Brexit' Gives EU Airlines Bumpy Ride -- Update

June 24 2016 - 4:19PM

Dow Jones News

By Robert Wall

LONDON -- European airlines were among the hardest hit by the

market turbulence Friday, following the startling decision by

Britons to leave the European Union.

Airline stocks fell sharply on concerns a weaker British

currency and possible slowdown in the wider European economy would

curtail demand for air travel. The result of the vote also puts

into doubt international agreements governing air traffic rights to

and from the U.K.

While much hinges on the broader economic fallout, the effect on

business quickly became clear. International Consolidated Airlines

Group SA, which owns British Airways, Ireland's Aer Lingus and

Spanish carriers Iberia and Vueling, issued a surprise profit

warning on Friday.

"In the run-up to the U.K. referendum during June, IAG

experienced a weaker-than-expected trading environment," the

London-based company said, adding it no longer expected to reach

its full-year target of an operating profit increase on par with

last year's. The operating profit target was around EUR3.2 billion

($3.6 billion).

The U.K. is one of Europe's biggest aviation markets and home to

some of the region's largest airlines, including British Airways

and EasyJet, Europe's No. 2 discount carrier.

Europe's largest airline, Irish discounter Ryanair Holdings PLC,

uses London Stansted airport as one of its main bases.

"We expect airlines serving the U.K. market to face immediate

weaker outbound leisure demand, as the pound weakens and business

travel declines given economic and political uncertainty," HSBC

analyst Andrew Lobbenberg said.

The International Air Transport Association projected the number

of air passengers traveling to and from the U.K. could drop by 3%

to 5% from its previous forecast.

EasyJet Chief Executive Carolyn McCall said the company has

asked the U.K. government and European Commission "to prioritize

the U.K. remaining part of the single EU aviation market, given its

importance to trade and consumers."

Ryanair Chief Executive Michael O'Leary said ahead of the

referendum the airline's growth in the U.K. could be slowed if the

country leaves the EU. Ryanair didn't address the effect of the

vote in its business plans, only saying a seat-sale linked to the

referendum had drawn strong interest.

Peter Simpson, chief executive of bmi regional, a smaller

carrier operating mainly from regional cities, signaled the airline

may reconsider being based in Britain. "Our continued business

domicile as a U.K. entity is less than clear at this point in

time," he said. The carrier had expanded heavily outside the U.K.,

he said, so it is wary of potential barriers to that growth.

The EU's single aviation market, which allows any airline within

the region to fly to any city in the bloc, has spurred air travel

and profits for many of the region's airlines. The agreement also

governs traffic rights with countries overseas, including services

from the U.S. to London, the single-largest destination for

trans-Atlantic flights.

"All of this facilitates greater competition between airlines

and, working effectively, results in lower fares and more choice

for passengers," lawyers at Eversheds said ahead of the

referendum.

British politicians now will have to negotiate new rules for the

skies. Options include becoming an adjunct member to the European

single aviation market, like Norway and a few other non-EU

countries. It could also pursue a bilateral agreement with the EU

similar to that agreed by Switzerland; or a hodgepodge of separate

deals with the EU, the U.S. and other countries, industry experts

said.

Pablo Mendes de Leon, professor of air law at Leiden University,

said adjunct membership in the European aviation market may be

unlikely, because it would subject the U.K. to European regulations

with little say to influence them. A more likely option would be

establishing bilateral agreements with EU member states, he said,

which may vary.

Traffic rights between the U.S. and Britain could revert to an

old and highly restrictive bilateral agreement, called Bermuda 2,

that limited flights and access to London Heathrow, said John

Byerly, the former chief U.S. aviation treaty negotiator. Both

sides would likely move quickly, though, to a more liberal deal, he

said, which would preserve existing services and pacts such as

those between American Airlines Group Inc. and British Airways, and

Delta Air Lines Inc. and Virgin Atlantic Airways Ltd.

--Doug Cameron contributed to this article.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

June 24, 2016 16:04 ET (20:04 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

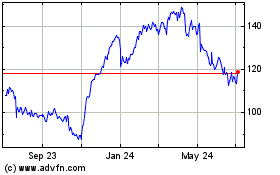

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

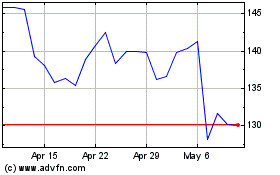

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024