Report of Foreign Issuer (6-k)

June 11 2015 - 8:44AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of June 2015

RYANAIR HOLDINGS PLC

(Translation of registrant's name into English)

c/o Ryanair Ltd Corporate Head Office

Dublin Airport

County Dublin Ireland

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F..X.. Form 40-F.....

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.

Yes ..... No ..X..

If "Yes" is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b): 82- ________

RYANAIR WILL APPEAL CMA'S RIDICULOUS RULING

Ryanair's Robin Kiely said:

"Today's CMA decision rejecting Ryanair's request to review its order to divest Ryanair's 29.8% minority stake in Aer Lingus is manifestly wrong and flies in the face of the current IAG offer for Aer Lingus. When the only basis for the CMA's original divestment ruling was that Ryanair's minority shareholding was or would prevent other airlines making an offer for Aer Lingus, the recent offers by IAG for Aer Lingus totally disprove and undermine the bogus theories and invented evidence on which the CMA based its untenable divestment ruling.

Simon Polito and his group were unable to establish any consumer harm arising from Ryanair's minority stake in Aer Lingus and instead resorted to speculating (in the CMA's August 2013 report) that Ryanair's 29.8% shareholding would deter other airlines from merging with or bidding for Aer Lingus. IAG's current offer for Aer Lingus proves that the the CMA's invented theory of harm was hopelessly wrong, and is now unsustainable given that the circumstances have manifestly changed, and accordingly the divestment remedy must be revoked in light of this compelling evidence.

Ryanair has instructed its lawyers to appeal today's ridiculous decision to the Competition Appeal Tribunal, given that it is factually unsustainable and legally flawed as the IAG offer for Aer Lingus proceeds.

In parallel, Ryanair's lawyers are currently seeking permission to appeal the unsustainable 2013 report to the UK Supreme Court."

For further information

please contact:

Robin Kiely Joe Carmody

Ryanair Ltd Edelman Ireland

Tel: +353-1-9451212 Tel: +353-1-6798 333

press@ryanair.com ryanair@edelman.com

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Date: 11 June 2015

| |

By:___/s/ Juliusz Komorek____

|

| |

|

| |

Juliusz Komorek

|

| |

Company Secretary

|

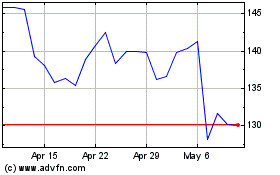

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

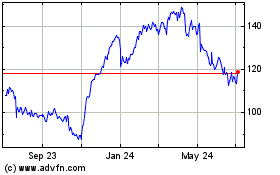

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024