Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

| Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

|

|

|

|

|

| RED ROBIN GOURMET BURGERS, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

|

(1) |

|

Title of each class of securities to which transaction applies:

|

| |

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

| |

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

| |

|

(5) |

|

Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| |

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

| |

|

(3) |

|

Filing Party:

|

| |

|

(4) |

|

Date Filed:

|

Table of Contents

RED ROBIN GOURMET BURGERS, INC.

6312 South Fiddler's Green Circle, Suite 200N

Greenwood Village, CO 80111

(303) 846-6000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 28, 2015

To our Stockholders:

The

annual meeting of stockholders of Red Robin Gourmet Burgers, Inc. will be held at 8:00 a.m. MDT, on Thursday, May 28, 2015, at our corporate headquarters,

located at 6312 South Fiddler's Green Circle, Suite 200N, Greenwood Village, Colorado 80111, for the following purposes:

- 1)

- To

elect Robert B. Aiken, Stephen E. Carley, Cambria W. Dunaway, Lloyd L. Hill, Richard J. Howell, Glenn B. Kaufman, Pattye L. Moore, and Stuart I.

Oran, as directors of the Company for one-year terms;

- 2)

- To

approve, on an advisory basis, the compensation of our named executive officers;

- 3)

- To

approve the Red Robin Gourmet Burgers, Inc. Cash Incentive Plan;

- 4)

- To

approve an amendment to the Company's Restated Certificate of Incorporation to increase the authorized common stock of the Company from 30,000,000 shares,

par value $0.001 per share, to 45,000,000 shares, par value $0.001 per share;

- 5)

- To

ratify the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for the fiscal year ending

December 27, 2015; and

- 6)

- To

transact such other business as may properly come before the meeting.

We

direct your attention to the proxy statement, which includes information about the matters to be considered at the annual meeting and certain other important information and which we

encourage you to carefully review. Our board of directors recommends that you vote FOR the board's nominees for director, FOR approval of our

executive compensation, FOR approval of the Cash Incentive Plan, FOR approval of the amendment to increase the authorized shares of common

stock of the Company, and FOR

ratification of the independent auditor. Your vote is important.

Stockholders

of record at the close of business on March 30, 2015 are entitled to notice of, and to vote at, the annual meeting or any postponement or adjournment thereof. This

Notice of Annual Meeting of Stockholders and related proxy materials are being distributed or made available to stockholders beginning on or about

April [ ], 2015.

This

year, we have again elected to provide access to our proxy materials on the Internet under the U.S. Securities and Exchange Commission's "notice and access" rules. Our proxy

materials are available at the following website:

http://www.redrobin.com/eproxy

We

cordially invite you to attend the annual meeting. Whether or not you plan to attend, it is important that your shares be represented and voted at the meeting. Please refer to your

proxy card or Notice Regarding the Availability of Proxy Materials for more information on how to vote your shares at the meeting and return your voting instructions as promptly as possible.

Thank

you for your support.

|

|

|

| |

|

By Order of the Board of Directors, |

|

|

|

|

|

Pattye L. Moore

Chair of the Board of Directors |

Greenwood

Village, Colorado

April [ ], 2015

Table of Contents

TABLE OF CONTENTS

i

Table of Contents

ii

Table of Contents

iii

Table of Contents

PROXY STATEMENT SUMMARY

This summary is intended to provide an overview of the items that you will find elsewhere in this proxy statement about our Company and

the upcoming 2015 annual meeting of stockholders. As this is only a summary, we encourage you to read the entire proxy statement for more information about these topics before voting.

|

|

|

|

|

|

Annual Meeting of Stockholders |

|

|

|

|

|

|

|

| Time and Date: |

|

8:00 a.m. MDT on Thursday, May 28, 2015 |

| Location: |

|

Red Robin Gourmet Burgers, Inc. corporate headquarters

6312 South Fiddler's Green Circle, Suite 200N

Greenwood Village, Colorado 80111 |

| Record Date: |

|

March 30, 2015 |

|

|

|

|

|

|

Proposals and Board Voting Recommendations |

|

|

|

|

|

|

|

|

|

|

|

Proposal

|

|

Board's Voting

Recommendation |

|

Page References

(for more detail) |

|

| 1 Election of Directors |

|

FOR EACH NOMINEE |

|

|

6 |

|

| 2 Advisory Vote to Approve Executive Compensation |

|

FOR |

|

|

58 |

|

| 3 Approval of the Cash Incentive Plan |

|

FOR |

|

|

60 |

|

| 4 Approval of the Amendment to Increase Authorized Shares |

|

FOR |

|

|

63 |

|

| 5 Ratification of Independent Auditor |

|

FOR |

|

|

65 |

|

Stockholders

may also vote on such other matters as may properly come before the meeting or any postponement or adjournment thereof. With respect to any other matter that properly comes

before the meeting, the proxy holders will vote as recommended by the board of directors or, if no recommendation is given, in their own discretion.

|

|

|

|

|

|

Director Nominees (Proposal No. 1) |

|

|

|

|

Board Nominees

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Age |

|

Director Since |

|

Principal Occupation |

|

Independent |

|

Current Committee Assignments |

Robert B. Aiken |

|

|

52 |

|

|

2010 |

|

CEO, Feeding America |

|

X |

|

*NGC, CC |

Stephen E. Carley |

|

|

62 |

|

|

2010 |

|

CEO, Red Robin |

|

|

|

|

Cambria W. Dunaway |

|

|

52 |

|

|

2014 |

|

Former U.S. President, Global Chief Marketing Officer, Kidzania |

|

X |

|

FC, NGC |

Lloyd L. Hill |

|

|

71 |

|

|

2010 |

|

Former CEO, Applebee's |

|

X |

|

*CC, AC |

Richard J. Howell |

|

|

72 |

|

|

2005 |

|

Former Partner,

Arthur Andersen |

|

X |

|

*AC, CC |

Glenn B. Kaufman |

|

|

47 |

|

|

2010 |

|

Managing Member,

D Cubed Group

investment firm |

|

X |

|

*FC, CC |

Pattye L. Moore |

|

|

57 |

|

|

2007 |

|

Consultant; former President and Director, Sonic Corp. |

|

X |

|

(C), AC, NGC |

Stuart I. Oran |

|

|

64 |

|

|

2010 |

|

Partner, Liberty Hall Capital Partners private equity firm |

|

X |

|

AC, FC |

- AC

- Audit

Committee

- CC

- Compensation

Committee

- FC

- Finance

Committee

- NGC

- Nominating

and Governance Committee

- (C)

- Denotes

Chair of the Board

- *

- Denotes

Chair of the Committee

1

Table of Contents

In

2015, all eight of our directors are standing for re-election and the board recommends a vote FOR all director nominees. Directors are elected by a majority of votes cast. See

"PROPOSAL 1—ELECTION OF DIRECTORS—Directors and Nominees" on page 6 of this proxy statement for more information about our directors and nominees. In 2014, each director

attended at least 75% of the aggregate number of board and applicable committee meetings.

Key Corporate Governance Highlights

The board of directors recognizes the connection between good corporate governance and the creation of sustainable stockholder value

and is committed to practices that promote the long-term interests of the Company, accountability of management, and stockholder trust. To this end, we continually evolve our practices to ensure

alignment with our stockholders.

Highlights

include:

- •

- Fully declassified board of directors.

- •

- Independent chair of the board of directors.

- •

- All director nominees are independent other than our CEO.

- •

- All committee members are independent.

- •

- Frequent engagement by management with institutional investors.

- •

- Majority voting standard for uncontested director elections.

- •

- Annual review of our succession plan and talent development plan.

- •

- Limits on outside board service.

- •

- Formal policy prohibiting hedging and pledging of Company securities by executive officers and directors.

- •

- Directors regularly engage in in-boardroom and outside director education.

|

|

|

|

|

|

Advisory Vote on Executive Compensation (Proposal No. 2) |

|

|

|

|

We

are requesting that stockholders approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement. The board recommends a vote FOR

Proposal No. 2 because it believes that the Company's executive compensation program is designed to link incentives and rewards for our executives to the achievement of specific, sustainable

financial and strategic goals, which are expected to result in increased stockholder value. In 2014, our executive compensation advisory vote proposal was supported by approximately 99.5% of the votes

cast. Highlights of our executive compensation program, pay for performance compensation structure, 2014 performance, and 2014 compensation are set forth below. Please see "Compensation Discussion and

Analysis" beginning on page 25 for a full discussion of the items below.

Executive Compensation Program

Listed below are highlights of our executive compensation program that reflect our focus on strong corporate governance and prudent

compensation decision-making:

- •

- Pay for performance focused executive compensation structure, with a significant portion of executive pay "at-risk."

- •

- Fully independent compensation committee advised by an independent compensation consultant.

2

Table of Contents

- •

- No excise tax gross ups.

- •

- Double trigger or attainment of performance targets required for equity vesting upon change in control.

- •

- No repricing of underwater options without stockholder approval.

- •

- Meaningful stock ownership guidelines for executives and board members.

- •

- Formal policy prohibiting hedging and pledging of Company securities by executive officers and directors.

- •

- Clawback policy for the return of certain incentive compensation received by executives.

- •

- Few perquisites offered to our executives.

Pay for Performance

Our compensation program is designed to pay our executives for performance. Our short-term annual cash incentive program uses

performance targets based primarily on annual EBITDA (earnings before interest, taxes, depreciation, and amortization) goals. Long-term incentive compensation is based on achievement of financial

goals designed to demonstrate sustained improvement over multi-year periods, and time vesting designed to reward executive retention. The cash portion of our long-term incentive awards is measured

over a three-year performance period based on both cumulative EBITDA and ROIC (return on invested capital) metrics. Restricted stock units and options each vest ratably in annual increments over four

years, with the amount realizable from such awards being dependent, in whole or in part, on increased stock price. Our 2014 performance was driven by strong operating results from the implementation

of our aggressive strategic plan, begun in 2011. Our strategic plan is designed to drive performance through top-line growth in sales and increased guest traffic, and lays the foundation for scalable

and sustainable long-term growth, profitability, and increased stockholder value.

2014 Performance Highlights

Our

fiscal 2014 performance continued to be strong. Highlights are set forth below.

- •

- Annual revenues were $1.1 billion in 2014, which exceeded $1.0 billion in 2013, an increase of 12.7%. This follows a

series of increases in annual revenues over the preceding three fiscal years: annual revenues in fiscal 2013 increased by 4.1% over total revenues for fiscal 2012 (including the 53rd week);

increased by 6.8% in 2012 (including the 53rd week) over 2011, and by 5.9% in 2011 over 2010.

- •

- Comparable restaurant revenue grew by 3.1% in 2014, after growing by 4.0% in 2013.

- •

- We achieved consistent adjusted EBITDA growth over the past four years and achieved net cash provided by operating activities of

$123.6 million in 2014, up approximately 75% over 2010.

- •

- Diluted earnings per share (EPS) grew to $2.25 in 2014, up 389% over 2010.

- •

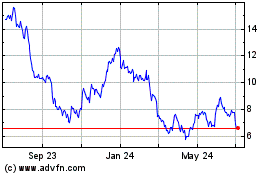

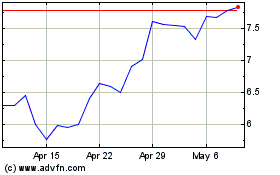

- Our stock price has more than doubled since 2013, beginning 2013 around $35 per share and beginning 2015 around $80 per share.

- •

- We significantly outperformed the casual dining industry in guest traffic for the 2014 full fiscal year by approximately 160 basis

points, as reported by Black Box Intelligence, a financial benchmarking report for the restaurant industry.

- •

- We added 22 new Red Robin® restaurants and three new Red Robin Burger Works® to our restaurant base and

acquired 36 franchised Red Robin® restaurants in fiscal 2014.

3

Table of Contents

- •

- We repurchased $26.9 million of our common stock in fiscal 2014 under our stock repurchase program, thereby using excess cash

to benefit our stockholders.

- •

- For the past four years, our cumulative total shareholder return on our common stock has shown marked improvement.

We

continue to make progress strengthening the fundamentals of our business and improving our performance. We have identified and continue to examine opportunities that

will:

- •

- drive strong financial performance through increasing guest traffic and revenues,

- •

- improve operational efficiencies and expense management, and

- •

- expand our restaurant base.

2014 Compensation

The

table below sets forth the 2014 compensation for our named executive officers:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position

|

|

Salary

($) |

|

Stock

Awards

($) |

|

Option

Awards

($) |

|

Non-Equity

Incentive

Plan

Compensation

($) |

|

All Other

Compensation

($) |

|

Total

($) |

|

Stephen E. Carley |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Executive Officer |

|

|

750,000 |

|

|

383,357 |

|

|

794,753 |

|

|

1,319,344 |

|

|

20,219 |

|

|

3,267,673 |

|

Stuart B. Brown, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SVP & Chief Financial Officer |

|

|

357,000 |

|

|

82,069 |

|

|

164,215 |

|

|

398,053 |

|

|

15,407 |

|

|

1,017,066 |

|

Denny Marie Post |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EVP & Chief Concept Officer |

|

|

392,700 |

|

|

286,345 |

|

|

172,782 |

|

|

406,189 |

|

|

14,523 |

|

|

1,275,539 |

|

Michael L. Kaplan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SVP Legal & Chief Legal Officer |

|

|

335,000 |

|

|

53,561 |

|

|

107,190 |

|

|

269,471 |

|

|

332,374 |

|

|

1,097,596 |

|

Cathy Cooney |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SVP & Chief People Officer |

|

|

305,000 |

|

|

48,737 |

|

|

97,596 |

|

|

245,339 |

|

|

25,635 |

|

|

722,308 |

|

Former Executives |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eric C. Houseman |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former President & Chief Operating Officer |

|

|

303,866 |

|

|

144,446 |

|

|

229,090 |

|

|

|

|

|

991,308 |

|

|

1,668,710 |

|

Todd A. Brighton |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former SVP & Chief |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Development Officer |

|

|

212,419 |

|

|

99,876 |

|

|

185,540 |

|

|

|

|

|

483,449 |

|

|

981,284 |

|

See

"2014 Executive Compensation Tables" and accompanying footnotes and narratives beginning on page 44 for additional information about the 2014 compensation for each named

executive officer.

4

Table of Contents

|

|

|

|

|

|

Cash Incentive Plan (Proposal No. 3) |

|

|

|

|

The

board of directors recommends a vote FOR the approval of the Red Robin Gourmet Burgers, Inc. Cash Incentive Plan. The compensation committee and our board unanimously adopted

the Cash Incentive Plan in October of 2014, subject to stockholder approval, and directed that we submit the Cash Incentive Plan to a vote of our stockholders at this annual meeting.

The

Cash Incentive Plan, if approved by stockholders, would be an important element of our executive compensation program going forward as it would allow us to continue to provide senior

management with incentives for the achievement of both near-term and mid-term financial and operational corporate goals and individual objectives in a manner that is intended to be tax-deductible. See

"Summary of the Cash Incentive Plan" beginning on page 60 for more information about the purpose and operation of the plan.

|

|

|

|

|

|

Amendment to Increase Authorized Shares (Proposal No. 4) |

|

|

|

|

The

board of directors recommends a vote FOR the approval of an amendment to the Company's Restated Certificate of Incorporation to increase the authorized common stock of the Company

from 30,000,000 shares, par value $0.001 per share, to 45,000,000 shares, par value $0.001 per share.

The

board is recommending an increase in authorized shares primarily to provide the Company the flexibility to issue shares of common stock for future corporate needs, such as future

acquisitions, capital-raising or financing transactions, stock splits, stock dividends, and current or future equity compensation plans. See "Effects of Increasing the Number of Authorized Shares of

Common Stock" and "Purpose of the Amendment" on page 63 for more information related to the effects of the increase in authorized shares and the purpose.

|

|

|

|

|

|

Independent Auditors (Proposal No. 5) |

|

|

|

|

The

board of directors recommends a vote FOR the ratification of the appointment of Deloitte & Touche LLP ("D&T") as the Company's independent auditor for the fiscal year

ending December 27, 2015. Set forth below are the fees billed by D&T for fiscal years 2014 and 2013:

|

|

|

|

|

|

|

|

|

|

2014($) |

|

2013($) |

|

Audit fees |

|

|

749,254 |

|

|

749,658 |

|

Audit-related fees |

|

|

125,000 |

|

|

— |

|

Tax fees |

|

|

139,309 |

|

|

10,774 |

|

All other fees |

|

|

2,200 |

|

|

37,200 |

|

Total |

|

|

1,015,763 |

|

|

797,632 |

|

5

Table of Contents

PROXY STATEMENT

The Board of Directors ("board" or "board of directors") of Red Robin Gourmet Burgers, Inc. ("Red Robin" or the "Company") is

providing this proxy statement to stockholders in connection with the solicitation of proxies on its behalf to be voted at our annual meeting of stockholders. The meeting will be held on Thursday,

May 28, 2015, beginning at 8:00 a.m. MDT, at our corporate headquarters, located at 6312 South Fiddler's Green Circle, Suite 200N, Greenwood Village, Colorado 80111. The proxies

may be voted at any time and date to which the annual meeting may be properly adjourned or postponed.

PROPOSAL 1

ELECTION OF DIRECTORS

General

As of the date of this proxy statement, our board of directors consists of eight directors, all of whom are independent except our CEO.

The board of directors may decide at a later time to add one or more directors who possess skills and experience that may be beneficial to our board and the Company. All of our directors are elected

on an annual basis for a one-year term.

The

directors elected at this annual meeting will serve in office until our 2016 annual meeting of stockholders or until their successors have been duly elected and qualified, or until

the earlier of their respective deaths, resignations, or retirements. Each nominee has consented to serve if elected and we expect that each of them will be able to serve if elected. If any nominee

should become unavailable to serve as a director, our board of directors can name a substitute nominee, and the persons named as proxies in the proxy card, or their nominees or substitutes, will vote

your shares for such substitute nominee unless an instruction to the contrary is written on your proxy card.

Selecting Nominees for Director

Our board has delegated to the nominating and governance committee the responsibility for reviewing and recommending nominees for

director. The board determines which candidates to nominate or appoint, as appropriate, after considering the recommendation of the committee.

In

evaluating a director candidate, the nominating and governance committee considers the candidate's independence, character, corporate governance skills and abilities, business

experience, industry specific experience, training and education, commitment to performing the duties of a director, and other skills, abilities, or attributes that fill specific needs of the board or

its committees. While there is no policy with regard to consideration of diversity in identifying director nominees, the nominating and governance committee considers diversity in business experience,

professional expertise, gender, and ethnic background, along with various other factors when evaluating director nominees. The nominating and governance committee will use the same criteria in

evaluating candidates suggested by stockholders.

The

nominating and governance committee is authorized under its charter to retain, at our expense, outside search firms and any other professional advisors it deems appropriate to assist

in identifying or

evaluating potential nominees for director. During fiscal year 2014, a third-party director search firm retained by the nominating and governance committee recommended Ms. Dunaway as a

candidate for our board.

Directors and Nominees

Below, you can find the principal occupation and other information about each of the director nominees standing for re-election at the

annual meeting. Information related to each director nominee's key attributes, experience, and skills, as well as their recent public company board service is included with each director's

biographical information.

6

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert B. Aiken, 52

Director Since: March 2010

Committees:

• Nominating and Governance (Chair)

• Compensation

Other Public Company Board Service:

United Stationers Inc. (February 2015-present)

Recent Past Public Company Board Service:

United Stationers Inc. (December 2010-May 2014) |

|

Mr. Aiken has been the Chief Executive Officer of Feeding America, a 501(c)3 hunger relief charity organization, since December 2012 and will serve in that role until June 30, 2015. Mr. Aiken was previously

the Chief Executive Officer of the food company portfolio at Bolder Capital, a Chicago-based private equity firm from February 2012 to December 2012 and from February 2010 to January 2011. Mr. Aiken was a Managing Director of Capwell Partners,

LLC, a Chicago-based private equity firm from January 2011 to February 2012. Prior to entering the private equity business in February 2010, Mr. Aiken served as the President and Chief Executive Officer of U.S. Foodservice (USF). At USF,

he served as President and Chief Executive Officer from July 2007 to February 2010, as President and Chief Operating Officer from October 2005 to July 2007, and as Executive Vice President of Sales/Marketing & Supply Chain from February 2004

to October 2005. Prior to joining USF, Mr. Aiken held several positions from 1994 through 2000 at Specialty Foods Corp. of Deerfield, Illinois, including Chief Executive Officer of its Metz Baking Company subsidiary. From 2000 until 2004,

Mr. Aiken also served as President and Principal of Milwaukee Sign Co. and early in Mr. Aiken's career, he worked as a business lawyer, first with the firm Sidley & Austin in Chicago and then with Wilson, Sonsini,

Goodrich & Rosati in Palo Alto, California.

Mr. Aiken brings to the board of directors, among his other skills and qualifications, experience as a chief executive officer of a corporation with significant operations and a large, labor-intensive workforce. He gained extensive experience in

management, operations, and logistics, as well as an understanding of the dining industry through his service at USF. In light of the foregoing, our board of directors has concluded that Mr. Aiken should continue as a member of our

board. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen E. Carley, 62

Director Since: September 2010

Other Public Company Board Service:

Harte-Hanks (March 2013-present)

Recent Past Public Company Board Service:

EPL Intermediate, Inc., an affiliate of El Pollo Loco (publicly traded debt) (2004-2010) |

|

Mr. Carley joined the Company as Chief Executive Officer and as a director in September 2010. Prior to joining the Company, Mr. Carley served from April 2001 to August 2010 as the Chief Executive Officer of El

Pollo Loco, Inc., a privately held restaurant company headquartered in Costa Mesa, California. Prior to his service at El Pollo Loco, Mr. Carley served in various management positions with several companies, including, PhotoPoint Corp.,

Universal City Hollywood, PepsiCo, Inc., and the Taco Bell Group. Mr. Carley holds a master's degree with a concentration in marketing from Northwestern University and a bachelor's degree in finance from the University of Illinois in Urbana,

Illinois.

Mr. Carley brings to the Company and the board of directors, among his other skills and qualifications, extensive restaurant industry experience and valuable executive leadership, which he gained as a chief executive officer of a corporation

with significant, large-scale operations. He has extensive knowledge and understanding of the restaurant industry, marketing and brand management in domestic and international markets, as well as significant insight into and experience with franchise

operations. In light of the foregoing, our board of directors has concluded that Mr. Carley should continue as a member of our board. |

|

|

|

|

|

|

|

|

|

|

7

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cambria W. Dunaway, 52

Director Since: June 2014

Committees:

• Finance

• Nominating and Governance

Other Public Company Board Service:

Nordstrom FSB (2014-present)

Recent Past Public Company Board Service:

Brunswick Industries (2006-2014) |

|

Ms. Dunaway served as the U.S. President and Global Chief Marketing Officer of KidZania, an international location based entertainment concept focused on children's role-playing activities, from October 2010 to

December 2014 and currently remains as an advisor to the company. From October 2007 to October 2010, Ms. Dunaway served as Executive Vice President for Nintendo, with oversight of all sales and marketing activities for the company in the United

States, Canada, and Latin America. Before joining Nintendo, Ms. Dunaway was Chief Marketing Officer for Yahoo! from June 2003 to November 2007. Prior to joining Yahoo!, Ms. Dunaway was at Frito-Lay for 13 years in various leadership

roles in sales and marketing, including serving as the company's Chief Customer Officer and as Vice President of Kids and Teens brands. Ms. Dunaway holds a Bachelor of Science degree in business administration from the University of Richmond and

an M.B.A. from Harvard Business School.

Ms. Dunaway brings to the board of directors, among other skills, more than 20 years of experience as a senior marketing and general management executive, launching and growing consumer businesses in entertainment, media, consumer

electronics, and package goods. She brings experience in the areas of marketing strategy, communications, data analytics, loyalty, digital transformation, and governance. In light of the foregoing, our board of directors has concluded that

Ms. Dunaway should continue as a member of our board. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lloyd L. Hill, 71

Director Since: March 2010

Committees:

• Compensation (Chair)

• Audit

Other Public Company Board Service:

AMC Entertainment, Inc. and its parent company AMC Entertainment Holdings, Inc. (December 2013-present)

Recent Past Public Company Board Service:

Applebee's International, Inc. (1989-2007) |

|

Mr. Hill is the former Chairman and CEO of Applebee's International, Inc. (Applebee's), based in Overland Park, Kansas. Mr. Hill joined Applebee's as Chief Operating Officer in January 1994, and was named

President in December 1994. He became Co-Chief Executive Officer in January 1997; Chief Executive Officer in January 1998; and was elected Chairman of the Board in May 2000. Mr. Hill first began serving on Applebee's board as an independent

director in 1989 and served until November 2007. Mr. Hill retired as Chief Executive Officer of Applebee's in September 2006. Prior to joining Applebee's, Mr. Hill served as President and Director of Kimberly Quality Care, a market leader

in home healthcare and nurse personnel staffing. Mr. Hill received his master's degree in business administration from Rockhurst University in Kansas City, Missouri.

Mr. Hill brings to the board of directors, among his other skills and qualifications, executive leadership and operations skills developed from his years of experience as a chief executive officer of several companies. As Chairman and Chief

Executive Officer of Applebee's, Mr. Hill substantially expanded Applebee's business while successfully maintaining relationships with Applebee's stockholders. Under Mr. Hill's leadership, Applebee's grew into the largest casual dining

concept in the world, with nearly 1,900 restaurants in 49 states and 17 countries. In 2005, Mr. Hill was named by Institutional Investor magazine as one of America's Best CEOs and as one of the top-performing CEOs within the restaurant industry.

Mr. Hill also brings deep knowledge of the casual-dining industry. In light of the foregoing, our board of directors has concluded that Mr. Hill should continue as a member of our board. |

|

|

|

|

|

|

|

|

|

|

8

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard J. Howell, 72

Director Since: September 2005

Committees:

• Audit (Chair)

• Compensation

Other Public Company Board Service:

Independent Trustee for the LKCM Funds

(July 2005-present)

Other Board Service:

Board of Directors of NACD North Texas Chapter (2010-present)

Recent Past Public Company Board Service:

None |

|

Mr. Howell was an audit partner with Arthur Andersen LLP for over 25 years before retiring in 2002. From January 2004 through May 2009, Mr. Howell served as an adjunct professor of auditing at the Cox

School of Business at Southern Methodist University, and he served in a similar capacity from August 2002 to December 2003 at the Neely School of Business at Texas Christian University.

Mr. Howell brings to the board of directors, among his other skills and qualifications, significant experience in accounting and information systems, as well as knowledge of controls and financial reporting requirements of public companies. In

addition, during Mr. Howell's career in public accounting he gained significant knowledge of due diligence practices, mergers and acquisitions, and risk management. In his role as the head of the audit division, he gained experience with

recruiting, personnel management, budgeting, and client development and management. As a public accountant, Mr. Howell worked with retail and manufacturing companies and developed experience working with supply chain, procurement, manufacturing

processes, and inventory management. Mr. Howell's work with audit committees of numerous public reporting companies and his directorship roles have provided him with substantial experience in corporate governance. In light of the foregoing, our

board of directors has concluded that Mr. Howell should continue as a member of our board. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Glenn B. Kaufman, 47

Director Since: August 2010

Committees:

• Finance (Chair)

• Compensation

Other Public Company Board Service:

None

Recent Past Public Company Board Service:

None |

|

Mr. Kaufman has been a Managing Member of the D Cubed Group, a private-market investment firm with a long-term focused value creation model, since January 2011. Prior to forming D Cubed, he consulted to boards and

senior executives of operating businesses as well as to private investment firms from January 2009 to December 2010. Previously he spent 11 years at American Securities Capital Partners, where he was a Managing Director. During his tenure at

American Securities, Mr. Kaufman spearheaded the firm's investing in the restaurant, food service and franchising, and healthcare sectors. He served as Chairman or a Director of Potbelly Sandwich Works, El Pollo Loco, Press Ganey Associates,

Anthony International, and DRL Holdings. He spent four years as an attorney with Cravath, Swaine & Moore and worked previously in the small business consulting group of Price Waterhouse. Mr. Kaufman holds a Bachelor of Science in

Economics from the Wharton School of Business of the University of Pennsylvania and a law degree from Harvard University.

Mr. Kaufman brings to the board of directors, among his other skills and qualifications, valuable strategic, finance, budgeting, and executive leadership experience, as well as an extensive understanding of restaurant operations,

direct/omni-channel marketing, and franchising. He has approximately 20 years of experience as an active, engaged, private market investor. Mr. Kaufman has extensive restaurant, food service, franchising, healthcare, and retail expertise as

a result of his investing and business activities at both the D Cubed Group and American Securities Capital Partners. In addition, Mr. Kaufman also has legal and business consulting expertise. In light of the foregoing, our board of directors

has concluded that Mr. Kaufman should continue as a member of our board. |

|

|

|

|

|

|

|

|

|

|

9

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pattye L. Moore, 57

Director Since: August 2007 (Board Chair since February 2010)

Committees:

• Audit

• Nominating and Governance

Other Public Company Board Service:

ONEOK (2002-present)

ONEGAS, Inc. (January 2014-present)

Recent Past Public Company Board Service:

Sonic Corp. (2000-2006) |

|

Ms. Moore is a business strategy consultant and the author of Confessions from the Corner Office, a book on leadership instincts. Ms. Moore was on the board of directors for Sonic Corp. from 2000 through January

2006 and was the President of Sonic from January 2002 to November 2004. She held numerous senior management positions during her 12 years at Sonic, including Executive Vice President, Senior Vice President—Marketing and Brand Development

and Vice President—Marketing. Prior to joining Sonic Corp., she served as a senior executive and account supervisor on the Sonic account at the advertising agency Advertising, Inc.

Ms. Moore brings to the board of directors, among her other skills and qualifications, significant executive leadership, management, marketing, business strategy, brand and concept development, and public relations experience as well as deep

knowledge of the restaurant industry. During her tenure at Sonic, the company grew from $900 million in system-wide sales with 1,100 units to over $3 billion in system-wide sales and 3,000 units. Ms. Moore was named one of the top 100

marketers by Advertising Age magazine in 2000 and one of the top 50 women in foodservice by Nation's Restaurant News in 2002. Ms. Moore's directorships at other companies also provide her with extensive corporate governance experience. In light

of the foregoing, our board of directors has concluded that Ms. Moore should continue as a member of our board. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stuart I. Oran, 64

Director Since: March 2010

Committees:

• Audit

• Finance

Other Public Company Board Service:

Spirit Airlines (2004-present)

FCB Financial Holdings, Inc. (2010-Present)

OHA Investment Corporation (2014-present)

Recent Past Public Company Board Service:

Deerfield Capital Corp. (2008-2010)

Hughes Telematics (f/k/a Polaris Acquisition Corp.) (2007-2009)

Wendy's International, Inc. (2005-2008) |

|

Since 2011, Mr. Oran has been a partner at Liberty Hall Capital Partners, a private equity firm focused on the aerospace and defense sectors. Mr. Oran is also the co-founder of FCB Financial Holdings, Inc.,

a bank holding company formed to acquire failed banks in FDIC-assisted transactions. Mr. Oran founded Roxbury Capital Group LLC in 2002 and was its managing member until December 2014. From 1994 to 2002, Mr. Oran held a number of

senior executive positions at UAL Corporation and its operating subsidiary, United Airlines, Inc., including Executive Vice President—Corporate Affairs (responsible for United's legal, public, governmental and regulatory affairs, and all of

United's properties and facilities), Senior Vice President—International (P&L responsibility for United's international division comprised of its operations and employees (approximately 12,000) in 27 countries), and President and Chief

Executive Officer of Avolar, United's aviation line of business. During that period, Mr. Oran also served as a director of United Air Lines (the operating subsidiary) and several of its subsidiaries, and on the Management Committee, Risk

Management Committee, and Alternative Asset Investment Committee of UAL. Mr. Oran resigned from his positions at UAL Corporation and United Airlines, Inc. in March 2002. Prior to joining UAL and United, Mr. Oran was a corporate partner

at the New York law firm of Paul, Weiss, Rifkind, Wharton & Garrison LLP.

Mr. Oran brings to the board of directors, among his other skills and qualifications, valuable business, leadership, management, and strategic planning experience which he gained during his employment with UAL Corporation and as a board member

of Wendy's International, Inc. He also brings significant knowledge of the restaurant industry from his board service at Wendy's. In addition, Mr. Oran has experience serving as a director of a number of other large public companies which

provided him with extensive corporate governance experience. In light of the foregoing, our board of directors has concluded that Mr. Oran should continue as a member of our board. |

|

|

|

|

|

|

|

|

|

|

10

Table of Contents

Vote Required

Proposal No. 1 requires the approval of a majority of the votes cast for each director.

Board Recommendation

Our board of directors recommends that you vote FOR the election of each of the nominees for

director.

11

Table of Contents

CORPORATE GOVERNANCE AND BOARD MATTERS

Governance Principles

The board of directors seeks to ensure that good governance and responsible business practices are part of our culture and values. To

ensure that we achieve this goal, the board of directors has previously established corporate governance guidelines that it follows with respect to corporate governance matters, which are available on

the investor relations section of our website at www.redrobin.com. The board of directors reviews the governance guidelines annually to ensure that they

are timely, effective, and supportive of the board's oversight and other responsibilities.

Executive Development and Management Succession

Executive development and succession is an important responsibility of the board of directors. Under the Company's corporate governance

guidelines, the board maintains an ongoing policy and plan for the development and succession of the CEO and other senior officers. The board has delegated some of this responsibility to the

nominating and governance committee. As provided in our corporate governance guidelines, the succession policy and plan has a multi-year focus that encompasses, among other things, the following

attributes:

- •

- criteria that reflect the Company's ongoing business strategies,

- •

- identification and development of potential internal candidates,

- •

- formal assessment processes to evaluate such potential internal candidates and their development, and

- •

- an emergency succession component to address the unforeseen loss of the CEO or other key executives through death, disability, or

other similar emergency.

The

nominating and governance committee and the board work closely with management to ensure that development and succession are anticipated, planned for, and addressed in a timely

manner. Under the guidance of the committee, Mr. Carley and each of the executive officers conduct annual succession planning activities. This process includes annual performance reviews,

evaluations, and development plans of the CEO and executive officers, who also conduct evaluations and development of their direct reports.

Mr. Carley

regularly meets with the full board on his performance, and his annual performance evaluation is conducted under the oversight of the compensation committee.

Mr. Carley conducts annual and interim performance and development evaluations of the other senior executives and reviews these evaluations with the compensation committee or full board.

At

least annually, and when otherwise necessary, the nominating and governance committee reviews, makes recommendations for, and reports to the board on programs that have been

implemented by management for executive and leadership team development and succession planning.

Stockholder Engagement

The board and management believe that the Company's relationships with our stockholders and other stakeholders are an important part of

our corporate governance responsibility, and recognize the value of continuing communications. Among other things, engagement with our stockholders helps us

to:

- •

- understand and consider the issues that matter most to our stockholders,

- •

- learn about expectations for our performance, and

12

Table of Contents

- •

- assess stockholder feedback and any emerging issues related to our governance practices, business, operations, or compensation.

This

approach has helped us to identify mutual perspectives and goals and to adopt a collaborative approach to these relationships, which has resulted in our receiving essential input

from our stockholders. To this end, we regularly engage with our stockholders through attendance at investor conferences, issuance of press releases and other stockholder communications, and

individual meetings throughout the year.

We

also recognize the connection between good corporate governance and our ability to create and sustain value for our stockholders. In response to evolving governance practices,

regulatory changes, and concerns of our stockholders, the Company has made a number of changes to our corporate governance practices over the past few years.

Highlights

of our governance program include:

- •

- Fully declassified board of directors.

- •

- Independent chair of the board of directors.

- •

- All director nominees are independent other than our CEO.

- •

- All committee members are independent.

- •

- Frequent engagement by management with institutional investors.

- •

- Majority voting standard for uncontested director elections.

- •

- Annual review of our succession plan and talent development plan.

- •

- Limits on outside board service.

- •

- Formal policy prohibiting hedging and pledging of Company securities by executive officers and directors.

- •

- Directors regularly engage in in-boardroom and outside director education.

Board Leadership Structure

The board recognizes that one of its key responsibilities is to evaluate and determine the optimal leadership structure so as to

provide independent oversight of management. Accordingly, at this time, we believe it is appropriate for our board to maintain the separation of the roles of board chair and chief executive officer.

Pattye L. Moore currently serves as chair of the board

due to, among other things, her prior experience on public company boards of directors, as well as her extensive leadership experience within the restaurant industry.

We

believe that having a non-executive, independent board chair is in the best interests of the Company and our stockholders at this time. The separation of the roles of board chair and

chief executive officer allows Mr. Carley to focus on managing the Company's business and operations, and allows Ms. Moore to focus on board matters, especially in light of the high

level of regulation and scrutiny of public company boards. Further, we believe that the separation of these roles ensures the independence of the board in its oversight role of evaluating and

assessing the chief executive officer and management generally.

Role in Risk Oversight

Our executive officers have the primary responsibility for enterprise risk management within our Company. Our board actively oversees

the Company's risk management and regularly engages in discussions of the most significant risks that the Company faces and how these risks are being

13

Table of Contents

managed.

The board receives regular reports on enterprise risk areas from senior officers of the Company. The board delegates certain risk oversight functions to the audit committee. Under its

charter, the audit committee is responsible for oversight of the enterprise risk assessment and management process framework and ensures that the board or a designated committee is monitoring the

identification, assessment, and mitigation of significant enterprise risks. The audit committee oversees policies and guidelines that govern the process by which major financial and accounting risk

assessment and management may be undertaken by the Company. The audit committee also oversees our corporate compliance programs and the internal audit function. In addition, the other board committees

receive reports and evaluate risks related to their areas of focus. The committees regularly report to the full board on the assessment and management of these risks. The board believes that the work

undertaken by the audit committee, together with the work of the other committees, the full board, and the senior officers of the Company, enables the board to effectively oversee the Company's risk

management.

Board Membership and Director Independence

Our board of directors has determined that each of our directors, except our CEO, Mr. Carley, qualifies as an independent

director under the rules promulgated by the U.S. Securities and Exchange Commission ("SEC") and The NASDAQ Stock Market® ("NASDAQ") listing standards. Only independent directors are

appointed to the board's audit committee, compensation committee, and nominating and governance committee. All members of each of our board committees are independent in accordance with SEC rules and

NASDAQ listing standards. There are no family relationships among any of our executive officers, directors, or nominees for directors.

Director Attendance

The board of directors held nine meetings in 2014, including four in-person meetings. Each of our current directors attended at least

75% of the aggregate total of meetings of the board of directors and committees during their period of service in 2014. The non-management directors of the Company meet at least quarterly throughout

the year and as necessary or appropriate in executive sessions at which members of management are not present.

The

board of directors strongly encourages each of the directors to attend the annual meeting of stockholders. All of our current directors who were directors at the time attended our

2014 annual meeting.

Committees of the Board of Directors

Our board of directors has four standing committees: an audit committee, a compensation committee, a finance committee, and a

nominating and governance committee. Each of our standing committees generally meets at least once each quarter. In addition, other regular and special meetings are scheduled as necessary and

appropriate depending on the responsibilities of the

particular committee. Each committee regularly meets in executive session without management present.

Each

board committee operates pursuant to a written charter. The charter for each committee is available on the corporate governance section of the investor relations tab of our website

at www.redrobin.com. The committee charters are reviewed at least annually by the respective committee to revise and update the committee duties and

responsibilities as necessary.

14

Table of Contents

15

Table of Contents

Stockholder Submission of Director Nominees

A stockholder may submit the name of a director candidate for consideration by the nominating and governance committee by writing to:

Nominating and Governance

Committee, Red Robin Gourmet Burgers, Inc., 6312 South Fiddler's Green Circle, Suite 200N, Greenwood Village, CO 80111.

The

stockholder must submit the following information in support of the candidate: (a) all information relating to such person as would be required to be disclosed in

solicitations of proxies for the election of such nominees as directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and such person's

written consent to serve as a director if elected; (b) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made

(i) the name and address of such stockholder, as they appear on the Company's books, and of such beneficial owner, (ii) the class and number of shares of the Company that are owned

beneficially and of record by such stockholder and such beneficial owner, (iii) a description of any agreement, arrangement, or understanding (including any derivative or short positions,

profit interests, options, warrants, convertible securities, stock appreciation or similar rights, hedging transactions, and borrowed or loaned shares) that has been entered into as of the date of

such stockholder's notice by, or on behalf of, such stockholder and such beneficial owner, whether or not such instrument or right shall be subject to settlement in underlying shares of capital stock

of the Company, the effect or intent of which is to mitigate loss to, manage risk of share price changes for, or increase or decrease the voting power of, such stockholder or such beneficial owner,

with respect to shares of stock of the Company, and (iv) whether either such stockholder or beneficial owner intends to deliver a proxy statement and form of proxy to holders of, in the case of

a proposal, at least the percentage of the Company's voting shares required under applicable law to carry the proposal or, in the case of a nomination or nominations, a sufficient number of holders of

the Company's voting shares to elect such nominee or nominees.

16

Table of Contents

Communications with our Board of Directors

You may communicate with any director, the entire board of directors, the independent directors, or any committee by sending a letter

to the director, the board of directors, or the committee addressed to: Board of Directors, 6312 South Fiddler's Green Circle, Suite 200N, Greenwood Village, CO 80111, or by sending an

e-mail to: Board@redrobin.com. The Company's chief legal officer will review all communications, categorize them, and forward them to the appropriate

board member(s). Messages pertaining to administrative matters, ordinary business matters, personal grievances, and similar issues will be forwarded to the appropriate member of management.

With

respect to issues arising under the Company's Code of Ethics, you may also communicate directly with the chair of the audit committee, vice president of internal audit, or the

compliance officer in the manner provided in the Company's Problem Resolution and Whistleblower Policy and Reporting Procedures. Both the Code of Ethics and the Problem Resolution and Whistleblower

Policy and Reporting Procedures may be found on the corporate governance section of the investor relations tab of our website at: www.redrobin.com.

Certain Relationships and Related Transactions

Transactions with Related Persons

For 2014, we had no material related party transactions which were required to be disclosed in accordance with SEC regulations.

Review, Approval, or Ratification of Transactions with Related Persons

The board of directors recognizes that transactions between the Company and certain related persons present a heightened risk of

conflicts of interest. In order to ensure that the Company acts in the best interest of our stockholders, the board has delegated the review and approval of related party transactions to the audit

committee. Pursuant to our Code of Ethics and the audit committee charter, any related party transaction required to be disclosed in accordance with applicable SEC regulations must be reviewed and

approved by the audit committee. In reviewing a proposed transaction, the audit committee must:

- •

- satisfy itself that it has been fully informed as to the related party's relationship and interest, and as to the material facts of

the proposed transaction, and

- •

- consider all of the relevant facts and circumstances available to the committee.

After

its review, the audit committee will only approve or ratify transactions that are fair to the Company and not inconsistent with the best interests of the Company and our

stockholders.

Compensation Committee Interlocks and Insider Participation

During the last completed fiscal year, Robert B. Aiken, Lloyd L. Hill, Richard J. Howell, Glenn B. Kaufman,

Pattye L. Moore, and James T. Rothe each served as members of the Company's compensation committee. None of the members of the compensation committee is or has been an officer or

employee of the Company. None of our current executive officers serves as a director of another entity that has an executive officer who serves on our Board.

17

Table of Contents

Director Compensation

Set forth below are the elements of our director compensation for 2014.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Retainer |

|

|

|

Each non-employee director of the Company received an annual retainer of $40,000, payable in equal quarterly installments. In addition, the following amounts were paid to the chair of the board and each

board committee chair in equal quarterly installments: |

|

|

|

|

|

|

|

|

Chair of the board |

|

|

$48,000* |

|

|

|

|

|

|

|

|

|

|

|

Chair of audit committee |

|

|

$15,000 |

|

|

|

|

|

|

|

|

|

|

|

Chair of compensation committee |

|

|

$12,500 |

|

|

|

|

|

|

|

|

|

|

|

Chair of nominating and governance committee |

|

|

$ 7,500 |

|

|

|

|

|

|

|

|

|

|

|

Chair of finance committee |

|

|

$10,000 |

|

|

|

|

|

|

|

|

|

|

*The compensation committee increased the board chair retainer from $40,000 to $48,000 in June 2014 based on market data and

the recommendation of its compensation consultant. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Meeting Fees |

|

|

|

Each non-employee director received $2,000 for each in-person board meeting attended and $1,000 for each regularly scheduled telephonic board meeting attended. Each member of the compensation committee, the

nominating and governance committee, and the finance committee received $2,000 for each in-person committee meeting attended, and each member of the audit committee received $3,000 for each in-person meeting of the audit committee attended. Each

committee member received $1,000 for each regularly scheduled telephonic committee meeting attended. A director receives one-half of the specified meeting fee for any regularly scheduled in-person meeting in which the director instead participates by

telephone. The Company also reimburses the directors for costs incurred by them in traveling to and attending board and committee meetings. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity Awards |

|

|

|

Upon initial appointment or election to the board of directors, each non-employee director generally receives a non-qualified stock option grant covering 5,000 shares. Each initial grant of 5,000 stock

options vests and becomes exercisable in equal monthly installments over the 24-month period following the date of grant. In addition, at the discretion of the board of directors, each non-employee director is eligible to receive annual grants of

stock options, restricted stock, or restricted stock units. In 2014, each non-employee director received an annual grant of restricted stock units with a grant date value of approximately $110,000. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18

Table of Contents

2014 Director Compensation

The following table sets forth a summary of the compensation we paid to our non-employee directors in fiscal 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Fees Earned

or Paid

in Cash

($) |

|

Option

Awards

($) |

|

Stock

Awards

($)(1) |

|

All Other

Compensation

($)(2) |

|

Total

($) |

|

Robert B. Aiken |

|

|

71,500 |

|

|

|

|

|

109,937 |

|

|

— |

|

|

181,437 |

|

Cambria W. Dunaway(3) |

|

|

26,262 |

|

|

150,241 |

|

|

100,792 |

|

|

— |

|

|

277,295 |

|

Lloyd L. Hill |

|

|

86,500 |

|

|

|

|

|

109,937 |

|

|

— |

|

|

196,437 |

|

Richard J. Howell |

|

|

89,000 |

|

|

|

|

|

109,937 |

|

|

— |

|

|

198,937 |

|

Glenn B. Kaufman |

|

|

77,000 |

|

|

|

|

|

109,937 |

|

|

— |

|

|

186,937 |

|

Pattye L. Moore |

|

|

119,024 |

|

|

|

|

|

109,937 |

|

|

— |

|

|

228,961 |

|

Stuart I. Oran |

|

|

66,000 |

|

|

|

|

|

109,937 |

|

|

— |

|

|

175,937 |

|

James T. Rothe |

|

|

35,810 |

(4) |

|

|

|

|

|

|

|

— |

|

|

35,810 |

|

- (1)

- Each

director, other than Ms. Dunaway, was awarded 1,525 restricted stock units in May 2014. The fair value of such restricted stock units was

computed in accordance with the authoritative guidance for accounting for stock compensation at $72.09 per share for all directors. All such restricted stock units are subject to vesting in three

equal installments on the first, second, and third anniversaries of the date of grant, unless earlier vested per the terms of the award agreement or the Company's Second Amended and Restated 2007

Performance Incentive Plan (the "2007 Plan").

- (2)

- The

aggregate amount of all other compensation paid to each director in fiscal year 2014 did not exceed $2,500 per director; in each case constituting meal

discounts used by such non-employee director.

- (3)

- Ms. Dunaway

received a pro-rated grant of 1,391 restricted stock units when she joined the board in June 2014. The fair value of such restricted

stock units was computed in accordance with the authoritative guidance for accounting for stock compensation at $72.65 per share. All such restricted stock units are subject to vesting in three equal

installments on the first, second, and third anniversaries of the date of grant, unless earlier vested per the terms of the award agreement or the 2007 Plan. Ms. Dunaway was awarded options to

purchase 5,000 shares of common stock upon joining the board. The fair value of such options was computed in accordance with the authoritative guidance for accounting for stock compensation at $30.05

per share covered by the option.

- (4)

- Mr. Rothe

retired in May 2014. Amounts reported above reflect fees earned through his retirement date.

19

Table of Contents

As

of the end of the fiscal year 2014, the aggregate number of options and restricted stock units outstanding for each non-employee director is set forth below. Options are considered

outstanding until exercised and restricted stock units are considered outstanding until vested and paid.

|

|

|

|

|

|

|

|

|

|

Options |

|

Restricted

Stock Units |

|

Robert B. Aiken |

|

|

5,000 |

|

|

5,111 |

|

Cambria W. Dunaway |

|

|

5,000 |

|

|

1,391 |

|

Lloyd L. Hill |

|

|

5,000 |

|

|

5,111 |

|

Richard J. Howell |

|

|

10,000 |

|

|

5,111 |

|

Glenn B. Kaufman |

|

|

0 |

|

|

4,893 |

|

Pattye L. Moore |

|

|

6,500 |

|

|

5,111 |

|

Stuart I. Oran |

|

|

5,000 |

|

|

5,111 |

|

2015 Director Compensation

In October 2014, the compensation committee voted to change the pay mix for non-employee directors effective in 2015. The committee

eliminated director meeting fees, rolling the approximate $30,000 value into the annual retainer, which was increased from $40,000 to $70,000. The change was made to ease administrative burden with

respect to the payment of director cash compensation and to better align the Company's practices with those of its peer group. This change was exclusive of chair retainers, which were not changed. In

addition, the board voted to reduce the vesting terms for future restricted stock unit grants from three years to one year. This change was made to be consistent with the Company's decision to

declassify its board of directors and move from a

staggered board with three-year elected terms to a non-staggered board with annual elections for one-year terms in accordance with governance best practices. No changes were made to the vesting terms

of existing awards.

Director Stock Ownership Guidelines

The compensation committee has had stock ownership guidelines in place for non-employee directors since March 2009 (see "Executive

Stock Ownership Guidelines" on page 42 for discussion of the ownership guidelines for executive officers). The current ownership guidelines require non-employee directors to own Company

securities with a cumulative cost basis of at least five times the director's annual retainer. Based on the current annual retainer for non-employee directors, that dollar amount is $350,000. The

value of the director's holdings is based on the cumulative cost basis of securities held, which is calculated using the price of the Company's common stock at the date of acquisition. All forms of

equity owned of record or beneficially, including vested in-the-money options, are credited toward the guidelines. New non-employee directors have five years from the time the director joins the board

to reach the minimum ownership threshold. Non-employee directors may not sell, transfer, or otherwise dispose of common stock that would decrease such director's cumulative cost basis below the

ownership guideline amount. All of our directors are currently in compliance or properly on track to be in compliance with the minimum ownership threshold.

20

Table of Contents

The

following table sets forth the ownership guidelines and the holdings of the non-employee directors as of March 10, 2015, valued at the acquisition dates pursuant to our

director stock ownership guidelines:

|

|

|

|

|

|

|

|

|

|

Director

|

|

Ownership

Guideline |

|

Current Dollar

Value of Guideline |

|

Cumulative

Cost Basis |

|

Robert B. Aiken |

|

5x Retainer |

|

$ |

350,000 |

|

$ |

819,241 |

|

Cambria W. Dunaway |

|

5x Retainer |

|

$ |

350,000 |

(1) |

$ |

108,441 |

|

Lloyd L. Hill |

|

5x Retainer |

|

$ |

350,000 |

|

$ |

828,180 |

|

Richard J. Howell |

|

5x Retainer |

|

$ |

350,000 |

|

$ |

983,023 |

|

Glenn B. Kaufman |

|

5x Retainer |

|

$ |

350,000 |

|

$ |

710,836 |

|

Pattye L. Moore |

|

5x Retainer |

|

$ |

350,000 |

|

$ |

672,829 |

|

Stuart I. Oran |

|

5x Retainer |

|

$ |

350,000 |

|

$ |

567,703 |

|

- (1)

- To

be achieved by June 2019.

Indemnification of Directors

The Company has entered into agreements to indemnify its directors, executive officers, and certain other key employees. Under these

agreements, the Company is obligated to indemnify its directors and officers to the fullest extent permitted under the Delaware General Corporation Law for expenses, including attorneys' fees,

judgments, fines, and settlement amounts incurred by them in any action or proceeding arising out of their services as a director or officer. The Company believes that these agreements are necessary

in attracting and retaining qualified directors and officers.

21

Table of Contents

STOCK OWNERSHIP INFORMATION

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with

respect to securities. Except as indicated by footnote, and except for community property laws where applicable, the persons named in the tables below have sole voting and investment power with

respect to all shares of common stock shown as beneficially owned by them. The percentage of beneficial ownership for each table is based on 14,107,108 shares of common stock outstanding as of

March 10, 2015.

Stock Ownership of Certain Beneficial Owners

The following table sets forth information regarding beneficial owners of more than 5% of our common stock as of March 10, 2015.

All information is taken from or based upon ownership filings made by such persons with the SEC or upon information provided by such persons to the Company.

|

|

|

|

|

|

|

|

|

|

Shares Beneficially Owned |

|

Name and Address of Beneficial Owner

|

|

Amount and Nature of

Beneficial Ownership |

|

Percent of

Class |

|

T. Rowe Price Associates, Inc.(1) |

|

|

1,373,837 |

|

|

9.7 |

% |

BlackRock, Inc.(2) |

|

|

1,220,453 |

|

|

8.7 |

% |

- (1)

- This

disclosure is based on an amendment to Schedule 13G filed with the SEC on February 11, 2015. The reporting person is an investment