CSeries narrow-body jet to Lufthansa's Swiss International Air

Lines unit because of delays from its engine supplier, United

Technologies Corp. Lufthansa said those planes should arrive next

year, raising capex levels beyond plans. Capital outlays thereafter

should be lower than planned as the airline tightens its belt.

Lufthansa last month also approved the purchase of 55% of

Brussels Airlines it doesn't already own.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

November 02, 2016 04:05 ET (08:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

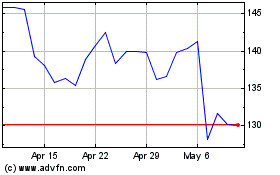

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

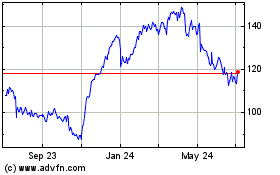

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024