By Robert Wall

In voting to exit the European Union, Britons also picked

corporate winners and losers.

News of the "leave" victory has sent the British pound down 5.9%

to $1.368; it earlier traded at a 31-year low of $1.323. The euro

lately was off 2.2% to $1.106. If they persist, the currency

declines will have far-reaching implications--both good and

bad--for large companies operating in the U.K.

"In leave scenarios, U.K. exporters would benefit from improved

price competitiveness due to sterling's depreciation," Fitch

Ratings said in a note before the votes were in. "But U.K.

companies with significant foreign-currency debt would face

servicing issues."

LOSERS

-- Airlines

European air carriers may be among the hardest hit by tumbling

domestic currencies, analysts believe.

European airlines from Ryanair Holdings PLC, Europe's largest

carrier by passenger numbers, to British Airways parent

International Consolidated Airlines Group SA make most of their

money in their money in pounds and euros, though they have

significant costs in dollars.

On an unhedged basis, the exchange-rate impact could reduce

earnings a share by as much as 18% at discount carrier easyJet PLC,

Barclays analyst Oliver Sleath said. IAG, which has significant

sales in the U.S., would be less affected.

Still, IAG issued a profit warning Friday, saying that while it

still expects a significant rise in operating profit this year, "it

no longer expects to generate an absolute operating profit increase

similar to 2015."

The currency impact is lessened by financial instruments the

airlines have in place to insulate themselves from exchange-rate

volatility. EasyJet PLC said it has about 80% of its dollar needs

locked in for the financial year ending in September, and 70% for

the following year.

-- Resources

U.K. resources companies, known for their hefty dividends, could

have to spend more to maintain those payouts if sterling doesn't

recover.

London-listed oil companies like Royal Dutch Shell PLC and BP

PLC, which declare dividends in U.S. dollars but pay them in

pounds, would have to come up with more of the British currency to

meet declared dividend payments, Biraj Borkhataria, an RBC Capital

Markets analyst, said in a recent note.

"Uncertainty is never helpful for a business such as ours," BP

said Friday. It added that it doesn't expect the Brexit to have a

significant impact on BP's business or investments in the U.K. and

continental Europe.

Shell said it would work with the U.K. government and European

institutions on implications for the company.

-- Car Makers

The Brexit puts European car makers at risk of both a sharp

downturn in demand, and an earnings hit from the fall in the

British currency. Germany's Volkswagen AG and France's PSA Peugeot

Citroën may be the companies most exposed.

The U.K. has been one of Europe's most robust car markets in

recent years. It is also Europe's third-largest center for car

production.

Evercore ISI in a note said VW's earnings before interest and

taxes could fall EUR75 million ($85 million) for every 1% drop in

sterling. The hit to VW is particularly strong because its

profitable Audi and Porsche brands represent a third of the

company's U.K. sales.

Porsche AG is very active in managing its currencies and has

done nothing specific in light of the U.K. vote, a spokesman

said.

PSA Peugeot Citroën said the sharp decline of sterling against

the euro in the wake of the referendum would force it to decide

between raising prices on cars sold in the U.K. or accepting losses

on cars sold there to protect market share.

WINNERS

-- Scotch

Companies like Diageo PLC and Pernod Ricard SA, which generate

25% of their sales from blockbuster Scotch whisky brands like

Johnnie Walker and Chivas Regal, could see a "significant currency

benefit" from the decline in sterling, Credit Suisse analysts said

in a note before the vote.

While the Scotch Whisky Association, which represents Diageo,

Pernod and other Scotch makers, had said a vote to leave would hurt

the export-focused Scotch industry, Credit Suisse said the currency

benefit could "more than offset the potential underlying business

risks."

The bank estimated Diageo's earnings a share could rise 9% to

17% on the weaker sterling, and Pernod Ricard's 6% to 9%.

Diageo shares rose despite Friday's market downdraft, up 0.4% to

GBP18.41, but the more euro-exposed Pernod Ricard was down 3.2% to

EUR93.56.

-- Luxury Goods

European luxury-goods companies could enjoy a windfall from

currency volatility. Overseas sales would yield higher profits when

repatriated into the European currency.

Companies more exposed to Asian or American markets would gain

the most from a weaker euro.

Luxury conglomerate LVMH Moët Hennessy Louis Vuitton SE, for

instance, said that only 22% of its 2015 sales were invoiced in the

European currency, compared with 32% in dollar revenue.

Not all of the luxury prospects are positive: The weaker pound

will force British houses to pay more to their eurozone-based

suppliers. Burberry Group PLC has about 65% of its costs in euros,

analysts at Sanford C. Bernstein estimate.

--William Boston, Saabira Chaudhuri, Manuela Mesco, Eric Sylvers

and Selina Williams contributed to this article

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

June 24, 2016 08:03 ET (12:03 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

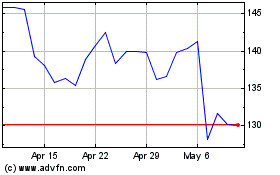

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

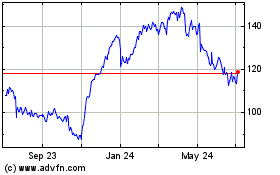

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024