Ryanair Raises Earnings Forecast on Better Fares

September 09 2015 - 4:30AM

Dow Jones News

LONDON—Ryanair Holdings PLC has raised its fiscal-year profit

target by as much as 26%, as Europe's biggest budget airline said

it would carry more passengers and sell tickets at better prices

than expected.

The airline said on Wednesday it should report net profit of

around €1.18 billion euros ($1.3 billion) to €1.23 billion for the

year to end-March. That represents a big improvement on a previous

forecast of profit nearer the top end of a projected range of €940

million to €970 million.

Ryanair, Europe's largest low-fare airline by passenger numbers,

said fares in the three months to end-December are now likely to be

flat compared with the same period the previous year. The airline

had previously expected a decline of as much as 8%.

The company said it expects to carry 104 million passengers, one

million more than in its earlier forecast. It began the year with

an estimate of 100 million passengers.

The Dublin-based carrier's upbeat outlook follows a series of

bullish forecasts and evidence of strong traffic growth among its

European rivals such as easyJet PLC, Norwegian Air Shuttle, and

Wizz Air PLC. EasyJet, Europe's No. 2 discount carrier, last week

raised its fiscal-year profit figure to end-September to a range of

£ 675 million ($1.04 billion) to £ 700 million, from £ 620 million

to £ 660 million.

The budget airlines have seen planes filled near capacity with

load factors—a measure of seats sold—in the key summer period

exceeding 90%.

"We have been surprised by the strength of close-in bookings and

fares this summer during which we delivered record 95% load factors

in both July and August while fares grew by over 2%, when we had

expected them to be flat," Ryanair Chief Executive Michael O'Leary

said.

Ryanair investors also are poised to a potential further gain as

the budget airline decides what to do with around €400 million it

received for the sale of its 29.8% stake in Aer Lingus Group to

British Airways-parent International Consolidated Airlines Group

SA.

Ryanair Chief Financial Officer Neil Sorahan said the airline

would decide ahead of its annual shareholder meeting on Sept. 24

what to do with the money. The carrier has a history of paying

special dividends and buying back its own stock.

The bullish outlook is further vindication of Ryanair's recent

shift in strategy. In the past two years, Ryanair has moved its

operations to more primary airports and sought to win business

travelers, helping it boost returns.

The airline also has benefited further from low fuel prices amid

a sustained slump in crude oil. Though much of its fuel costs are

locked in through hedges, or financial instruments used to secure

future prices and gain certainty over costs, it has benefited on

the unhedged portion of its fuel consumption.

Ryanair, which tends to provide conservative guidance, warned

there was still uncertainty to its outlook, with only about 30% of

tickets sold for its fiscal third quarter ending in December and no

visibility for the rest of the financial year.

The airline said it expects "downward pressure" on fares and

yields in the winter as it expands in major European Union markets

such as Germany while rivals are likely to use low fuel prices to

discount more heavily.

Ticket prices in the January through March period are now

expected to contract 2% to 4%, Mr. Sorahan said.

The airline has benefited from a number of nonoperational

factors, such as bad weather in Northern Europe and a strong

British currency, Mr. O'Leary said.

Ryanair also said it has recovered all of the funds from

fraudulent electronic transfer to a Chinese bank earlier in the

year. Less than $5 million was at stake, the airline said, adding

it had taken measures to prevent a repeat of such a transfer.

Write to Robert Wall at robert.wall@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 09, 2015 04:15 ET (08:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

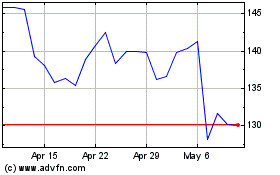

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

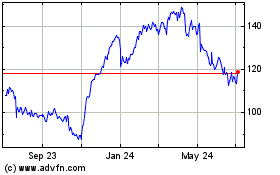

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024