Ryanair Sees Bumper Profits From Global Crude Slump

May 23 2016 - 3:30AM

Dow Jones News

LONDON—Ryanair Holdings PLC Monday posted a 43% rise in

full-year net income but warned profit growth would slow and that

concerns over terrorist attacks could weigh on ticket prices.

Net profit for the 12 months ended March 31 was €1.24 billion

($1.39 billion), up from €867 million for the prior financial year.

Europe's largest budget airline by traffic benefited from the sharp

drop in fuel costs amid a global slump in crude prices, fuller

planes and a focus on higher-paying passengers.

Sales rose to €6.5 billion from €5.7 billion as the Irish

airline carried 106.4 million passengers, 18% more than a year

earlier and a new Ryanair record. The airline's planes were packed

as load factor, a measure of seats sold, rose to 93%.

After the bumper profit growth, Ryanair forecast a more modest

pace for earnings improvement for the financial year that began in

April. "Fares are the biggest question mark," Neil Sorahan, the

airline's chief financial officer, said.

Profit should rise only around 13% to €1.38 billion to €1.43

billion, the Dublin-based airline said. The carrier's earnings

guidance at the start of a financial year typically is conservative

and often adjusted upward in subsequent months.

Rivals have warned that bookings have been impacted by the

terror attacks in Brussels in March and that ticket prices are

expected to weaken amid strong price competition. Some carriers,

including British Airways parent International Consolidated

Airlines Group SA have trimmed capacity growth and accelerated

cost-cutting efforts to compensate for the fall in ticket

prices.

The crash for still undetermined reasons of an EgyptAir flight

Thursday flying from Paris to Cairo with 66 people on board could

once more dampen bookings.

"If people have a feeling this is terrorist related then we

probably will see a kind of softening of demand," Mr. Sorahan said

in an interview.

Ryanair said ticket prices in the final quarter of the last

financial year suffered because of the Brussels attacks and

strikes.

The start of the new financial year also has been hit by

air-traffic control strikes in several European countries and the

weakness of the British pound ahead of a June 23 referendum, which

could see the U.K. exit the European Union, the carrier said.

Britain is a major source of Ryanair bookings.

Ryanair vowed to maintain its low-cost edge over rivals,

promising to cut nonfuel costs 1% this year. The fuel bill should

be €200 million lower.

Even though fuel costs on the spot market have inched higher in

recent weeks, Mr. Sorahan said pricing in futures markets has moved

less. That has allowed Ryanair to lock around 44% of its expected

fuel consumption for the next financial year at low prices, a

higher level than typical for the carrier, he said.

The airline expects to carry around 116 million passengers and

maintain its packed planes with around 93% of seats sold on a

typical flight. Average fares should fall about 7% as Ryanair cuts

ticket prices to lure passengers.

Ryanair has been adding capacity aggressively, introducing 31

new Boeing Co. 737 single-aisle planes as part of its expansion

plan in the first four months of this year, according to the plane

maker. The airline expects to take delivery of 52 new Boeing plane

this financial year, growing its fleet to 380 planes including

disposals of older aircraft.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

May 23, 2016 03:15 ET (07:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

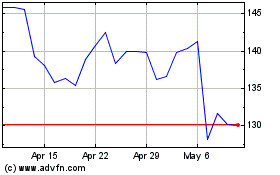

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

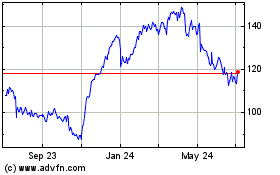

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024