UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 21, 2015

RED ROBIN GOURMET BURGERS, INC.

(Exact name of registrant as specified in its charter)

|

| | | |

Delaware | 001-34851 | 84-1573084 |

(State or other jurisdiction

of incorporation) | (Commission

file number) | (IRS employer

identification no.)

|

6312 S. Fiddler’s Green Circle, Suite 200N Greenwood Village, Colorado |

80111 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (303) 846-6000

Not Applicable

(Former name or former address, if changed since last report.)

________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 210.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement

On December 21, 2015, Red Robin Gourmet Burgers, Inc. (the “Company”) entered into the First Amendment (the “Amendment”) to the Credit Agreement, dated as of July 2, 2014, by and between the Company; Red Robin International, Inc., as the borrower; the domestic subsidiaries of the borrower from time to time parties thereto; the lender parties thereto; Wells Fargo Bank, N.A. as Administrative Agent; Bank of America, N.A. as Syndication Agent; BBVA Compass and U.S. Bank National Association as Documentation Agents; Rabobank Nederland as Senior Managing Agent; and Wells Fargo Securities, LLC and Merrill Lynch, Pierce, Fenner & Smith Incorporated as Co-Lead Arrangers and Co-Bookrunners (the “Credit Agreement”).

As a result of the Amendment, the amount of the revolving line of credit available under the Credit Agreement was increased from $250 million to $325 million. No other material changes to the Credit Agreement were made pursuant to the Amendment.

The summary description of the Amendment set forth above does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment. A copy of the Amendment is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 above is incorporated herein by reference.

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

| |

Exhibit No. | Description |

10.1 | First Amendment to Credit Agreement, dated as of December 21, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

RED ROBIN GOURMET BURGERS, INC.

Dated: December 23, 2015

By: /s/ Stuart B. Brown

Stuart B. Brown

Senior Vice President and Chief Financial Officer

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

10.1 | First Amendment to Credit Agreement, dated as of December 21, 2015. |

EXECUTION VERSION

CID #000004547

FIRST AMENDMENT TO CREDIT AGREEMENT

THIS FIRST AMENDMENT TO CREDIT AGREEMENT (this “Agreement”), dated as of December 21, 2015, is by and among RED ROBIN INTERNATIONAL, INC., a Nevada corporation (the “Borrower”), RED ROBIN GOURMET BURGERS, INC., a Delaware corporation (the “Parent”), the Guarantors, the Lenders party hereto, and WELLS FARGO BANK, NATIONAL ASSOCIATION, a national banking association, as administrative agent on behalf of the Lenders under the Credit Agreement (as hereinafter defined) (in such capacity, the “Administrative Agent”).

W I T N E S S E T H

WHEREAS, the Borrower, the Parent, the other Guarantors, the Lenders from time to time party thereto, and the Administrative Agent are parties to that certain Credit Agreement dated as of July 2, 2014 (as amended, modified, extended, restated, replaced, or supplemented from time to time, the “Credit Agreement”; capitalized terms used herein and not otherwise defined herein shall have the meanings ascribed thereto in the Credit Agreement, as amended hereby);

WHEREAS, the Credit Parties have requested that the Lenders make certain amendments to the Credit Agreement as set forth herein; and

WHEREAS, the Lenders have agreed to amend the Credit Agreement subject to the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the agreements hereinafter set forth, and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

AMENDMENTS TO CREDIT AGREEMENT

1.1 Amendment to “Commitment”. The last sentence of the definition of “Commitment” in Section 1.1 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

The aggregate Commitments of all the Lenders on the First Amendment Effective Date is $325,000,000.

1.2 Amendment to “Federal Funds Rate”. The definition of “Federal Funds Rate” in Section 1.1 of the Credit Agreement is hereby amended by inserting the following new sentence at the end thereof:

Notwithstanding the foregoing, if the Federal Funds Rate shall be less than zero, such rate shall be deemed to be zero for purposes of this Agreement.

1.3 Amendment to “Guarantor”. The definition of “Guarantor” in Section 1.1 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Guarantor” shall mean (a) the Parent, (b) each Domestic Subsidiary of the Parent identified as a “Guarantor” on the signature pages hereto, (c) each Additional Credit Party (other than Liquor License Subsidiaries and Immaterial Subsidiaries) which executes a Joinder Agreement, (d) with respect to (i) all existing or future payment and other obligations owing by any Credit Party under any Secured Hedging Agreement and any Secured Cash Management Agreement, and (ii) any Swap Obligation of a Specified Credit Party (determined before giving effect to Section 10.1 and 10.10) under the Guaranty, the Borrower, and (e) the successors and permitted assigns of the foregoing.

1.4 Amendment to “LIBOR Rate”. The definition of “LIBOR Rate” in Section 1.1 of the Credit Agreement is hereby amended by inserting the following new sentence at the end thereof:

Notwithstanding the foregoing, if the LIBOR Rate shall be less than zero, such rate shall be deemed to be zero for purposes of this Agreement.

1.5 Amendment to “Sanctioned Country”. The definition of “Sanctioned Country” in Section 1.1 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Sanctioned Country” shall mean at any time, a country or territory which is itself the subject or target of any Sanctions (including, without limitation, Cuba, Iran, North Korea, Sudan and Syria).

1.6 Amendment to “Sanctioned Person”. The definition of “Sanctioned Person” in Section 1.1 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Sanctioned Person” shall mean, at any time, (a) any Person listed in any Sanctions-related list of designated Persons maintained by OFAC, the U.S. Department of State, the United Nations Security Council, the European Union, Her Majesty’s Treasury, or other relevant sanctions authority, (b) any Person operating, organized or resident in a Sanctioned Country or (c) any Person owned or controlled by any such Person or Persons described in clauses (a) and (b).

1.7 Amendments to Section 1.1. Section 1.1 of the Credit Agreement is hereby amended by inserting the following new definitions in the appropriate alphabetical order therein:

“Anti-Corruption Laws” shall mean all laws, rules, and regulations of any jurisdiction applicable to the Borrower or its Subsidiaries from time to time concerning or relating to bribery or corruption, including, without limitation, the United States Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations thereunder.

“First Amendment Effective Date” shall mean December 21, 2015.

“Sanctions” shall mean economic or financial sanctions or trade embargoes imposed, administered or enforced from time to time by the U.S. government (including those administered by OFAC), the European Union, Her Majesty’s Treasury, or other relevant sanctions authority.

1.8 Amendment to Section 2.1(a). The reference to “TWO HUNDRED FIFTY MILLION DOLLARS ($250,000,000)” in the first sentence of Section 2.1(a) of the Credit Agreement is hereby amended to read “THREE HUNDRED TWENTY FIVE MILLION DOLLARS ($325,000,000)”.

1.9 Amendment to Section 2.5. The reference to “$100,000,000” in the first sentence of Section 2.5 of the Credit Agreement is hereby amended to read “$25,000,000”.

1.10 Amendment to Section 3.27. Section 3.27 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

Section 3.27 Anti-Corruption Laws and Sanctions.

None of (a) any Credit Party, any or their Subsidiaries or, to the knowledge of any such Credit Party any such Subsidiary, any of their respective directors, officers, employees or affiliates, or (b) to the knowledge of any Credit Party, any agent or representative of any Credit Party or any of their Subsidiaries that will act in any capacity in connection with or benefit from the credit facility established hereby, (i) is a Sanctioned Person or currently the subject or target of any Sanctions or (ii) has taken any action, directly or indirectly, that would result in a violation by such Persons of any Anti-Corruption Laws.

1.11 Amendment to Section 3.28. Section 3.28 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

Section 3.28 [Reserved].

1.12 Amendment to Article V. Article V of the Credit Agreement is hereby amended by inserting the following new Section 5.17 at the end thereof:

Section 5.17 Compliance with Anti-Corruption Laws and Sanctions.

(a) The Borrower will not request any Extension of Credit, and the Borrower shall not use, and shall ensure that no Credit Party and none of their Subsidiaries or their respective directors, officers, employees and agents use, the proceeds of any Extension of Credit (i) in furtherance of an offer, payment, promise to pay, or authorization of the payment or giving of money, or anything else of value, to any Person in violation of any Anti-Corruption Laws, (ii) for the purpose of funding, financing or facilitating any activities, business or transaction of or with any Sanctioned Person, or in any Sanctioned Country, or (iii) in any manner that would result in the violation of any Sanctions applicable to any party hereto.

(b) The Credit Parties will maintain in effect and enforce policies and procedures designed to promote and achieve compliance in all material respects by each such Credit Party, their Subsidiaries and their respective directors, officers, employees and agents with Anti-Corruption Laws and applicable Sanctions.

1.13 Amendment to Article IX. Article IX of the Credit Agreement is hereby amended by inserting the following new Section 9.20 at the end thereof:

Section 9.20 No Advisory or Fiduciary Relationship.

(a) In connection with all aspects of each transaction contemplated hereby, each Credit Party acknowledges and agrees, and acknowledges its Affiliates’ understanding, that (i) the facilities provided for hereunder and any related arranging or other services in connection therewith (including in connection with any amendment, waiver or other

modification hereof or of any other Credit Document) are an arm’s-length commercial transaction between the Borrower and its Affiliates, on the one hand, and the Administrative Agent, the Arrangers and the Lenders, on the other hand, and the Borrower is capable of evaluating and understanding and understands and accepts the terms, risks and conditions of the transactions contemplated hereby and by the other Credit Documents (including any amendment, waiver or other modification hereof or thereof), (ii) in connection with the process leading to such transaction, each of the Administrative Agent, the Arrangers and the Lenders is and has been acting solely as a principal and is not the financial advisor, agent or fiduciary, for the Borrower or any of its Affiliates, stockholders, creditors or employees or any other Person, (iii) none of the Administrative Agent, the Arrangers or the Lenders has assumed or will assume an advisory, agency or fiduciary responsibility in favor of the Borrower with respect to any of the transactions contemplated hereby or the process leading thereto, including with respect to any amendment, waiver or other modification hereof or of any other Credit Document (irrespective of whether any Arranger or Lender has advised or is currently advising the Borrower or any of its Affiliates on other matters) and none of the Administrative Agent, the Arrangers or the Lenders has any obligation to the Borrower or any of its Affiliates with respect to the financing transactions contemplated hereby except those obligations expressly set forth herein and in the other Credit Documents, (iv) the Arrangers and the Lenders and their respective Affiliates may be engaged in a broad range of transactions that involve interests that differ from, and may conflict with, those of the Borrower and its Affiliates, and none of the Administrative Agent, the Arrangers or the Lenders has any obligation to disclose any of such interests by virtue of any advisory, agency or fiduciary relationship, and (v) the Administrative Agent, the Arrangers and the Lenders have not provided and will not provide any legal, accounting, regulatory or tax advice with respect to any of the transactions contemplated hereby (including any amendment, waiver or other modification hereof or of any other Credit Document) and the Credit Parties have consulted their own legal, accounting, regulatory and tax advisors to the extent they have deemed appropriate.

(b) Each Credit Party acknowledges and agrees that each Lender, the Arrangers and any Affiliate thereof may lend money to, invest in, and generally engage in any kind of business with, any of the Borrower, the Parent, any Affiliate thereof or any other person or entity that may do business with or own securities of any of the foregoing, all as if such Lender, Arranger or Affiliate thereof were not a Lender or Arranger or an Affiliate thereof (or an agent or any other person with any similar role under the Revolving Credit Facility) and without any duty to account therefor to any other Lender, the Arrangers, the Parent, the Borrower or any Affiliate of the foregoing. Each Lender, the Arrangers and any Affiliate thereof may accept fees and other consideration from the Parent, the Borrower or any Affiliate thereof for services in connection with this Agreement, the Revolving Credit Facility or otherwise without having to account for the same to any other Lender, the Arrangers, the Parent, the Borrower or any Affiliate of the foregoing, provided that nothing in this Section shall modify, limit or invalidate any agreement between any of the Arrangers, the Lenders or the Affiliates thereof for payment of fees or other consideration related to this Agreement or the Revolving Credit Facility.

1.14 Amendment to Schedule 1.1(a). Schedule 1.1(a) to the Credit Agreement is hereby amended in its entirety to read in the form of Schedule 1.1(a) attached this Agreement.

ARTICLE II

CONDITIONS

2.1 Closing Conditions. This Agreement shall become effective upon the satisfaction of the following conditions precedent:

(a) Execution of Agreement. The Administrative Agent shall have received a copy of this Agreement duly executed by the Borrower, the other Credit Parties, the Administrative Agent and the Required Lenders (including each Lender providing an increase to its Commitment under the Revolving Credit Facility).

(b) Authority Documents. The Administrative Agent shall have received:

(i) copies of the articles of incorporation or other charter documents, as applicable, of each Credit Party, certified by a secretary or assistant secretary of such Credit Party and, to the extent any changes have been made to such articles of incorporation or other charter documents since the Closing Date, the appropriate Governmental Authority of the state of each such Credit Party’s organization, in each case, to be true and complete as of a recent date;

(ii) copies of resolutions of the board of directors (or other appropriate governing body) of each Credit Party approving and adopting this Agreement, the transactions contemplated herein and authorizing execution and delivery thereof, certified by a secretary or assistant secretary of such Credit Party as of the date hereof to be true and correct and in force and effect as of such date;

(iii) a copy of the bylaws or comparable operating agreement of each Credit Party certified by a secretary or assistant secretary of such Credit Party as of the date hereof to be true and correct and in force and effect as of such date;

(iv) copies of certificates of good standing, existence or its equivalent with respect to each Credit Party certified as of a recent date by the appropriate Governmental Authorities of each Credit Party’s state of organization; and

(v) an incumbency certificate of each Credit Party certified by a secretary or assistant secretary to be true and correct as of the date hereof (or otherwise certifying that no changes have been made to the incumbency certificate delivered by such Credit Party as of the Closing Date).

(c) Officer’s Certificate. The Administrative Agent shall have received from the Borrower an officer’s certificate in form and substance reasonably satisfactory to the Administrative Agent demonstrating that, as of the date hereof and after giving effect to this Agreement (and the increase of the Commitments hereunder) on a Pro Forma Basis, the Credit Parties will be in compliance with the financial covenants set forth in Section 5.9 of the Credit Agreement, and no Default or Event of Default shall exist.

(d) Legal Opinions of Counsel. The Administrative Agent shall have received opinions of legal counsel for the Credit Parties, dated the date hereof and addressed to the Administrative Agent and the Lenders in form and substance reasonably acceptable to the Administrative Agent.

(e) Fees and Out of Pocket Costs. The Administrative Agent shall have received upfront fees for the account of each Lender providing an increase to its Commitment under the Revolving Credit Facility and the Borrower shall have paid any and all reasonable, documented out-of-pocket costs incurred by the Administrative Agent (including the fees and expenses Moore & Van Allen, PLLC as legal counsel to the Administrative Agent) and all other fees and amounts required to be paid to the Administrative Agent in connection with this Agreement to the extent invoiced prior to the date hereof.

ARTICLE III

MISCELLANEOUS

3.1 Amended Terms. On and after the date hereof, all references to the Credit Agreement in each of the Credit Documents shall hereafter mean the Credit Agreement as amended by this Agreement. Except as specifically amended hereby or otherwise agreed, the Credit Agreement is hereby ratified and confirmed and shall remain in full force and effect according to its terms.

3.2 Representations and Warranties of Credit Parties. Each of the Credit Parties represents and warrants as follows:

(a) Each of the Credit Parties has full corporate power, authority and right to execute, deliver and perform this Agreement and has taken all necessary limited liability company or corporate action to authorize the execution, delivery and performance by it of this Agreement.

(b) This Agreement has been duly executed and delivered on behalf of each of the Credit Parties. This Agreement constitutes a legal, valid and binding obligation of each of the Credit Parties, enforceable against such Credit Party in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors’ rights generally and by general equitable principles (whether enforcement is sought by proceedings in equity or at law).

(c) No consent or authorization of, filing with, notice to or other act by or in respect of, any Governmental Authority or any other Person is required in connection with the execution, delivery or performance of this Agreement by the Credit Parties (other than those which have been obtained) or with the validity or enforceability of this Agreement against the Credit Parties.

(d) The representations and warranties made by the Credit Parties in the Credit Agreement, in the Security Documents or which are contained in any certificate furnished at any time under or in connection with the Credit Agreement are true and correct on and as of the date hereof as if made on and as of such date, except for representations and warranties expressly stated to relate to a specific earlier date.

(e) No Default or Event of Default has occurred and is continuing on the date hereof.

(f) The Security Documents continue to create a valid security interest in, and Lien upon, the Collateral purported to be covered thereby, in favor of the Administrative Agent, for the benefit of the holders of the Secured Obligations, which security interests and Liens are perfected in accordance with the terms of the Security Documents and prior to all Liens other than Permitted Liens.

(g) The Obligations of the Credit Parties are not reduced or modified by this Agreement and, as of the date hereof, are not subject to any offsets, defenses or counterclaims.

3.3 Reaffirmation of Obligations. Each Credit Party hereby ratifies the Credit Agreement, as amended hereby, and each other Credit Document to which it is a party and acknowledges and reaffirms (a) that it is bound by all terms of the Credit Agreement, as amended hereby, and each other Credit Document to which it is a party applicable to it and (b) that it is responsible for the observance and full performance of its respective obligations under the Credit Documents.

3.4 Credit Document. This Agreement shall constitute a Credit Document under the terms of the Credit Agreement.

3.5 Entirety. This Agreement and the other Credit Documents embody the entire agreement among the parties hereto and supersede all prior agreements and understandings, oral or written, if any, relating to the subject matter hereof.

3.6 Expenses. The Borrower agrees to pay all reasonable costs and expenses of the Administrative Agent in connection with the preparation, execution and delivery of this Agreement, including without limitation the reasonable fees and expenses of the Administrative Agent’s legal counsel.

3.7 Counterparts; Electronic Execution. This Agreement may be executed in counterparts (and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. Delivery of an executed signature page of this Agreement by facsimile transmission or other electronic means shall be effective as delivery of a manually executed counterparty hereof.

3.8 GOVERNING LAW. THIS AGREEMENT AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES UNDER THIS AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED AND INTERPRETED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK (INCLUDING SECTION 5-1401 AND SECTION 5-1402 OF THE GENERAL OBLIGATIONS LAW OF THE STATE OF NEW YORK) WITHOUT REGARD TO CONFLICTS OR CHOICE OF LAW PRINCIPLES THAT WOULD REQUIRE APPLICATION OF THE LAWS OF ANOTHER JURISDICTION.

3.9 Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective permitted successors and assigns.

3.10 Consent to Jurisdiction; Service of Process; Waiver of Jury Trial. The jurisdiction, services of process and waiver of jury trial provisions set forth in Section 9.14 and Section 9.17 of the Credit Agreement and the limitation of liability provisions of Section 9.5(b) of the Credit Agreement are hereby incorporated by reference, mutatis mutandis.

[Signature pages to follow]

IN WITNESS WHEREOF the parties hereto have caused this Agreement to be duly executed on the date first above written.

BORROWER:

RED ROBIN INTERNATIONAL, INC.,

a Nevada corporation

By: /s/ Stuart B. Brown

Name: Stuart B. Brown

Title: President and Treasurer

GUARANTORS:

RED ROBIN GOURMET BURGERS, INC.,

a Delaware corporation

By: /s/ Stuart B. Brown

Name: Stuart B. Brown

Title: Senior Vice President and Chief Financial Officer

RED ROBIN WEST, INC.,

a Nevada corporation

By: /s/ Stuart B. Brown

Name: Stuart B. Brown

Title: President and Treasurer

WESTERN FRANCHISE DEVELOPMENT, INC.,

a California corporation

By: /s/ Stuart B. Brown

Name: Stuart B. Brown

Title: President and Treasurer

RED ROBIN DISTRIBUTING COMPANY LLC,

a Nevada limited liability company

By: /s/ Stuart B. Brown

Name: Stuart B. Brown

Title: Manager

NORTHWEST ROBINS, L.L.C.,

a Washington limited liability company

By: /s/ Stuart B. Brown

Name: Stuart B. Brown

Title: President and Treasurer

FIRST AMENDMENT TO CREDIT AGREEMENT

RED ROBIN INTERNATIONAL, INC.

RED ROBIN EXPRESS, LLC,

Colorado limited liability company

By: /s/ Stuart B. Brown

Name: Stuart B. Brown

Title: Manager

RED ROBIN NORTH HOLDINGS, INC.,

a Nevada corporation

By: /s/ Stuart B. Brown

Name: Stuart B. Brown

Title: President and Treasurer

FIRST AMENDMENT TO CREDIT AGREEMENT

RED ROBIN INTERNATIONAL, INC.

ADMINISTRATIVE AGENT

AND LENDERS:

WELLS FARGO BANK, NATIONAL ASSOCIATION,

as Administrative Agent and a Lender

By: /s/ Stephen A. Leon

Name: Stephen A. Leon

Title: Managing Director

FIRST AMENDMENT TO CREDIT AGREEMENT

RED ROBIN INTERNATIONAL, INC.

BANK OF AMERICA, N.A.,

as a Lender

By: /s/ Anthony Luppino

Name: Anthony Luppino

Title: Vice President

FIRST AMENDMENT TO CREDIT AGREEMENT

RED ROBIN INTERNATIONAL, INC.

COMPASS BANK,

as a Lender

By: /s/ James T. Short

Name: James T. Short

Title: EVP/ Director of Food Franchise

FIRST AMENDMENT TO CREDIT AGREEMENT

RED ROBIN INTERNATIONAL, INC.

U.S. BANK NATIONAL ASSOCIATION,

as a Lender

By: /s/ Jeff Benedix

Name: Jeff Benedix

Title: Vice President

FIRST AMENDMENT TO CREDIT AGREEMENT

RED ROBIN INTERNATIONAL, INC.

COOPERATIEVE CENTRALE RAIFFEISEN-BOERENLEENBANK B.A., “RABOBANK NEDERLAND”, NEW YORK BRANCH,

as a Lender

By: /s/ Jeff Geisbauer

Name: Jeff Geisbauer

Title: Executive Director

By: /s/Bert Corum

Name: Bert Corum

Title: Executive Director

FIRST AMENDMENT TO CREDIT AGREEMENT

RED ROBIN INTERNATIONAL, INC.

Schedule 1.1(a)

COMMITMENTS AND COMMITMENT PERCENTAGES

|

| | |

Lender | Commitment | Commitment Percentage |

Wells Fargo Bank, National Association | $86,666,667.10 | 26.666666800% |

Bank of America, N.A. | $86,666,667.10 | 26.666666800% |

Compass Bank | $50,555,555.70 | 15.555555600% |

U.S. Bank National Association | $50,555,555.70 | 15.555555600% |

Cooperatieve Centrale Raiffeisen-Boerenleenbank B.A., “Rabobank Nederland”, New York Branch | $50,555,555.70 | 15.555555600% |

TOTALS | $325,000,000.00 | 100.000000000% |

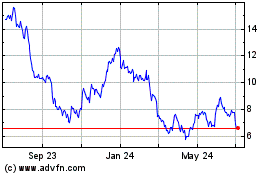

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Apr 2023 to Apr 2024