Ryanair Launches Share Buyback as Profit More Than Doubles

February 01 2016 - 2:20AM

Dow Jones News

LONDON—Ryanair Holdings PLC on Monday announced a new €800

million ($867 million) share-repurchase program and said

third-quarter net profit more than doubled despite sales weakness

the airline suffered in the wake of the terror attacks in Paris

last year.

Net profit was €102.7 million, compared with €48.9 million in

the prior year, the Dublin-based budget airline said. Sales for

Europe's largest discount carrier rose 17% to €1.33 billion in the

three months ended in December, it said.

EasyJet PLC, Europe's No. 2 budget airline, last week said sales

retreated after terror attacks in Paris and Egypt triggered a

temporary bookings slump. Ryanair said the Paris attacks in

November that killed 130 people and a subsequent security shutdown

in Brussels led average fares in the period to decline 1%, having

earlier projected them to be flat. Lower costs helped compensate

for the negative development.

"I think it has worked its way out of the system," Neil Sorahan,

the airline's chief financial officer said of the Paris impact.

The share-buyback program is due to start Feb. 5, Ryanair said,

and is likely to run about nine months. It is the airline's single

biggest share buyback program, Mr. Sorahan said in an interview,

adding that the carrier will have returned in excess of €4 billion

to shareholders over the past eight years.

Ryanair has undertaken a string of share buybacks or paid

special dividends in recent years to reward investors. Last year it

distributed €398 million in special shares to investors after

selling its stake in Aer Lingus to International Consolidated

Airlines Group SA.

The discount carrier also lifted its fourth-quarter passenger

traffic forecast to 26% growth for the three-months period ending

in March, up from a projected 22% increase. It now expects to

transport 106 million passengers in the current financial year.

Even so, Ryanair stuck to its full-year earnings guidance that

net profit should be toward the upper end of its €1.175

billion-to-€1.225 billion range.

The airline's long-term growth projections last year were

already lifted to carrying 180 million passengers a year in the

2024 fiscal year, 20 million passengers more than it had previously

forecast.

The carrier also said it had taken advantage of low fuel costs

to start locking in prices into future years using financial

instruments. Ryanair has now secured fuel prices for about 95% of

next year's expected consumption at a cost that should deliver

around €430 million in year-over-year savings.

Fuel hedges also are now in place for about 50% of consumption

in the subsequent year, promising a further cut in the airline's

fuel bill. Fuel prices at such levels could yield another €300

million in lower costs, Mr. Sorahan said.

The savings would be used to lower ticket prices as Ryanair

continues a period of capacity expansion, it said. Ryanair expects

the airfare environment to get more competitive as other Europe

carriers also see fuel higher-price fuel hedges replaced with lower

terms.

"We see pressure on pricing in the next number of months," Mr.

Sorahan said.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

February 01, 2016 02:05 ET (07:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

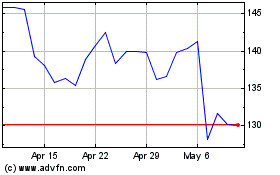

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

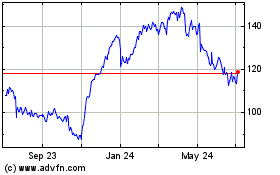

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024